Huawei's Closest Partner Among Its In-Depth Collaborators

![]() 01/23 2025

01/23 2025

![]() 596

596

Some say that having everything Huawei equals having nothing at all, a notion that starkly contrasts with Chinese cultural norms.

"For car companies that follow existing models, what do you think will be the outcome in terms of business models?" Only those who can answer this question with genuine insight and sufficient evidence can accurately predict Huawei's next move in the Chinese automotive market.

With two major announcements in early January, Huawei's in-depth partners in the Chinese automotive industry have surpassed ten.

In just one year, the number of collaborations has surged, with a year-on-year increase exceeding 100%. However, the significance of these percentage figures is limited; the more notable change lies in the penetration rate, a term favored by public opinion: "Huawei content."

From 2022 to 2024, when discussing Huawei's in-depth collaborations in the automotive industry, the term "marginal car companies" was often used. At that time, its ecosystem was nascent, primarily comprising car companies like Thalys and ARCFOX of BAIC.

Currently, among car companies that have in-depth collaborations with Huawei, the three major Japanese brands have at least deep cockpit collaborations, and within German brands, Audi has embraced Huawei. Should the Audi A5 prove successful, the likelihood of Volkswagen following suit is high. Among China's leading independent brands, BYD, Changan, Great Wall, SAIC, GAC, FAW, and Dongfeng have all partnered with Huawei. In other words, only a handful of car companies have yet to embrace Huawei, making Huawei a de facto standard in the automotive industry.

While all these collaborations involve Huawei, their performances vary.

Minimize internal friction, and if it occurs, quickly adjust. This is Huawei's current approach in the automotive industry.

Starting with the product lines of the four brands, the early division was clear. AITO, as the pioneer, has deeper collaboration, undoubtedly.

Initially, ZHIJIE was positioned as a pure electric player, but due to factors like production capacity affecting the initial popularity of the ZHIJIE S7, it needed to quickly secure a hit to sustain further development. Thus, on the second model, ZHIJIE R7, it promptly launched an extended-range version. Unlike previous HarmonyOS Intelligence models, there was a notable detail: the extended-range version of ZHIJIE R7 did not have a large-scale launch event.

Instead, Yu Chengdong and the leaders of the four brands gathered in Hainan, proclaiming the slogan "HarmonyOS Intelligence, Together." However, with the release of the extended-range version of ZHIJIE R7, priced at 249,800 yuan, the same as the extended-range version of AITO M7, a shift in sales dynamics emerged. In 2024, AITO M7 did not maintain its impressive monthly sales of 20,000 to 30,000 units from the fourth quarter of 2023. Concurrently, ZHIJIE R7 saw a surge in sales and deliveries.

According to upcoming trends, AITO M7 is expected to undergo a facelift in 2025, potentially with increased configurations and prices, to avoid overlap with ZHIJIE R7. Furthermore, AITO will focus more on the segment above 300,000 yuan, such as increasing investment in AITO M9 and launching the equally premium AITO M8.

The market reality is that within Huawei's automotive ecosystem, each partner plays in its respective market segment. ZHIJIE, in collaboration with Chery, focuses on performance and individuality, while AITO, with Thalys, emphasizes luxury and family use. XIANGJIE, with BAIC, targets luxury administration, and ZUNJIE, with JAC, focuses on ultra-luxury. Other areas are generally consistent. Additionally, there are BYD's FANGCHENGBAO in the hardcore off-road segment and AITO's collaboration with the NIO-Huawei-Changan tripartite joint venture.

However, as the circle of partners expands, there is increasing overlap between Huawei's internal Select Cars and HI Mode. For instance, with the upcoming deep collaborations between GAC, SAIC, and BYD, there are concerns that "having Huawei equals not having Huawei."

But in reality, besides business models, Huawei's technical deployment logic also varies across different car models.

First, there are differences in the version update speed of intelligent driving:

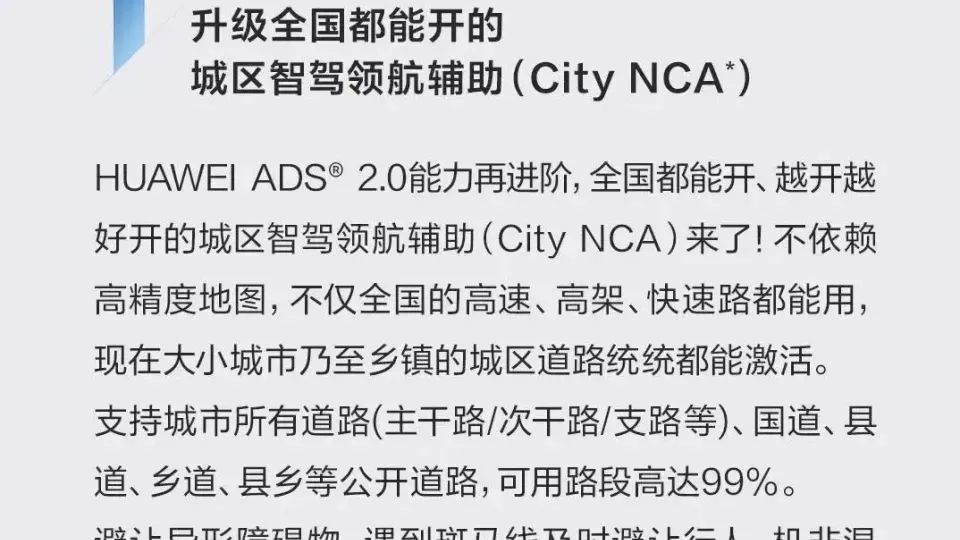

For example, the system upgrade schedule among the four brands is generally synchronized. In 2024, on March 19, post-Spring Festival, the mapless NCA function covering AITO and ZHIJIE brands was simultaneously rolled out. Then, on September 10, HarmonyOS Intelligence announced at Huawei's Autumn Scene Launch Event that ADS 3.0 would be pushed to all models of AITO, ZHIJIE, and XIANGJIE, with LiDAR-equipped models achieving park-to-park functionality simultaneously.

Unlike the unified performance, the corresponding pushes in non-four-brand modes exhibit more significant differences.

The Lantu Dreamer was launched on September 19, with production scheduling starting over a month later. On December 27, over two months later, the park-to-park advanced intelligent driving function was rolled out.

In comparison, BYD's FANGCHENGBAO BAO8 was launched on November 22, 2024, with high-speed NCA pushed on December 30, but park-to-park capability has yet to be rolled out.

Moreover, AITO has often led the pace, with AITO 12 users receiving the function push for mapless urban NCA one month earlier than the four brands, on February 4.

Does embracing Huawei only make us temporary close partners?

The difference in push time actually reflects the depth of collaboration. Undoubtedly, AITO has long had an advantage in OTA-related aspects, an advantage expected to persist due to INVOY.

"As long as INVOY releases new technology, the entire automotive industry has to follow," asserts the executive team of an independent brand automaker's R&D department.

One of the most influential events for the Chinese automotive industry in 2025 will be how INVOY, inheriting Huawei's automotive BU technology and resources, will exert its strength. As of now, Huawei's presence in the automotive industry will be divided into two sectors: one led by Yu Chengdong's automotive BU, deeply involved in assisting automakers and even leading new product definitions; the other is the HI Mode.

The latest change is that after Yu Chengdong's original statement that the "resource-limited and already saturated" Select Cars mode had reached its full capacity, the HI Mode is now divided into three types. The first is the initial HI Mode, where Huawei serves as a supplier of auto parts to automakers. The second is the deep HI Mode brought by new collaborations with automakers like SAIC and GAC, which may not enter HarmonyOS Intelligence's sales channels but involves Huawei's participation in product definition, similar to the four brands. The third and most impactful is the INVOY Mode.

For instance, when INVOY first signed a shareholding agreement with AITO for 11.5 billion yuan, Changan secured the priority right to use Huawei's new technologies. Zhu Huarong stated, "AITO will have the opportunity to obtain cross-level strategic support from INVOY and Huawei, and receive more resource倾斜. In the future, all Huawei's automotive business intelligence, new technologies, new hardware, etc., will be the first to be applied to AITO."

Similarly, when Thalys invested 11.5 billion yuan in INVOY, it secured stability and a larger supply. The original text of the agreement stated that Huawei and INVOY would provide AITO with more predictable, manageable, and sustainable technology and supply guarantees, helping AITO become a high-end smart car brand loved by consumers in China and globally.

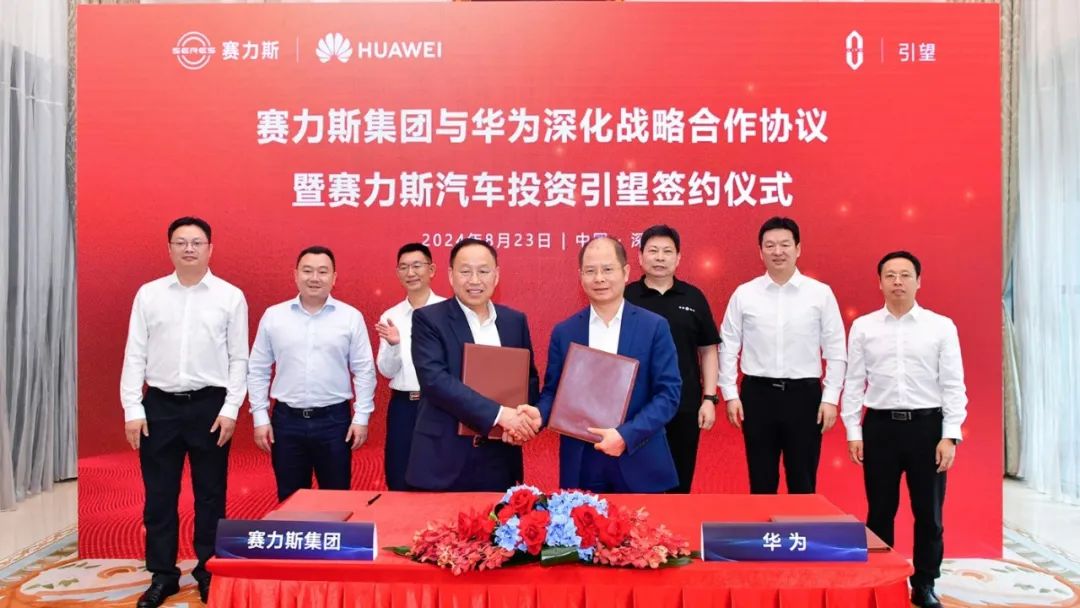

Moreover, in late August 2024, new information emerged: "AITO may continue to increase its shareholding in INVOY to 20%." It is evident that due to real cash investments and a proactive collaboration attitude, AITO and Thalys are Huawei's closest partners.

Being able to first obtain Huawei's latest technology application launch rights can generate significant traffic and attention during pre-sales and launch, increasing the likelihood of conversion into orders. Additionally, securing a more abundant supply ensures relatively sufficient production capacity. In today's Chinese automotive market, this is undoubtedly the foundation for creating a hit.

However, this is more of a long-term outcome. In the short term, among two typical variables, Huawei's closest partners will change. First, when a new business model is launched and requires maximum sound, or when new car model sales fall short of expectations, Huawei may cooperate more deeply in marketing, or Yu Chengdong may engage in live sales. The former is exemplified by GAC, SAIC, and Huawei's first launch of new car models in 2025, and the latter by Yu Chengdong's Spring Festival trip this year, which was with the pickup of XIANGJIE S9 rather than AITO. It is foreseeable that during the Spring Festival, his Weibo and Moments will become sources of related reports.

Furthermore, from Huawei's technological development perspective, whoever is currently most important to it will stand out. Similarly, this scenario will unfold and be verified in 2025 due to the first launch of L3. Yu Chengdong has already set a goal for L3 autonomous driving to be commercially available on highways in 2025 and pilot used in urban areas. Undoubtedly, attention is now focused on its ultra-luxury car ZUNJIE S800, in collaboration with JAC, priced at 1 million yuan. However, since AITO and INVOY's agreement includes first-launch rights for new technologies, it will become clear who holds a higher degree of importance in the collaboration with Huawei when this technology is officially announced.

When this technology is officially announced, it will become evident who holds a higher degree of importance in the collaboration with Huawei. Undoubtedly, there will also be a collision between the Smart Selection Vehicle BU and the Vehicle BU. Given the capital relationship, the Vehicle BU will be spun off from the Huawei system through the introduction of new investors. Logically, the four boundaries will remain closer.

Written at the End

In fact, it is also foreseeable that 2025 will be a critical node for the transition from ADS 3.0 to ADS 4.0. According to available information, the biggest change is that the entire large model will be replaced with a one-stage end-to-end model. However, the variable to watch is whether the hardware of existing models can support the new software, which may lead to differences in closeness. This is a common phenomenon in the industry, such as NIO transitioning from NT 1.0 to NT 2.0, Li Auto switching from the ONE series to the L series, and Tesla upgrading from HW 3.0 to 4.0.

Currently, Huawei's Intelligent Driving System can upgrade from ADS 2.0 to ADS 3.0. However, when upgrading from ADS 3.0 to ADS 4.0, taking the AITO M7 as an example, its lidar is divided into the previous 126 lines and the latest 192 lines. This is similar to smartphones, where models may be delayed in updates or not receive updates at all, as evidenced by Lei Jun's frequent announcements of Pengpai OS.

Many

Currently, this is a typical advantage for consumers. Yet, automakers must distinguish themselves from existing models; otherwise, they risk internal conflict.