Xiaomi's Annual Revenue Tops RMB 300 Billion Again, with SU7 Contributing 9%

![]() 03/19 2025

03/19 2025

![]() 550

550

One year after entering the automotive market, Xiaomi disclosed the specific delivery volume for 2024 in its annual report for the first time.

Throughout the year, the cumulative delivery of the SU7 reached 136,854 vehicles, surpassing the annual sales target of 130,000 vehicles and helping the group's total revenue exceed RMB 300 billion for the first time in two years.

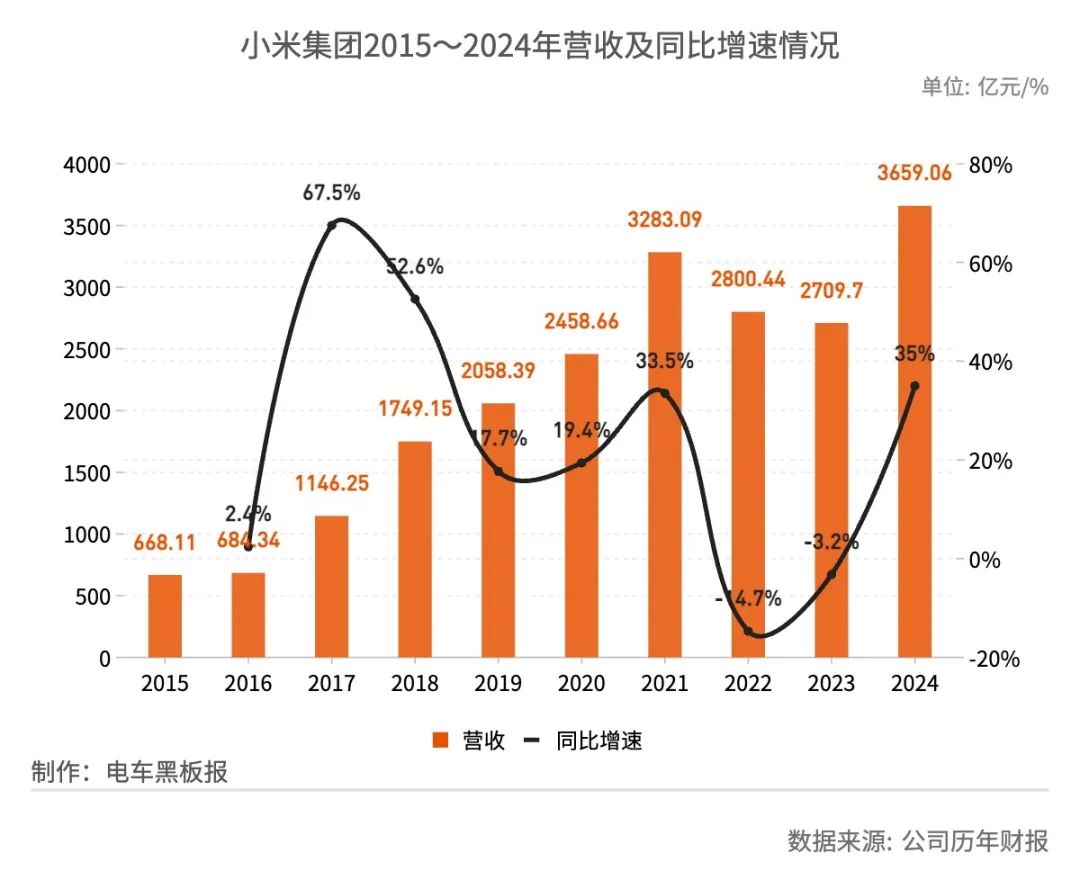

According to Xiaomi's financial report released after the Hong Kong stock market closed on March 18, total revenue for 2024 increased by 35% year-on-year to RMB 365.906 billion. Among this, revenue from automotive and other related businesses amounted to RMB 32.754 billion, accounting for 9% of total revenue.

Following the release of the financial report, Lei Jun posted on Weibo, calling the 2024 financial report Xiaomi Group's "strongest annual report ever".

Since Q2 2024, reflecting the company's strategy of an "all-ecological approach encompassing people, vehicles, and homes," Xiaomi's financial report has updated its segment reporting to include two major segments: Mobile × AIoT and innovative businesses such as smart electric vehicles. The former includes smartphones, IoT and consumer products, internet services, and other related businesses, while the latter encompasses the smart electric vehicle business and other related endeavors.

On a quarterly basis, benefiting from national subsidy programs, the company's total revenue for Q4 2024 increased by 48.8% year-on-year to RMB 109.005 billion, marking the first time quarterly revenue exceeded RMB 100 billion. Within this, the Mobile × AIoT business segment contributed 84.7%, while the automotive and other related businesses segment contributed 15.3%, with the revenue share increasing by 4.8 percentage points from the previous quarter.

Comprehensive financial report data indicates that the significant quarter-on-quarter growth in revenue from automotive and other related businesses was primarily driven by the continuous increase in SU7 deliveries during the period. During the reporting period, Xiaomi delivered 69,697 vehicles, representing a quarter-on-quarter increase of 75.2%.

Along with revenue growth, the gross margin of the automotive business also saw an uptick. In Q4 2024, the gross margin of Xiaomi's automotive and other related businesses increased by 3.3 percentage points quarter-on-quarter to 20.4%, marking the third consecutive quarter of growth for this indicator. The average selling price (ASP) per vehicle declined in Q4, decreasing by 1.8% quarter-on-quarter to RMB 234,322.

Based on published financial reports of automotive companies, Xiaomi's quarterly gross margin for automotive and other related businesses has surpassed that of leading industry players. Tesla's gross margin and automotive gross margin (excluding regulatory credit points) for Q4 2024 were 16.3% and 13.6%, respectively, while Li Auto's corresponding figures for the same period were 20.3% and 19.7%.

The economies of scale resulting from the substantial increase in delivery volumes have also contributed to a continued narrowing of the adjusted net loss for automotive and other related businesses. In Q4 2024, the adjusted net loss for this business segment decreased to RMB 700 million from the previous quarter; for the full year, the adjusted net loss for automotive and other related businesses amounted to RMB 6.2 billion.

On the same day the financial report was released, Xiaomi Automobile completed the delivery of its 200,000th new vehicle. Considering delivery data from last year and the first two months of this year, Xiaomi Automobile has delivered close to 14,000 vehicles since March. At this rate, Xiaomi Automobile is poised to deliver over 20,000 vehicles for six consecutive months.

However, Lei Jun and Xiaomi Automobile, which he leads, are also facing "happy troubles." The company's current production capacity cannot keep up with the continuously increasing new orders and previously accumulated orders, leading to repeated extensions of the delivery cycle.

At the launch event for the SU7 Ultra at the end of February, Lei Jun revealed that Xiaomi SU7 had accumulated over 248,000 locked orders in the nine months since its launch. This means that, excluding the nearly 137,000 vehicles already delivered, there were over 110,000 pending orders for the vehicle in 2024. Coupled with new orders received each month since 2025, Xiaomi Automobile still faces significant production capacity pressure.

Xiaomi Automobile's official website shows that the estimated delivery period for the three versions of the SU7 after order locking has further extended compared to three weeks ago. Specifically, the standard version's delivery period has been extended by 5 weeks to 37-40 weeks; both the Pro and Max versions have been extended by 4 weeks, requiring waits of 34-37 weeks and 30-34 weeks after order locking, respectively.

The delivery period for the high-end sedan SU7 Ultra is relatively shorter, with an estimated delivery period of 13-16 weeks after order locking. Within three days of its launch, the SU7 Ultra received over 10,000 locked orders, helping the company achieve its annual sales target for the vehicle ahead of schedule. Considering subsequent new orders, the delivery period for the SU7 Ultra is likely to extend further.

Lei Jun has publicly stated more than once that he will seriously discuss how to further increase production capacity.

Before this financial report was released, he posted on Weibo that Xiaomi Automobile has been fully committed to increasing production capacity and has made some progress, raising the annual delivery target for 2025 to 350,000 vehicles. This new target is 50,000 vehicles higher than the 300,000 vehicles announced by Lei Jun at the end of last year and represents an increase of over 150% compared to the delivery volume in 2024, equivalent to an average monthly delivery of 29,200 vehicles.

Judging from the delivered data and locked orders, Xiaomi's progress in the electric vehicle market has far exceeded expectations, driving the company's valuation to soar.

Since the launch of the SU7 on March 28 last year, Xiaomi Group's market capitalization in Hong Kong has increased by over HK$1 trillion, ranking it among the top three global automotive companies by market value. As of the close of trading on March 18, Xiaomi Group's share price increased by 3.32% to HK$57.65, with a cumulative increase of 67.1% since the beginning of the year, bringing the company's total market capitalization to HK$1.448 trillion.