China's Auto Exports Reach a Pivotal Point: Will Plug-in Hybrids Lead the Next Wave? | 2024 Year-end Review

![]() 01/05 2025

01/05 2025

![]() 744

744

Since China surpassed Japan in auto exports for the first time in 2023, becoming the world's leading exporter, the automotive industry has echoed with talk of a "window of opportunity" for globalization. Consequently, China's progress in automotive globalization in 2024 has been highly anticipated. Assuming no unforeseen circumstances, China is poised to reclaim the global auto export crown in 2024, with annual exports anticipated to reach 5.8 million vehicles.

However, unlike the surging growth rates exceeding 50% in the past two years, auto export growth in 2024 has declined. Based on China Association of Automobile Manufacturers' statistics from January to November, the annual growth rate is expected to be no more than 25%. A more intuitive comparison reveals that auto exports increased by approximately 1.1 million and 1.8 million vehicles year-on-year in 2022 and 2023, respectively. If the annual export volume is estimated at 5.8 million vehicles, the increase in auto exports in 2024 will only be 0.89 million vehicles, marking a certain degree of slowdown.

After years of golden development, China's auto exports face a new landscape in 2024. Not only have trade barriers emerged in Europe and the United States, but even the once unstoppable pure electric vehicles have encountered a temporary downturn. A new turning point has arisen, presenting Chinese automakers with entirely new risks and challenges as they venture abroad.

Russia remains China's largest single auto export market.

China's auto exports have surged in recent years, consecutively overtaking South Korea, Germany, and Japan from 2021 to 2023 to become the world's largest auto exporter. In 2024, China continued to achieve significant growth, albeit at a slower pace. According to data from the China Passenger Car Association, China exported 4.387 million passenger vehicles from January to November, a year-on-year increase of 27%, a decrease of 35 percentage points compared to the 62% growth in 2023.

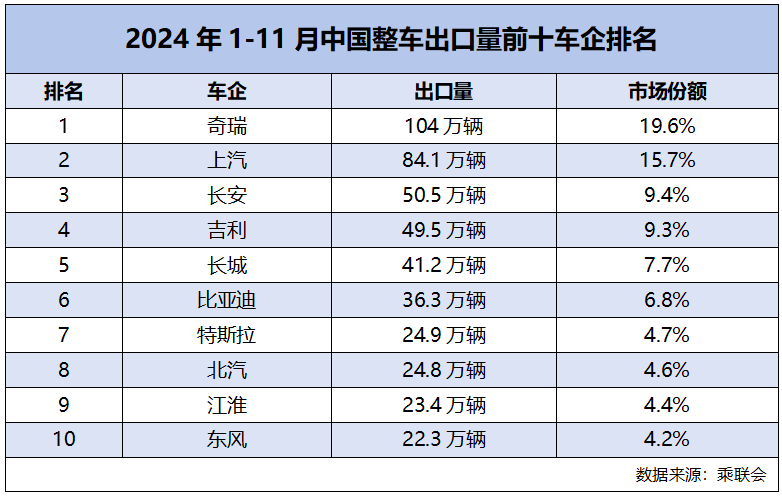

In terms of rankings, the top three automakers in export volume are

Russia continues to be China's largest single auto export market. Since other international automakers gradually withdrew from the Russian market in 2023, Chinese automakers have swiftly stepped in, setting new records, surpassing a 50% market share in 2023 and continuing to exceed 60% in 2024. Moreover, Russia's dominance in the market has become increasingly apparent. According to data from the China Passenger Car Association, China sold a total of 957,300 complete vehicles to Russia from January to October 2024, far ahead of Mexico (386,500 vehicles) and the United Arab Emirates (261,600 vehicles), which ranked second and third, respectively.

Apart from achieving a near-monopoly position in the Russian market, the most significant breakthrough in China's auto exports in recent years has been the marked increase in its influence in the European market.

Leveraging the global trend towards electrification, China's independent brands have increased their market share in the European Union, a long-standing automotive production hub, from 2.2% to 6.5% and then to 9.2% over the three years from 2021 to 2023. Notably, Geely entered the top five in electric vehicle sales in the EU from January to August 2024, trailing fourth-placed

Furthermore, over 20 Chinese brands have entered or plan to enter the European market. Many automakers aim to further expand into the European market by establishing local factories or collaborating with local enterprises. Establishing factories locally can be protected by the policies of the host country or region, avoiding trade disputes and tariffs, and enhancing market competitiveness. Therefore, this has become an important strategy for qualified Chinese automakers to consider.

It is reported that BYD's plant in Hungary is expected to commence production by the end of 2025. Chery has established a joint venture in Spain to produce passenger vehicles by acquiring and transforming an existing

Plug-in Hybrids Emerge as the New Trend for Going Abroad

Another notable feature of China's auto exports in 2024 is the surge in plug-in hybrid exports, standing out among all categories.

According to data from the China Association of Automobile Manufacturers, plug-in hybrid vehicles accounted for a cumulative export of 246,000 units from January to November 2024, a year-on-year increase of 1.8 times. In comparison, traditional fuel vehicle exports reached 4.203 million units, a year-on-year increase of 26.7%, while pure electric vehicle exports totaled 894,000 units, a year-on-year decrease of 10.8%. Although the volume of plug-in hybrid vehicles is still relatively small, they have become a new engine driving China's auto exports. It is worth mentioning that there is a trend of one type of new energy vehicle declining while the other rises, with pure electric vehicles cooling off while plug-in hybrids gaining popularity.

Why has the export volume of pure electric vehicles declined? Apart from inadequate overseas charging infrastructure, it is also closely related to the EU's imposition of tariffs.

The European Union imposed provisional countervailing duties on electric vehicles imported from China from July 4, 2024, and began to impose additional countervailing duties of 17.0%-35.3% on top of the existing 10% import tariff on October 30. This trade protectionist measure has had a significant impact on China's electric vehicle exports. In particular, SAIC Motor, which is subject to a cumulative import tariff of 45.3%, has seen a significant decrease. Its autonomous brand MG, which has a high profile and sales volume in Europe due to its British origins, saw a year-on-year decline of 58% in registrations in Europe in November after the additional tariffs were imposed (data from research firm Jato Dynamics).

It is worth mentioning that in November, BYD's car registrations in Europe more than doubled year-on-year to 4,796 units. Besides the relatively small sales base of BYD in the European market, this growth is also related to the lower tariffs (a cumulative 27.0%, the lowest among Chinese brands) imposed on it. The EU's leniency towards BYD is likely an attempt to attract the battery production giant to invest and build factories in Europe, thereby driving the development of the local industrial chain.

Although the US has also increased tariffs on electric vehicles from China from 25% to 100%, the overall impact on China's auto exports is minimal due to the small base of Chinese vehicles sold in the US.

Why are plug-in hybrid vehicles selling well overseas despite the market trend? An important reason is that after years of rapid development, China's PHEV market has flourished, with technological strength reaching a world-leading level. Examples include BYD's DM-i technology, Geely's Leishen EM-i hybrid system, Great Wall's Hi4 and Hi4-T technologies, Dongfeng Fengshen's Max Hybrid, and Changan's Blue Core iDD. These technologies have been well-received by a large number of consumers due to their low cost and low threshold.

As President Wang Chuanfu of BYD said, "The world's most advanced plug-in hybrid technology is in China." Based on these advanced technologies, Chinese independent brands have developed plug-in hybrid vehicles that significantly surpass foreign average levels in terms of pure electric range, fuel consumption in low-battery conditions, and intelligence. Coupled with cost advantages, these vehicles almost overwhelm foreign brands.

Moreover, the EU's additional tariffs on electric vehicles from China only apply to pure electric vehicles and do not involve plug-in hybrids, extended-range electric vehicles, or other new energy vehicles. This has prompted Chinese automakers to shift their export focus to hybrid products to avoid tariffs. This also means that plug-in hybrid vehicles are becoming a new trend, helping Chinese automakers accelerate their "going abroad" efforts.

China's Auto Exports Face a Turning Point

As the development path of new energy vehicles, dominated by pure electric vehicles, diverges, the coexistence of multiple technological routes has gradually become a consensus in the industry. The situation of China's auto exports, which relatively relied on pure electric vehicles in the past two to three years, is also changing.

China's new energy vehicles are popular in the global market primarily due to their low cost, long range, high intelligence and digitization, and significant scale advantages in power batteries. However, with changes in EU and US tariff policies on electric vehicles from China and the formation of trade barriers, as well as the catch-up of local automakers in Europe and the US in the electrification race (e.g., Volkswagen, BMW, and Mercedes-Benz will launch more competitive models based on new pure electric platforms), the competitive pressure on China's electric vehicles in overseas markets will increase.

On the other hand, affected by the reduction of electric vehicle subsidies, insufficient infrastructure (compared to China), and low residual values of electric vehicles, European car users are gradually losing interest in pure electric vehicles and opting for fuel or hybrid vehicles instead. Some traditional automakers are also reassessing and formulating their electrification strategies, which will lead the global electric vehicle market into a period of turbulence. The demand for pure electric vehicles will be diluted, while the demand for fuel and hybrid vehicles (including plug-in hybrids) will increase.

Based on these changes, Chinese automakers will face a new turning point as they go abroad. Whether it's overseas development strategies, product strategies, or industrial chain layouts, every move will have far-reaching implications. This is both a challenge and an opportunity. Chinese automakers must balance the deployment of various products such as pure electric, hybrid, and fuel vehicles, strengthen communication with local consumers, patiently cultivate overseas consumer markets, and flexibly choose marketing models according to the characteristics of different regional markets.

To address tariff barriers, many Chinese automakers have accelerated the construction of R&D centers and vehicle manufacturing bases overseas. However, achieving localized production is only the first step. More importantly, a closed loop must be formed within the industrial and supply chains. Currently, the supply chain system for the European electric vehicle industry is not yet perfect, and some key components rely heavily on imports. If Chinese automakers want to reduce costs and enhance overall competitiveness, they must strengthen their supply chain resilience and achieve coordinated development of the industrial chain.

Against the backdrop of fierce competition in the domestic auto market, going abroad is no longer a choice but a necessity for Chinese automakers. This is a significant test. Looking ahead to 2025, the global automotive industry is entering a period of profound change, facing many uncertainties. It remains to be seen whether Chinese automakers can seize opportunities and overcome challenges.