Tesla's Renewal: A Controversial Dominance?

![]() 01/13 2025

01/13 2025

![]() 544

544

In the near term, Tesla's position remains unassailable.

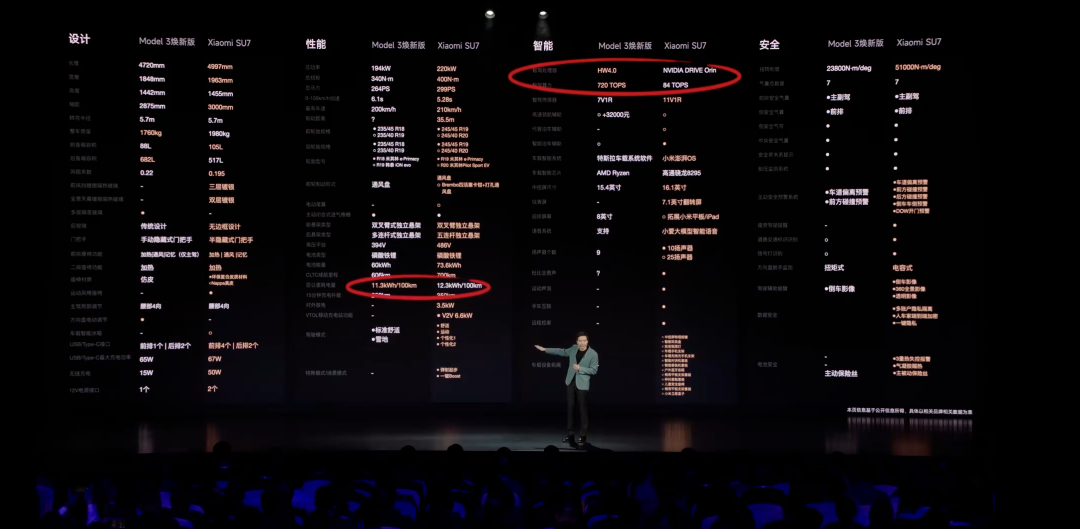

Tesla has emerged as the focal point for new energy vehicle (NEV) companies in 2024. Starting with Xiaomi's car launch event, meticulous comparisons with Tesla models have become a staple.

In the first half of the year, it was pure electric C sedans like Xiaomi's SU7 that benchmarked Tesla's Model 3. In the second half, mid-to-large pure electric SUVs, represented by NIO's Ledao L60, comprehensively compared themselves to Tesla's Model Y.

Despite not winning in terms of parameters, Tesla achieved a significant sales victory, selling 657,000 vehicles, an 8.8% increase year-on-year. This performance, while lagging behind the growth rate of domestic NEVs, remains Tesla's best globally.

More impressively, Tesla sells only four models in the Chinese market, with Model 3 and Model Y being the true volume drivers. With just these two models, Tesla sold 600,000 vehicles in China, a feat unmatched by any other domestic automaker.

It's fair to say that automakers' offensive against Tesla in 2024 did not fully succeed.

First without an adjective

Specifically, Model Y contributed the lion's share of Tesla's sales in China, with 480,000 units sold, making it the world's best-selling passenger car and China's top-selling passenger car, requiring no adjectives for modification.

Crucially, the Model Y sold in 2024 was still the 2021 model, yet no model has emerged to surpass it after three years.

Such confidence prompted Tesla to recently launch the renewed Model Y, paired with comparative text on the poster, which immediately garnered attention from major automaker leaders on Weibo.

As the benchmark, Tesla has always played the role of a ruler at competitors' launch events. Xiaomi, in particular, brought the comparison method from mobile phone launches to the automotive industry, listing dozens of comparison items to highlight the power of Xiaomi SU7.

Other new force automakers quickly adopted this approach. In the second half of the year, NIO's Ledao became the first brand to challenge Model Y. However, models like Zeekr 7X, Ledao L60, and Avitar 07 have not posed a direct threat to Tesla Model Y.

Behind this is Musk's experience learned from traditional automakers. Tesla adopts a strategy of minimal changes, allowing Model Y to maintain long-term market competitiveness without consumer hesitation.

Compared to domestic brands that frequently change models, Tesla appears more stable, avoiding consumer discomfort.

More importantly, Tesla has leading technology in the electric powertrain. Even Lei Jun acknowledged Tesla's excellence in comparisons. For instance, in terms of energy consumption, Tesla Model Y consistently ranks among the lowest globally.

As a global NEV leader, Tesla has a simple product lineup but captures consumer needs effectively. With these advantages, Tesla remains the best-selling automaker in the pure electric market globally, selling 1.78 million vehicles annually, slightly ahead of BYD's 1.76 million.

With its first-mover advantage, Tesla has established a strong initial impression among consumers. For many potential customers, Tesla is often a top consideration. For general consumers, Tesla's strong sales and high market presence make it a reliable choice.

Moreover, under the influence of domestic brands' setbacks, consumers emphasize brand influence when purchasing new cars. As a foreign enterprise, Tesla is highly valued by national and local governments. Musk's influence also ensures Tesla's operational stability in the short term.

A stable brand image significantly supports Tesla's popularity, enabling it to maintain strong sales in the domestic market. Compared to domestic competition, Tesla is even more dominant overseas. In the North American market, Model 3 and Model Y are years-long sales champions.

Risks Increase Sharply

While Tesla maintained good sales in the Chinese market in 2024, globally, it rarely experienced a sales decline. However, sales in Europe and North America declined, with China's growth becoming Tesla's sales ballast.

This ballast harbors hidden dangers. In 2024, China's NEV sales grew by 35%, contributing over 90% to global NEV sales. Tesla's growth rate in China was only 8.8%, far below the industry average.

Amidst slowing global NEV support, the Chinese market is Tesla's sole reliance. Shanghai's Gigafactory provides 40% of Tesla's production capacity, serving both the Chinese market and exports to Europe and Southeast Asia.

In China, Tesla can only trade volume for price. For example, the renewed Model 3's launch price was 269,900 yuan, now dropped to 235,500 yuan, a reduction of over 30,000 yuan in just over a year.

Even with such a price reduction, Model 3's sales remain unstable, fluctuating annually and even less stable than Xiaomi SU7's sales. The annual sales volume is only about 50,000 vehicles more than Xiaomi's, with the gap narrowing significantly.

Model Y's price has also declined continuously. The starting price at the beginning of the year was 258,900 yuan, now dropped to 239,900 yuan, with an additional five-year interest-free financial service. This significant discount sustains Model Y's sales.

Currently, apart from price advantage, Tesla has no other strong points. Tesla's prized Full Self-Driving (FSD) capability, after a year of hype, remains unavailable in China. Conversely, domestic automakers' intelligent driving capabilities are intensifying, with new forces rolling out nationwide end-to-end assisted driving without maps.

While FSD is available in North America, the full version is unavailable in Europe and China, significantly reducing Tesla's competitiveness.

Moreover, Tesla's focus in 2024 was almost entirely on FSD. After Cybertruck sales cooled, Musk shifted Tesla's focus to AI and intelligent driving, investing heavily in computing centers to train models.

The annual technology conference also centered on FSD-based unmanned driving technology, including futuristic robotaxis. The long-rumored affordable model remains just a rumor.

Relying solely on the current lineup, it's challenging for Tesla to maintain sustained sales growth. As the world's largest NEV automaker, Tesla's development has hit a bottleneck, making it difficult to continue leading global NEV advancements.

After the launch of the renewed Model 3 and Model Y, consumers find it hard to see Tesla's NEV innovation. Especially, the renewed Model Y's exterior design is highly similar to Xiaopeng P7+. Even for many overseas netizens, the upcoming Xiaomi YU7 is considered more attractive.

In an actively developing global NEV industry, it's astonishing that Tesla, a NEV pioneer, is among the few automakers experiencing sales declines. More crucially, behind the sales decline, Tesla's profitability hasn't improved, with its gross profit margin continuing to decline.

Under such circumstances, Tesla Model Y's position as the year's best-selling model may also be usurped. Although Tesla claims it's not afraid of comparisons, the fact that it says so proves it cares about such comparisons and is starting to pay attention to competitors once overlooked.

For now, Tesla still has plenty of confidence. According to third-party information, orders for the new Model Y are continuously increasing. On January 10 alone, a single store received around 300 orders. It's even said that as of January 12, new Model Y orders exceeded 50,000.

It can only be said that while Tesla shows signs of decline, it remains resilient. A single facelift can revitalize it. Domestic NEV automakers still need to continue their efforts to challenge Tesla.

Note: Some images are sourced from the internet. If there is any infringement, please contact us for removal.