NIO, Ledo, and Firefly: Li Bin's Strategic Portfolio for Success

![]() 01/09 2025

01/09 2025

![]() 689

689

2014 marked the dawn of China's new energy vehicle (NEV) industry, with sales hovering just below 100,000 units. A decade prior, the Chinese government foresaw the potential and issued up to 16 policies aimed at fostering NEV market growth and achieving a "leapfrog development."

In this nascent market, Li Bin, a sociology graduate from Peking University and founder of U.S.-listed Bitauto Holdings Limited, decided to venture into the NEV sector. With an international perspective, he established NIO Inc. in 2014, embodying the dream of ushering in a new era for the automotive industry. Sociology's dreams are indeed beautiful.

Subsequently, in 2015, Li Auto and Xpeng Motors emerged as key players.

An ad from 1989 posed a question: "What would the world be like if humans lost their imagination?" The answer arrived 25 years later.

Even without imagination, humans still possess ideals;

To embark on the journey to the future, NIO is essential;

Humans rely on greenhouses for nourishment and Xpeng for mobility.

These words are more jest than prophecy. In the fiercely competitive automotive landscape, where battles rage but the outcome remains uncertain, NIO, Li Auto, and Xpeng strive to navigate from turbulent waters to the red ocean. Occasionally, they encounter rogue missiles fired by rule-breaking Houthi rebels. Yet, they are far from reaching the serene blue waters of the Pacific.

The "NIO, Li Auto, and Xpeng" trio each has its unique survival strategy. Li Bin, akin to Batman in the Justice League, excels not in superpowers but in "financial prowess."

01

Is high-end synonymous with financial abundance?

According to NIO's third-quarter 2024 financial report, the net profit per vehicle was negative 104,000 yuan/unit.

To support its high-end brand positioning, NIO has raised a total of 18.9 billion dollars globally. Li Bin's financing prowess is widely regarded as the best in the industry.

Imagine a marathon runner sprinting at full speed, blood loss making them dizzy, yet they carry a transfusion bag, infusing blood while running, and chewing Dong'e Ejiao for sustenance.

NIO's debut model, the high-end pure electric ES8, was a mid-to-large SUV with high originality and excellent design. For its 2017 launch event, NIO chartered 160 buses, 8 planes, 60 high-speed train carriages, and booked 19 five-star hotels, inviting investors, media, and 5,000 prospective users. The American rock band Imagine Dragons performed live, setting a high tone for the event.

Li Bin intended to convey that NIO is positioned as high-end, luxurious, and refined, not merely a "trial-and-error" venture like Tesla. The ES8's base version had a pre-subsidy price of 448,000 yuan and introduced a battery rental scheme.

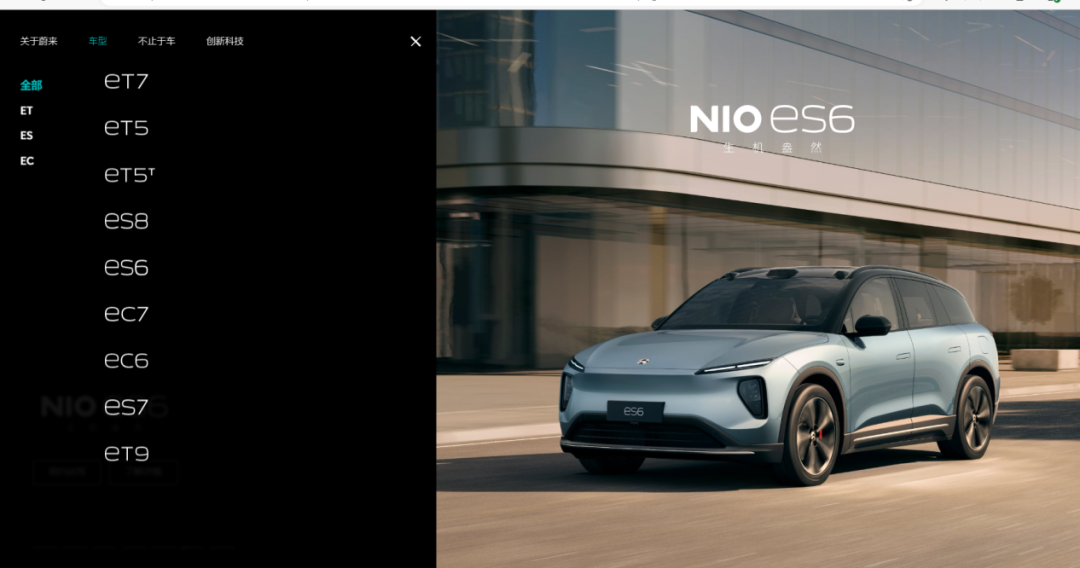

Subsequently, NIO launched models like the ES6 and ET7, maintaining prices above the 300,000 yuan mark. Only with the ET5 did prices dip below 300,000 yuan.

In 2024, NIO delivered a total of 220,000 vehicles, a 38.7% year-on-year increase.

According to China EV100 predictions, China's total vehicle sales in 2024 were approximately 31.3 million units, a 4% year-on-year increase, while NEV sales reached around 13 million units, a 37% year-on-year surge.

In other words, NIO's 2024 sales (including overseas) accounted for only 1.7% of China's NEV sales and 0.7% of overall vehicle sales, with a growth rate on par with the NEV market average.

Such performance is unsatisfactory, and NIO must strive to break the deadlock.

02

Diversification: A Strategy Imperative

If highbrow music and cold peaks are inaccessible, then prices and brands must be adjusted to cater to a broader audience.

With an average monthly sales volume of less than 20,000 units, NIO has yet to become a true market leader. Furthermore, factors like battery swapping network construction hinder profitability. Hence, NIO's diversification strategy stems from the following considerations:

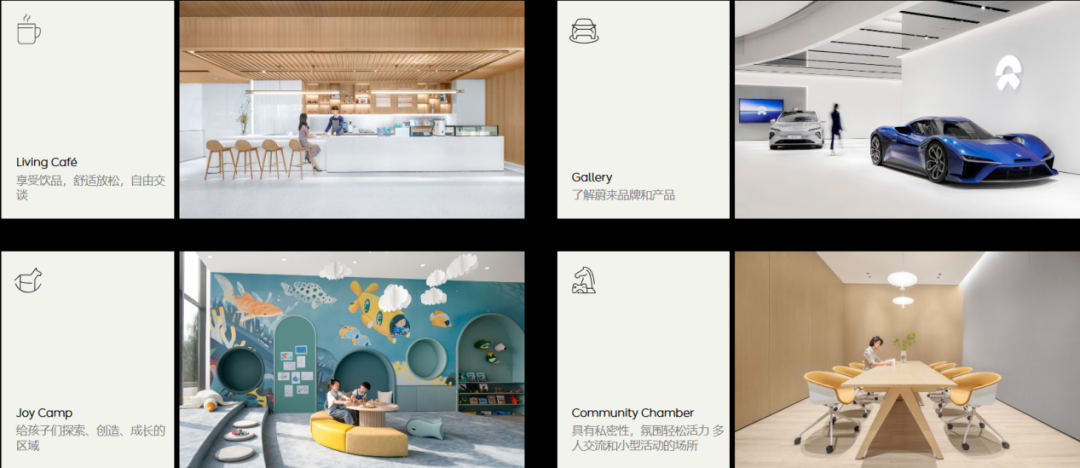

As NIO Inc.'s three main brands, NIO, Ledo, and Firefly each have distinct brand positioning and product characteristics targeting mid-to-high-end consumers, family vehicles, and younger demographics, respectively.

Market Segmentation Theory: This theory posits that the market comprises consumer groups with diverse needs, characteristics, and behaviors. Diversification enables precise targeting of consumer needs across segments, offering products and services tailored to individual preferences, thereby increasing market share.

Brand Positioning Theory: Brand positioning involves establishing a unique and differentiated position in the target market. Multiple brands with different positioning cover a broader market, meeting the needs of consumers at various levels and preferences. Each brand has a clear positioning and value proposition, enhancing recognition and choice, thereby boosting competitiveness.

Synergy Theory: Synergy refers to achieving overall benefits greater than the sum of individual parts through resource sharing and complementary advantages. Multiple brands can synergize in procurement, production, R&D, sales, marketing, etc., reducing costs, improving efficiency, and enhancing innovation, thereby strengthening overall competitiveness and profitability.

NIO's diversification strategy targets specific demographics and user personas:

NIO's primary target customers are in the mid-to-high-end market.

A 2024 report by the Electric Vehicle User Alliance revealed that the average age of NIO ET5T users is 28.9 years, with 73.3% under 30. 79.3% hold a bachelor's degree or higher, and the average annual household income is 462,000 yuan. Most are highly educated, high-income young professionals in private enterprises, predominantly in the IT industry. Network influencers also account for a significant proportion, showcasing strong purchasing power.

According to Li Bin, the average age of NIO car owners is 37.2 years, with 75% being post-80s and 50% post-85s. Over 50% have an annual household income between 600,000 and 1.2 million yuan. They seek high-quality, high-performance, high-tech travel solutions, viewing NIO vehicles as their second or third car. They prioritize vehicle intelligence, environmental friendliness, and brand.

The Ledo brand emphasizes family vehicle scenarios.

The Ledo L60's standard range version costs 206,900 yuan, and the long-range version 235,900 yuan. With the BaaS battery rental scheme, prices start at 149,900 yuan.

Market research shows that Ledo's target customers are primarily aged 25 to 40, with an average age of 32.2 years. They prioritize large space, long range, low energy consumption, and reasonable pricing.

Ledo's model design fully caters to family travel needs, featuring spacious rear seating and convenient storage.

The Firefly brand targets young consumers.

The Firefly's pre-sale price, announced at NIO Day 2024, is 148,800 yuan, confidently positioning itself against the Volkswagen ID series. Volkswagen's brand power and the I.D. 3's pricing cannot compete.

The Firefly series appeals to urbanites yearning for freedom and enjoying life. This demographic desires a free travel experience, values quality of life and personalized expression, and wishes to showcase their unique taste and lifestyle through their vehicles. The Firefly, with its "freely shining" brand spirit and dynamic design, resonates with their pursuit of freedom and individuality.

Firefly's target audience is no longer captivated by foreign designs and brand premiums. They prioritize product interestingness, style, and personalization. Post-launch, Firefly garnered online buzz, albeit "black red," with its abrupt "three-eye light" design becoming a focal point of discussion.

Public aesthetics are hard to please, but being ugly-cute is better than bland. For a new brand, swiftly shifting from "ugly" to "cute" is crucial and potentially life-saving.

03

Product/Technology Differentiation

With a clear market positioning, the next step is refining products according to targets and positioning, followed by strategic marketing. NIO, Ledo, and Firefly each have distinct product and technology orientations.

Design Style

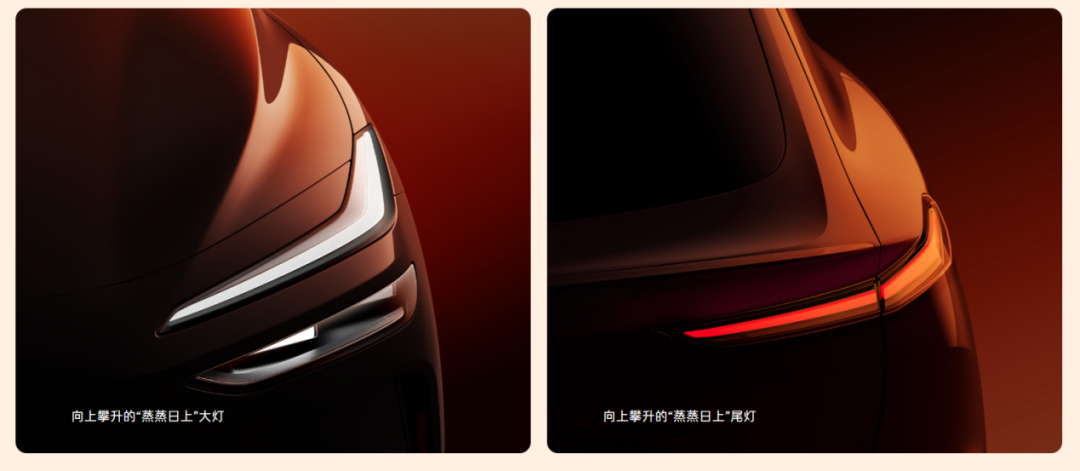

NIO: Fashionable and streamlined exterior design with simple yet tensile lines, creating high recognizability and a luxurious feel. The interior is exquisite, focusing on details and quality, using premium materials to create a comfortable and luxurious driving environment. Even the 800,000 yuan ET9 can exude a youthful vibe for a CEO.

Ledo: Conventional overall design emphasizing practicality and comfort, with a reasonable spatial layout catering to various family travel needs.

Firefly: Round, compact, agile, and cute exterior design, offering high recognizability and a unique personality.

Technology Application

As the flagship brand, NIO's models embody most of its mature technologies, including the NIO Pilot autonomous driving assistance system, NOMI intelligent voice assistant, SkyOS·Tianshu system, steer-by-wire, and the all-domain 900V architecture. The flagship ET9 will feature nearly all NIO's top technologies, utilizing the best materials available.

As a family-oriented brand, Ledo can be seen as a simplified version of NIO. It inherits NIO's battery swapping mode and relies on existing technologies and facilities. The L60 uses a combination of a MacPherson front suspension and a multi-link rear suspension, inferior to NIO's five-link system in handling stability and ride comfort. Additionally, Ledo is one grade lower than NIO in sensing hardware, autonomous driving, and body materials.

Firefly, positioned in the high-end compact car market, offers various paint options and personalized intelligent cabins. While it won't directly use NIO's Banyan system, it may adopt the SkyOS Tianshu system in the future. With support from NIO's intelligent team in in-car interaction and autonomous driving, Firefly's intelligent driving capabilities are expected to be among the best in its price segment.

Closing Remarks

In the fiercely competitive year of 2025, NIO must triumph!

NIO's diversification strategy is a necessary response to market pressures.

To succeed, NIO has launched three brands: NIO, Ledo, and Firefly. NIO leads the mid-to-high-end market with luxury and intelligence, Ledo satisfies family travel needs with practicality and comfort, and Firefly attracts young consumers with its individuality and agility.

Success will form a triangular support for sustainable company growth; failure will mean half-baked efforts falling short of greatness.

Previous Articles

2025: No Looking Back, Accelerating the Automotive Industry's Elimination Race

The 800,000 NIO ET9: A New Choice for Both "Old Money" and "New Money"?