Behind Mercedes-Benz's layoffs in China: Declining sales in China dragging down overall performance

![]() 03/10 2025

03/10 2025

![]() 803

803

Recently, the German automaker Mercedes-Benz Group AG (hereinafter referred to as "Mercedes-Benz") has been trending on the internet due to layoffs. Behind the decision to lay off a large proportion of staff is the pressure on performance in the Chinese market, where sales of Mercedes-Benz declined by over 7% year-on-year in 2024. As the largest single market for Mercedes-Benz globally, the sluggish performance in China has also resulted in a lackluster performance for Mercedes-Benz in 2024, with revenue, profit, and sales all showing a downward trend.

Stockstar noticed that domestic new energy vehicle companies are coming on strong, eroding Mercedes-Benz's market share. The failure of the EQ series and the lagging development of the MB.OS system have further increased the pressure on Mercedes-Benz in the Chinese market. Today, Mercedes-Benz is no longer adhering to its strategy of full electrification by 2030, instead increasing investment in fuel vehicles to stabilize profits.

Currently, this century-old automaker is undergoing an unprecedented strategic contraction, and reversing the decline in the Chinese market is key to breaking the deadlock. In response, Mercedes-Benz is attempting to accelerate its integration into the Chinese market through cost reduction and product innovation to revive its performance, but the future direction of the brand remains to be seen.

01. Forced "slimming down" under sales pressure

Recently, media outlets revealed that Mercedes-Benz China has initiated large-scale layoffs, planning to reduce up to 15% of its staff in China, mainly affecting the finance and sales systems. It is reported that employees affected by this round of layoffs will receive compensation of N+9, and if they do not join a new company within the next two months, they will also receive salaries for March and April.

Regarding the widely circulated news, Mercedes-Benz China issued a statement saying that the integration or reduction of business will inevitably involve the work arrangements of some employees. Mercedes-Benz China also stated that it will apply new digital technology more deeply to empower business operations, improve operational efficiency, and streamline business processes.

Stockstar noticed that behind the layoffs in China, Mercedes-Benz is facing enormous pressure on sales and performance. According to the disclosed 2024 financial performance report, Mercedes-Benz achieved a turnover of 145.594 billion euros in 2024, a decline of 4.5% compared to the 152.39 billion euros in 2023; earnings before interest and taxes reached 13.599 billion euros, a year-on-year decline of 30.8%; net profit was 10.409 billion euros, a decline of 28.4% compared to 14.5 billion euros in 2023.

Regarding such performance, Mercedes-Benz stated that it was mainly affected by factors such as reduced sales, especially in the Chinese market, lower net prices, and an unfavorable model mix.

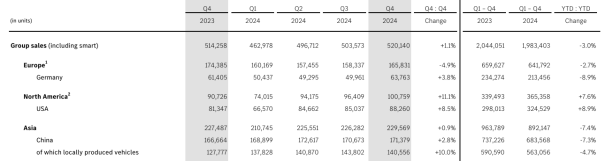

Data shows that Mercedes-Benz sold 2.389 million vehicles globally in 2024, a year-on-year decline of 4%. Among them, total passenger car sales declined by 3% year-on-year to 1.9834 million vehicles.

By market segment, with the exception of a 7.6% year-on-year increase in sales in the North American market, other major markets all experienced declines to varying degrees. Among them, the European market declined by 3% year-on-year to 641,800 vehicles, and the Asian market declined by 7% to 892,100 vehicles.

Data shows that Mercedes-Benz sold over 710,000 vehicles in the Chinese market in 2024, a year-on-year decline of 7.8%, accounting for nearly 30% of its sales. Among them, passenger car sales declined by 7.3% year-on-year to 683,600 vehicles, with revenue declining by 8.5% year-on-year to 23.139 billion euros during the same period.

It is worth mentioning that the decline in the Chinese market was second only to its home market of Germany, where sales declined by 8.9% year-on-year to 213,500 vehicles in 2024.

Ola Kaellenius, Chairman of the Board of Management of Mercedes-Benz, said on the 2024 financial report conference call that we will not close factories in Germany. We will limit the production capacity of German factories to approximately 300,000 vehicles each; at the same time, we will reduce the number of employees through natural turnover to adjust production capacity.

In the view of industry insiders, fierce competition in the Chinese market and the sluggish European economy in recent years have had a significant impact on automotive giants like Mercedes-Benz. This has also led Mercedes-Benz to remain cautious about its performance this year. The company expects a slight decline in sales in 2025, with revenue expected to decline by 2%-7.5% and earnings before interest and taxes by 15% or more.

02. Indecisive electric transition

The sharp decline in Mercedes-Benz's sales in China is closely related to the current wave of new energy vehicles in the domestic market. Amid the general trend of intelligence and electrification, new energy brands such as NIO, Li Auto, and AITO have quickly captured the market with their cost-effective products, rapid technological iteration, and precise grasp of consumer needs. The market share of traditional luxury brands is gradually being diluted.

According to data from Guosen Securities (002736.SZ), sales of foreign luxury brands in 2024 were 2.8765 million vehicles, a decline of 10% compared to 2023. Meanwhile, the market share of domestic mid-to-high-end brands continued to rise, with sales of 1.823 million vehicles throughout the year, an increase of 76% year-on-year.

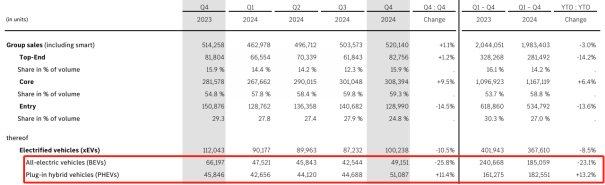

Stockstar noticed that the fuel vehicle business is still an important source of profit for Mercedes-Benz at present. However, in terms of transitioning to electrification, Mercedes-Benz's pace has been somewhat sluggish. In 2024, Mercedes-Benz sold 367,600 electric passenger vehicles globally, a year-on-year decline of 8.5%. Among them, sales of pure electric models declined by 23.1% year-on-year to 185,100 vehicles, while sales of hybrid models increased by 13.2% to 182,600 vehicles. This also exposes the imbalance in product development during Mercedes-Benz's electric transition. Among commercial vehicle models, global sales of pure electric vehicles declined by 13.9% year-on-year to 19,500 vehicles.

Mercedes-Benz's electric vehicles mainly focus on the EQ series. Due to the failure of EQ series sales, Mercedes-Benz halted a large number of improvement projects for the EQ series in 2023. Recently, Mercedes-Benz announced a major electric vehicle strategy that will revolutionize its electric product line in the coming years and make significant adjustments to model naming. According to the plan, Mercedes-Benz will launch new or upgraded electric vehicle models, including the electric C-Class, GLC, S-Class, and E-Class, by 2027. The brand is gradually phasing out the EQ prefix on electric vehicles and will instead use the suffix "equipped with EQ technology" in the future.

In the view of industry insiders, the failure of the EQ series lies in the "oil-to-electric" technical route adopted by its early models, which directly replaces the powertrain on the fuel vehicle architecture. While this approach saves research and development costs to a certain extent, it also leads to issues such as short range, high energy consumption, and low space utilization, seriously affecting the reputation of the EQ series products.

As competition in electric vehicles shifts from electrification to intelligence, Mercedes-Benz has still failed to seize the opportunity. The development of its self-developed MB.OS system is behind schedule, delaying the production of the pure electric long-wheelbase CLA by about 4 months. The originally planned production date for this new pure electric vehicle was April 2025, exposing the shortcomings of Mercedes-Benz's intelligent transformation.

Stockstar noticed that Mercedes-Benz announced a strategic shift early last year, abandoning its original plan to achieve full electrification by 2030. While continuing to develop electric vehicles, Mercedes-Benz will increase investment in fuel vehicles to stabilize the higher-profit margin of fuel vehicles.

According to the plan, Mercedes-Benz will launch a new lineup of internal combustion engine models by 2027, enabling internal combustion engines to continue until 2030. Between 2025 and 2027, Mercedes-Benz will launch 19 fuel vehicles and 17 pure electric vehicles.

03. Self-rescue in the Chinese market

Facing the pain of its electric transition, Mercedes-Benz has begun to review its strategic layout and cost control strategies.

To cope with fierce competition and unbalanced demand in the global automotive market, cost reduction has become an important measure for Mercedes-Benz at present. On the 2024 financial report conference call, Mercedes-Benz proposed plans to reduce production costs by 10% by 2027 and will continue to work closely with suppliers to address material cost issues. Fixed cost reduction measures will also continue until 2027.

Zhejiang Online reported that Ola Kaellenius plans to save a total of 5 billion euros by 2027, with the goal of achieving cost reductions of 2.5 billion euros alone in 2025. Haibao News disclosed that to achieve this goal, Mercedes-Benz plans to implement large-scale layoffs globally, potentially affecting up to 20,000 employees. In terms of production capacity planning, Mercedes-Benz will maintain production capacity at approximately 2 million to 2.5 million vehicles over the next three years, with a reduction of 100,000 vehicles in Germany.

Faced with its failure in the Chinese market, Mercedes-Benz has also made changes. In addition to cost reduction measures, it has also intensified its product localization efforts. From 2025 to 2027, Mercedes-Benz will launch its largest-ever product rollout, planning over 30 new products and creating multiple exclusive models for the Chinese market.

According to the plan, Mercedes-Benz will launch the CLA model in 2025 and a major upgrade of the S-Class in 2026. It will also launch the pure electric versions of the GLC and C-Class models. For the Chinese market, Mercedes-Benz will launch 7 China-exclusive models in the next three years, including pure electric MPVs and long-wheelbase CLAs.

Autopixel exclusively learned that Mercedes-Benz is expanding its R&D team in China, particularly focusing on software and intelligent cockpit teams, with the goal of allowing the Chinese team to take on more MB.OS software development tasks.

In addition, as early as December last year, personnel changes had already begun in the Chinese market. Hubertus Troska, who is responsible for business in Greater China, will retire and leave his position upon the expiration of his contract in 2025. Replacing Hubertus Troska will be Oliver Thoene, head of product strategy and transformation. (This article was originally published on Stockstar, authored by Lu Wenyan)

- End -