The Dawn of Automotive-Phone Convergence: The Race for Ecological Dominance

![]() 07/18 2025

07/18 2025

![]() 502

502

Without swift action, the diversity of mobile phone brands is at risk.

Following the seemingly waning price wars, automotive competition has shifted gears, ushering in new arenas of rivalry.

On July 15, BYD announced the rollout of driver-vehicle interconnection capabilities across its entire lineup, supporting all major Chinese mobile phone brands. By deeply integrating mobile phones and in-vehicle systems, BYD creates a seamless smart travel experience across all scenarios and links.

From the first half's focus on intelligent driving to the second half's emphasis on driver-vehicle interconnection, BYD, as a new energy pioneer, continues to blaze new trails in the automotive industry.

As cars fully embrace the era of intelligence, they morph into an extension of consumer electronics. Automakers view smart cars as new ecosystems, while mobile phone manufacturers see cars as an extension of their interconnected ecosystems. Both sides aspire to dominate each other's domains.

With performance and space nearing saturation, the underappreciated driver-vehicle interconnection has resurfaced as a new competitive frontier. Automakers are expanding their collaborations with mobile phone manufacturers to secure advantageous ecological positions.

Mobile Phone Ecosystem Value

From Xiaomi's foray into automotive to Huawei's HarmonyOS Smart Drive, mobile phone companies' impact on new energy vehicles is evident. The popularity of these vehicles stems from their deep engagement with mobile phone users.

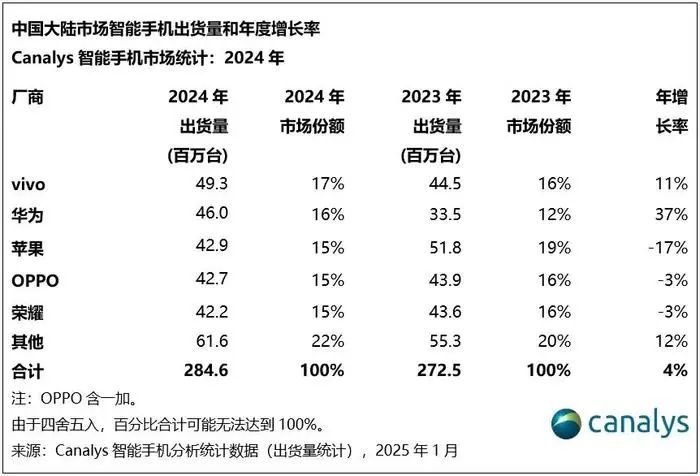

Compared to car sales, mobile phone shipments and ownership are several orders of magnitude higher. In 2024, China's mobile phone market saw 285 million units shipped, with Huawei shipping 46 million and Xiaomi approximately 40 million. In sheer numbers, this is hundreds of times larger than car sales.

Both Xiaomi and Huawei have made the "people-car-home" intelligent ecosystem their hallmark. From seamless phone-car infotainment integration to tablets replacing rear screens, they have positioned the cockpit ecosystem as a core selling point.

According to J.D. Power, consumers are more willing to pay for smart cockpit features like navigation transfer and voice assistants than for intelligent driving functions. The impact of the smart cockpit experience on car purchasing decisions is steadily growing.

This underscores the increasing influence of smart ecosystems on automotive competitiveness, affirming the strategic focus of automakers like BYD on cockpit ecosystem development.

For a time, automakers preferred solo ventures in smart cockpit construction, aiming to retain control over the core. Some even poached talent from mobile phone manufacturers to build cockpit ecosystems.

New force automakers like NIO, XPeng, and Li Auto have recruited key members from mobile phone companies.

Xie Yan, former Vice President of Huawei's Consumer BG-Software Department, Director of the Terminal OS Department, and Chief Architect of the Distributed Smart OS, joined Li Auto in 2022 as CTO, responsible for developing Li Auto's proprietary operating system and computing platform.

After Xie Yan's arrival, Li Auto's in-vehicle infotainment system ecosystem accelerated. In December 2023, Li Auto launched the 5.0 infotainment system, integrating the Mind GPT large model into its intelligent space platform, enhancing the assistant's capabilities. In December 2024, the 7.0 version debuted, adding AI reasoning visual interaction and Mind Diffusion V2.0 drawing features.

Though Li Auto hasn't ventured into mobile phones, it has established a comprehensive system ecosystem on its infotainment system, offering a smartphone-like experience.

On the other hand, Geely constructed its infotainment system ecosystem by acquiring Meizu Technology. In 2023, Geely, through its subsidiary Xingji Times, acquired Meizu and released the Flyme Auto infotainment system, first installed in the Lynk & Co 08 model.

Prior to Flyme Auto's release, Lynk & Co received numerous complaints about its infotainment system. Due to the traditional supplier model, various Lynk & Co models featured different infotainment systems, affecting the brand. With Flyme Auto, previous infotainment issues improved.

After its success with Lynk & Co models, Geely began mass-equipping its internal vehicles with the Flyme Auto infotainment system, covering multiple brands, giving Geely an edge in the new energy vehicle competition.

The mobile phone ecosystem significantly impacts automotive smart cockpits. With in-car interactions shifting to large screens and touch controls, mobile phone manufacturers' years of experience have become a crucial asset. Even declining brands like Meizu excel in in-vehicle infotainment systems.

However, automakers' aspirations to manufacture mobile phones in return seem unrealistic.

To bolster its driver-vehicle interconnection ecosystem, NIO chose to enter the mobile phone market, aiming to reverse-engineer the ecological niche. After assembling talent from multiple mobile phone companies, it launched its proprietary NIO Phone in September 2023.

Despite continuous updates, the NIO Phone hasn't significantly impacted the mobile phone market or spurred widespread replacements among NIO car owners. Mobile phone manufacturers have established stable market ecosystems and consumer bases over years of competition, making it challenging for new brands to gain a foothold.

From Competition to Integration

As smart cockpits emerged as cars' core competitiveness, automakers initially increased investments in infotainment system ecosystems. However, due to various factors, automakers alone struggled to meet consumers' growing demands for automotive ecosystems.

According to J.D. Power, the infotainment system is the most complained about feature within the first three months of car ownership. The significant variations in infotainment system designs among automakers increase learning costs for consumers, particularly for voice commands requiring precise execution.

Moreover, current infotainment systems require automotive-grade hardware, which faces long certification times and high standards. Mainstream infotainment system chips still lag significantly behind mobile phone chips.

The lack of hardware and system complexity complicate infotainment system usage for consumers. The closed nature of infotainment system ecosystems also leads to consumer dissatisfaction.

For instance, automakers' built-in map navigation and music software are fixed, conflicting with consumers' daily software use. Software function updates are often slow, with in-car navigation system features lagging behind mobile phones. Additionally, some software requires separate in-car fees, treating the infotainment system as a new revenue stream.

Faced with these challenges, automakers alone struggle to influence software vendors, presenting new development opportunities for driver-vehicle interconnection. Compared to in-vehicle infotainment systems, the mobile phone ecosystem, after decades of development, has established a stable and tacit understanding, fostering an open and secure software ecosystem.

Companies like Xiaomi and Huawei have achieved unified software systems through automobiles. However, other automakers can't fully embrace mobile phone companies already in the automotive industry, desiring relative system independence. This explains why Apple's CarPlay Ultra system struggles with large-scale implementation. Automakers aim to enhance infotainment system usage without ceding core information to mobile phone manufacturers.

Thus, BYD chose an open ecosystem like the ICCOA Alliance, isolating and running the mobile phone system within the infotainment system, ensuring security while improving usability and addressing outdated infotainment system chips.

However, relying solely on an open ecosystem is insufficient for a true ecosystem. After Apple launched the first-generation CarPlay, various mobile phone manufacturers followed suit, but their efforts lacked significant impact.

Even now, automakers reject Apple's CarPlay Ultra while continuing to equip the first-generation CarPlay. More car models this year have opted for CarPlay functionality.

Behind this lies Apple's powerful mobile phone market ecosystem. Once consumers become accustomed to the Apple ecosystem, transitioning to other operating systems is challenging. To expand their ecosystems, mobile phone manufacturers are increasingly integrating into the Apple ecosystem, aiming to gradually dismantle barriers.

Lei Jun, of Xiaomi, stated that Xiaomi will design its cars to be the most user-friendly for Apple users. After Apple abandoned car manufacturing, large-scale Apple ecosystem users became a significant consumer group. According to Xiaomi, 52% of Xiaomi YU7 orders came from Apple users.

In mobile phone market share, though Apple's Chinese shipments are declining, it remains a mainstream product. In 2024 alone, it sold 42.9 million units, second only to VIVO and Huawei, maintaining its status as an important ecosystem user.

By fully supporting Apple phones, Xiaomi's potential target users more than double, encompassing not just Xiaomi phone users.

Recognizing this influence, automakers are approaching mobile phone manufacturers. On June 30, MG announced a joint intelligent vehicle-mobile phone interconnection ecosystem with OPPO, becoming another automaker to collaborate with a mobile phone company. Converting even a fraction of users can generate significant sales for automakers.

In the short term, compatibility between automakers and mobile phone manufacturers will prevail. Automakers can only enhance user loyalty and expand consumer bases by embracing an open ecosystem. Companies thriving in both automotive and mobile phone ecosystems, like Huawei and Xiaomi, will develop deeper integrations, potentially achieving reverse sales from cars to mobile phones.

Long-term, automotive and mobile phone ecosystems will focus on compatibility and deep integration, with the middle ground unlikely to dominate. The essence of automaker-mobile phone manufacturer competition and cooperation is to secure the "interface rights" of users' full-scenario digital lives.

In the future, companies failing to integrate into the mainstream ecological chain, whether automakers or mobile phone manufacturers, may face a dual crisis of user loss and technological generational gaps.

Note: Some images are sourced from the internet. If there is any infringement, please contact us for removal.

-END-