Empowering Dealers for Profitability: Leapmotor's Journey Beyond 'Small Ideals'

![]() 01/16 2025

01/16 2025

![]() 600

600

Introduction

In the vibrant Chinese automotive landscape, Leapmotor stands out with a unique narrative.

As 2024 draws to a close, it's time to reflect on the market's most surprising and delightful newcomer. Without hesitation, I bestow this accolade on today's protagonist—Leapmotor.

Over the past 365 days, Leapmotor's performance has been nothing short of remarkable. It surpassed sales targets ahead of schedule, launched successful products, refined its brand marketing, shone in technological R&D, pursued overseas expansion with a unique approach, fostered a positive team atmosphere, and garnered favorable responses from the capital market. Both emotionally and logically, there's much to admire.

Just this week, Leapmotor once again stunned the industry with groundbreaking news. On January 13, Beijing time, the newly released earnings forecast revealed that the just-concluded fourth quarter of 2024 would see a turnaround in net profit, achieving quarterly profitability a year ahead of schedule. Furthermore, in 2024, Leapmotor dealers nationwide achieved a cumulative profitability rate close to 85%, leading the industry.

Yes, you heard that right—Leapmotor is that strong. The protagonist of today's article has unequivocally dispelled outside doubts with tangible actions.

Following Li Auto, Leapmotor has become the second new force in auto manufacturing to achieve quarterly profitability.

In the eyes of outsiders, the two automakers share many similarities, with Leapmotor even being labeled a 'small ideal.' However, a closer look reveals distinct growth paths despite some convergences.

Leapmotor's unique market positioning, technological innovation, and global expansion strategy give it independent brand value and development direction. It is far from being a mere 'small ideal.'

Capitalizing on its 'quarterly profitability' milestone, let's delve into some perceptions and feelings about this burgeoning auto manufacturing force.

Why Leapmotor is Definitely Not a 'Small Ideal'

In 2023, Li Auto achieved annual profitability for the first time in its history with cumulative deliveries exceeding 370,000 new vehicles. In 2024, with deliveries surging past 500,000, annual profitability was all but assured.

Li Auto, positioned in the mid-to-high-end new energy market, has indeed carved out a unique niche, firmly establishing its foothold. It serves as a 'model' worth emulating for all competitors.

Li Auto's relentless sprint underscores the automotive industry's emphasis on scale effects. Without sales volume as support, visions remain castles in the air. Popular products are essential, and one must endure hard times to succeed.

In this regard, Leapmotor understands the game well.

The main reason for Leapmotor's net profit turnaround in the fourth quarter of 2024 was a surge in deliveries, with an average monthly sales volume exceeding 40,000 units. Additionally, the product structure was continuously optimized, with the sales proportion of higher-priced C-series models exceeding 77%. Effective cost control and operational efficiency improvements also played crucial roles.

This success formula hinges on these factors.

Many Leapmotor dealers achieve high profitability not only due to product strength and brand influence but also because of its pragmatic mass market positioning and effective market strategies. The profitability trend demonstrates steady growth, showcasing the balanced development of Leapmotor.

Throughout 2024, many readers have heard that dealers of joint venture brands, including BBA and Porsche, have begun turning to 'franchising' new forces in auto manufacturing. Such changes reaffirm who the 'darling' of the Chinese automotive market truly is.

Leapmotor is a 'quality stock' among this group. Its journey thus far reveals significant differences from Li Auto.

First, Leapmotor has always focused on the highly competitive mass mainstream market of 100,000-200,000 yuan, encompassing a wider range of potential customers. By deeply cultivating this market, 'high value for money' has become a defining label for Leapmotor.

Secondly, Leapmotor is flexible in market positioning and can adjust its product strategy in real-time based on market changes and user needs. Models like Leapmotor C10 and C16, though labeled 'Li Auto alternatives,' maximize their unique characteristics in product design and configuration.

Furthermore, unlike Li Auto, which relies heavily on L-series extended-range SUVs, extended-range products account for only 20% of Leapmotor's current sales composition. For the C-series alone, extended-range products account for 25%-30%. Leapmotor has truly achieved 'having but not relying on' and adheres to a pure electric technology path.

Finally, in overseas markets where Li Auto has made limited progress, Leapmotor gained expansion capabilities through cooperation with its global strategic partner, the Stellantis Group. With Stellantis's distribution network, Leapmotor quickly entered the global market, establishing more than 400 sales outlets in 13 segmented markets with sales and after-sales service functions since September 2024.

At this juncture, it's evident why Leapmotor is emphatically not a 'small ideal.' Instead, it creates its own story in the Chinese automotive market.

'Quarterly profitability' marks an excellent start.

Becoming the Uniqlo of the Automotive Industry and the Toyota of the New Energy Sector

Having addressed why Leapmotor is not a 'small ideal,' the question arises: 'What exactly does it aim to achieve?' Or, put differently, what is its corporate vision?

Before answering, we must clarify why Leapmotor stands out in the fiercely competitive Chinese automotive market and delivered impressive results in 2024.

Photo | In December 2024, Zhu Jiangming and Leapmotor engineers took a group photo on the occasion of the 9th anniversary

A friend's analysis sums it up well: 'Its rise requires the right timing, geographical advantages, and harmony among people, none of which can be lacking.'

Indeed, the cooling consumer environment has made the 100,000-200,000 yuan segment market a focal point for most potential customers. Policy-level replacement subsidies have also spurred vehicle upgrade needs. Coupled with the surge in new energy penetration, electric vehicles have reached a true turning point, becoming the mainstream choice.

These conditions have provided a favorable environment for Leapmotor's robust sales.

Leveraging this trend, Leapmotor's product matrix shines. The T03, in the pure electric small car market, secures a significant market share. The three SUVs—C10, C11, and C16—are its absolute mainstays, adopting a 'walking on two legs' technology path with both extended range and pure electric options. They conform to mainstream aesthetics without being overly forceful and differentiate in product positioning, avoiding excessive internal competition and meeting most potential customers' purchasing intentions.

Pricing remains a crucial factor, maintaining high value for money across all models.

In the new energy sedan market, C01 contributes significantly with a similar approach. At the Guangzhou Auto Show, the debut of B10 quickly garnered attention.

The popularity of multiple models reflects Leapmotor's keen sense of consumer preferences.

In 2024, Leapmotor refrained from following competitors' overly aggressive marketing strategies. Instead, it adopted a down-to-earth approach, allowing its products to gradually gain recognition.

These aspects highlight Leapmotor's pragmatic nature.

The company's leadership is not extravagant, and there are no flamboyant executives. It doesn't chase hot topics or gimmicks but rather focuses on configuration. If compared to the fast-moving consumer goods industry, Leapmotor's image resembles that of 'Uniqlo.'

In fact, CEO Zhu Jiangming has repeatedly emphasized: 'Ultimately, automobiles are durable consumer goods and means of transportation. Treating cars as such may offer more advantages. Our brand positioning is to provide users with products offering higher configuration, better quality, and affordability. No matter the temptation, gross margin, or potential, Leapmotor will always adhere to treating automobiles as mass consumer goods.'

Striving to 'disenchant' consumers and become the 'Uniqlo of the automotive industry' has always been Leapmotor's unwavering pursuit.

In Zhu Jiangming's 'business philosophy,' Toyota is also a respected teacher. Specifically, Toyota's lean production philosophy is crucial for cost control.

By optimizing production processes, reducing waste, and improving efficiency, Toyota produces high-quality automobiles at lower costs. Through vertical integration, it achieves full-process control from parts manufacturing to vehicle assembly, ensuring quality, supply stability, and cost reduction through economies of scale.

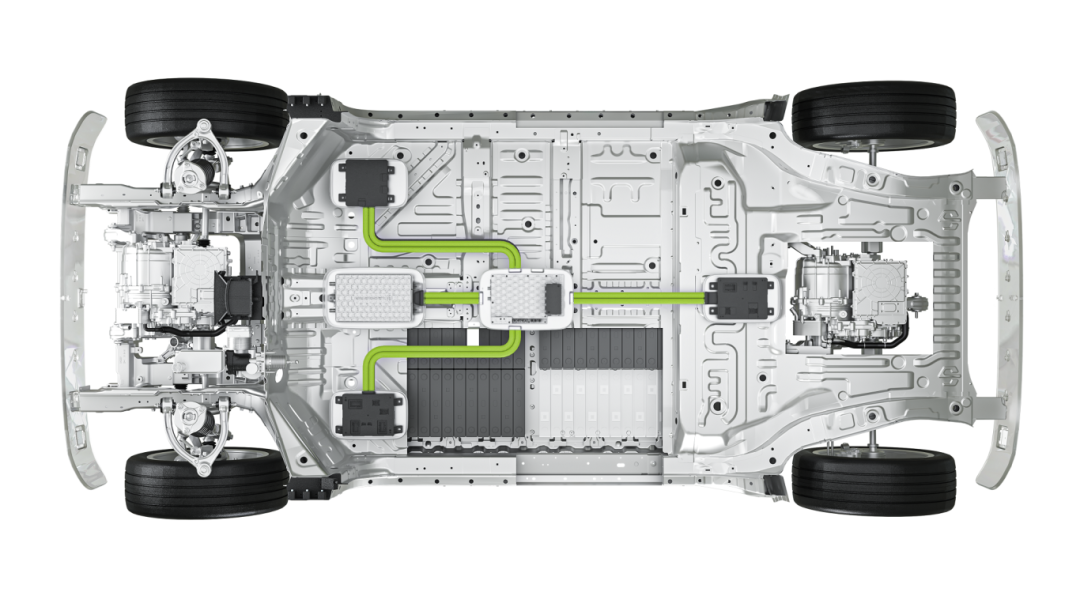

Today, Leapmotor, through a full-stack in-house R&D strategy, has achieved in-house R&D in core three-electric systems and various high value-added components, possessing strong vertical integration capabilities. Except for outsourced battery cells, interior and exterior trim, and self-developed plus outsourced production of chassis and automotive electronics, all other components are self-produced. This makes Leapmotor the domestic new force in auto manufacturing with the highest degree of full-stack in-house R&D capability and vertical integration.

Photo | Leapmotor's central integrated electronic and electrical architecture

Leapmotor's current technological innovations cover multiple fields like electronic and electrical architecture, smart cockpits, and smart driving. Through in-house R&D, it continuously reduces costs and increases efficiency, forming a strong technological barrier.

Relying on this strategy, Leapmotor aims to achieve cost control like Toyota through vertical integration and modular design, further improving production efficiency and product quality.

From being the 'Uniqlo of the automotive industry' to the 'Toyota of the new energy sector,' Leapmotor embodies the values of today's protagonist, steadily walking on a development path suitable for itself. Simultaneously, the question posed at the beginning of this paragraph finds its answer.

As we conclude, I would like to emphasize that Leapmotor's journey is just beginning. Its future promises even greater heights.

Currently, Leapmotor has set an ambitious annual target of producing 500,000 vehicles. Having successfully transitioned from losses to profits in the fourth quarter of 2024 and backed by impressive sales figures, the company intends to maintain its upward trajectory. It seems plausible that achieving full-year profitability is within reach.

In 2025, Leapmotor exudes both ambition and determination...