Musk Must Save Tesla: Stepping Aside May Be Best

![]() 03/17 2025

03/17 2025

![]() 754

754

Should Musk Step Away from Tesla's Day-to-Day Management?

"Share Price Halved in Less Than Three Months"

Following Trump's presidential election victory, Tesla's share price surged. However, since the start of this year, it has plummeted over 35%, halving from its peak and erasing most post-election gains. Recently, Tesla stores and Supercharger stations have been vandalized from the US to Europe. Sales and survey data from various countries indicate that Musk's recent actions have had a profoundly negative impact on Tesla, causing sales challenges and significantly reducing brand value.

Musk Strives for Optimism. On X, he responded to a post about Tesla's plunging share price, stating, "Everything will be fine in the long run." Yet, Keynes famously remarked, "In the long run, we are all dead." The market is no longer swayed by Tesla's grand promises, and Musk must now address what concrete measures are in place.

In November and December, Tesla benefited from Trump's policies, such as tariffs on Mexican cars, earning it the moniker "Trump trade." However, Tesla's North American deliveries last year were poor, failing to meet targets. Thus, any benefits Trump brought to Tesla seem offset by broader economic factors.

From Tesla's perspective, current deep political entanglements do more harm than good. Tesla's US market primarily consists of white leftists and environmentalists, typically high-income individuals with college degrees or higher. For example, the average household income of Model X owners in the US is $143,000, and $128,000 for Model 3 owners. Regionally, Tesla's main markets are in technologically advanced areas like California and Florida, while states like Texas and Louisiana, known for their conservative demographics, are not its markets.

Musk's support for expanding H-1B visas offended many anti-immigrant conservatives, causing significant uproar. His "political career" has also been tumultuous, with rumors of disputes with the Trump team soon after the election and recent heated arguments with US Secretary of State Rubio and others at a White House meeting.

In a recent interview, Musk admitted facing immense difficulties leading the efficiency department of the DOGE government, appearing tired and disappointed. Musk now feels "alone," facing challenges far greater than Tesla's initial production hell and SpaceX's failed flights. The political struggle has left Musk struggling to cope.

I won't evaluate the merits of Musk's statements and actions, but his deep involvement in politics has become Tesla's biggest liability. As CEO of Tesla and SpaceX, informally involved in X and Neuralink, and consulting for DOGE, Musk's focus is spread too thin, preventing him from fully committing to Tesla.

A topic repeatedly discussed on Wall Street has resurfaced: Should Tesla consider stepping Musk aside to focus on product vision and technological innovation, handing over daily operations to a professional management team?

We don't know if Musk will make such a decision, but Tesla's fundamentals remain worth studying.

Tesla Faces Another "Darkest Hour"

01. Musk Injects "Performance Chicken Blood" Again

Tesla's crisis management follows a pattern: Musk causes controversy, the share price drops short-term, the company rebounds with strong performance, and ultimately, the share price reaches new highs.

Over the years, Musk has repeatedly tricked short sellers, propelling Tesla's share price skyward and causing numerous short-selling funds to collapse. He mocked short sellers on X: "Your money is my fuel." Musk once said, "The real moat has never been numbers on financial statements, but the courage to continue disrupting the world."

While many once believed in Musk's "Iron Man" narrative, Wall Street is now questioning it. A UBS report states that since 2022, Tesla's share price has fluctuated with an expected P/E ratio for the next 12 months between 20-60 times, while the current share price corresponds to an expected P/E ratio exceeding 60 times, reaching over 100 times. UBS notes that investors must have extraordinary faith to continue increasing Tesla holdings at the current price level, believing Tesla can achieve a delivery target of 15.5 million vehicles by 2030 (currently market expectations are 4.8 million) and an energy storage deployment target of 780 GWh (current market expectations are 139 GWh). Simply put, it's a pessimistic judgment that doesn't believe Tesla can achieve its goals.

On March 2, Musk shared a post on X about expected profit growth over the next five years. The post showed Tesla's expected profit growth rate at 258%, compared to 193% for NVIDIA, 137% for Amazon, 128% for Netflix, 107% for Microsoft, 76% for Alphabet, and 45% for Apple (based on analyst estimates). Musk commented, "It will require excellent execution, but I think it's possible for Tesla to achieve a 1000% return within five years."

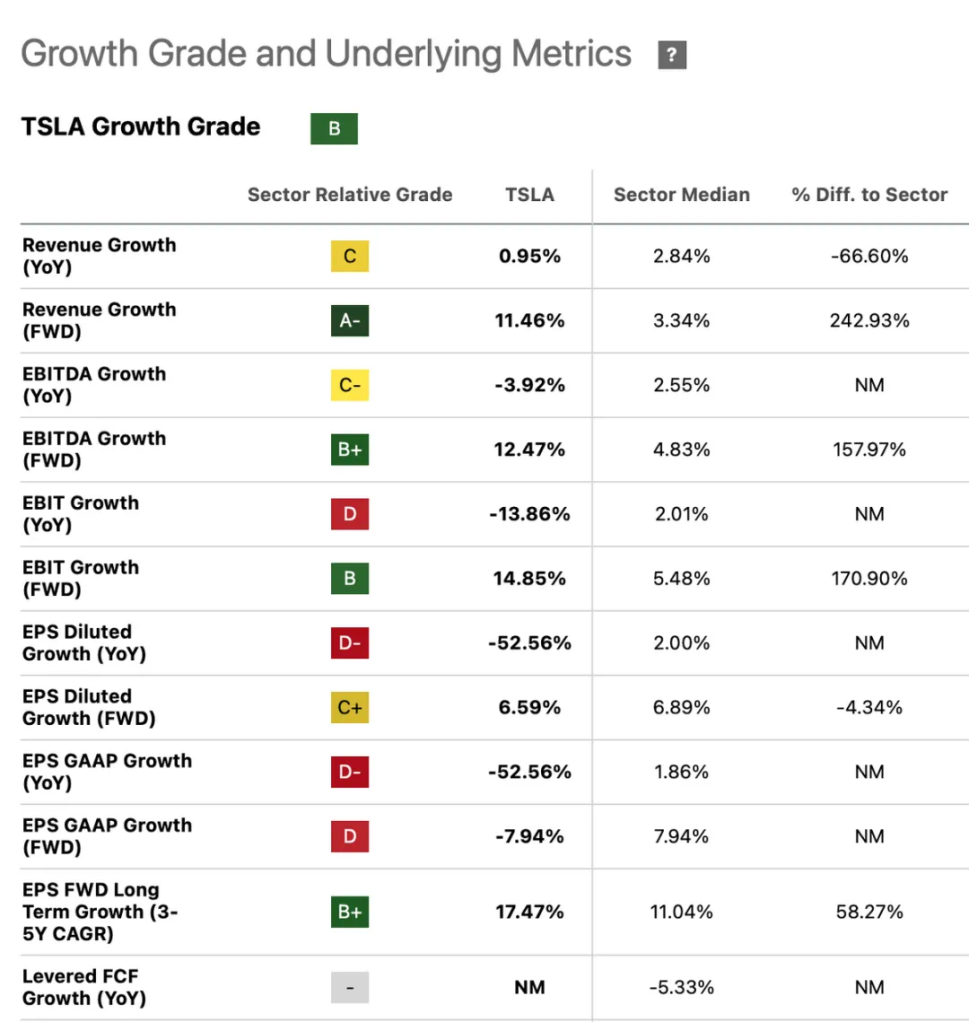

However, Tesla's previously announced 2024 financial report showed annual revenue of $97.69 billion, with a meager 1% year-on-year increase. Automotive business revenue was $77.07 billion, down 6% year-on-year; net profit was $7.091 billion, down 53% year-on-year; and gross margin was 17.9%, lower than 18.2% in 2023. The report indicates revenue growth has hit a bottleneck, and net profit has fallen significantly due to price wars and declining demand in the Chinese market.

Wall Street's most optimistic judgment is based on assumptions: FSD subscription rate increases to 30%, Model Q annual sales reach 400,000 units, and energy storage business grows by 50%. Valuation: $280-$350 (supported by long-term potential but requiring successful technology verification). This is a huge gap from Musk's stated 1000% profit growth in five years, leaving investors with a binary choice: believe in Musk or leave. Those who believed in Musk in past cycles made significant gains, but will it be the same this time?

02. Tesla's Potential in the Chinese Market Remains

To understand, one must first clarify which bearish reasons are far-fetched, which are difficult to prove, and which are indeed significant problems.

In 2024, Tesla's global sales declined 1.1% to 1.789 million vehicles, the first decline in a decade. BYD, ranking second, sold 1.76 million new energy vehicles, up 12.1% year-on-year, nearly overtaking Tesla. In China, Tesla continued its strong performance last year, selling 657,000 electric vehicles, a record high; however, the annual growth rate of 8.8% was significantly lower than new forces like NIO, Xpeng, and Li Auto.

While Tesla's global sales have declined, there are objective factors, such as waning new energy subsidies in Europe and the US, supply chain crises due to political factors, and the adverse impact of Musk's political involvement in Europe. Tesla's performance in the Chinese market has been weak, but the reasons are known: slow model replacement and an incomplete version of FSD.

However, these issues are not insurmountable. For example, the new Model Y launched at the end of last year has seen decent sales. According to 36Kr, multiple Tesla salespeople revealed that the new car has accumulated 200,000 orders; in the first week after deliveries began, nationwide deliveries exceeded 6,000 units. Moreover, industry chain sources indicate Tesla is developing a "stripped-down, cheaper version of the Model Y" specifically for the Chinese market. Tesla has previously launched a low-priced Model Y in the Mexican market and is considering stimulating the market with lower-priced models.

In recent years, Tesla has been criticized for outdated configurations, insufficient space, small batteries, and low horsepower, paling in comparison to domestic new forces. Tesla is aware of these issues, but Musk's philosophy has always been to promote global models, which explains the Model Y's global sales surpassing the Corolla. Redesigning models for each country would incur costs and inventory troubles, explaining Tesla's slow updates. While new models can boost sales, they also bring uncontrollable financial risks.

Now, however, Musk might be rethinking this approach. Relying solely on a Model 2 priced at the 150,000 yuan level is insufficient to save Tesla's sales. The launch of a lower-priced Model Y specifically for the Chinese market marks the beginning of change. As a sharp businessman and supply chain expert, Musk is aware of domestic market competition, so staying stagnant is not an option.

After introducing FSD in China, issues like "picked up the car in the morning, deducted 12 points in the afternoon" emerged. From media evaluation videos, it's evident that various violations and misidentifications make Tesla's FSD seem suddenly inferior. But in reality, FSD's capabilities aren't that bad. Multiple industry insiders say that since Tesla has always been a self-developed solution and leads in data, its perception algorithms and intelligent driving experience are undoubtedly top-tier.

The head of an intelligent driving map company says Tesla's FSD errors may have three causes: first, issues with map data; second, the map data is fine, but there's a problem with FSD's positioning, which might not be with the positioning chip but the model's perception; third, both map data and positioning are fine, but the model believes it's okay to drive on certain lanes, like bicycle lanes, solid lines, and bus lanes, as it hasn't localized its understanding of driving boundaries.

It's still a matter of data localization. Tesla's previous hasty use of publicly available data for training cannot continue indefinitely. Policies haven't closed the door to Tesla's data localization. Taking Lingang, Shanghai, as an example, as a nationally designated offshore port, data processing, handling, and exit here are compliant. Tesla is also registered in Lingang. From the perspective of data trading and sharing, there could be policy openings, and discussions are possible. Recently, there have been rumors that Tesla will cooperate with Baidu to improve its intelligent driving capabilities. Although both parties haven't admitted it, such cooperation is plausible considering their previous map collaboration.

Overall, if Tesla's FSD solves the issue of data sources and training, it's likely to become a T0-level player after improvement.

Therefore, Tesla still has ample room for improvement in the Chinese market. It's too early to say Tesla is out of fashion in China.

03. Tesla's Share Price Hinges on Belief in Musk's Story

Of course, discussing Tesla solely in terms of vehicle sales misses the mark. The secondary market's past attitude towards Tesla was to ignore the weakness of its core business and fantasize about autonomous driving, robotaxis, and humanoid robots supporting valuation increases.

For example, Goldman Sachs' valuation: the entire vehicle business is worth $89 per share (assuming sales will reach 5.3 million vehicles by 2030); the autonomous driving business is worth $168 per share (assuming that by 2040, 65% of Tesla owners will subscribe, with a service fee of $200 per year).

In other words, the relatively certain entire vehicle business accounts for only 20% of the valuation, while the imaginative intelligent driving business accounts for 40% of the valuation.

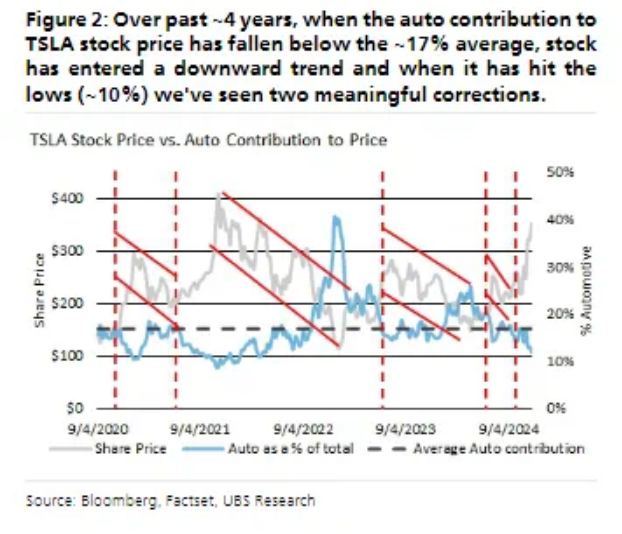

A UBS report states that Tesla's current automotive business only accounts for 12% of its total market value, with a low of 10% at one point. UBS also stated that whenever the market value of the core automotive business reaches the recent average level (about 17%), the share price tends to enter a "downward channel." This has only happened twice in the past four years, bringing over 30% and 70% corrections to Tesla's share price, respectively. So it's currently difficult to see that a decline in the automotive business will necessarily trigger a significant correction. It would be more troubling if only the automotive business is growing.

Will the Robotaxi, which has garnered a sky-high valuation from Cathie Wood, ultimately succeed? Some insiders in the US market assert that Tesla's Robotaxi faces an uphill battle due to the company's limited presence in the ride-sharing market. For this service to take off, Tesla must deploy a substantial fleet in each city. However, the question remains: How many vehicles are necessary? Do we need 1 million, 5 million, or perhaps just 500,000 nationwide? At the city level, does this equate to capturing a 5%, 10%, or 15% market share in ride-sharing? These are costly queries, and any missteps will take a considerable amount of time to rectify.

Based on current information, the Cybercab boasts several design features: no steering wheel, gull-wing doors, a two-seat layout, a starting price under $30,000, and a projected production date of 2026. While this pricing isn't exactly affordable, Tesla's plan isn't solely reliant on individual sales. Instead, it aims to establish its own fleet combined with C2C sharing (where owners' idle vehicles participate), akin to a hybrid of Uber and Airbnb, to boost vehicle utilization. Musk forecasts a market size reaching the trillion-dollar mark by 2030. However, the crux of the matter isn't how inexpensive the Cybercab is or how many users will purchase it, but whether it can genuinely help users earn $30,000 annually, as Musk claims. This necessitates L4-level autonomous driving.

In Tesla's vision, the "Robotaxi+FSD" solution is poised to meet the commuting needs of the masses. Consequently, Musk prioritizes intelligent driving in his planning for the coming years, deeming it unwise to follow the iterative path of traditional automakers.

The ultimate question revolves around Tesla's end-to-end FSD model capability and its future trajectory. Musk has been truthful about enhancing model capabilities, as evidenced by data from the third-party website FSD Tracker, which underscores improvements in FSD stability. Post the Tesla FSD v12 update, the proportion of trips without user intervention soared from 47% to 72%, with the average miles per intervention (MPI) increasing from 186 kilometers to 536 kilometers. Following the FSD v13 update, Tesla's MPI witnessed a 5-6 times increase compared to v12.5, culminating in a three-order-of-magnitude improvement throughout 2024, equating to a 1,000-fold enhancement.

This remarkable progress is attributed to the exponentially enhanced generalization capability of the end-to-end FSD model. Regarding user complaints about traffic rule violations and other issues, Tesla is employing supervised learning models to provide AI models with learning benchmarks, thereby minimizing infractions and recognition errors.

Should fully autonomous driving become a reality, Tesla cannot afford to be left behind. When discussing which company stands the highest chance of achieving L4-level autonomous driving, Tesla undeniably emerges as the frontrunner. This is because Tesla boasts an industry-leading position with over 1.6 billion miles of intelligent driving training data, whereas domestic intelligent driving teams typically do not exceed 500 million kilometers, making it exceptionally challenging for them to catch up in the short term. Furthermore, Tesla's computing power is far superior. In October 2024, Dojo's total computing power reached 100 Exa-Flops, whereas many domestic newcomers generally do not exceed 10 Exa-Flops. And Tesla still has additional computing centers in the pipeline.

Ultimately, the battle for intelligent driving hinges on computing power and data. If both are relatively weak, overtaking through algorithmic advancements alone is nearly impossible, unless an independently developed new architecture can present a model superior to end-to-end. However, this prerequisite has yet to materialize, solidifying Tesla's position as the strongest player at the forefront of intelligent driving.

Written at the end

Is Tesla expensive? It depends on the benchmark. A price-to-earnings ratio of 120 times is exaggerated compared to peers, and past price-to-earnings ratios have been overestimated by more than 30%. Nevertheless, Tesla's stock price is heavily influenced by Musk's performance and capabilities. Its intelligent driving narrative isn't valued based on industry averages but is instead accorded a sky-high valuation akin to that of OpenAI for pioneering innovators.

If Musk were a conventional professional manager, his current performance would warrant reconsideration. However, Musk is a unique and perplexing figure to Wall Street, making it plausible for him to stage another "turnaround in adversity." Of course, the prevailing risk stems from Musk's political involvement. To avert another stock price roller coaster, he must either step down early, hand over Tesla to professional managers, or take charge of innovative ventures behind the scenes.

So, will you exit now or take a chance on Musk's fortunes by buying at the bottom?

Reference materials:

Can the new Model Y save Tesla? Source: LetterRank

Musk Crashes Tesla Source: Caijing Magazine

UBS Throws Cold Water on Tesla Source: Wall Street CN