Fight to 2026: Noah's Ark or Fatal Blow

![]() 03/17 2025

03/17 2025

![]() 471

471

Edited by | Li Guozheng

Produced by | Bangning Studio (gbngzs)

'Joint ventures are back', 'Joint-venture electric vehicles launch the strongest counterattack', 'Joint ventures counterattack new energy', 'Joint-venture brands launch counterattacks...'

Recently, the media has reported intensively on joint-venture automakers attempting to make a comeback.

Since the end of February this year, Dongfeng Honda, SAIC Volkswagen, GAC Toyota, Dongfeng Nissan, FAW-Volkswagen, SAIC-GM, etc., have successively used technology conferences, new car launches, and price system innovations as breakthrough points to launch counterattacks in both intelligent fuel vehicles and new energy.

From a deeper perspective, this reflects that multinational automakers are stepping up their efforts to correct their previous strategic misjudgments regarding the electrification and intelligence of the Chinese market.

Currently, this counterattack is only a new beginning, far from the final outcome.

According to relevant plans, by 2026, mainstream joint-venture automakers will usher in the concentrated launch of electrified and intelligent platform products. Obviously, 2026 is the 'decisive year' for joint-venture automakers, which will directly determine their future fate.

No Way Back

The phrase 'no way back' aptly describes the urgent situation of joint-venture automakers.

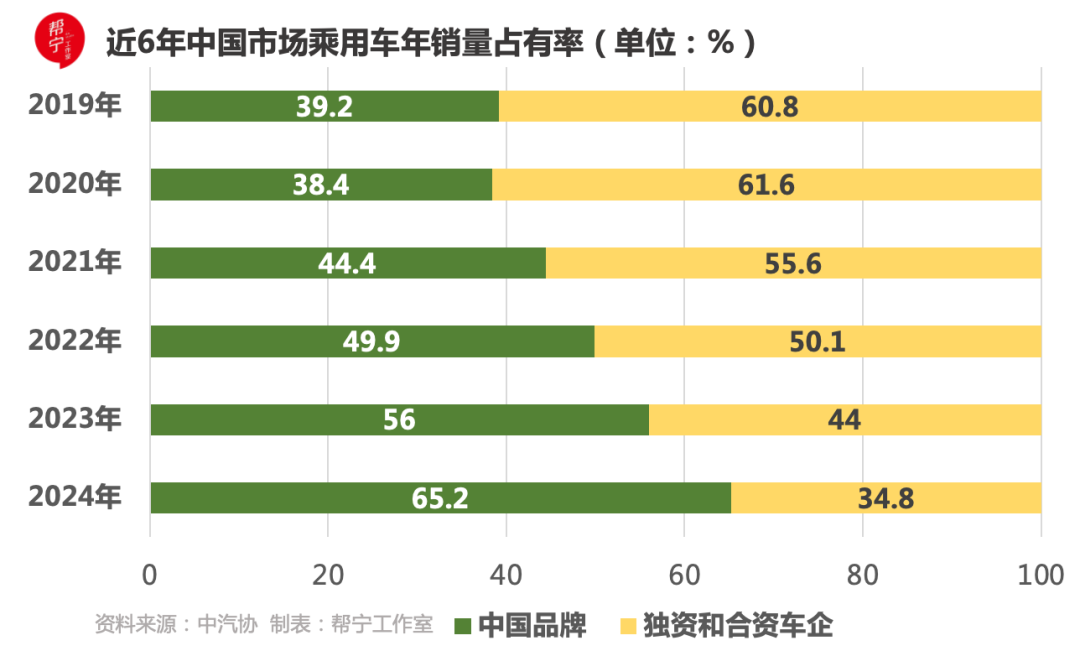

Looking back at the years 2020-2024, the Chinese automobile market was like a grand and intense battlefield, experiencing unprecedented structural changes. Chinese brands have been riding the wave and making rapid progress, while joint-venture automakers have gradually faded, with their market share receding year after year like a tide.

From 61.6% in 2020 to 34.8% in 2024, the key 50% and 40% market share points were successively lost, and the trend of retreat was obvious.

And this trend continues. On the afternoon of March 11, 2025, the China Association of Automobile Manufacturers (CAAM) released a set of data at its monthly information meeting, once again clearly showing the change in market position between Chinese brands and joint-venture automakers.

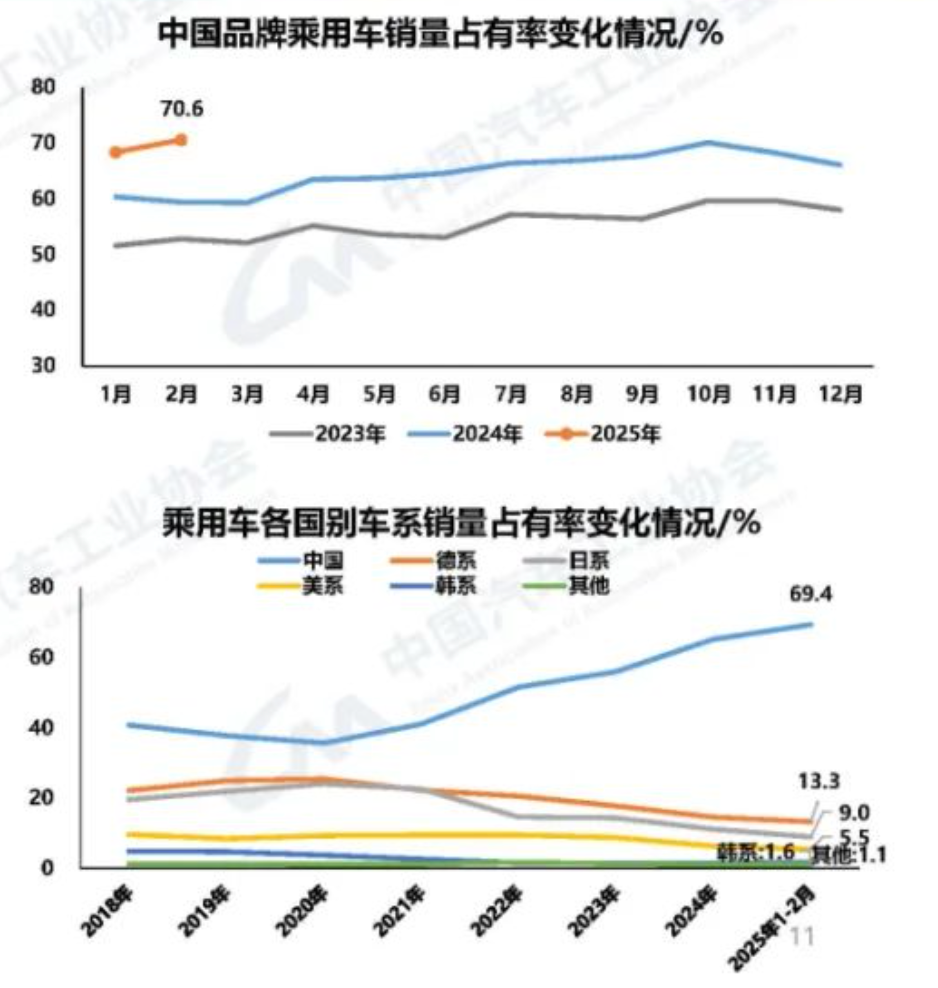

In February, the sales of Chinese brand passenger vehicles reached 1.282 million units, a year-on-year increase of 62%, and the sales share soared to 70.6%, a significant increase of 11.2 percentage points from the same period last year.

In stark contrast, the market share of joint-venture automakers fell to 29.4% - below 30%. Further breakdown shows that German brands accounted for 13.3%, Japanese brands accounted for 9.0%, and American brands accounted for 5.5%; Korean brands accounted for only 1.6%, becoming increasingly marginalized.

'The performance of Chinese brand passenger vehicles is much better than the overall market, with a market share of about 70%. The rapid development of high-end Chinese brand passenger vehicles has promoted the overall development of the high-end brand passenger vehicle market,' said Chen Shihua, Deputy Secretary-General of CAAM.

To break through the siege, joint-venture automakers have played three key 'cards' since the beginning of this year:

First, stick to the fuel vehicle market and fully stabilize their basic plate; second, accelerate the launch of electrified and intelligent products to catch up with new market trends; third, actively expand overseas markets, promote export business, and seek new growth space.

Can they board the life-saving Noah's Ark with this?

Technology-Driven Counterattack

2026 is destined to be a turning point in the fate of joint-venture automakers.

From the relevant strategic blueprints, it can be seen that joint-venture automakers such as Toyota, Volkswagen, Honda, Hyundai, and Nissan have unanimously positioned 2026 as a major product year, aiming to curb the downward trend and make a comeback with a newly created product matrix.

In the field of electrification transformation, Toyota takes the lead, demonstrating its determination to go all in.

Toyota plans to launch 10 new pure electric vehicle models in 2026. To ensure the progress of the project, an independent R&D and production department has been established. The global industry leader is determined to achieve the goal of selling 1.5 million new energy vehicles globally in that year, striving to seize a high ground in this emerging battlefield.

Within the Volkswagen Group, FAW-Volkswagen will usher in a major product launch year in 2026 and kick off the hybrid era, achieving full coverage of PHEV (including REEV).

SAIC Volkswagen began its layout as early as last June. According to the plan, it will jointly develop 3 plug-in hybrid models and 2 pure electric models. At the technical level, China and Germany will jointly empower technology to the joint venture, with the first new model to be launched in 2026.

Unsurprisingly, in 2026, SAIC Volkswagen will inevitably launch a fierce offensive for the major product year, with new PHEV, EREV, BEV, and other vehicle projects being advance in an orderly manner.

On December 11 last year, Beijing Hyundai received a capital increase of $1.095 billion, injecting a shot in the arm for its subsequent development. From 2026, Beijing Hyundai will enter an offensive mode, successively launching 5 new models to expand its market presence and enhance its brand market share with a diversified product layout.

Similarly, Volkswagen Anhui also regards 2026 as the year of strategic victory, planning to launch 5 new models by 2026, covering the two popular segments of SUVs and sedans, further enriching the product matrix and enhancing the brand's competitiveness in the market.

SAIC-GM has also made it clear that from 2025 to 2027, it plans to launch 12 new models, all of which are new energy vehicles, covering multiple power forms such as pure electric, plug-in hybrid, and extended range.

'In the future, 100% of the product definition and digital function development of all new models will be led by SAIC-GM and the Pan Asia Technical Center to ensure that they better meet the needs of Chinese users and achieve faster iterative upgrades,' said Lu Xiao, General Manager of SAIC-GM.

Dongfeng Nissan plans to launch 5 vehicles within two years, including 3 powertrain models: pure electric, plug-in hybrid, and extended range, to make a foray into the new energy market and enhance the brand's influence in the field of new energy.

Making up for the shortcomings in electrification and intelligent technology is the confidence of these joint-venture automakers in the fight to 2026.

At the electrification level, many actions have been taken frequently, with the Volkswagen Group particularly noteworthy.

Volkswagen is systematically strengthening its R&D capabilities of 'In China, For China'. Volkswagen (China) Technology Co., Ltd., located in Hefei, Anhui, China, is the core of this strategy.

As the largest R&D center of the Volkswagen Group outside its German headquarters, Hefei Volkswagen Technology focuses on the research and development of intelligent connected vehicles, committed to shortening the time-to-market for automotive and component products by 30% through efficient product development processes and the application of cutting-edge technologies.

As a result, Volkswagen will better leverage the growth momentum of the Chinese market. The Hefei company will undertake key development tasks for the group, including the development of a local electric vehicle platform for entry-level markets. Derived from the group's MEB platform, the new platform aims to further expand China's market segments.

'From 2026, the group will develop pure electric vehicle models tailored to the needs of Chinese customers based on this platform. The development cycle of this platform is only 36 months, about one-third shorter than the previous platform development cycle of the Volkswagen Group,' said a relevant responsible person from Volkswagen Anhui.

In terms of industrial chain collaboration, Volkswagen (China) Technology Co., Ltd. plays a pivotal role. It works closely with group joint ventures in China such as FAW-Volkswagen, SAIC Volkswagen, and Volkswagen Anhui to promote the sharing of R&D resources and the coordinated advancement of projects. It also has in-depth cooperation with many local enterprises such as Guoxuan High-Tech (batteries), XPeng Motors (electrification), Horizon Robotics (autonomous driving), Shanghai Muchuan Industrial Design (user experience), and Thundersoft (infotainment), building a complete new energy vehicle industry chain ecosystem.

At the intelligence level, joint-venture automakers are fully accelerating their catch-up efforts, striving to narrow the gap with the industry frontier. Dongfeng Nissan is one of the typical representatives.

It has decisively cooperated deeply with Momenta, which is in the first tier in China, to realize a one-stop end-to-end intelligent driving model.

In terms of intelligent driving safety, Dongfeng Nissan's high-speed NOA can still brake stably at a speed of 130km/h. In the intelligent cockpit segment, Dongfeng Nissan's Cloud Enjoy Cockpit is the first among joint-venture brands to access top AI models such as DeepSeek.

'By the end of 2026, Dongfeng Nissan will continue to invest 10 billion yuan to expand the size of its R&D team to 4,000 people, focusing on in-depth exploration and innovation of electrification and intelligent technology,' said Hiroshi Sekiguchi, Vice President of Dongfeng Motor and General Manager of Dongfeng Nissan. Dongfeng Nissan actively collaborates with leading Chinese technology companies, deeply integrates the HarmonyOS ecosystem with Huawei, and collaborates with Momenta to create a high-level intelligent driving solution based on the end-to-end intelligent driving model, enhancing intelligent competitiveness.

Can They Make a Comeback Successfully

Although most joint-venture brands regard 2026 as a crucial year to turn the tide, hoping to achieve market breakthroughs through this major product year, everyone knows in their hearts that this is undoubtedly an adventure full of unknown variables.

First, the challenge at the technical level is like a roadblock.

The technology iteration in the automotive industry is changing rapidly, and Chinese brands continue to make innovative breakthroughs in core areas such as intelligent driving assistance and battery technology.

If joint-venture brands want to stand out from the crowd with new products in 2026, they must ensure that the technology on the new products not only keeps up with the forefront of the industry but also strives to achieve overtaking in the bend. Otherwise, the application of old technology to new products will inevitably become a bottleneck restricting their comeback.

For example, in the field of intelligent driving, Chinese brands have already widely used high-precision maps and multi-sensor fusion technology to achieve high-level autonomous driving assistance functions, with some models reaching L3.5 level. In this regard, if new products from joint-venture brands cannot keep up with these new technologies, even new models will not be able to reverse the adverse trend.

Second, market competition is fierce, and cost control is one of the key factors determining the survival of enterprises.

Cost directly determines product price, which in turn affects sales and market share. Due to inherent factors such as the supply chain system and production and operation mode, joint-venture automakers generally face many thorny problems in cost control. If they cannot effectively reduce costs, they are doomed to have no price advantage and cannot drive sales.

Take LiDAR as an example. This cutting-edge technology was once considered a high-end configuration but has now extended to models priced at around 120,000 yuan. For example, Changan Automobile is actively promoting the democratization of intelligent driving technology and announced that starting this year, its models priced at 100,000 yuan will also be equipped with LiDAR.

Third, Chinese brands have risen across the board, from low-end to high-end.

BYD, Geely, Changan, Chery, Hongmeng Zhixing, XPeng... Autonomous brands are continuously expanding their product matrix, making full efforts from family sedans to SUVs to high-end new energy vehicle models, launching attacks from various market segments.

13 years ago, the disaster movie '2012' swept the world, depicting an unprecedented disaster on Earth, with humans and animals ultimately surviving by boarding the 'Noah's Ark' made in China.

In 2026, will joint-venture brands welcome Noah's Ark or suffer a fatal blow?