Sales Share Dips to 35%: When Will Joint Venture Brands Transition from Winter to Spring?

![]() 01/15 2025

01/15 2025

![]() 624

624

Author | Zhen Yao

Editor | Li Guozheng Produced by | Bangning Studio (gbngzs)

At 31.436 million units, sales surged 4.5% year-on-year, setting a new high. On January 13, the China Association of Automobile Manufacturers (CAAM) released 2024 sales data, highlighting steady progress. China's auto production and sales have topped the global charts for 16 consecutive years, with both 2023 and 2024 exceeding 30 million units. Passenger car production exceeded 25 million units for two straight years, while new energy vehicle sales soared past 12 million units, accounting for over 40% of total sales. Auto exports reached 5.859 million units. Amidst these macro statistics, some brands rejoice, while others lament, particularly as the market share gap between Chinese and foreign brands widens once more.

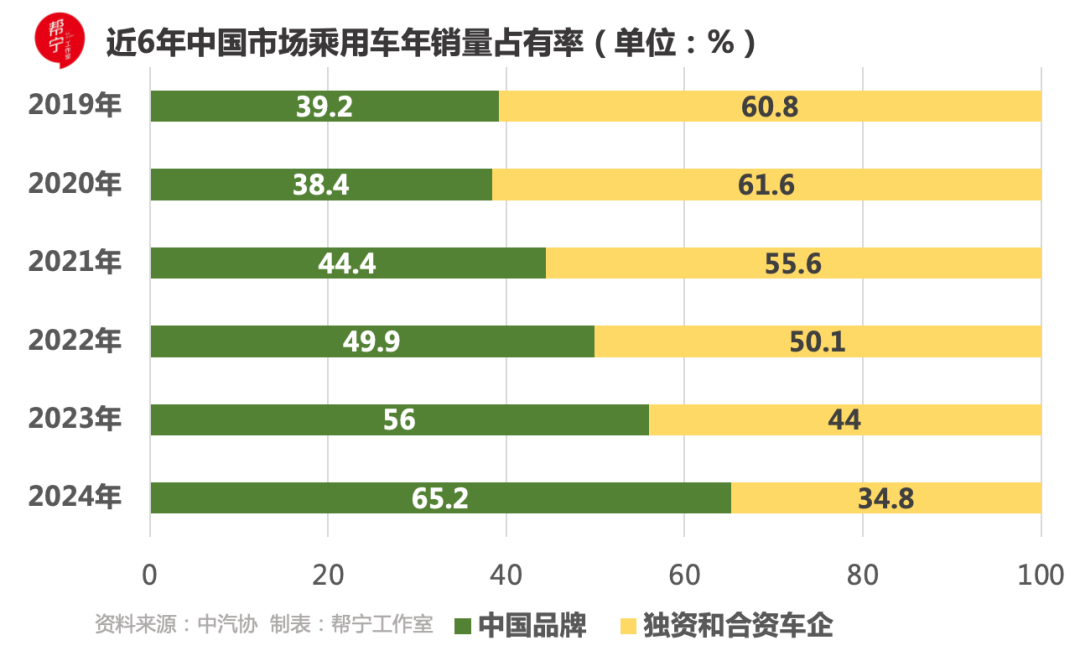

In 2024, Chinese brand passenger car sales hit 17.97 million units, a 23.1% year-on-year increase, with a market share of 65.2%, up 9.2 percentage points. Conversely, joint venture automaker sales dipped below 10 million units for the first time, reaching 9.592 million units, or just 34.8% of the market. Specifically, German brands held 14.6%, Japanese brands 11.2%, American brands 6.4%, and Korean brands a mere 1.6%. This starkly contrasts with 2020, when Chinese brand passenger car sales accounted for just 38.4% and joint ventures 61.6%. This signifies a fundamental shift: Chinese brands are experiencing leapfrog growth, with market share increasing annually, while joint ventures are declining, facing an increasingly dire situation. Last year's sales comparison between Chinese and foreign brands, rounded to the nearest whole number, was 65%:35%, clearly indicating that joint venture brands have suffered a major setback. Is this ratio the final chapter in the sales battle between Chinese and foreign brands? Does the Chinese brand still have growth potential? When will joint venture brands see a turnaround?

The pie is shrinking.

"There is no balance point for market share between Chinese and foreign brands," said Cui Dongshu. On the evening of January 13, the secretary-general of the Passenger Car Market Information Joint Meeting of the China Automobile Dealers Association (CADA) granted an interview to Bangning Studio, making a bold prediction: as Chinese brands rise comprehensively, joint venture automakers may gradually exit the Chinese market. Earlier, BYD Chairman Wang Chuanfu echoed this sentiment, stating that 2024-2026 will be crucial for scale, cost, and technology. "In the next 3-5 years, joint venture automakers' share will drop from 40% to 10%, with 30% representing future growth space for Chinese brands," Wang Chuanfu also noted at the China EV100 Forum (2024), indicating that "with escalating R&D efforts in new energy vehicles and a rapid increase in new vehicle launches, China's new energy vehicle transformation is progressing deeply and breaking through the iteration critical point."

Various signs are confirming this prediction. First, amidst the electrification and intelligence wave, Chinese auto brands have surged, with pure electric, plug-in hybrid, and extended-range electric vehicles proliferating. Second, the in-car cabin has become a battleground for automotive technology. Chinese brand models feature rotatable large screens and multi-screen interconnected designs, integrating rich entertainment and vehicle control functions. Open operating systems support numerous third-party applications, making the in-car experience akin to that of a smart living room. Third, for family travel, features like queen-size co-pilot seats and full-car voice interaction transform the in-car space into a cozy home. Fourth, advanced intelligent driving assistance systems and other functions are highly appealing to users.

Facing these trendy and practical technologies, joint venture automakers seem like bystanders, anxious yet unable to find a path forward. Meanwhile, in price wars, traffic wars, oil-electric disputes, and other competitive arenas, Chinese brands hold the upper hand. Joint ventures are constrained by cost, system, and shareholder interests, proceeding cautiously and always lagging behind. Models like BYD Qin L, Yinhe Xingjian 7EM-i, Seal 06, Song Pro DM, Yinhe E5, Lixiang L6, Wenjie M7, Xiaomi SU7, and Wenjie M9 have successively replaced joint venture models, becoming new market leaders in their segments. In October 2024, Chinese brand passenger car market share surpassed 70% for the first time, shocking the global auto industry and prompting domestic consumers to reassess Chinese brands' strength and market position. A decade ago, in 2014, joint venture automakers dominated with over 70% market share, whether German, American, French, or Korean brands were all favorites. The turning point came in 2022, when joint venture automakers' market share dropped to about 50%, continuing to decline since then to just over 30%.

In just 10 years, the market landscape has transformed dramatically. Joint venture brands have experienced the seasons, from spring to summer to autumn to winter, and this may be a one-way journey rather than a cycle. Many joint venture brands, including FAW-Volkswagen, Tesla, SAIC-Volkswagen, FAW-Toyota, GAC-Toyota, Dongfeng-Nissan, Dongfeng-Honda, DPCA, GAC-Honda, SAIC-GM, Beijing Hyundai, BMW Brilliance, Beijing Benz, FAW-Audi, Changan Ford, and Changan Mazda, among others, share just over 30% of the market, illustrating fierce competition. Worse still, their pie is likely to shrink further. In 2025, who will be eliminated?

Counterattack Sounds Again

At the start of 2025, joint venture automakers are planning their comeback. On January 7, at a meeting at SAIC-Volkswagen's headquarters in Anting, Shanghai, Tao Hailong, the party secretary and general manager of SAIC-Volkswagen, outlined 2024's operating conditions, systematically planned 2025's work direction, and proposed corresponding strategies. That same day, Nissan (China) also held a related event. Subsequently, on January 10, FAW-Volkswagen held a 2025 media communication event in Beijing, where senior executives from Volkswagen, Audi, and Jetta brands unveiled their plans. On the same day, Volvo, Mercedes-Benz, Toyota China, and other foreign and joint venture automakers held media communication meetings in Beijing. On the 13th, SAIC-GM held a new year media communication event in Shanghai, revealing that in 2025, it will focus on electrification, intelligence, and high value, launching a series of innovative technologies and new products. It also stated that it will accelerate its transition to new energy and intelligence, supported by a new architecture, Aote Neng 2.0, and advanced intelligent driving technology.

How will they counterattack? Bangning Studio has initially summarized three main counterattack strategies for joint venture brands. First, an intensive product offensive. FAW-Volkswagen stated that in the next 20 months, the Volkswagen, Audi, and Jetta brands will launch 19 new models across oil, electric, and hybrid routes, paving the way for product breakthroughs. For instance, the Volkswagen brand aims to launch and succeed with each fuel vehicle, making each a hit, while for new energy vehicles, it aims to learn from others' strengths and achieve overall leadership in three electrics and two intelligences. SAIC-GM plans to launch 12 all-new models from 2025 to 2027, all of which will be new energy vehicles covering sedans, SUVs, and MPVs. Beijing Hyundai received a $1.095 billion capital increase on December 11 last year, planning to successively launch five new models from 2026 onwards. Volkswagen Anhui also announced that by 2026, it will introduce five new models, including SUVs and sedans, encompassing fuel, plug-in hybrid, and pure electric vehicles. Volvo will launch seven new models this year. Second, seize the discourse power of intelligence. In recent years, Chinese brands have leveraged intelligence and electrification as selling points to capture joint venture brand users' hearts. This year, joint venture automakers are intensifying their counterattacks. "In 2025, our goal is to transition from being a follower in intelligence to the industry's first tier," said Lu Xiao, general manager of SAIC-GM.

In the chip field, FAW-Volkswagen has achieved 4-nanometer chip process technology and is actively developing a new generation of technology. Simultaneously, it adopts Horizon's latest J6 chip to propel its products into the forefront of high-order intelligent driving. "In the future, we will successively introduce higher-order L2++ autonomous driving functions, 4-nanometer process chips, 3.0 AI cabins, AI large models, and other features to make intelligent FAW-Volkswagen stand out even more," said Wu Yingkai, deputy general manager (business) of FAW-Volkswagen. Volvo announced that it will introduce AI large models in 2025 to better empower dealers and users with AI. Third, marketing innovation. Last year, Cadillac's new XT5 adopted a "limited-time fixed price" strategy, subsequently extended to some Buick models, shifting the business model from traditionally waiting for customers to active marketing. "Stronger, prettier, smarter," Fu Qiang, executive deputy general manager of Sales and Marketing and general manager of Shanghai SAIC-Volkswagen, introduced a more aggressive marketing strategy and overall approach.

A relevant responsible person from FAW-Volkswagen stated that they will accelerate the transformation of thinking modes and propel the breakthrough of the entire marketing system. Volvo stated that it will embrace new media, flexibly deploy sales and service channels and communication channels through a combination of online and offline, and establish a multi-dimensional and multi-role new media communication matrix in the four major matrices (official, media, dealers, and users) to enhance brand influence. Joint venture automakers are also intensively expanding their channels, frequently playing the quality, safety, and service cards, in an attempt to consolidate their discourse power. Simultaneously, they are adjusting their senior management, vowing to break through the status quo and fully launch a battle to defend market share. However, considering foreign strategy, most joint venture automakers, particularly those in the Toyota, Volkswagen, Honda, Hyundai, and Nissan systems, will not see a major product launch until 2026. 2025 will remain a challenging year for joint venture brands, with the collective loss of the 30% share almost a foregone conclusion.