Who Will Dominate the Auto Industry's 'Cash Magnet' Title in 2024?

![]() 01/16 2025

01/16 2025

![]() 690

690

For the automotive market, 2024 is undeniably a year of relentless competition. Automakers vie for supremacy in pricing, product offerings, market share, and even leadership. This underscores the importance of proving one's mettle in an increasingly cutthroat environment.

Against this backdrop, maintaining a robust and ample cash flow is paramount for automakers. The cautionary tales of bankruptcies among emerging players like HiPhi and Geely's EV brand remain fresh in memory. Consequently, many automakers have accelerated their financing efforts to bolster risk resilience, determined to avoid a similar fate. AITO stands out as a prominent example, epitomizing the "privileged heir" in the automotive realm. On December 17, 2024, AITO officially announced the completion of its Series C funding round, raising over RMB 11 billion. This funding round is poised to be the largest in the new energy vehicle industry.

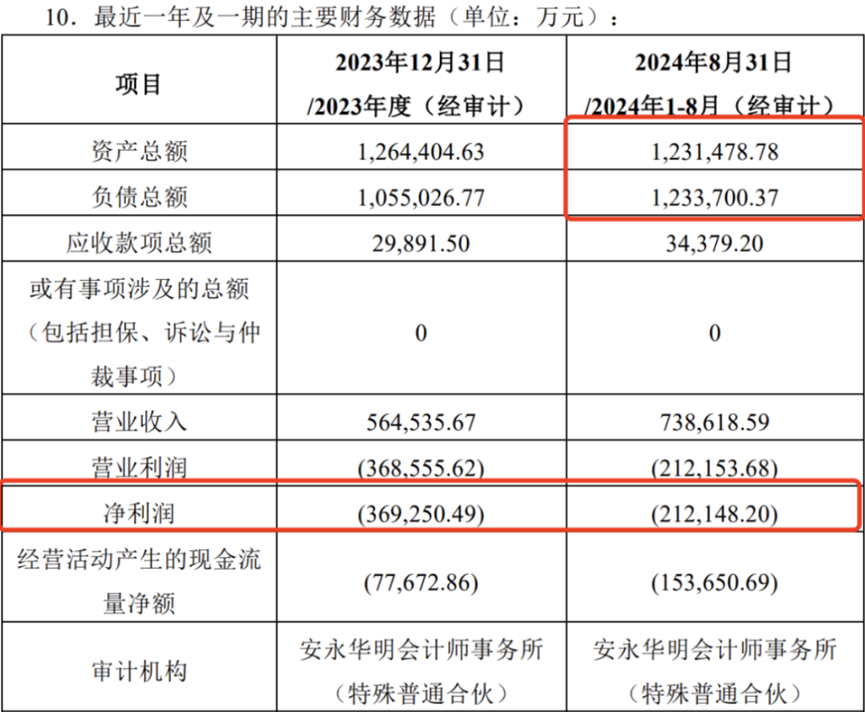

Relevant announcements reveal that the over RMB 11 billion funding primarily stems from 13 investors, including Changan Automobile, South Capital, Anyu Fund, and BOCOM International Investment. Notably, Changan Automobile invested RMB 4.551 billion, emerging as AITO's largest investor. Upon the completion of this Series C funding round, AITO's valuation will surge from RMB 14.085 billion in September last year to over RMB 30 billion. Currently, AITO has embarked on preparations for its IPO, aiming for a listing in 2026. However, achieving self-sustaining growth and turning around losses are critical milestones AITO must conquer before its IPO. Official data indicates that AITO's net loss of RMB 2.12 billion in the first eight months of 2024 has already surpassed its full-year loss in 2022. Moreover, AITO's current total liabilities (RMB 12.337 billion) exceed its total assets (RMB 12.315 billion).

Chen Zhuo, President of AITO, once disclosed that Changan expects AITO to achieve break-even by the second half of 2025. To meet this challenge, AITO must intensify revenue generation and cost reduction efforts. In 2024, AITO transitioned from a direct sales model to a dealer model on a large scale, delegating after-sales operations to partners to alleviate significant channel-side cost pressures. Meanwhile, the launch of extended-range products has also served as a catalyst for AITO's sales. Data reveals that sales have surpassed 10,000 units for three consecutive months since the introduction of AITO 07.

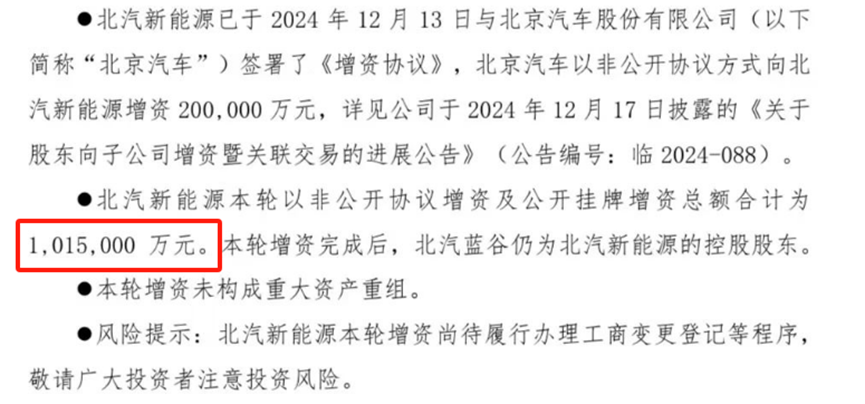

By 2026, AITO plans to introduce a large six-seat SUV model and an MPV model to the market. These vehicles will adopt Changan's self-developed SDA 2.0 platform, deviating from the CHN platform jointly developed by Changan, Huawei, and CATL. With multiple strategic initiatives in place, will AITO become the first "national team" to successfully navigate an IPO? Time will tell. With over a hundred billion yuan in investment, BAIC BJEV also has lifesaving funds at its disposal. Right after AITO's capital increase announcement, BAIC BJEV received a capital replenishment of a hundred billion yuan. Officials confirmed that BAIC BJEV, the subsidiary operating ARCFOX, completed a capital increase and share expansion, introducing 11 external strategic investors and Beijing Automotive Industry Holding Co., Ltd., with a total capital increase of RMB 10.15 billion.

In addition to Beijing's state-owned assets institutions and AIC institutions, CATL and Pony.ai's wholly-owned subsidiaries also invested in BAIC BJEV. This financing is anticipated to alleviate BAIC BJEV's financial pressures. However, issues such as brand competition, sluggish market share, and losses still necessitate urgent resolution. Data shows that BAIC BJEV incurred a total loss of RMB 27 billion in the first three quarters of 2024. More alarmingly, BAIC BJEV's asset-liability ratio reached 92.31% during the same period. Beyond financial pressures, BAIC BJEV's sales performance is also unremarkable. Among the three brands - ARCFOX, ENJOY, and BEIJING - ARCFOX leads in sales. In the first 11 months of 2024, ARCFOX's cumulative sales reached 68,985 units, marking a 213.4% year-on-year increase.

Previously, BAIC BJEV stated, "The company has already initiated research and development on multiple new models to cater to the growing demand from large families and is conducting pre-research on iterations of existing products." By 2027, BAIC BJEV aims to transform ARCFOX into an automotive enterprise with annual sales exceeding 600,000 units. Clearly, BAIC BJEV retains ample confidence. However, industry insiders caution, "BAIC BJEV is still mired in losses, and even with a hundred billion yuan in financing, it is far from the time to relax." IM Motors, having completed RMB 9.4 billion in Series B funding, is also poised to "come ashore." Recently, SAIC's "own son," IM Motors, announced that it has raised a total of RMB 9.4 billion in its Series B funding round. Since its inception, IM Motors has amassed RMB 22.4 billion in funding.

In this funding round, officials indicated that the raised funds will be allocated towards research and development in core technologies such as digital intelligent chassis, steer-by-wire, and intelligent driving, as well as accelerating the launch of new products. IM Motors plans to introduce 2 pure electric vehicle models and 2 extended-range vehicle models to the market in 2025. This signifies that IM Motors is quietly preparing for mass production. In 2024, IM Motors achieved an annual sales volume of 65,500 units, marking a 71% year-on-year increase. Notably, the market performance of the new LS6 is commendable. Since its launch in September, IM Motors LS6 has witnessed a surge in large-scale orders, helping IM Motors regain its sales momentum.

However, relying solely on the success of the IM Motors LS6 is insufficient, and IM Motors requires more star products to break the deadlock. Given the thriving extended-range vehicle market, the launch of IM Motors' 2 extended-range products next year could emerge as new sales growth points for the company. Absorbing over RMB 20 billion in a single year, NIO's "good show" is yet to come. On December 26, 2024, NIO Holdings Inc. underwent a change in business registration, with its registered capital increasing from approximately RMB 7.429 billion to approximately RMB 7.857 billion, a hike of RMB 428 million. In fact, NIO has received multiple capital increases within 2024. Relevant reports indicate that on December 6, 2024, the registered capital of NIO Auto Technology Co., Ltd. surged from RMB 6 billion to RMB 18 billion, a 200% increase. On October 30 of the same year, the registered capital of NIO Holdings Inc. rose from RMB 6.43 billion to RMB 7.43 billion. Earlier, on September 29, NIO and three existing shareholders of NIO Holdings Inc. signed a strategic investment agreement, investing RMB 3.3 billion and RMB 10 billion, respectively, to subscribe for newly issued shares of NIO China.

Based on these four funding rounds, NIO raised at least RMB 26.728 billion in 2024. The quest for external financing is intricately linked to NIO's long-standing losses. Financial report data reveals that in the third quarter of 2024, NIO's revenue was RMB 18.674 billion, a year-on-year decrease of 2.06%; its net loss amounted to RMB 5.06 billion, with the loss margin expanding by 11% year-on-year. Statistically, from 2018 to the third quarter of 2024, NIO's cumulative losses have surpassed RMB 100 billion. To achieve profitability, NIO is pursuing a multi-brand strategy. In 2024, NIO introduced two new brands - LeDao and Firefly. The first model under the LeDao brand, the LeDao L60, has already been launched, with deliveries exceeding 20,000 units within 100 days. The Firefly brand targets the high-end compact car market, with its first model having a pre-sale price of RMB 148,800 and expected to launch in April 2025.

According to official forecasts, NIO's sales volume will double in 2025, with its loss margin narrowing, and the company anticipates achieving profitability in 2026. This underscores NIO's confidence in its three brands.

Written at the end: In 2024, multiple emerging players collapsed due to financial woes, yet many new forces have secured significant investments. This highlights the substantial capital support from parent companies and their robust "cash-absorbing" capabilities. However, it also indicates that these new forces still rely on "blood transfusions" to survive. For them, developing "blood-producing" capabilities represents the long-term solution.

(Images sourced from the internet, remove if infringing)