Tesla's Urgency in China

![]() 03/19 2025

03/19 2025

![]() 619

619

Introduction

Tesla's position in the Chinese market is crucial, yet the current situation is far from optimistic.

"Over the past few years, Tesla's meteoric rise in the Chinese auto market has been evident. This year, however, we may witness its decline."

This is no exaggeration; it's a genuine sentiment based on two significant moves by the American EV maker in China this week.

While I anticipated challenges for Tesla due to various reasons, the current situation has surpassed expectations.

Compared to its previous ease, the heightened competition in the auto market is taking its toll on Tesla, and for the first time, a sense of urgency is palpable.

Given its performance since the year's beginning and Elon Musk's political ambitions, Tesla has lost ground in both European and US markets.

In this context, Tesla's ability to maintain stable growth in China will be crucial for its overall performance.

However, its current situation suggests otherwise. For instance, February's double-digit sales decline year-on-year and month-on-month has raised alarms.

As March marks the final battle of the first quarter, Tesla must intensify its efforts, leading to what can be termed a "combination punch" strategy.

01 Price Reduction: The Only Path for FSD

So, what is Tesla's "first punch" in China? The answer lies in the limited-time free access to FSD.

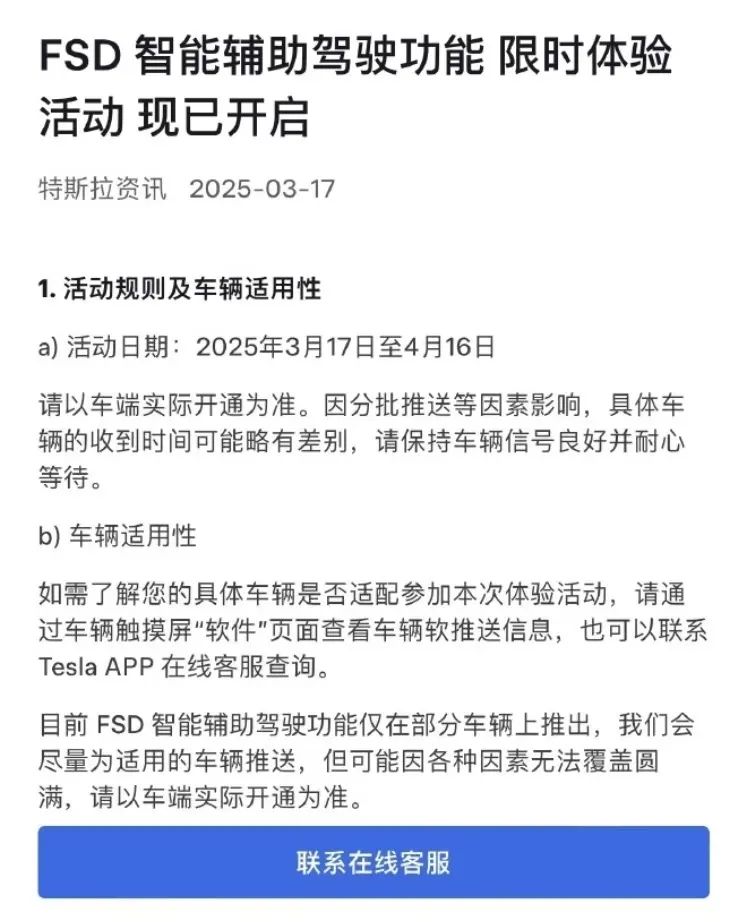

Tesla's official statement reads: "From March 17, 2025, to April 16, 2025, subject to actual activation in the vehicle. Due to factors such as batch delivery, the receipt time may vary slightly for different vehicles."

As previously analyzed, the primary goal of FSD's launch in China is to boost sales and restore Tesla's technological aura.

Rationally and objectively, FSD's system capabilities and user experience still have flaws and signs of incompatibility, based on current feedback. However, as an observer, I'm not concerned about Tesla's engineering capabilities.

Rather, the one-time purchase price of up to RMB 64,000 is a significant barrier to widespread adoption. In this year's Chinese auto market, driven by domestic brands, a trend of "no subscription, no fees, standard configuration" for intelligent driving systems has emerged.

The high cost of FSD seems increasingly out of place.

Frankly, with the current strategy, only a small batch of early adopters will opt for FSD. Remember, both the refreshed Model 3 and Model Y have entry-level prices just over RMB 200,000.

This week's announcement of a month-long free access to FSD appears as a "customer-friendly benefit" from Tesla.

However, I read between the lines: "With the embarrassingly low adoption rate of this advanced intelligent driving system, Tesla is in a rush."

After much deliberation, it resorted to this tactic to potentially stimulate purchases.

But the same logic applies: while paying separately for good features isn't wrong, this model doesn't align with current market conditions and consumer habits. Offering FSD for free for a month is unlikely to yield significant results.

"I'll try it if it's free, but I won't pay for it." This candid statement from a Tesla owner reflects authentic feedback.

Without exaggeration, if FSD wants to achieve the desired expansion in China, it should seriously consider a reasonable monthly subscription system based on demand, rather than a one-time purchase of RMB 64,000, which simply won't work.

In other words, price reduction is the only way out for this advanced intelligent driving system. Otherwise, FSD's entry into China will be akin to "entering into emptiness," causing little to no impact.

02 Is the Refreshed Model Y Struggling with Sales?

Having discussed FSD, let's move on to Tesla's second move, which reveals the same urgency: "It's in a rush."

Before elaborating, let me ask: "What do you think of Model Y's position in the Chinese auto market?"

At the market level, it has been "unstoppable," facing virtually no competition. It's also the benchmark for mid-size pure electric SUVs and all pure electric vehicles. At the corporate level, it plays a leading role, contributing over 400,000 vehicles annually.

One could say that since its localization, Model Y has sailed smoothly.

Logically, with the highly anticipated entry of the precisely upgraded and refreshed version, it should have demonstrated an even stronger market dominance.

However, the results have been disappointing.

This week, Tesla announced in China that the price of the refreshed Model Y Long Range All-Wheel Drive version has increased by RMB 10,000 to RMB 313,500.

But this move is more like a "smokescreen."

The real focus is the introduction of a 3-year 0% interest and 5-year ultra-low-interest policy for the refreshed Model Y Rear-Wheel Drive version, with a minimum monthly payment of just RMB 3,808. Tesla's China official website shows delivery periods of 6-10 weeks and 2-4 weeks for these two models, respectively.

Reflect on this: what do you sense?

In my view, the price increase of the Long Range All-Wheel Drive version is a reverse strategy to push potential customers to make a decision. The Rear-Wheel Drive version, recently launched, is eager for promotions, and with a minimum delivery period of just half a month, it's clearly facing an awkward situation of oversupply.

Simply put, Tesla expected high demand for the entry-level version and prepared sufficient production capacity but didn't anticipate sluggish sales.

The underlying reasons are twofold. Firstly, competition in the mid-size new energy SUV market has intensified to an "extreme" level, eroding the advantages of the refreshed Model Y.

Secondly, compared to the older model, its starting price of RMB 263,500 is unappealing. Most consumers believe there's significant room for price adjustments, leading to many "wait-and-see" buyers.

This begs the question: "Is it really not selling?" I'd say, "It's not completely unsellable, but far from the overwhelming demand it once enjoyed."

Tesla's urgency is understandable.

Last week, reports emerged that Tesla's Chinese R&D team is developing a "low-priced Model Y" to achieve cost control through configuration streamlining while retaining core functions like the battery, powertrain, and chassis.

This product's development adopts an internal R&D model called "depop," focused on quickly launching new models through modular adjustments to reduce costs without compromising core performance.

Notably, this new car's code name breaks Tesla's previous naming rules, using a combination of letters and numbers for the first time, highlighting Tesla's emphasis on the Chinese market.

The launch date hasn't been determined, and the final release schedule will depend on the refreshed Model Y's sales performance. If it fails to meet expectations, the low-priced Model Y may debut earlier in the second half of this year.

In conclusion, Tesla's urgency is palpable. Past experience shows that the transition from rapid rise to decline can happen swiftly.

This year, Tesla faces immense pressure in China and is surrounded by competitors globally.

Editor-in-Chief: Shi Jie, Editor: He Zengrong