Yuqian Guanjia, the next Fuyao Glass! Another leading subdivision player in the new energy vehicle industry is coming!

![]() 03/04 2025

03/04 2025

![]() 537

537

For many people, the auto parts industry is definitely not a sexy industry, but it is deep and filled with opportunities. Relying on the global largest industry of automobiles, numerous super growth enterprises have emerged. Moreover, every industrial iteration in the automobile industry has brought brand-new growth opportunities to enterprises in the industrial chain. A typical representative is Fuyao Glass, one of the well-recognized white horses in China's capital market. Now, another leading subdivision player in the auto parts industry is about to enter the capital market and is expected to become the next Fuyao Glass.

01 The Underestimated Automotive Sunroof Industry

On March 3, 2025, Shanghai Yuqian Guanjia Technology Co., Ltd. (hereinafter referred to as "Yuqian Guanjia") landed on the A-share market (which is today).

According to the company's prospectus, Yuqian Guanjia is an automotive moving parts manufacturer with automotive sunroofs as its main product. It possesses the integrated capabilities of automotive sunroof design, research and development, and production. It mainly serves well-known domestic and foreign automakers established in China and some overseas vehicle manufacturers, providing professional and systematic solutions for various automotive sunroofs and other automotive moving parts. It is an excellent Tier 1 supplier of automotive parts. The company's current main customers include well-known domestic vehicle manufacturers such as Changan Automobile, FAW Group, Geely Automobile, GAC Group, SAIC Volkswagen, Great Wall Motor, and Chery Automobile.

In simple terms, Yuqian Guanjia is a leading domestic automotive sunroof company.

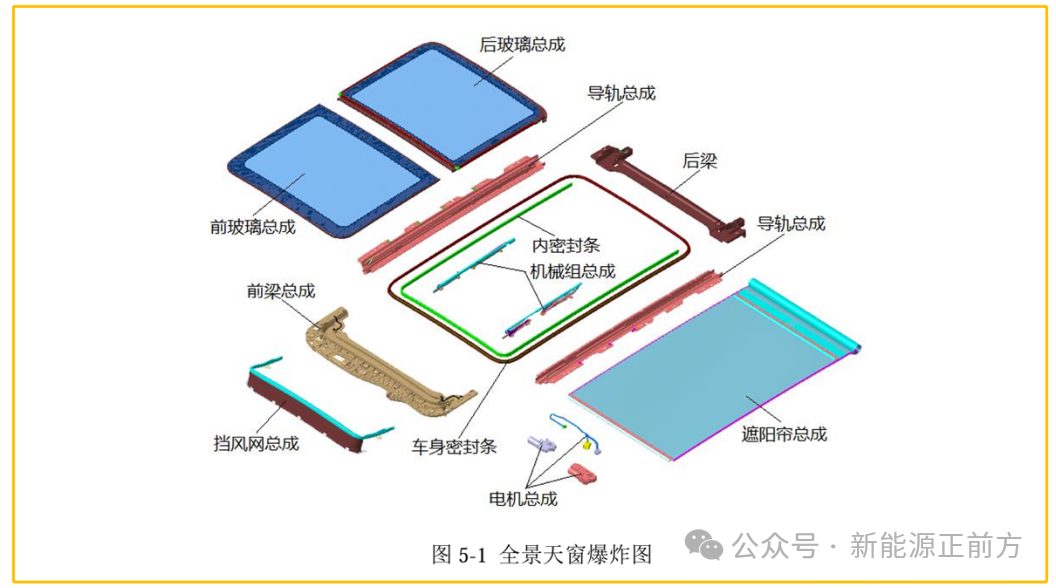

Automotive sunroofs are familiar to everyone and may seem like an inconspicuous field, but in fact, they are one of the larger and more complex supporting sub-assemblies in the vehicle body system. They are highly integrated intelligent products that integrate light, machine, and electricity. The structure is relatively complex. They are both interior and exterior trim parts, and they also undertake the responsibilities of safety and functional parts. The requirements for the overall design, quality of parts, and functions of automotive sunroofs are extremely stringent.

Due to the need to integrate hundreds of components such as motors, controllers, guide rails, sealing strips, and glass panels within the limited space of the roof while ensuring that these components work precisely and effectively together, the design, development, and assembly process of automotive sunroofs is a technology-intensive and highly complex systematic project. It has high requirements for the development capabilities, motion analysis and simulation, system integration capabilities, and the integrated application of horizontal knowledge in the automotive field of manufacturers.

Just like most mid-to-high-end manufacturing industries were initially monopolized by foreign companies, the automotive sunroof industry is the same.

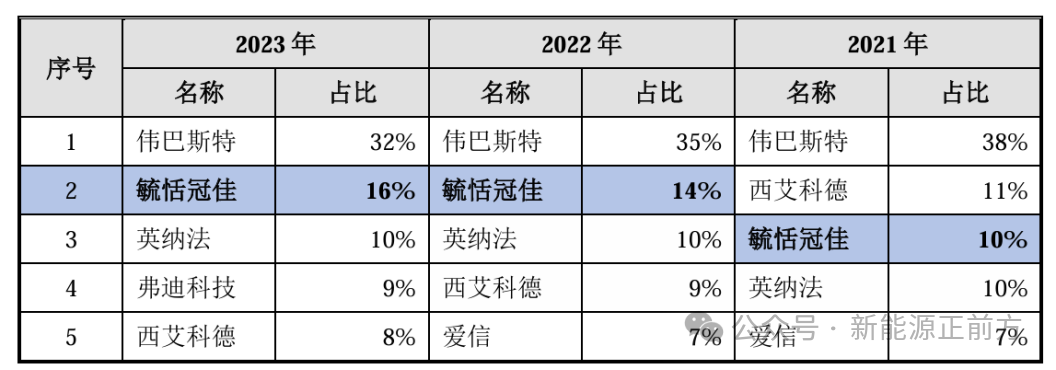

Since Webasto invented the first folding roof in 1932, the domestic and foreign automotive sunroof markets have been monopolized by foreign giants such as Webasto. Until now, Webasto remains the global leader in automotive sunroofs.

Yuqian Guanjia is a leading domestic automotive sunroof company. In 2023, Yuqian Guanjia sold 2.311 million automotive sunroofs. According to the report titled "Independent Market Research on the Global and Chinese Automotive Sunroof Industry" issued by Top Research Institute, in 2023, Yuqian Guanjia became the second largest supplier in the Chinese automotive sunroof market with a market share of 16%.

02 Long-term Growth Logic of Yuqian Guanjia

Domestic substitution is one of the core logics of most domestic manufacturing enterprises in recent years, and the automotive sunroof industry is no exception.

The automotive sunroof industry itself belongs to precision manufacturing with a certain level of technological content. Coupled with the high safety requirements of the automotive industry and the high threshold of the supply chain for OEM manufacturers, industry leaders have first-mover advantages. This is also the reason why global automotive sunroof leaders have always been foreign companies for so many years.

Since its establishment, Yuqian Guanjia has focused on the automotive sunroof field. After nearly 20 years of unremitting efforts, it holds 323 patented technologies (as of October 9, 2024). At the same time, it has grown to be the second in the domestic market with a market share of 16%. It was even the only local manufacturer in the domestic sunroof market before 2022. It was not until 2023 that BYD Auto's soaring sales allowed Fudi Technology to enter the top five list for the first time.

The company's years of cultivation and market performance in the automotive sunroof industry have fully proven that it is no longer a problem for it to enter downstream OEM manufacturers. In the future, it is expected to gradually complete domestic substitution by leveraging the competitive advantages of local manufacturers in terms of cost and flexibility, replicating stories in other fields. Conversely, the industry's high technical barriers and the company's first-mover advantage in the automotive sunroof field have built strong competitive barriers, allowing the company to continuously stay ahead of domestic peers.

In the future, Yuqian Guanjia is expected to fully benefit from the general logic of domestic substitution and become the world's largest independent automotive sunroof leader, with plenty of room for market share growth.

Another opportunity is the triple benefit brought to Yuqian Guanjia by the wave of new energy vehicles.

The reason why it is said to be a triple benefit opportunity is that, on the one hand, with the advent of the era of new energy vehicles, automotive sunroofs have gradually shifted from small sunroofs in the era of fuel vehicles to panoramic sunroofs. Panoramic sunroofs, especially those on new energy vehicles, have higher or entirely new requirements in terms of lightweight, material strength, heat insulation, light adjustment, and even intelligence, and their value content has also increased accordingly. The company can fully benefit from this process.

This is indeed the case. From 2021 to 2023, the revenue share of panoramic sunroofs at Yuqian Guanjia was 65.44%, 67.94%, and 71.90%, respectively, with a year-on-year increase. During the same period, the average gross margin of panoramic sunroofs was 18.56%, significantly higher than the average gross margin of 8.3% for small sunroofs.

On the other hand, due to the higher or entirely new requirements for panoramic sunroofs in terms of lightweight, material strength, heat insulation, light adjustment, and even intelligence, coupled with the fierce competition in the new energy vehicle market and the significantly shortened vehicle development cycle compared to fuel vehicles, this places higher demands on suppliers. These demands are not only technical but also all-encompassing, including flexibility and research and development cycles. Local enterprises inherently have stronger advantages in this regard, and Yuqian Guanjia's competitive advantage over foreign manufacturers has become increasingly prominent.

In addition, as the penetration rate of new energy vehicles gradually increases globally, local sunroof manufacturers deeply tied to local new energy vehicle manufacturers are also expected to synchronously increase their global market share.

According to the prospectus, as of 2023, the company has achieved mass production for a total of 22 customers in the new energy vehicle field, completing coverage of mainstream domestic and foreign new energy vehicle manufacturers.

These triple opportunities determine that Yuqian Guanjia is expected to continue to deeply benefit from the wave of new energy vehicles in the future, achieving both volume and price increases.

However, objectively speaking, at present, Yuqian Guanjia also has a small concern - the risk of a rapid and substantial increase in the market share of automotive canopies in the short term.

In recent years, with the increasing penetration rate of new energy vehicles, the penetration rate of canopies has also gradually accelerated, from 5.6% in 2021 to 14.5% in 2023. The canopy itself is a subdivision category of panoramic sunroofs and is a fixed, non-openable panoramic sunroof. However, the canopy is mainly the territory of automotive glass manufacturers. If the market share of canopies increases rapidly in the short term, it will inevitably squeeze the market share of panoramic sunroofs and small sunroofs.

Fortunately, although canopy products have been sought after by some manufacturers in recent years, due to inherent defects such as ventilation, safety, heat insulation, and maintenance costs, after the initial novelty wears off, many users begin to disenchant with canopy products, and the penetration rate has gradually slowed down. Moreover, Yuqian Guanjia also has technical reserves for integrated canopies and has obtained the project approval for the integrated canopy of the H77 model from Voyah. It can be expected that as the company increases its investment in canopy products, this business will also catch up in the future.

03 Expected to Become the Next Fuyao Glass

The reason why Fuyao Glass could create a decades-long growth "myth" is that it has always firmly rooted itself in the deep and abundant field of automotive glass. Yuqian Guanjia shares many similarities with Fuyao Glass in terms of corporate traits. Both have focused on their main business for decades, with one specializing in automotive glass and the other in automotive sunroofs.

In addition, Yuqian Guanjia also attaches great importance to research and development. The company's R&D team has also established close cooperative relationships with many well-known domestic and foreign universities and research institutions to jointly promote the continuous progress of automotive sunroof technology.

The 575 million yuan that Yuqian Guanjia plans to raise through this IPO will mainly be used for the construction of new factories, research and development projects for new technologies in automotive roof systems and moving parts, as well as research and development and construction projects for automotive electronics. This demonstrates its emphasis on research and development and innovation.

Looking globally, the era of new energy vehicles has only just begun, and the era of panoramic sunroofs has also just begun. Yuqian Guanjia, which holds a leading edge but remains focused, is expected to replicate the legendary growth story of Fuyao Glass and deserves close attention!