Is Makoto Uchida on the Brink of Dismissal? Nissan Ushers in Leadership Transition for Future Growth

![]() 03/11 2025

03/11 2025

![]() 578

578

Multiple insiders have revealed that the board of directors at Nissan Motor will convene on March 11 to deliberate on potential successors to President Makoto Uchida. It is reported that Nissan is contemplating selecting a successor from a pool of three candidates, indicating that Uchida's tenure may soon come to an end.

In fact, news of Nissan's impending leadership change has surfaced earlier. Ten days ago, Bloomberg cited several insiders claiming that the Nissan Motor board of directors is planning a significant personnel shuffle, contemplating the premature dismissal of current CEO Makoto Uchida. This shift is expected to profoundly influence the strategic direction of Nissan Motor in the years to come. A prominent reason cited for Uchida's potential "dismissal" is the collapse of cooperation negotiations with Honda. Honda attributed the primary obstacle in the negotiations to Uchida, the current CEO of Nissan, whose inflexible stance and unyielding position are seen as key factors leading to the breakdown of the alliance. Honda is now preparing to reinitiate negotiations under the guidance of a new leader capable of better managing internal opposition.

Overseas media has unveiled that Nissan Motor is contemplating accepting partial investment from its Japanese counterparts, potentially involving collaborations with Honda, Mitsubishi, and Foxconn. Should Nissan decide to accept Honda's investment, its CEO Makoto Uchida might be dismissed, with the current Chief Financial Officer Jeremy Papin temporarily stepping in to lead a fresh round of negotiations with Honda. Industry experts believe that the root cause of Uchida facing "dismissal" is the deteriorating business performance under his leadership. In the second fiscal quarter of 2024 (July to September), Nissan's net revenue stood at 2.99 trillion yen (approximately 144.77 billion yuan), a year-on-year decrease of 5%; operating profit was 31.9 billion yen (approximately 1.54 billion yuan), a year-on-year drop of 85%; operating profit margin declined from 6.6% in the same period last year to 1.1%; and net loss amounted to 9.3 billion yen (approximately 450 million yuan), in stark contrast to the net profit of 190.7 billion yen (approximately 9.23 billion yuan) recorded during the same period last year.

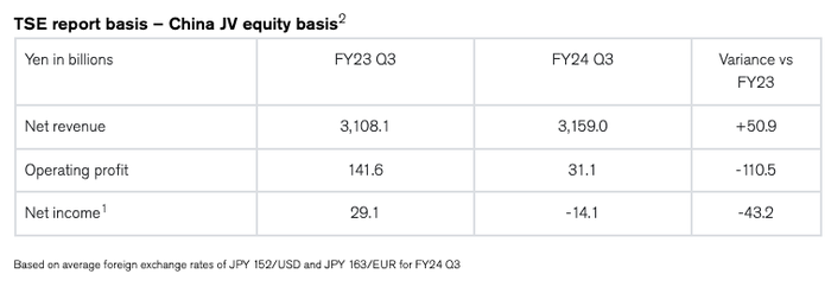

In the third fiscal quarter, Nissan Motor's consolidated net revenue reached 3.159 trillion yen, while consolidated operating profit was 31.1 billion yen, marking a year-on-year decrease of 78.0%; net loss stood at 14.1 billion yen, as opposed to a profit of 29.1 billion yen during the same period last year. In late November of last year, an unnamed Nissan executive stated, "We have 12 to 14 months to survive. We need Japan and the United States to generate cash." On February 26, Fitch Ratings announced that it had downgraded Nissan Motor Co., Ltd.'s long-term foreign and local currency issuer default ratings (IDRs) and senior unsecured ratings from "BBB-" to "BB+". The rating agency also downgraded Nissan's short-term foreign and local currency IDRs from "F3" to "B". The company's rating outlook is negative. Fitch predicts that earnings before interest and taxes (EBIT) and free cash flow (FCF) of the automotive business will remain negative until the fiscal year ending March 2026 (FYE26). This downgrade reflects Nissan's lower profitability and a slower recovery process than initially anticipated.

The industry notes that Uchida has implemented substantial cost reforms, achieving significant cost reductions and efficiency enhancements, yet these measures have failed to translate into substantial performance improvements. Over the past decade, the electrification of automobiles has emerged as an irreversible trend. However, Nissan's progress in electrification has been significantly slower than expected. According to the plan, Nissan was supposed to launch at least 8 electric vehicles in the global market during the Nissan Next plan period (before 2024) and promote the application of the e-Power series hybrid models in various compact and subcompact car markets, aiming to achieve sales of 1 million new energy vehicles (including HEV) by March 2024. Among these targets, the new energy penetration rate was set at 60% in Japan, 50% in Europe, and 23% in China. Nevertheless, in the final fiscal year of the Nissan Next plan, Nissan only managed to sell 520,000 new energy vehicles out of its 1 million target. The new energy penetration rate stood at 52% in Japan, less than 45% in the European market, and a mere 6% in the Chinese market. In the Chinese market, where the new energy penetration rate has long surpassed 50%, Nissan offers only one pure electric model, the ARIYA, and its sales are negligible.

While new energy vehicles are being slowly rolled out, Nissan's gasoline vehicles are defying the trend. In 2021, Nissan launched the all-new X-Trail in China. Notably, the all-new X-Trail abandoned the traditional 2.0L and 2.5L naturally aspirated four-cylinder engines in favor of a 1.5T three-cylinder turbocharged engine. As anticipated, Chinese consumers have shown low acceptance for three-cylinder engines, compounded by issues such as vibration. Consequently, the three-cylinder X-Trail quickly fell from grace, with sales plummeting from a peak of 210,000 to 30,000. Many analysts believe that this outcome stems from Uchida's misjudgment of the products in demand in the key sales markets.

According to insiders, Uchida is aware that the decline in performance is primarily attributed to weak sales and profitability in North America and China. However, some Japanese analysts commented, "When we inquire about their well-being in the United States and China, or the lack of hybrid vehicles, they respond with 'It's okay, it's okay.'" Amidst the pressure from both internal and external challenges, there are differing opinions within the Nissan Motor board of directors regarding Uchida's leadership abilities and decision-making directions, along with concerns about his future role. It is reported that a Nissan insider stated, "Nissan realizes that decisive action is necessary and a strong leader is required to drive this action forward."

The latest news indicates that Jun Kun, the former Senior Vice President of the Renault-Nissan-Mitsubishi Alliance, Papan, the Vice President of Nissan North America, and the current Chief Financial Officer of Nissan, along with Nissan's Chief Performance Officer Cartier, have emerged as potential candidates for the next CEO of Nissan. Some public opinions suggest that Nissan is inclined to select the next CEO based on the future main sales market. It is anticipated that whoever assumes the role of the new CEO at Nissan will face considerable challenges.

(Pictures are sourced from the internet. Please remove them if there is any infringement.)