Tesla China Achieves One-Year High Retail Market Share in March, Driven by Model 3 and Y

![]() 04/14 2025

04/14 2025

![]() 614

614

Following the delivery of the refreshed Model Y, Tesla China's sales rebounded significantly in the first full month thereafter.

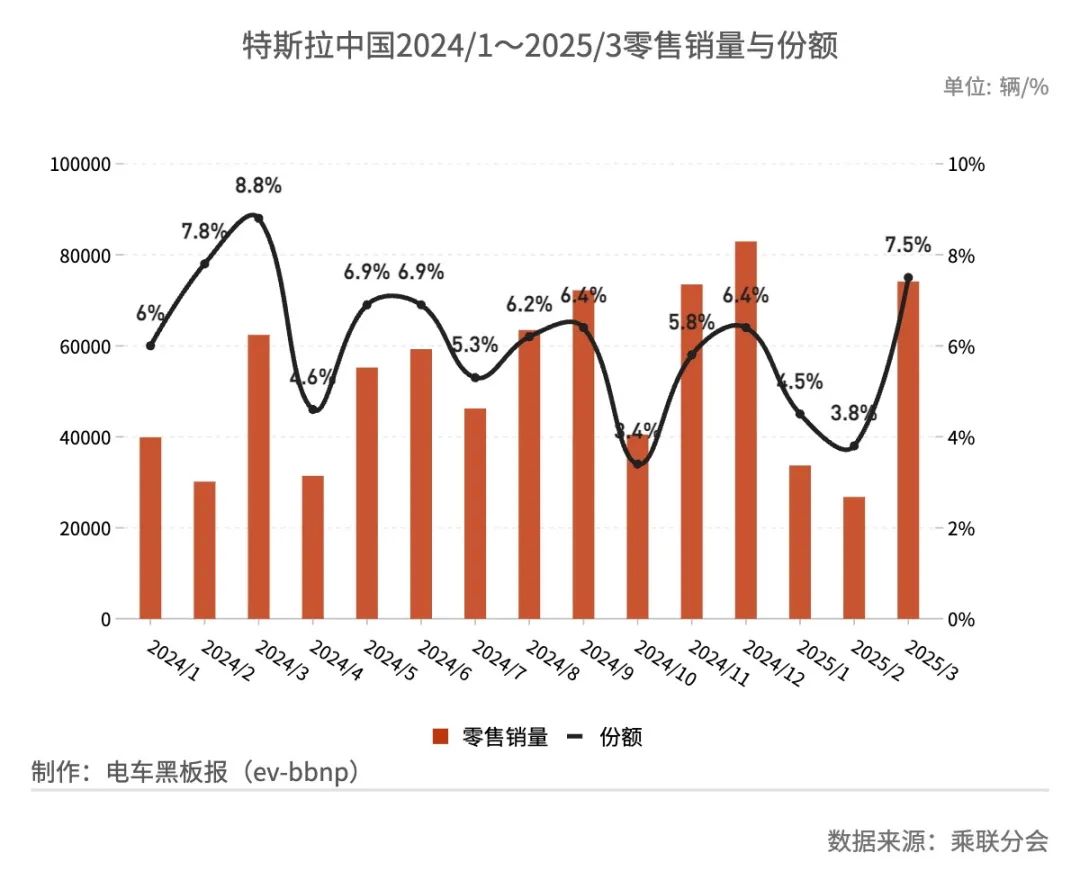

According to data from the Passenger Car Association, Tesla China's retail sales soared 176.8% month-on-month to 74,127 units in March, marking a 18.8% increase year-on-year. During this period, Tesla's retail market share in China reached 7.5%, its highest level since April 2024.

Among new energy vehicle manufacturers, Tesla China's sales ranking jumped from seventh last month to third, trailing only BYD and Geely Auto.

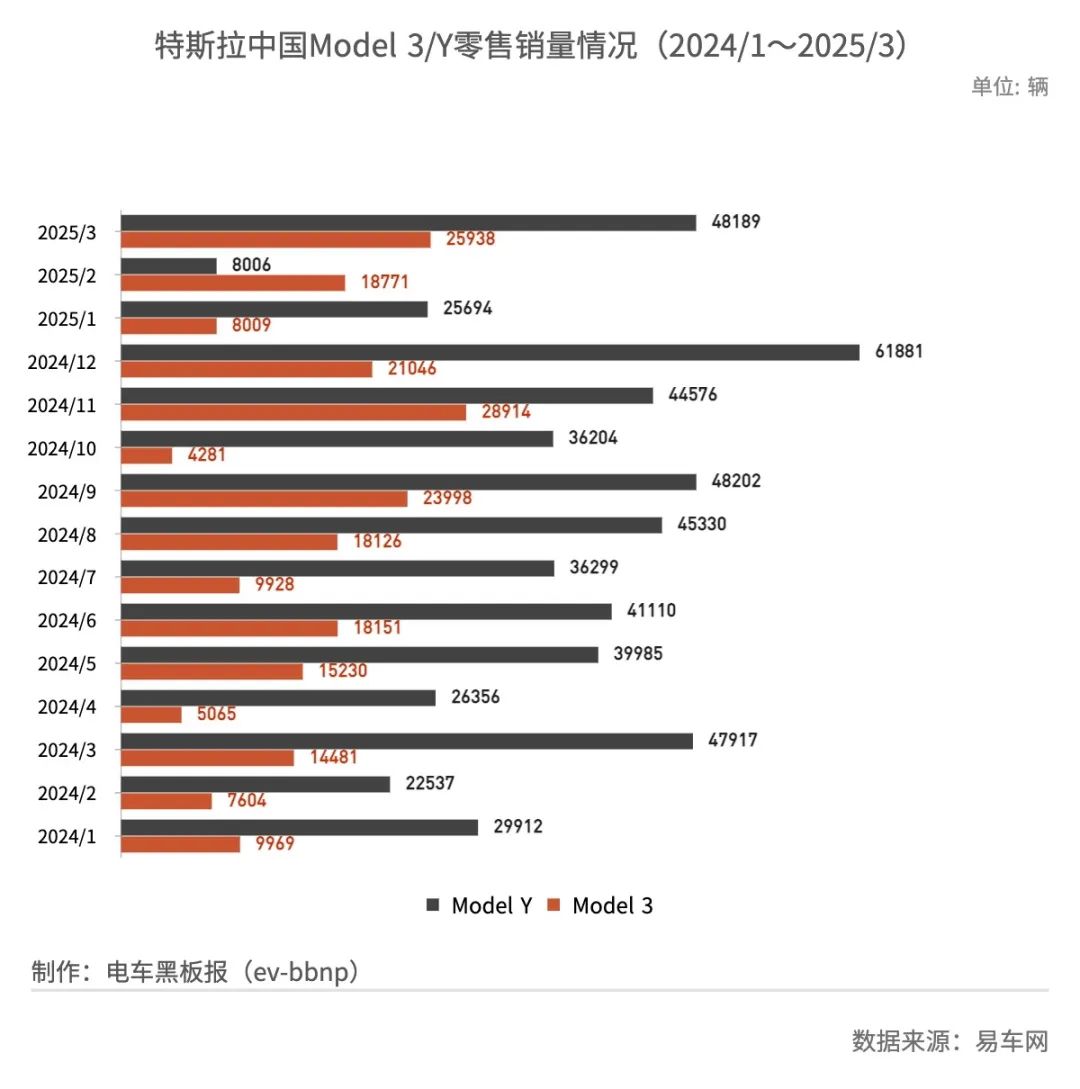

In March, the company's two flagship models, the Model 3 and Y, contributed 25,938 and 48,189 units, respectively. Retail sales of the Model 3 increased by 79.1% year-on-year and 38.2% month-on-month, while those of the Model Y surged by 0.6% year-on-year and 501.9% month-on-month.

As Tesla's primary delivery model, the updated Model Y continues to maintain a dominant position in the Chinese market.

In March, the Model Y reclaimed the monthly sales crown as China's best-selling model after a brief two-month hiatus. From 2023 to 2024, it topped China's best-selling model sales list for two consecutive years.

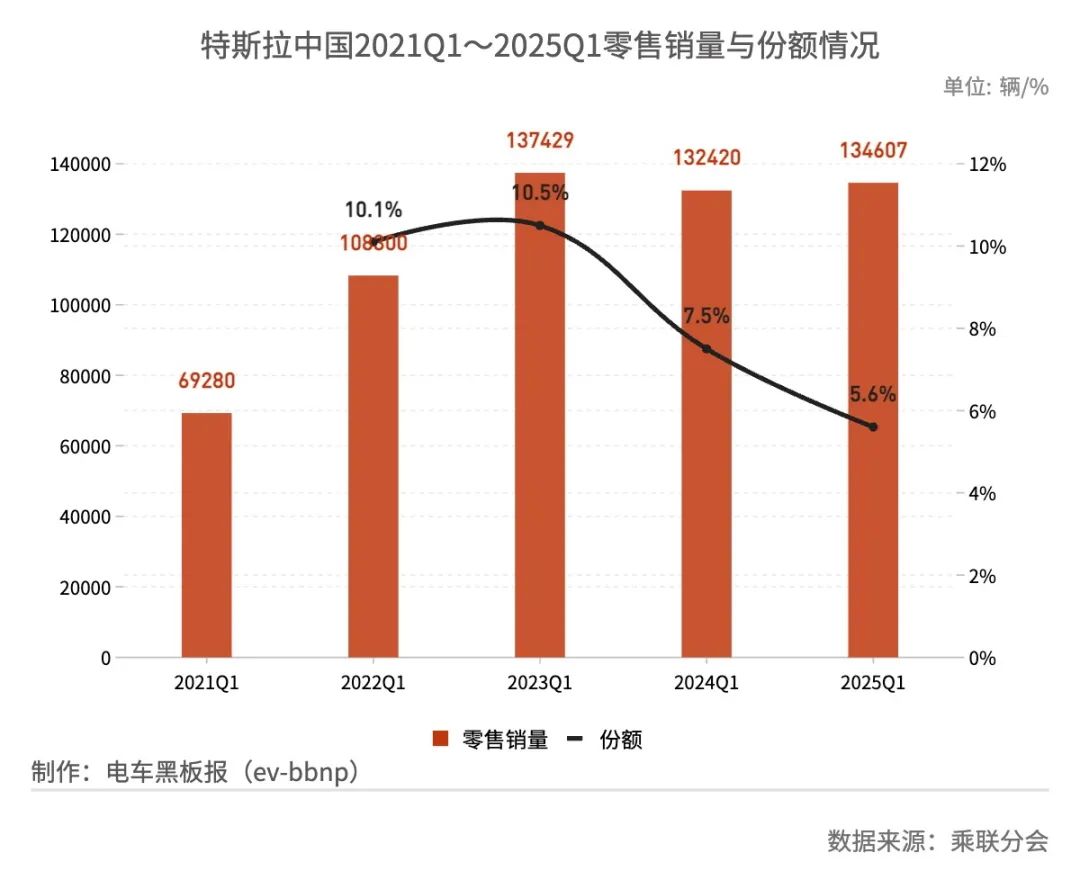

However, due to a significant sales decline in February, particularly as the updated Model Y only commenced deliveries in the Chinese market at the end of the month, Tesla China's Q1 retail sales increased by only 1.7% year-on-year. Its market share fell to 5.6%, the lowest for the same period since 2022.

Compared to other markets, Tesla faces more intense competitive challenges in China.

In Q1 of this year, eight out of the top ten new energy vehicle manufacturers in China by retail sales maintained double-digit year-on-year growth rates. Notably, Lingpao Motors, Geely Auto, Chery, and XPeng all recorded triple-digit year-on-year growth, with only Hongmeng Zhixing experiencing a sales decline.

During the same period, Tesla's global deliveries declined 13% year-on-year to 336,681 units, marking a new low since Q3 2022. Besides intensified market competition and demand factors, the production line transition for the updated Model Y also significantly contributed to the delivery decline.

Tesla stated that it adjusted the Model Y production lines at its four global factories, including the Shanghai factory, in Q1, resulting in reduced production for several weeks. Consequently, the company's global total production decreased by 16% year-on-year to 362,615 units in the quarter, also hitting a new low since Q3 2022.

From an annual perspective, although Tesla China's retail sales have grown for four consecutive years, the increasing penetration of China's new energy vehicle market and the emergence of stronger competitors have eroded Tesla's early lead in the Chinese market.

With the rise of independent brands like BYD, joint venture brands such as SAIC, and new entrants represented by NIO, XPeng, Li Auto, and Zero-Run, Tesla's share in China's new energy vehicle market has further diminished.