BMW Struggles in China with 13.4% Year-on-Year Sales Decline: Why the Race for the Top Spot with Mercedes-Benz and Audi Continues

![]() 01/21 2025

01/21 2025

![]() 662

662

Author | Duoke

Source | Beiduo Finance

As the Chinese Lunar New Year approaches, the established luxury automakers BBA (BMW, Mercedes-Benz, and Audi) have hastily announced their 2024 annual sales figures through their respective online official channels, garnering widespread market attention.

Interestingly, with the release of these data, all three luxury automakers employed eye-catching slogans to proclaim themselves as sales champions in the Chinese luxury car market, inevitably sparking speculation. Is the intensifying competition in the Chinese auto market compelling them to form an "unspoken understanding" to amplify their voices?

I. BBA All Claim to Be Sales Champions: What's the Situation?

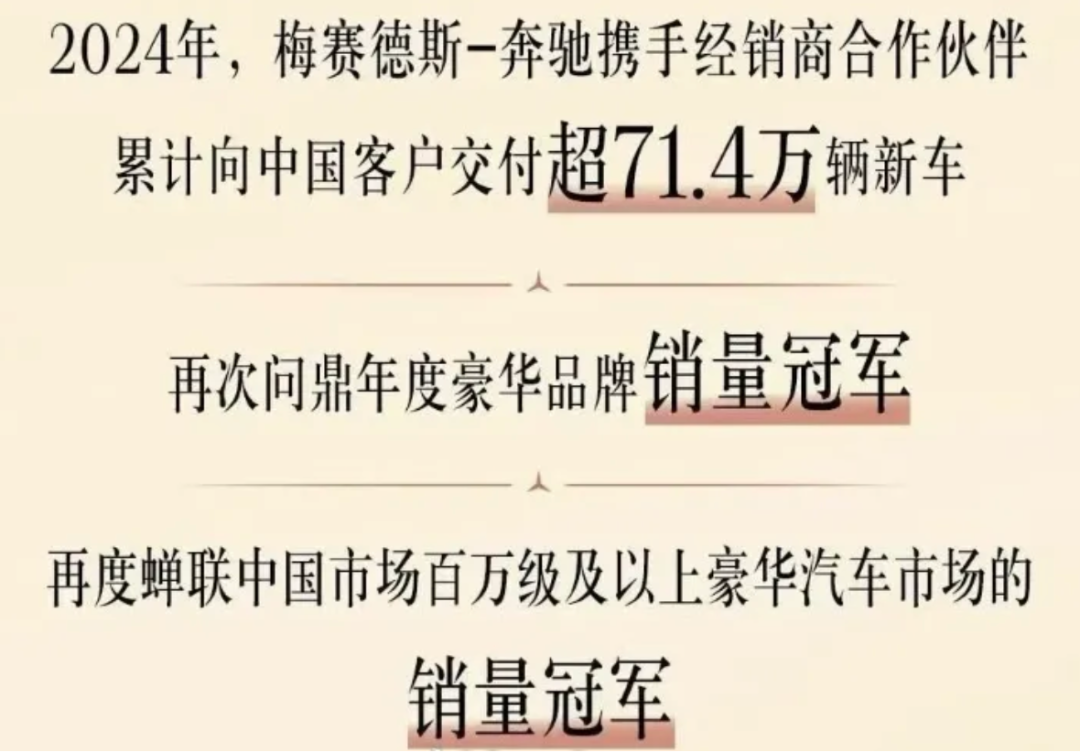

On January 10, Mercedes-Benz announced its 2024 sales on its official website, claiming to have delivered 714,000 new vehicles to Chinese customers, once again securing the sales championship among luxury brands.

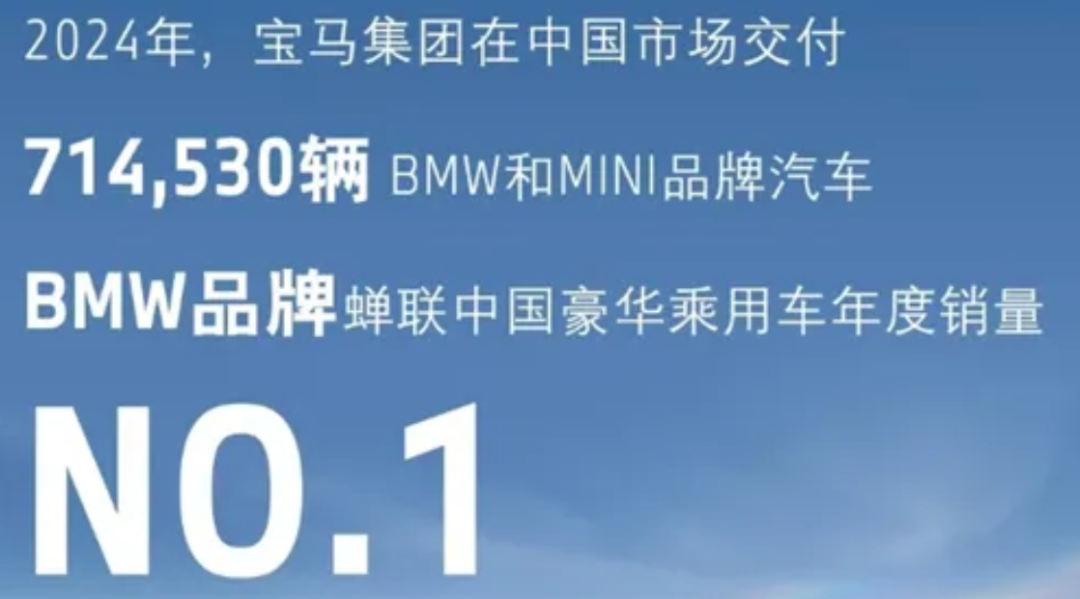

Just three days later, on January 13, BMW China announced that it had delivered a total of 714,530 BMW and MINI brand vehicles in the Chinese market in 2024, retaining its position as the annual sales champion of luxury passenger vehicles.

The sales gap between the two is negligible, with BMW narrowly edging out Mercedes-Benz by approximately 530 vehicles.

Meanwhile, Audi boasts of ranking first in sales share in the domestic fuel-powered luxury vehicle market in 2024, also claiming a sales championship. Additionally, Audi has separately secured three special championships in the "luxury mid-to-large sedan" segment, the "luxury B-class SUV fuel vehicle" segment, and the "luxury A-class fuel vehicle" segment.

However, from the sales data, Audi lags far behind BMW and Mercedes-Benz. According to its disclosed data, FAW-Volkswagen Audi sold a total of 611,088 new vehicles in 2024, with a sales gap of over 100,000 vehicles compared to the other two. Even adding the 43,200 vehicles sold by SAIC-Volkswagen Audi, it still cannot surpass them.

It is evident that all three BBA companies claim to be sales champions, but the statistical calibers and claims differ. BMW specifically refers to luxury passenger vehicles; Mercedes-Benz calculates the total of passenger vehicles and light commercial vehicles; Audi emphasizes its advantage in the field of fuel-powered luxury vehicles. No wonder some netizens joked, "As long as there are enough qualifiers, you are the sales champion." This well explains the obsession of these three luxury automakers with securing the No.1 sales position in the Chinese market, forming an unspoken "art of tacit understanding".

II. BBA's Domestic Sales Decline Together, with BMW Leading the Drop

In the century-long history of the automotive industry, German luxury brands have always been deeply loved by the public. Mercedes-Benz, BMW, and Audi have forged unique brand labels through their centuries-old heritage: Mercedes-Benz represents luxury and extravagance, BMW symbolizes ultimate driving, and Audi highlights technological innovation.

Supported by their respective halo labels, BBA has always been a symbol of noble status in China and has never struggled with sales. However, everything goes through cycles, and the current automotive industry is undergoing unprecedented changes. As the domestic and foreign auto markets rapidly shift into the era of new energy, the market position of traditional luxury brands is facing severe challenges.

Especially in the context of the strong rise of domestic new energy vehicles, BBA's sales in the Chinese market share a common characteristic: an overall decline. Among them, BMW has experienced the largest decline and has also suffered from the dual ordeal of market compression and brand renewal.

In fact, in the global market, these three traditional luxury automakers have also failed to escape the fate of declining sales.

The latest data shows that BMW's global sales reached 2.4508 million vehicles in 2024. Although this figure is still substantial, it declined by 4% year-on-year compared to the previous year. Following closely behind is Mercedes-Benz, with annual sales of 1.9834 million vehicles, a year-on-year decrease of 3%. Audi's performance was even more bleak, with annual sales of only 1.6712 million vehicles, a significant year-on-year drop of 11.8%.

Let's focus on the Chinese market. As mentioned at the beginning, the sales figures of these three brands seem quite impressive, and each claims to be the sales champion of luxury cars in China. However, from the perspective of growth rate, the situation is also not optimistic, with sales declining to varying degrees. Among them, BMW experienced the largest decline, reaching 13.4%, accounting for 29% of global sales. Mercedes-Benz and Audi experienced smaller declines, with drops of 7% and 10.9% respectively, accounting for 29% and 39% of global sales respectively.

From the perspective of market size, China is still the largest single market for BBA globally, and BMW is still the top luxury brand in China. However, it is also the luxury brand with the largest decline.

The industry believes that the main reason BMW is the automaker with the largest decline among the three brands is directly related to its indecisive attitude towards price wars in the middle of the year.

As we all know, BMW has long sneered at price wars and refused to engage in them with competitors and the market. However, due to the intense competitive pressure in both domestic and foreign markets, it is important to note that in August 2024, its sales even fell by a staggering 46% year-on-year. With sales declining, BMW had to bow its head and return to the battlefield of price wars, beginning to slash prices significantly to attract consumers and attempt to achieve its sales target for 2024.

For example, the price reduction of BMW's flagship pure electric model i7 once reached 38%, with prices in some regions even dropping by 555,000 yuan, reducing the bare car price to 663,300 yuan. The entry price of the i5 model is also close to 300,000 yuan, while the entry-level bare car price of the iX3 has dropped to over 260,000 yuan. In terms of fuel vehicles, BMW also offered many discounts, with the bare car price of the 1 Series dropping to just over 140,000 yuan, the 4 Series offering discounts of 50,000 to 60,000 yuan, and the X1 experiencing a drop of 110,000 to 120,000 yuan.

Although BMW's price reduction had an immediate effect, according to the sales ranking of various types of vehicles in the Chinese passenger vehicle market for the 48th week of 2024 (November 25 - December 1) released by the China Passenger Car Association, BMW topped the sales ranking with 19,500 vehicles. However, it should be noted that BMW has a total of 9 models, and only 19,500 vehicles were sold, averaging just over 2,000 vehicles per model per week. In contrast, Tesla, which ranked second, sold 18,600 vehicles with only two models. From this perspective, BMW's sales of individual models may not be that strong.

III. Indecisiveness in Price Wars Has Caused BMW to Endure Pain

Admittedly, the above behavior of repeatedly vacillating on price wars has severely damaged BMW's brand value, which is a matter of great vigilance.

On the one hand, BMW has always followed a high-end route, and after this price reduction, consumers may feel that BMW is not so special, lowering its brand image and weakening its brand premium ability.

Moreover, this significant price reduction has also caused considerable harm to existing car owners. For example, when the topic of "BMW returns to price wars" trended on social media, it sparked strong dissatisfaction from many existing users - "I just spent over 400,000 yuan on a car, and now it's suddenly cheaper by over 100,000 yuan. Who wouldn't be upset?", "I didn't expect BMW to drop prices so much. I'll avoid it when buying a new car in the future.", "Is BMW determined to fight it out with domestic automakers? Who will compensate me for the price difference?"...

This move has obviously offended many long-term customers of BMW, greatly reducing user stickiness and planting a "big bomb" for future repurchase rates.

On the other hand, dealers are subsidizing out of their own pockets to complete sales tasks, and their survival situation is worrying. One of the most notable events was the recent official announcement of the closure of Beijing Xingdebao, BMW's first global 5S store. According to the announcement, Beijing Xingdebao is currently facing severe financial pressure, and the group is actively seeking capital injection or other group trusteeship solutions to address the current difficulties.

As the incident continued to develop, many consumers reported on social media platforms that they had purchased maintenance services worth tens of thousands of yuan when ordering cars, but now these services cannot be fulfilled, and refunding the funds has also become a problem. Additionally, employees of Beijing Xingdebao reported that they had been owed wages for nearly four months and had already entered the arbitration process.

Beiduo Finance also noticed that recently, employees live-streamed revelations, stating that Xiamen Zhongbao, the largest BMW 4S store in Xiamen, announced a halt in production due to poor management and is now deserted. Similar to Beijing Xingdebao, the closed Xiamen Zhongbao also has historical issues such as unpaid wages for employees and customers unable to enjoy their rights, making it quite difficult to seek redress.

The numerous incidents of downstream dealers struggling to operate and exploding one after another have undoubtedly caused considerable damage to BMW's brand image, and its survival difficulties may be more challenging than imagined.

Apart from the decline in sales, what is even more difficult for BMW is the sharp downward pressure on its performance. Due to the continuation of price wars in China, BMW's pricing strategy seems to have become quite common.

But even with price promotions, it cannot withstand the strong impact of domestic brands, and BMW's market position is facing unprecedented challenges.

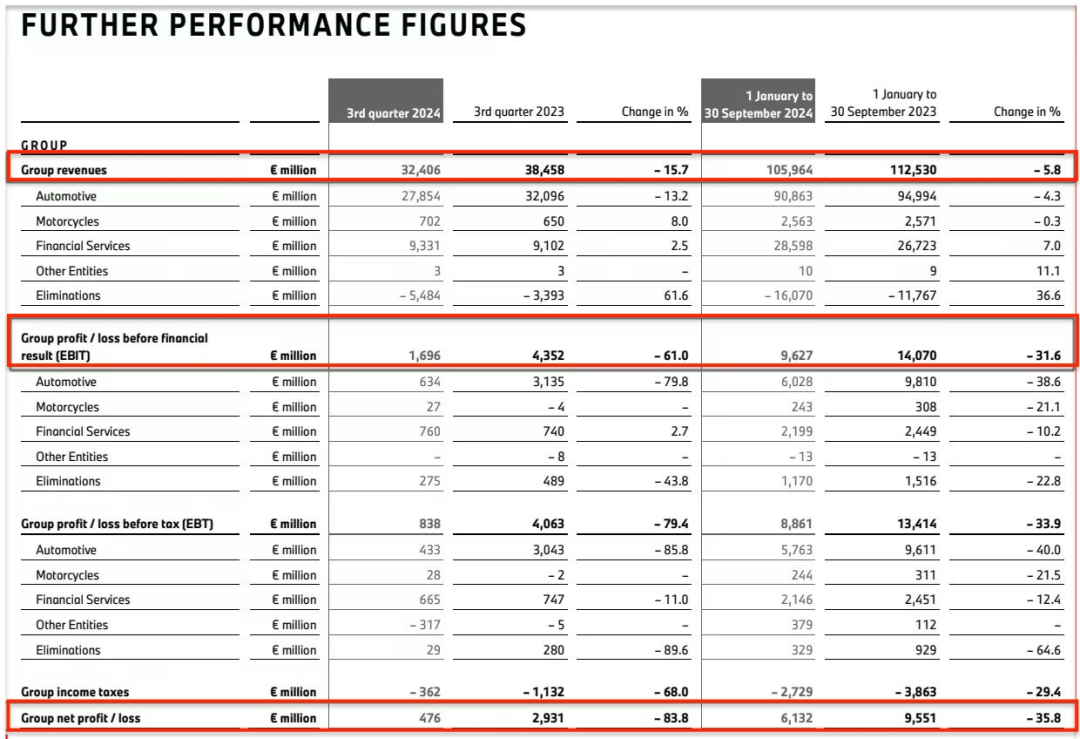

On November 6 last year, BMW Group officially released its third-quarter financial report. The report revealed that due to multiple adverse factors such as shrinking market demand, the company's revenue and profits both showed a downward trend.

Specific data shows that BMW achieved operating revenue of 32.406 billion euros in the third quarter of last year, a decrease of 15.7% year-on-year. Among them, the revenue of the core business - the automotive segment - was 27.854 billion euros, with a decline of 13.2%. In terms of profits, BMW only achieved a profit of 1.696 billion euros in the third quarter, a significant year-on-year drop of 61%. It is particularly noteworthy that BMW's automotive business profit shrank drastically to 634 million euros, a staggering 79.8% decrease from the same period last year, and the profit decline in the Chinese market reached 29.8%, becoming the biggest drag on BMW's overall performance.

The fundamental reason is that the penetration rate of China's new energy vehicle market has continuously broken through the important threshold of 50%, achieving rapid development. However, BMW has been slow to respond in the transition to new energy vehicles. Although it has always focused on electric vehicle models, hoping to maintain growth momentum by continuously expanding its pure electric vehicle lineup, its product competitiveness appears relatively insufficient.

In terms of configuration, domestic electric vehicles completely outperform BMW. It is important to note that configurations that were previously only available in BMW luxury cars are now equipped in basic models of domestic new energy vehicles, and their cost-effectiveness far exceeds that of BMW. In terms of intelligence, BMW also does not have an advantage; in terms of in-car infotainment systems, there is no comparability. In other words, China's new energy luxury automakers undoubtedly outperform BMW in terms of low cost, low prices, richer configurations, and more advanced intelligent performance.

Faced with such a fiercely competitive new energy market, BMW has failed to quickly adapt to market changes, resulting in a double impact on its market share and profits. It is conceivable that with the domestic auto market being eroded, BMW still wants to fight a beautiful comeback battle. There is a lot of work to be done in the future.