Yu Chengdong's Bold Move: Huawei's New Car Pricing Strategy Reflects Resilience, Not Aggression

![]() 03/21 2025

03/21 2025

![]() 487

487

Introduction

In the realm where steel meets code, seeds of the future are being sown. HarmonyOS Auto's pricing strategy isn't a testament to Huawei's aggression; rather, it showcases the resilience of a rising superpower.

Cars are increasingly becoming the focal point of Huawei's new product launches.

As some friends held their tickets to the "Huawei Pura Vanguard Ceremony and HarmonyOS Auto New Product Launch Event," they still wondered if "there would be less content about cars this time." What was widely known in advance was that the AITO M5 and M9 would be refreshed.

As the spotlight of the Chunjian Stadium pierced through the dark background, Yu Chengdong unveiled one "main course" after another. Personally, I found the prices of the new cars in the second half of the event more surprising than the foldable phone.

When the large screen behind Yu Chengdong lit up with "AITO M5 Ultra: starting at 229,800 yuan" and "Enjoy S9 Extended Range Edition pre-sale price of 318,000 yuan," the price tags were like a string of explosive codes that instantly breached the psychological defenses of countless onlookers.

This isn't a simple product showcase; it's a meticulously orchestrated "industrial symphony" – low-priced models like thunder breaking the sky, high-priced flagships like still deep waters, and extended range technology like an undercurrent. Many may associate it with Huawei's early years of aggressive expansion, but upon closer inspection, it's the resilience of a rising superpower relying on manufacturing.

"Huawei is really going all in. It seems like a high-price version of BYD's price war," someone exclaimed from the audience.

"The whole process was painful, but the general direction is correct." Mass production – spreading costs – reducing end prices – industry reshuffle – resource concentration – expanding scale again. This is the only way for the rapid advancement of the manufacturing industry, but rigid laws eventually seem stiff in the face of human emotions.

Therefore, it's not surprising that Yu Chengdong's HarmonyOS Auto and even the entire Huawei approach receive both supporters and critics.

However, neither the voices of support nor opposition can stop the wheel of time from rolling forward.

01 Pricing Tactics: A Balancing Act

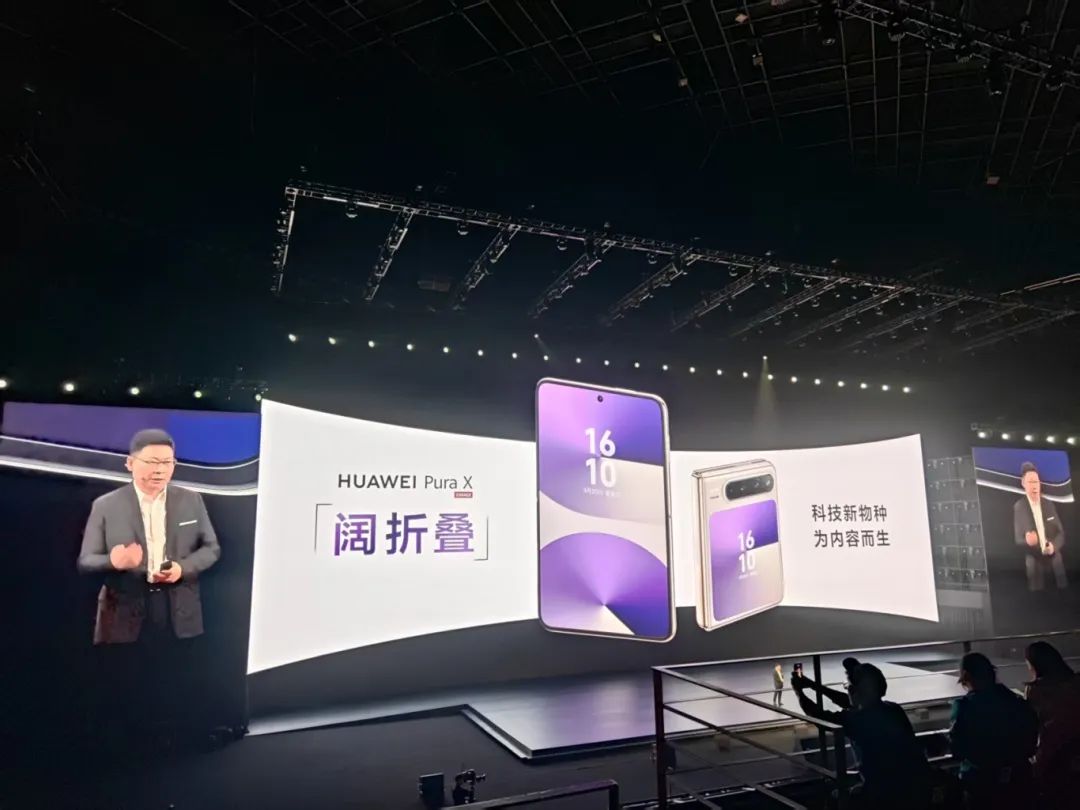

Comparing the Pura X foldable phone and the subsequent HarmonyOS Auto new cars, they represent two vastly different launch strategies.

The Pura X foldable phone requires careful appreciation. The subtle dimensional experience upgrade brought about by the change in size exceeded the expectations of many in advance – it's not about exchanging cost-effectiveness for widespread consumer acceptance, but rather about following the high-end route to find the corresponding elite customer group.

HarmonyOS Auto's new cars, on the other hand, make a direct impact, with price tags serving as a heavy weight on the viewer's mental scale.

When the AITO M5 Ultra debuted with a starting price of 229,800 yuan, Huawei demonstrated a pricing strategy akin to surgical precision. Compared to the 2024 AITO M5's starting price of 249,800 yuan, the new model's price is a direct reduction of 20,000 yuan; if compared to the pre-sale price of 238,000 yuan displayed on previous vertical platforms, the actual reduction is 8,200 yuan.

There's not only a "price reduction" but also an "increase in value": all models come standard with Huawei's high-end intelligent driving ADS 3.3 system, 192-line LiDAR + 4D millimeter-wave radar; enhanced active safety, equipped with an omnidirectional collision avoidance system CAS3.0, upgraded ESA emergency steering assistance and e-AES automatic emergency steering functions, supporting braking and yielding; exterior design improvements have also been made.

What about Beijing Automotive's Enjoy brand? The Enjoy S9 finally introduced an extended range version – many had previously predicted that the extended range version would be about 30,000 to 50,000 yuan cheaper than the pure electric version with the same configuration, but the Enjoy S9 Extended Range Edition's starting price of 318,000 yuan is a direct reduction of 80,000 yuan compared to the pure electric version.

In terms of performance, the extended range version achieves a CLTC combined range of 1,355 kilometers through Huawei's Xuexiao intelligent extended range system, which not only solves the range anxiety of pure electric vehicles but also leverages price advantages to impact the mainstream luxury sedan market.

However, Huawei's pricing strategy is by no means a "one-size-fits-all" approach.

The price of the 2025 AITO M9 six-seater version has increased by 10,000 yuan to 479,800 yuan compared to the 2024 version, but due to the integration of the latest ADS 4.0 high-end intelligent driving system, distributed vehicle satellite communication, and other cutting-edge technologies, it has instead strengthened its positioning as a "technology flagship."

The pricing approach can be fully referenced by the sales performance of each model.

Taking the cumulative sales volume from February 2024 to February 2025 as an example:

The AITO M9 stands out among the HarmonyOS Auto models, with a retail sales volume of 168,525 units, making it the best-selling model above 500,000 yuan without needing to add restrictions such as "autonomous brand" or "new energy vehicle," and even higher than the more mainstreamly priced AITO M7 from the same brand;

While the M5 sold only 36,527 units in the past year, averaging 3,000 units per month, which is already unsatisfactory to Yu Chengdong;

The Enjoy S9 sold a total of 5,494 units in five months, with an average monthly sales volume of over 1,000 units, which is considered top-notch among pure electric sedans near 400,000 yuan, but not impressive without restrictions.

This "alternating hot and cold" pricing logic demonstrates Huawei HarmonyOS Auto's precise control over its product matrix: for popular models, choose one with a slight price increase and offset it substantively with benefits to test the market; for models with previously sluggish sales, provide better price competitiveness, thereby constructing a product pyramid that is both offensive and defensive.

02 The Industrial Logic Has Changed: A Race for Scale and Cost

If Huawei HarmonyOS Auto, in the market above 200,000 yuan, also stirs up a wave of price competition like BYD in the 70,000 to 200,000 yuan market, how will the entire industry be affected?

So far, no one has elaborated on this. But deeper than the level of "price competition" is the change in the development logic of China's automotive market.

After being baptized by semiconductor technology and internet marketing, the automotive industry is no longer operating at a leisurely pace but is relying on the macro era of heavy industry to expand scale and reduce costs, participating in price competition. From BYD's mainstream market tactics to HarmonyOS Auto's "overturning the table" in the high-end market, they are almost identical.

"This strategy has two sides: on the one hand, it directly enhances price competitiveness; on the other hand, risks need to be considered, such as maintaining brand status and reassuring existing car owners," said commentators.

A decade ago, observers in the automotive industry were still labeling niche markets with "niche" and "mass" tags, but starting with Tesla, new players like Huawei HarmonyOS Auto and Xiaomi have shattered the boundaries of the original rules.

For example, during the pure gasoline vehicle era, coupe SUVs once created a wave of popularity around 2015 with their hatchback streamlined design. After Mazda CX-4 reaped the benefits, models such as Fengguang ix7 and Tiguan Coupe followed suit, ultimately failing due to limited space, a small audience, and oversupply.

The turning point came with the Tesla Model Y. Tesla pursues a minimalist approach, with the Model S, Model X, Model 3, and Model Y all adopting a Coupe streamlined contour "nested doll" design. Many industry observers originally did not expect the Model Y to be a bestseller, but it has long been the best-selling model in China and even globally.

And Xiaomi's SU7 and Zhidian's R7 once again showed the industry that so-called "niche designs" and pure electric shortcomings are vulnerable in the face of brand power and affordable prices. The pure electric coupe-styled SU7 now sells over 20,000 units per month and is still in short supply; Zhidian's R7, without the S7 paving the way, easily surpassed 10,000 units per month in sales before the extended range version even hit the market.

China's automotive market is undergoing an unprecedented "industrial revolution."

When BYD pushes the price of mid-sized sedans down to just over 100,000 yuan with its vertically integrated system, when Leapmotor's B10 brings high-end intelligent driving vehicles equipped with LiDAR to 129,800 yuan, and when Tesla's Model Y is forced to abandon its intelligent driving label and respond with price cuts under the siege of Huawei's ADS, Momenta, Yuanrong Qixing, and Zhuoyu, this war has long surpassed the single dimension of product capabilities and evolved into a comprehensive game of supply chain efficiency, scale effects, and cost control.

What lies behind this? China's unparalleled automotive supply chain and talent soil, the most complete and extensive system in the world, and the most diligent and hardworking talent.

Why did Tesla abandon LiDAR? Besides not wanting multiple data sources due to its minimalist approach, cost is the biggest obstacle. But China, with leading enterprises such as RoboSense and Hesai, has worked hard for years to reduce the unit price of mainstream automotive-grade LiDAR from the previous ten-thousand yuan level to the current three-thousand yuan level, with further reductions to the thousand-yuan level expected in the future.

Looking at the intelligent driving R&D teams, Huawei's VBU intelligent driving R&D team exceeds 7,000 people; Yang Dongsheng, Dean of BYD's New Technology Research Institute, stated that BYD has invested over 5,000 intelligent driving engineers with a research and development duration of 7 years; Geely, after integrating its R&D Institute's intelligent driving center, the Zeekr self-developed intelligent driving team, the Lotus intelligent driving team, subsidiary Ecarx, and Freetech, which was spun off from Geely, also has several thousand people, and Xiaomi's intelligent driving team will increase from 1,500 to 2,000 people.

Besides China, with a population of 1.4 billion and over 97% literacy rate, which country can provide so much talent? Besides China, which has been baptized by the internet economy and e-commerce economy, which country can provide such a solid foundation for intelligent driving research and development to the industry? Although Tesla boasts that its intelligent driving R&D efficiency is much higher than that of its competitors, it ultimately only has 120 people.

But the cost of price wars is also heavy.

How to get rid of the notorious reputation of "backstabbing existing car owners" and "internal competition tearing apart peers"?

When the AITO M5 Ultra makes LiDAR and 4D millimeter-wave radar standard equipment, Huawei has to face two contradictions: first, the balance between technology affordability and brand premium. If high-end configurations are excessively delegated, it may dilute the flagship value of the AITO M9; second, the maintenance of existing car owners' rights and interests.

Whether it's BYD, Huawei HarmonyOS Auto, or other manufacturers, they all need to carefully consider the serious issue of the negative effects of price competition. Fortunately, at this launch event, Huawei introduced a "hardware upgrade solution" in an attempt to ease the psychological impact of price differences with "technology equity." This "technology + price" dual-track strategy is both Huawei's compromise to market laws and an expedient measure to maintain user loyalty.

03 Conclusion: Navigating Between Aggression and Foresight

Huawei HarmonyOS Auto's new car pricing strategy is like a prism, reflecting the collective dilemmas and breakthroughs of China's automotive industry.

When the AITO M5 Ultra makes LiDAR standard equipment at a price of 229,800 yuan, it pierces not only the deadlock of market competition but also the high wall of technology monopoly; when the Enjoy S9 Extended Range Edition impacts the luxury market at 318,000 yuan, it carries not only sales targets but also ambitions for ecological integration.

But this battle is far from over. Price competition may erode brand value, technology affordability requires huge R&D support, and ecological construction requires time to mature.

For Huawei, finding a balance between the "aggressiveness of the industrial era" and the "foresight of the ecological era" will determine whether HarmonyOS Auto is a "spear" aimed at the old order or a "shield" guarding the new world.

While price competition may be excruciatingly evident at the micro level, it remains unstoppable at the macro level.

Regardless of whether Huawei or BYD emerges victorious, the true beneficiary is an even more impressive figure—the advancement of the industry as a whole.

Editor-in-Charge: Shi Jie

Editor: He Zengrong