21-Year IPO Journey: 'Overseas King' Chery Sprints for Hong Kong Stock Exchange

![]() 03/18 2025

03/18 2025

![]() 521

521

This article is based on publicly available information and is intended for information exchange purposes only, not constituting investment advice.

Produced by | Corporate Research Lab IPO Group

Recently, Chery Automobile officially submitted its IPO application to the Hong Kong Stock Exchange, positioning itself as the only traditional vehicle manufacturer in China yet to go public.

Since 2004, Chery has made multiple attempts to list through various channels, but each time fell short due to factors such as the financial crisis, complex shareholding structures, and insufficient technological innovation.

In 2024, Chery Group's global automobile sales surpassed 2.6 million units, ranking 11th globally. From 2022 to the first three quarters of 2024, Chery Automobile's revenue amounted to 92.618 billion yuan, 163.205 billion yuan, and 182.154 billion yuan, respectively, with net profits of 5.806 billion yuan, 10.444 billion yuan, and 11.312 billion yuan, demonstrating robust growth momentum.

However, behind this impressive performance lies hidden concerns: Chery's over-reliance on the Russian market as the 'Overseas King' and its sluggish transition to new energy, with a cluttered product line lacking standout hits.

The Double-Edged Sword of the Russian Market

As one of the earliest Chinese automakers to embark on the 'going out' strategy, Chery Automobile stands as a beacon of overseas expansion success. Since exporting its first batch of sedans to Syria in 2001, Chery has accumulated over two decades of experience in developing international markets. As of 2024, Chery has been the leading exporter of Chinese brand passenger vehicles for 22 consecutive years, with cumulative overseas sales exceeding 4 million units.

The data speaks volumes: From 2020 to 2024, Chery Automobile's exports soared from 114,000 units to 1.144 million units, a tenfold increase over five years, averaging an annual growth rate of 77.7%. According to the China Association of Automobile Manufacturers, China's total automobile exports reached 5.86 million units in 2024, with Chery (including brands like JETOUR) accounting for 19.5% of the market with 1.144 million units, meaning one out of every five cars exported from China is a Chery. In terms of revenue, Chery's overseas earnings were 33.07 billion yuan, 79.48 billion yuan, and 80.15 billion yuan in 2022, 2023, and the first nine months of 2024, respectively, accounting for 35.7%, 48.7%, and 44.0% of total revenue during these periods.

However, beneath this stellar overseas performance lies a hidden concern: Chery's over-reliance on the Russian market. While Chery entered the Russian market as early as 2005, it was 2022 that marked a significant turning point. Following the Russia-Ukraine conflict, European, American, Japanese, and Korean automakers collectively withdrew, leaving a void that Chinese automakers like Chery swiftly filled. Prior to 2022, Chinese brands held only a 7% share in Russia, but by 2024, this figure skyrocketed to 60%, with Chery alone accounting for 20%. According to the China Passenger Car Association, Chinese automakers exported 1.03 million passenger vehicles to Russia in 2024, with Chery leading the pack with 325,000 units, a year-on-year increase of 47%. Chery's three major brands – Chery, OMODA, and JETOUR – all ranked among the top ten in annual sales.

The Russian market's contribution extends beyond sales. In 2023, Chery achieved a turnover of 590.3 billion rubles (approximately 49 billion yuan) in Russia, corresponding to sales of 220,000 units, which accounted for 61.6% of its overseas revenue that year. In 2024, the 325,000 vehicles sold by Chery to Russia represented 28.5% of its total exports, serving as a cornerstone supporting its export growth. While Chery rose due to geopolitical opportunities, it may also face setbacks from geopolitical changes. Should the Russia-Ukraine conflict ease and European, American, Japanese, and Korean automakers return to the Russian market, Chinese automakers like Chery will encounter severe challenges. For instance, Renault's CEO has stated that the company does not rule out returning to Russia post-peace agreement; Toyota and Volkswagen have restarted parts supply to Russia; and Hyundai Motor plans to resume production at its Russian factory by 2025. If Western brands make a comeback, Chery's market share in Russia is likely to shrink, affecting its export sales and overseas revenue. Additionally, Chery faces the risk of tightening policies in Russia. In 2024, Russia increased import tariffs and disposal fees for automobiles and strengthened environmental protection certification requirements. While this has not significantly weakened Chery's sales, it may compress its profit margins. Even more alarming, the growth rate of Chinese automakers in Russia in 2024 (47%) was lower than that in 2023 (101%), indicating a slowdown in the Russian market's growth rate. As Chery's largest single export market, geopolitical and policy risks in Russia cannot be overlooked.

New Energy Race: Early Starter, Late Arrival

Chery's overseas expansion primarily relied on fuel vehicles to drive sales, potentially causing the company to miss out on the explosive growth period of the domestic new energy market. Although Chery launched new energy models as early as 2009, it lost the first-mover advantage due to unclear positioning. In 2023, its new energy vehicle sales totaled only 133,000 units, trailing far behind BYD (3.02 million units), Geely (487,400 units), and Changan (470,000 units). Yin Tongyue, chairman of Chery Holding Group, once admitted, 'In new energy vehicles, we started early but arrived late.' Taking micro electric vehicles as an example, Chery's Ant eQ1 (priced between 60,000 and 100,000 yuan), launched in 2017, preceded Wuling Hongguang MINI by three years but lagged significantly in sales and influence. Data shows that the Ant sold 150,000 units in 2020, 77,100 units in 2021, and 96,500 units in 2022; whereas Wuling Hongguang MINI sold 128,800 units, 426,000 units, and 554,000 units from 2020 to 2022, respectively, far outpacing the Ant. In 2021, Chery launched the even cheaper QQ Ice Cream, priced between 30,000 and 60,000 yuan, with sales of 95,700 units in 2022. However, with the phase-out of subsidies and intensified market competition, sales of both models declined in 2023, with the Ant falling to 26,800 units and the QQ Ice Cream dropping to 67,800 units, resulting in a sharp decline in pure electric revenue from 10.95 billion yuan to 5.19 billion yuan, a year-on-year decrease of 52.6%.

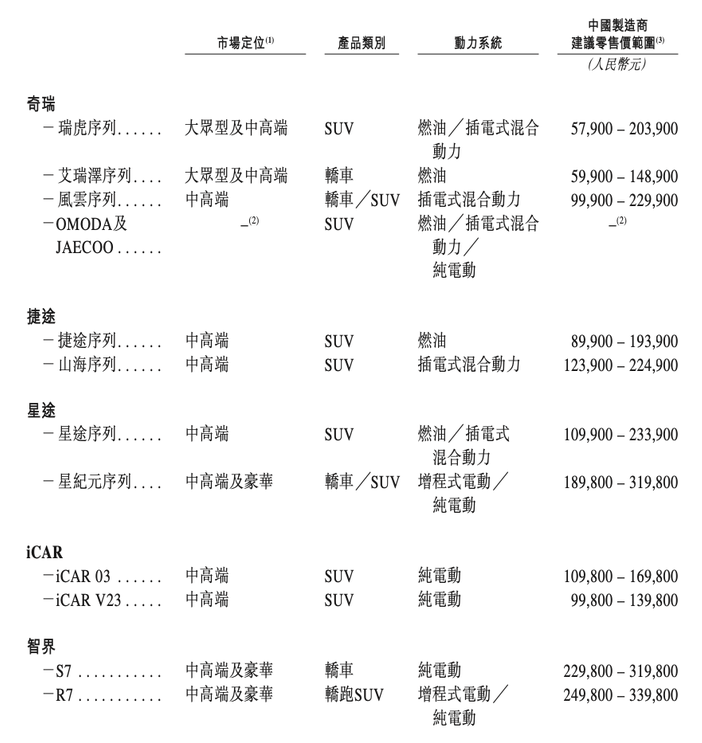

The pressure of declining sales forced Chery to accelerate its transition towards new energy. In October 2023, Yin Tongyue declared at Chery Technology Day, 'Next year, we won't be polite anymore. We must enter the forefront of the national new energy vehicle industry.' After reorganizing its product line, Chery's new energy vehicles can be divided into five major brands: Chery Fengyun for pure electric and hybrid sedans and SUVs, EXEED Star Era for high-end pure electric sedans and SUVs, JETOUR for hybrid urban SUVs and off-road SUVs, iCAR for pure electric vehicles targeting young consumers, and Smart Auto, a collaboration with Huawei. In 2024, Chery Group's new energy vehicle sales surged, with annual sales of 584,000 new energy vehicles, a year-on-year increase of 232.7%; and new energy vehicle revenue in the first three quarters was 29.1 billion yuan, a year-on-year increase of 534.7%. This breakthrough stems from three major shifts: first, the shift in technical focus from pure electric to hybrid and extended-range vehicles; second, the adoption of a sea of vehicle tactics to launch new models intensively; and third, the upward shift in price bands to target the mid-to-high-end market.

In 2024, hybrid and extended-range models became the mainstay, with Chery launching over a dozen new models such as Fengyun T6, Fengyun T9, Fengyun T10, Shanhai T1, Shanhai T2, Shanhai L6, Shanhai L7, EXEED Star Era ET extended-range version, EXEED Yao Guang C-DM, EXEED Zhuifeng C-DM, and Smart Auto R7 extended-range version. Relevant revenue in the first three quarters reached 18.07 billion yuan, a year-on-year increase of 957%. Additionally, the pure electric sector also rebounded, with the new pure electric brand iCAR achieving annual sales of 66,000 units and sales of nearly 58,000 units for Smart Auto (with the main model S7). In the first three quarters of 2024, revenue related to pure electric models was 11.03 billion yuan, a year-on-year increase of 283%.

Chaotic Product Line Lacking Memorable Points

Regarding Chery's growth in the new energy field, Zhang Xiang, secretary-general of the International Intelligent Transport Technology Association, said, 'As a traditional automaker, Chery Automobile's strategy of focusing on new energy is correct. By launching high-end new energy brands and rolling out new models like a snowball, it makes up for the company's shortcomings in new energy.' However, some car enthusiasts have also expressed that Chery continues to adopt the mindset of 'having more children to fight better,' using a multitude of models to boost sales, but none have become standout hits. Marketing is mediocre, models are unremarkable, the product line is chaotic, and there is a lack of a strong, memorable point.

Taking Fengyun T9, the best-performing model in the Fengyun series, as an example, this mid-size SUV has sold over 10,000 units for three consecutive months in the market. However, the Fengyun T9 is essentially a hybrid version of the fuel vehicle Tiggo 8L, with similar dimensions, styling, and interior design, yet divided into two brands, inevitably confusing consumers. Among the Shanhai series under JETOUR, the best-performing Shanhai T2 was launched in April 2024, with cumulative sales exceeding 47,000 units in 2024, averaging approximately 5,200 units per month. This performance would probably be considered underwhelming if it were a new model launched by a new force brand in 2024.

As for the iCAR brand, Yin Tongyue once said, 'iCAR is a 'new special economic zone' created by Chery Automobile. The group will spare no effort to support the development of iCAR, with no upper limit on investment, to help iCAR enter the first tier of the new energy industry.' However, after the launch of the second iCAR V23 in 2024, issues such as reduced configuration, bundled sales, and more triggered dissatisfaction among users, leading to a wave of cancellations. For instance, it was announced during the pre-sale stage that the battery used would be from CATL, but at the time of release, it became a mix of batteries from Guoxuan High-Tech and CATL. The top-spec 501km four-wheel-drive high-end version priced at 139,800 yuan required users to add 10,000 yuan to select the 'Tech Package,' which bundles rigid demands and common configurations such as 360-degree imaging, dashcam, and transparent chassis, forcing users to pay extra. Subsequently, Zhang Hongyu, general manager of iCAR, responded to the issue of reduced configuration, saying, 'iCAR builds cars for young people, with the initial intention of bringing an ultimate experience to young people. Ask the people around you, do any of the ten people use assisted driving? This is internal competition, competing in functions and configurations, which are actually useless. Many functions and configurations in cars are something you never use after getting the car.' This response did not quell users' anger, with some users saying, 'Young people are not stupid and should not be treated as easy prey. If something is reduced, I may not use it, but you can't not have it.'

Additionally, iCAR is positioned towards an off-road style, with annual sales of 66,000 units in 2024, averaging about 5,500 units per month. However, off-road vehicles have always been a niche segment in the Chinese automobile market. According to a Northeast Securities report, 224,000 hardcore off-road vehicles were sold in China in 2023, accounting for only 1% of total automobile sales in China, a fraction of household SUVs and sedans. Currently, Chery's strategy of 'having more children to fight better' may temporarily boost sales, but to achieve long-term development, it still needs to find an accurate positioning, leave a distinctive label in the hearts of users, and enhance its ability to create standout hits. Furthermore, Chery stands at a crossroads, deciding whether to focus on the overseas fuel vehicle market or the domestic new energy vehicle market, and how to allocate its limited resources and energy is also a critical test for the company.