The Mainstream Plug-in Hybrids and Extended-Range Electric Vehicles Are Set to Be Phased Out Again in 2024

![]() 01/06 2025

01/06 2025

![]() 571

571

The fuse for technological obsolescence in 2025 is not limited to Link&Co's 2.0T three-motor plug-in hybrid.

When the internal competition in plug-in hybrids and extended-range electric vehicles catches up with advancements in intelligent driving, new technologies tend to remain popular for only a year before being phased out in 2024.

"46% will be a pivotal figure, and most multinational automakers have restarted engine development." At a media briefing at the end of December, a senior executive from a top-tier Chinese automaker revealed the competitive landscape for 2025 based on observations during our discussions.

Just over a month ago at the Guangzhou Auto Show, when we queried several automaker executives, most expressed uncertainty about the future prospects of plug-in hybrids and extended-range vehicles. For instance, "Engines have been in development for over 130 years, and the upper limit of range extenders is quite obvious," and "It mainly depends on the progress of batteries in extended-range or plug-in hybrids," were common responses.

Within a span of one month, however, most automakers have already set their general development goals for 2025. Intense internal competition means focusing on what sells and pursuing what's popular. Consequently, besides the rapid popularization of intelligent driving in the RMB 200,000 to RMB 100,000-150,000 price range, more automakers are engaging in the development of plug-in hybrid and extended-range power technologies. Given that new technologies will be successively implemented, many mainstream technologies from 2024 will also be on the verge of obsolescence.

Multiple automakers are developing new engines with 46% thermal efficiency, potentially saving 20% more fuel than before?

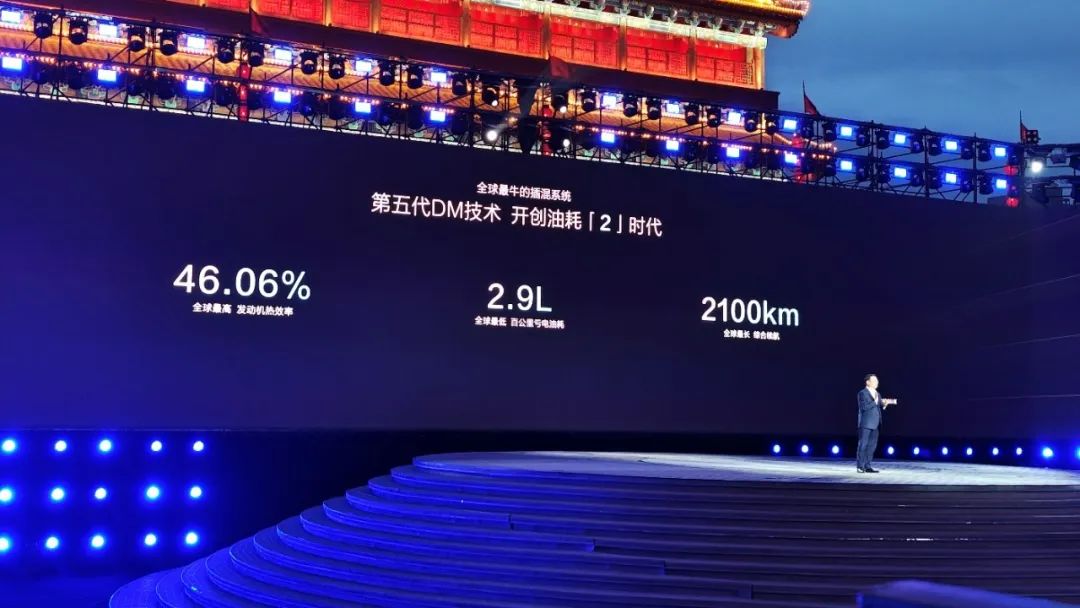

"Conservatively speaking, it will be difficult to sell plug-in hybrids well in 2025 without an engine with a thermal efficiency of over 45%." He didn't specify a specific number but mentioned a thermal efficiency of over 45%. However, we understand that the real competition in plug-in hybrids in 2025 will center around achieving 46% thermal efficiency.

Geely's exceptionally rapid rise in the fourth quarter of 2024 has already demonstrated the necessity of this progress to the industry. Falling behind could make it difficult to catch up with leaders in a short period, similar to the experiences with pure electric vehicles and intelligent driving in previous years.

In terms of sales, Geely's Galaxy Starship 7 can almost be called the first dark horse in China's plug-in hybrid market in 2024. Launched on December 6, Galaxy Starship 7 delivered over 10,000 units within 13 days of its launch. By December 31, 2024, cumulative sales reached 20,636 units in 25 days. When consolidated, this figure actually surpassed BYD's biggest hit of 2024, the Qin L with the fifth-generation DM, which sold 20,100 units in its first month on the market.

The reason is that after intelligent driving, pricing, design, large screens, and other aspects tend to become homogenized, lower fuel consumption figures and driving range are indeed the core factors influencing consumer decisions. This was evident with BYD's Qin L and Seal 06 when the fifth-generation DM was launched, with a starting price of RMB 99,800 and marketing focused on a NEDC fuel consumption of 2L per 100 kilometers. There was even a month-long discussion in the industry and among consumers about who had the most thermally efficient engines, BYD or Geely. Based on a maximum engine thermal efficiency of 46.06%, BYD has been virtually unbeatable after gradually equipping all its models with the fifth-generation DM.

The emergence of Geely's Galaxy Starship 7, on the other hand, surpassed BYD's model. With an unexpectedly low entry price of RMB 99,800, the engine's thermal efficiency soared to a global-leading 46.5%, and media tests recorded a minimum fuel consumption of 2.83L per 100 kilometers.

Additionally, policymakers have clear next steps for PHEV technology. For example, the "High-Quality Development Plan for the Internal Combustion Engine Industry (2021-2035)" proposes that by 2025, effective thermal efficiency will reach 45%-47%, and vehicle fuel consumption will reach 4L per 100 kilometers; by 2030, 50%-52% and 3.2L per 100 kilometers, respectively; and by 2035, 55%-57%.

Examining the popular new technologies in 2024, the situation is as follows:

Lixiang One has a thermal efficiency of 40.5%, NIO has 40%, Dongfeng has a minimum of 41%, Honda has 41%, Chery has 44.5%, Great Wall has 41.5%, and Changan has 44.28%. However, there is some misleading information in these data. Some automakers promote the thermal efficiency under actual operating conditions, some cite the maximum thermal efficiency in the laboratory, and others promote the reserved maximum thermal efficiency.

As of now, the technology and product launches of major plug-in hybrid automakers are generally as follows:

BYD has basically completed the replacement of the fifth-generation DM-i in most vehicles, all achieving lower prices, with thermal efficiency increasing from 43.04% in the previous generation to the current 46.06%. Taking the Qin PLUS as an example, the fuel consumption under depleted battery conditions has dropped from 4.6L per 100 kilometers in the 2023 model to the current 3L level.

Geely, with the launch of EM-i, is expected to introduce new versions of the Galaxy L6 and Galaxy L7 before the Spring Festival in January. The fuel consumption under depleted battery conditions for the Galaxy L7 is expected to decrease by at least 1L per 100 kilometers after using EM-i, from 5.35L per 100 kilometers.

Changan's new Blue Whale 3.0 plug-in hybrid will definitely complete the full replacement of existing gasoline vehicles in 2024, and fuel consumption under depleted battery conditions will also drop to the 3L level from the previous iDD era.

Chery's Fengyun A8L, launched at the end of the year, achieved an average fuel consumption of 2.8L per 100 kilometers under depleted battery conditions with the support of Kunpeng C-DM 5.0, down from the previous 5L per 100 kilometers level. Additionally, Great Wall's new plug-in hybrid with 45% thermal efficiency will be launched, as will SAIC and GAC's new plug-in hybrids with 46+% thermal efficiency.

Plug-in hybrids without good engines have no place at the table?

All of the above illustrates the same point: just like the progress of intelligent driving and pure electric vehicles, plug-in hybrids are also accelerating the obsolescence of old technologies through continuous internal competition. Two years ago, the fuel consumption under depleted battery conditions for plug-in hybrids was mostly around 5L per 100 kilometers. By 2025, plug-in hybrid household vehicles with fuel consumption higher than 4L per 100 kilometers will significantly lose their competitiveness.

The same is true for the elimination rounds of intelligent driving. In 2022-2023, the competition was for highway NOA, and in 2023-2024, it was for urban NOA. Many mainstream new cars purchased in 2022 have already been phased out. The iteration of pure electric vehicle range several years ago also showed a similar pattern. In 2021, a range of 300 kilometers was entry-level, 400 kilometers was mainstream, in 2022, 500 kilometers was mainstream, and after entering 2023, 600 kilometers became mainstream. Early car buyers became forgotten by the progress of the times.

Besides the application of plug-in hybrid technology by some of the above-mentioned mainstream automakers, even bigger changes will come from the iteration of plug-in hybrid technology in higher-end models. Currently known examples include BYD's sudden announcement of the Tang L and Han L on January 3, as well as Link&Co's announcement of the 900 on the same day. The next direction of internal competition in plug-in hybrid technology for household models within RMB 300,000 has also been determined. New batteries, larger displacement and higher thermal efficiency engines, and information such as 0-100km/h acceleration in under 4 seconds, over 100 kilometers of pure electric range, and fuel consumption under depleted battery conditions below 5L per 100 kilometers will emerge in an endless stream.

In BYD's hands, the second-generation Blade Battery is a key card. Besides the previously announced increase in energy density to 190Wh/kg and pure electric range to over 1,000 kilometers, the core changes are limited in terms of excitement for the pure electric segment.

If applied to plug-in hybrids, a key indicator of the second-generation Blade Battery that was previously released is that its volume utilization rate is over 40% higher than that of the first generation. This means that BYD has the opportunity to significantly improve performance while also achieving a significant price reduction. Because once smaller and lighter batteries can be used, the vehicle's handling, performance, and power consumption, which are core competitiveness factors, will be significantly improved.

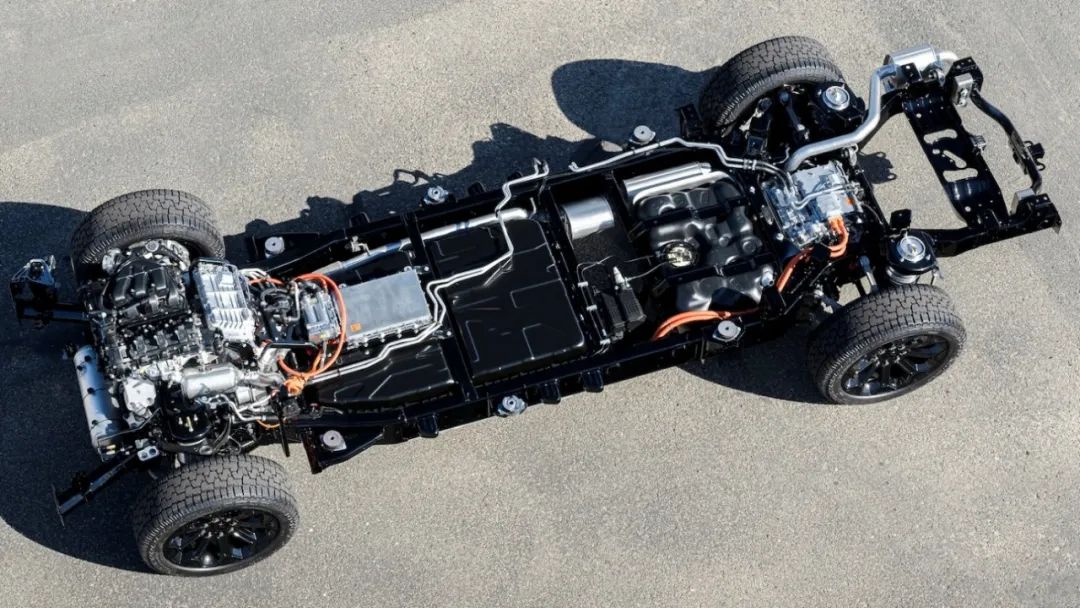

Geely, on the other hand, has two major moves up its sleeve. Link&Co has already made it clear that there will be dual-motor and three-motor versions, and the engine will no longer be limited to the industry's more commonly used 1.5T, but will instead have an upper limit of 2.0T. The logic of technological evolution is to use the strongest parameters and highest power equipment to build cars in the intelligent mode of models like the AITO Askev and Lixiang One L9. Therefore, competing with extended-range vehicles becomes a dimensionality reduction attack. After all, the current upper limit of plug-in hybrids is significantly higher than that of extended-range vehicles, making it easy to surpass and create market selling points.

Although the AITO Askev has a 0-100km/h acceleration time of 4.3-4.9 seconds and the Lixiang One L9 has a 0-100km/h acceleration time of 5.3 seconds, when the battery is low and the range extender forcibly or frequently intervenes, the attenuation of power performance is also a difficult problem to solve at present. As well as the issue of high fuel consumption on highways.

The reason why plug-in hybrids currently have a significant advantage over extended-range vehicles is that major automakers are gradually changing their stance. Many automakers have previously stated that PHEV plug-in hybrids are transitional technology, and extended-range vehicles are transitional within that transition.

However, new variables have emerged. Due to the rapid rise of new energy vehicles, global oil consumption is nearing its peak, and as US shale oil production continues to increase, it offsets OPEC production. Lower and lower oil prices and changes in new emission regulations have prompted many established automakers with engine development capabilities to start internally promoting better range extender research and development. For example, the American pickup truck Ram 1500 Ramcharger has been extended-range.

The latest goal is that several multinational automakers are preparing to not only increase laboratory conditions to over 46% but also achieve a combustion efficiency of over 46% for range extenders under actual operating conditions. Toyota, Mazda, and Subaru announced their new engine plans for the global transition to new energy in the first half of 2024. If the relevant technical goals can be achieved and installed at a relatively low cost, then the existing extended-range technology in 2024-2025 will encounter decreased competitiveness if it stands still, even if it comes from HarmonyOS Intelligent Driving or Lixiang Auto.

Consequently, with the seasoned player Mercedes-Benz entering the fray, the competition in the realm of extended-range and plug-in hybrid powertrains is poised to escalate, transforming into a comprehensive contest of overall vehicle engineering. This evolution encompasses not only the thermal efficiency of engines but also extends to transmissions, electric motors, and numerous other facets.

Final Thoughts

As always, internal competition within the automotive industry fosters innovation and drives technological advancements. Such fierce rivalry expedites the emergence and application of cutting-edge technologies, presenting opportunities for transformative growth within the sector. Moreover, it significantly enhances consumer experiences. However, given the rapid pace of this internal competition, intelligent driving technology constantly evolves in tandem with the latest chip trends, rendering older chip-based vehicle models technologically obsolete within a year or so. Similarly, annual advancements in battery technology lead to increased range and decreased prices for new vehicles, posing challenges for owners of older cars.

Considering the current intense competition in the plug-in hybrid and extended-range vehicle segments, 2025, heralded as the dawn of the decisive battle, has already rendered many mainstream models purchased in 2023 or even 2024 as outdated. The elimination of older models is, unfortunately, an inevitable aspect of this rapid technological progression.

Being phased out is a harsh reality of this dynamic industry.