AI Dual Buffs: Will Dell Embrace Another 'Spring'?

![]() 07/18 2025

07/18 2025

![]() 558

558

In our previous article, "Dell: AI Wave Rising, Will the Old Factory Make a Comeback?", we delved into Dell's historical ups and downs and its current competitiveness in the server market. Now, we shift our focus to the investment value perspective, addressing two key questions:

1) What is the potential in transitioning from traditional PCs to AI-enhanced PCs?

2) With the empowerment of AI servers and AI PCs, how substantial is Dell's investment value?

Let's dive into Dolphin's detailed analysis of Dell's future prospects:

I. New Opportunities in Traditional Fundamentals: Transition from PCs to AI PCs

Dell's client business spans laptops and desktops, workstations, displays and peripherals, as well as software and security solutions. Laptops and desktops form the backbone of the CSG business.

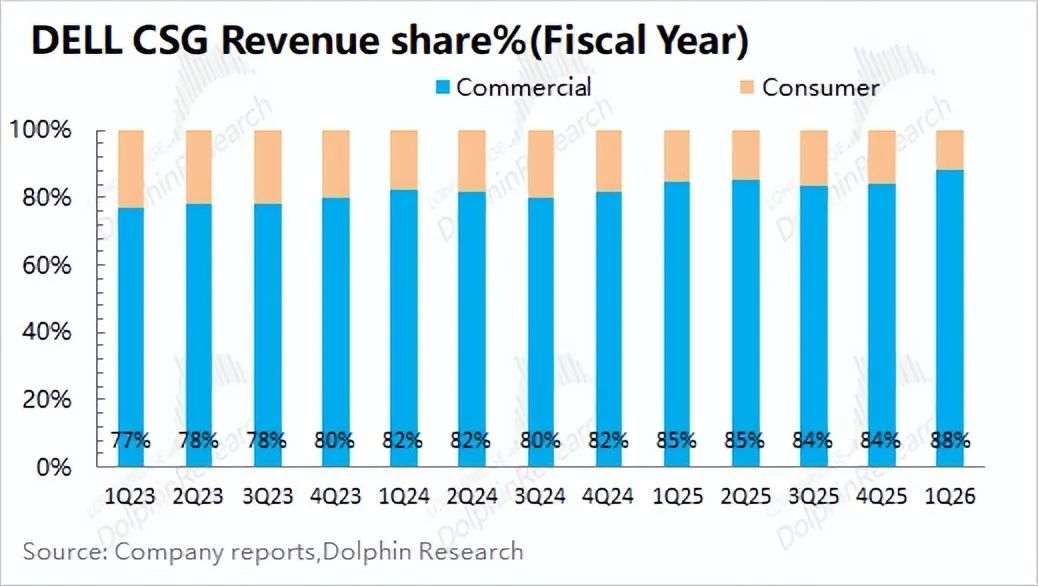

Unlike Lenovo and HP, Dell's largest customer base for computers comes from enterprises. Currently, revenue from commercial customers accounts for 88% of the entire client business.

As Dell strengthens its enterprise-level ecosystem, the CSG business, primarily focused on computer displays, can leverage ISG's (Infrastructure Solutions Group) customer resources to offer a one-stop "PC + server + storage" solution. The proportion of corporate customers has consistently risen, while the C-end proportion has gradually declined to about 10%.

1.1 PC Market Structure

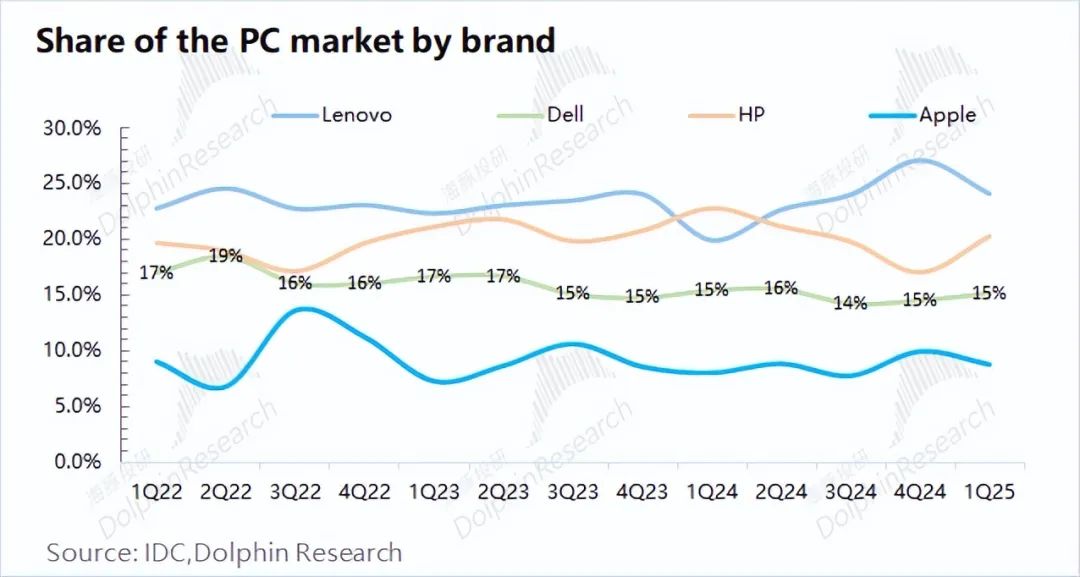

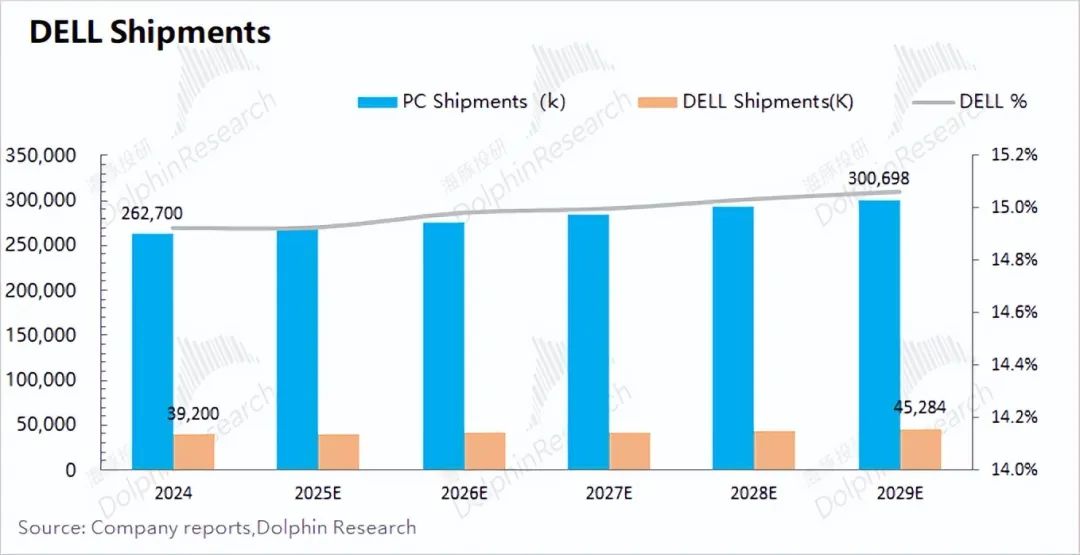

In the global PC market, Dell holds a 15% shipment share, ranking third. Despite not being the global leader, the company remains in the top tier. With a strategic focus on enterprise information services, Dell also targets enterprise customers in the PC market. Relying on long-term cooperation with enterprise customers, Dell's PC business remains relatively stable despite C-end market fluctuations.

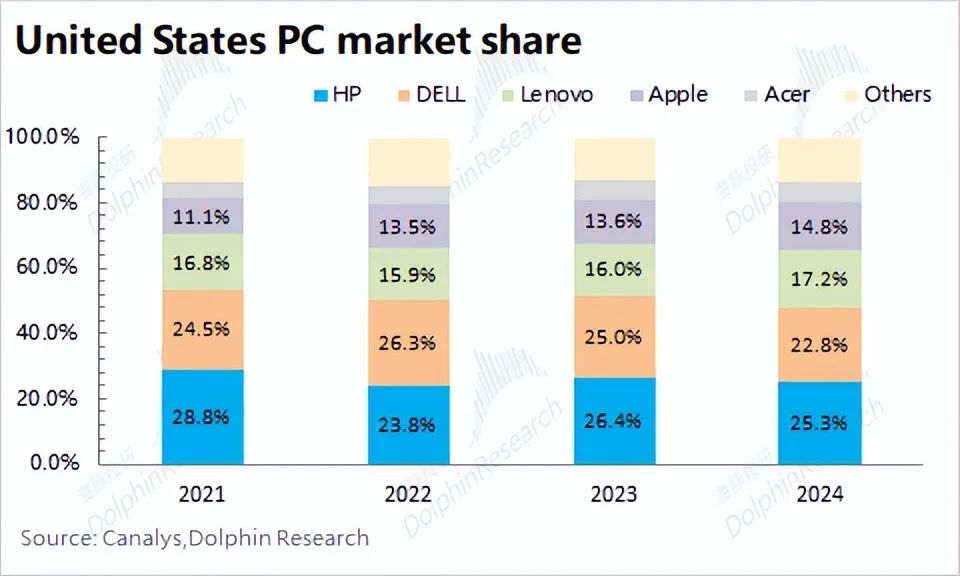

Since nearly 60% of Dell's CSG revenue comes from the American market, its US market position directly reflects CSG performance. In the US PC market, HP and Dell dominate, together accounting for nearly half of the market share. Since late 2020, when Apple began equipping its Macs with M chips, Apple's US market share has risen, but Dell still maintains over 20%.

In 2024, Dell's US PC market shipments were around 15.8 million units, accounting for 40% of total shipments but contributing nearly 60% of client business revenue. This highlights Dell's higher average selling price (ASP) in the US market.

1.2 Competitiveness of Dell's PC Products

As a PC market leader, Dell's products demonstrate strong competitiveness. In the PC market, flagship products are typically categorized as business or gaming. Apple's iOS stands alone, while other brands belong to the Windows camp, facilitating comparisons:

a) Performance configuration: Dell, ASUS > Lenovo, HP > Acer

b) Price for the same configuration: Dell > ASUS (gaming laptops) > Lenovo > HP > Acer

Dell's PC products excel in performance configuration, with relatively high prices for similar configurations. The XPS series caters to corporate executives and creative professionals, while the acquired Alienware series appeals to affluent gamers.

Dell's higher overall ASP drove its 2024 PC market shipments to two-thirds of Lenovo's, but its client business revenue approached Lenovo's $50 billion.

1.3 Dell's Layout in AI PCs

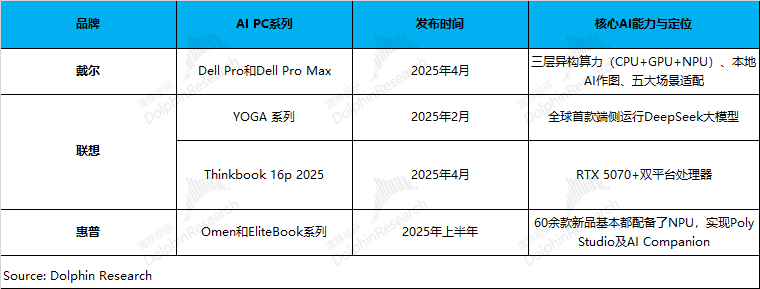

AI PCs are desktops and laptops equipped with chips or modules (like NPUs) designed for AI workloads. With increasing market attention, core players (Dell, Lenovo, HP) have entered the AI PC market.

While integrating NPUs into PC products, they are refining their AI positioning. All three companies have released new PCs with Core Ultra or AMD Ryzen 9 (NPU computing power: 10-60 TOPS).

Dell has restructured its PC product line into three categories: "Dell (daily use), Dell Pro (professional office), and Dell Pro Max (ultimate performance and AI development)", inspired by Apple's naming convention.

Dell has also partnered with NVIDIA, Qualcomm, AMD, and Intel in AI. Dolphin predicts Dell's future DELL series (low to mid-range) will primarily use Qualcomm and Intel products, while Dell Pro and Dell Pro Max (mid to high-range) will adopt AMD and Intel.

The top three PC companies synchronized efforts in the first half of this year, clarifying the AI PC trend. Specifically: Dell focuses on a three-tiered computing power architecture and deep enterprise integration; Lenovo focuses on large models and intelligent agent systems (integrating with ERNIE Bot and WPS); HP adopts a 0-threshold AI strategy, like HuiXiaowei AI Assistant.

Products like Deepseek showcase AI potential. Currently, some computers have NPUs, but AI applications lack innovation and popularization, limiting AI PC advantages.

This is another "hardware and software" synergy process. As PC market leaders fully transition, AI PC hardware penetration will significantly increase, driving software application innovation. When application-side innovations boost productivity, demand for hardware (like AI PCs) will rise.

1.4 Will AI PCs Drive Significant Growth in the PC Market?

Despite AI PC launches, limited application-side innovation means consumers currently show no strong preference for AI PCs. As PC market leaders fully transition, Dolphin believes AI PC penetration growth is primarily supply-driven.

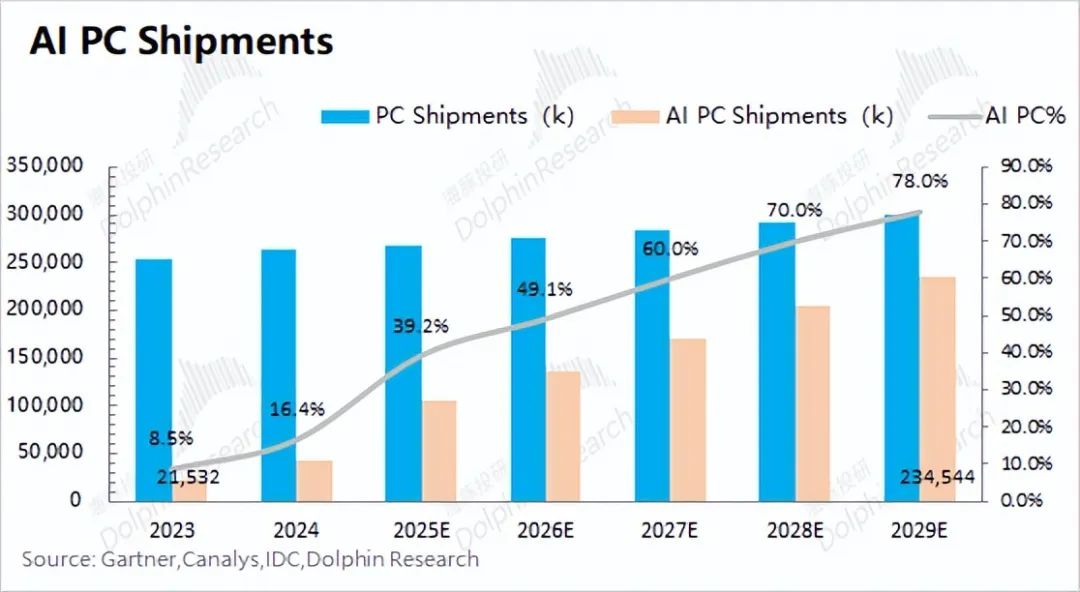

AI PC shipment growth will aid overall PC market recovery. 2024 marked the first year of AI PCs, and global PC market growth stopped declining and rebounded.

However, with annual shipments of 250-300 million units and AI applications not significantly stimulating demand, AI PC growth will drive PC market recovery but not rapid growth.

In other words, "if AI PC growth is supply-driven, it can be seen as an iterative upgrade of the overall PC market product line".

Combining AI PC progress and market expectations, Dolphin estimates global AI PC shipments will reach 230 million units by 2029, with a 78% penetration rate. AI PCs will continue driving PC market recovery, with annual shipments expected to exceed 300 million units again.

While AI PCs may not significantly boost overall PC shipments, the overall product iterative upgrade presents an opportunity for Dell and other brands to redistribute market share, achieving excessive PC market growth.

II. AI Empowerment: Dual Growth of Servers and PCs?

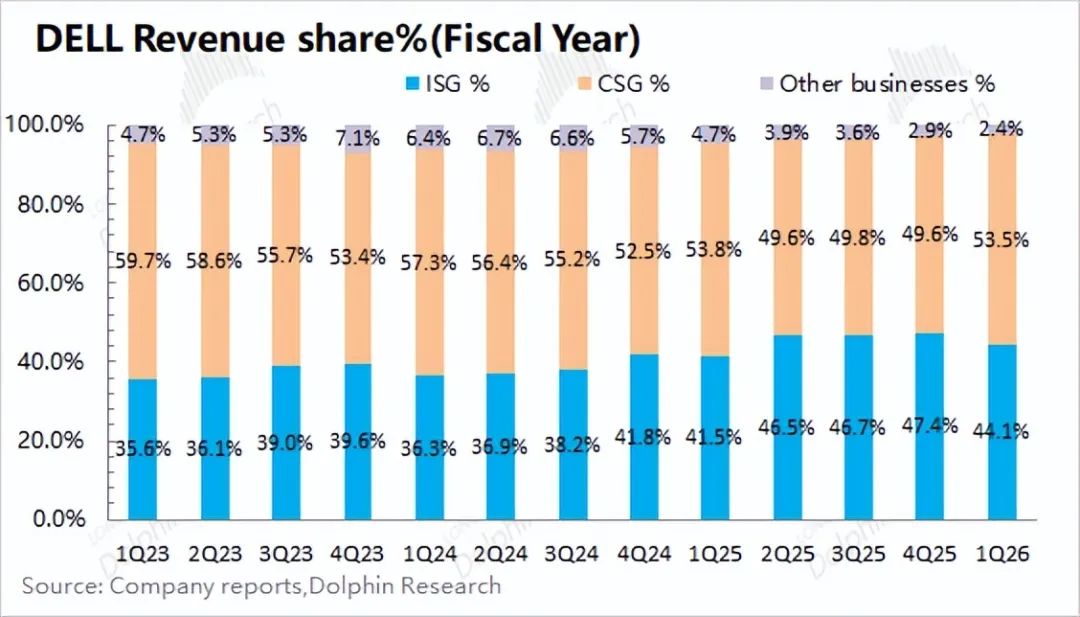

With "AI servers + AI PCs" driving growth, can Dell usher in a new era? Dell's performance projections hinge on servers and PCs. Servers are crucial for ISG (45% revenue), while PCs form the CSG foundation (53% revenue).

2.1 Server Segment

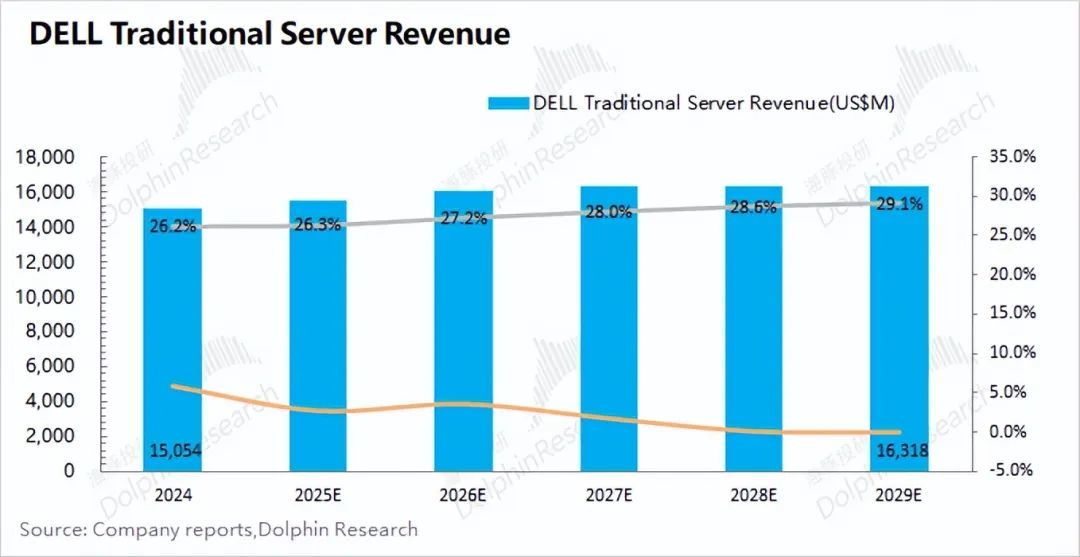

Before Dell's large-scale AI server deployment in 2023, traditional server revenue hovered around $15 billion. As the market shifted to AI demand, cloud service providers prioritized AI server investments. Sticking to traditional servers would face intensified competition and business shrinkage, making AI servers a critical breakthrough.

Dell's server business performance projections are divided into traditional and AI servers:

a) Traditional Servers: Core assumptions ① Quantity: Traditional server shipments remain stable at 1.3-1.4 million units annually; ② Price: ASP maintains low single-digit annual growth.

Combining these assumptions, Dolphin expects Dell's traditional server revenue to grow slightly, reaching $16 billion by 2029. Market share is expected to rise from 26% to around 29%.

b) AI Servers

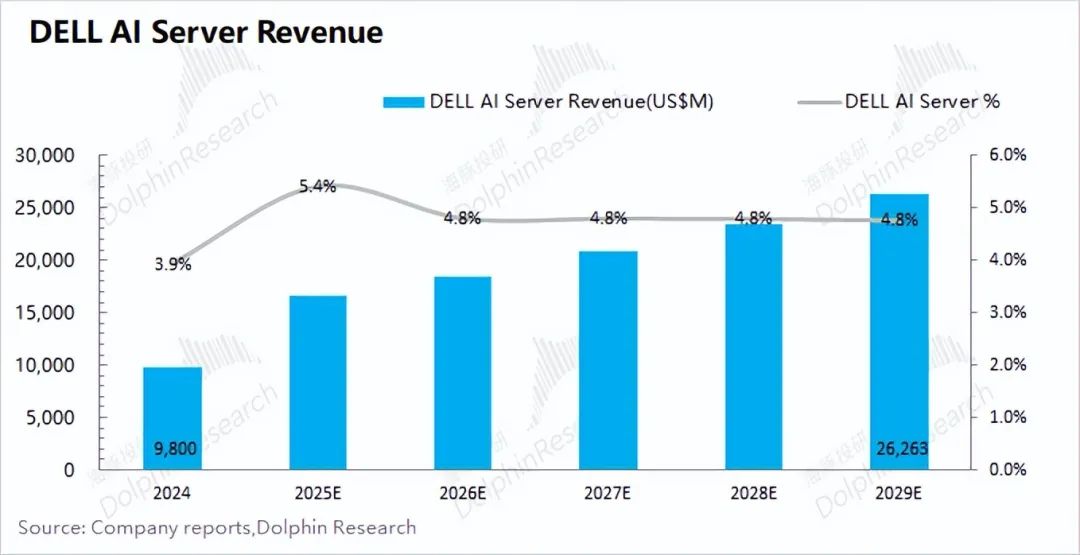

① Quantity: As Dell's main customers are second-tier manufacturers, overall market shipments will not be high. Based on AI server market growth, Dolphin expects Dell's AI server sales to reach 130,000 units annually by 2029.

② Price: While offering high-quality servers, Dell's prices are higher than competitors. Dolphin estimates the current AI server ASP is around $150,000, while Dell's is above $200,000. With increased GB series shipments, Dell's AI server ASP is expected to rise this year and remain above $200,000 next year.

Combining these assumptions, Dolphin expects Dell's AI server revenue to surpass traditional servers in 2025, reaching $26 billion by 2029, with a 2024-2029 CAGR of 21.8%. As large cloud service providers prefer ODM direct sourcing, Dell's AI server market share will remain around 5%.

Combining (a+b), Dell's AI server revenue is expected to grow to $42.5 billion by 2029, with a 2024-2029 CAGR of 11.4%, accounting for about 7% of the overall server market. Market share may decline by one percentage point due to ODM market share expansion in AI servers.

2.2 PC Segment

With AI applications yet to explode, AI PCs do not significantly outperform traditional PCs. Current AI PCs are primarily supply-driven iterative upgrades. Assuming a single-digit PC market recovery over the next five years:

Dell's PC business expectations focus on quantity and price:

① Quantity: As AI PCs develop faster in enterprise scenarios, and Dell targets enterprise customers, its PC shipment growth will outperform the market. Dolphin expects Dell's PC shipments to reach around 45 million units by 2029, maintaining a 15% market share.

② Price: Since AI PCs have a higher ASP than traditional PCs, the first two years of increased AI PC penetration will structurally drive up Dell's overall PC ASP. However, as AI PC penetration reaches 50%, competition or price wars may intensify, and Dolphin expects Dell's PC ASP to decline after 2027.

Combining ①+②, Dolphin expects Dell's CSG business to grow to approximately $59 billion by 2029, with a 2024-2029 CAGR of 4%.

2.3 Dell's Overall Earnings Expectations

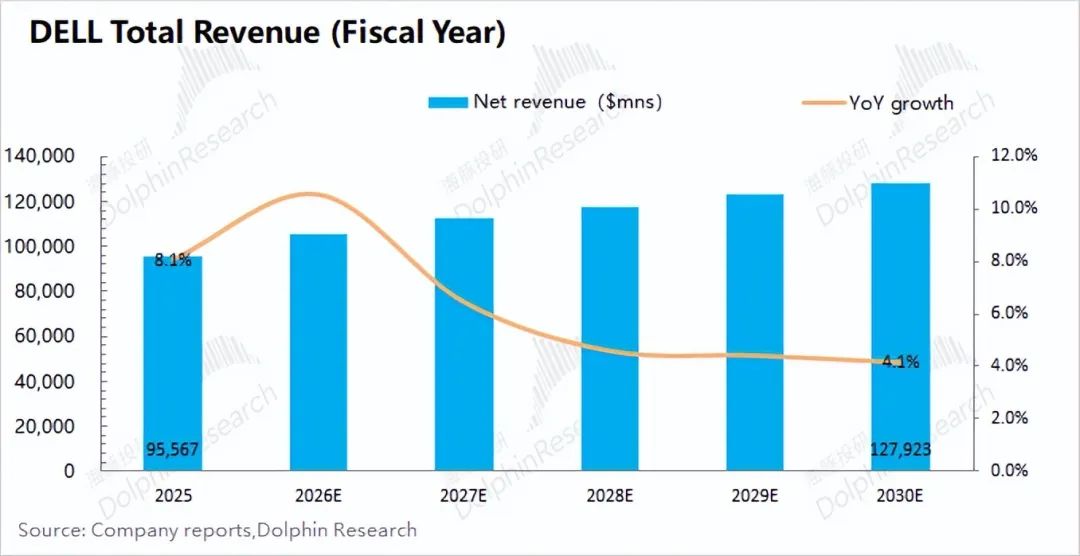

Based on the aforementioned data regarding Dell's server and PC segments, Dolphin anticipates Dell's total revenue to surge to $127.9 billion by fiscal year 2030 (roughly aligning with calendar year 2029), showcasing a CAGR of 6% from fiscal year 2025 to fiscal year 2030.

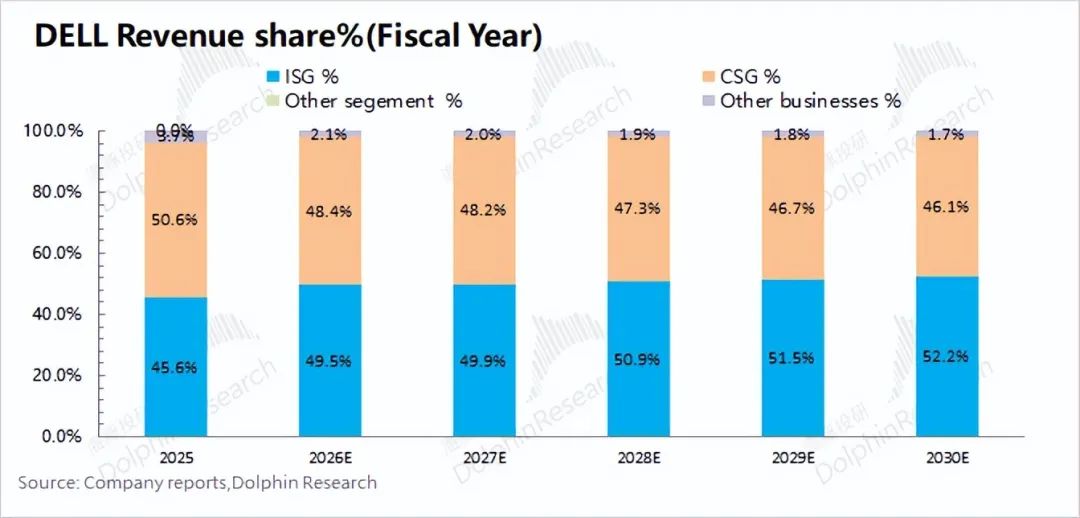

Fueled by AI servers and AI PCs, both Dell's ISG (Infrastructure Solutions Group) and CSG (Client Solutions Group) are poised for sustained growth. Given the server business's higher CAGR compared to the PC business, Dell's ISG business share will increase, yet the overall revenue ratio between these two divisions will remain close to 1:1.

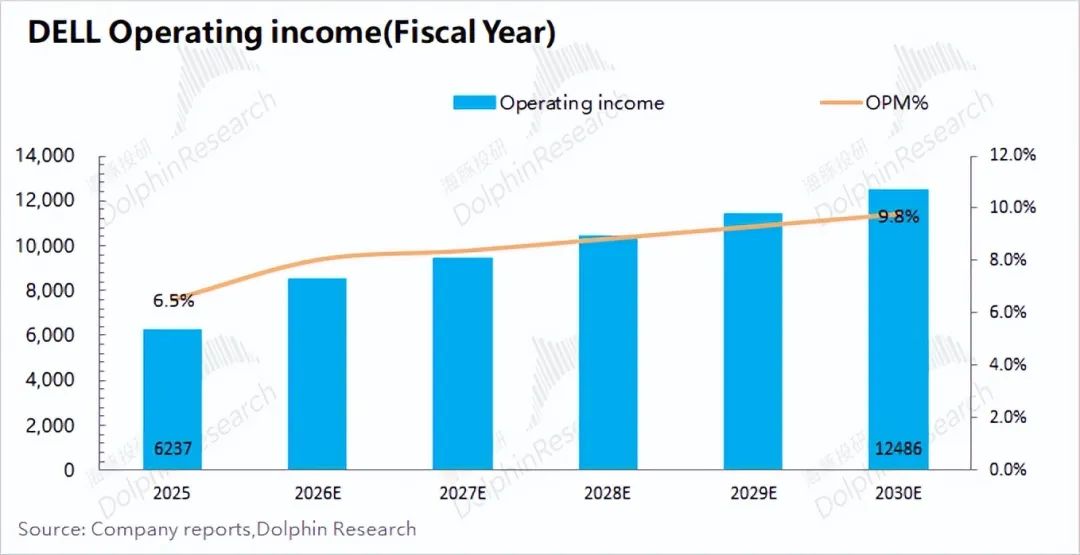

Assuming hardware and service gross margins remain relatively stable, Dell's revenue growth will enable economies of scale, mitigating the impact on R&D expenses and SG&A (selling, general, and administrative) expenses. Consequently, Dell's overall operating expense ratio (R&D + SG&A) is expected to decrease from the current 14-15% to approximately 12%.

Combining these projections, Dolphin forecasts Dell's core operating profit to reach roughly $12.5 billion by fiscal year 2030 (approximately calendar year 2029), marking a CAGR of 15% from fiscal year 2025 to fiscal year 2030. Due to the decline in the operating expense ratio, Dell's core operating profit margin is anticipated to rise from 6.5% to approximately 9.8%.

[Core Operating Profit = Gross Profit - R&D Expenses - SG&A Expenses]

III. Reflections on Dell's Investment Potential

Regarding Dell's investment potential, we analyze it from both PE and DCF viewpoints:

a) PE Valuation:

Aligning with the aforementioned earnings expectations for Dell and assuming a tax rate of 15.9%, the company's after-tax core operating profit for fiscal year 2026 (roughly equivalent to calendar year 2025) will amount to $7.15 billion, representing a year-on-year growth rate exceeding 30%. In fiscal year 2026, the company's performance growth will accelerate due to shipments of AI servers equipped with the GB series. Post fiscal year 2026, Dolphin anticipates the company's core profit CAGR to revert to around 10%.

When considering valuation, it's crucial to note that Dell has a substantial amount of ongoing interest-bearing debt, necessitating the deduction of over $1 billion in interest expenses from profits annually.

After deducting interest expenses (approximately $1.3 billion), Dell's profit for fiscal year 2026 will be roughly $5.8 billion. Considering the company's current market capitalization of $86.8 billion, this roughly translates to an PE ratio of ** times for fiscal year 2026, which still falls below the company's historical valuation center. The company's central level is generally around ** times, corresponding to a premium space of nearly ** times.

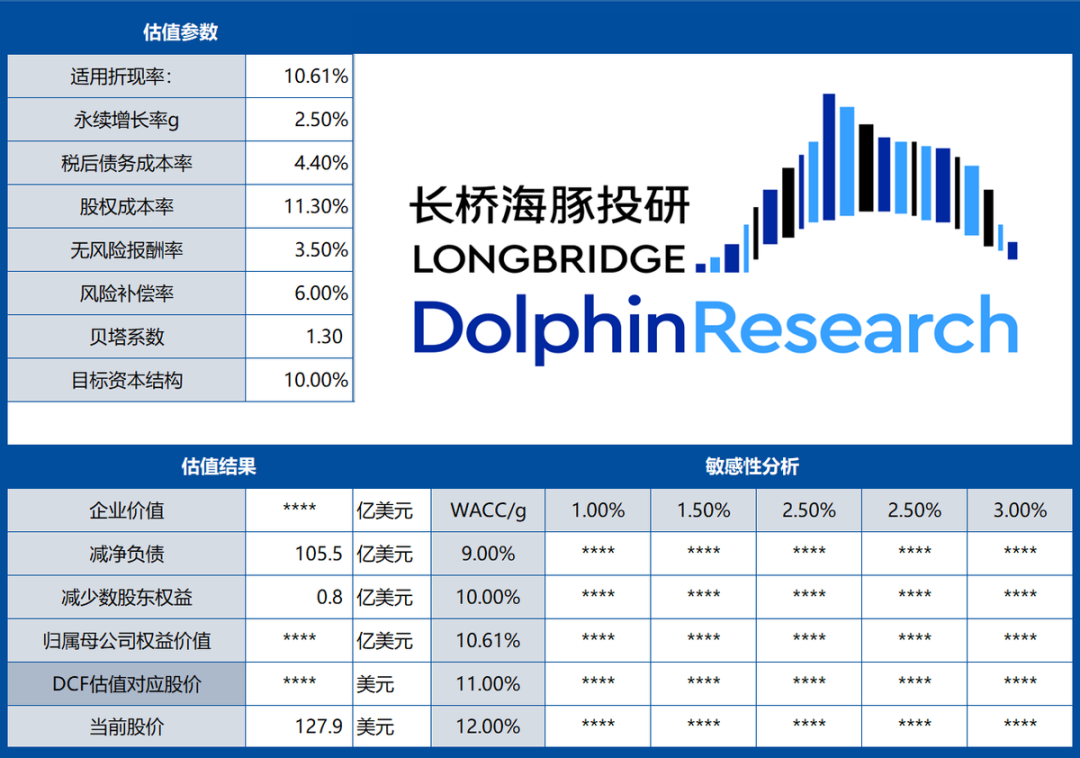

b) DCF Valuation:

While PE valuation primarily reflects relative valuation from a short-term perspective, DCF valuation offers an absolute viewpoint. Assuming a WACC of 10.6% and a perpetual growth rate of 2.5%, the DCF-calculated stock price for Dell Technologies (DELL) is $** billion, roughly equivalent to ** billion dollars, indicating an upside potential of **% compared to the current stock price ($128). This projection holds relatively high certainty.

c) Summary

From both perspectives (a+b), Dell's current stock price appears undervalued. The company's current PE ratio sits below the center of its historical valuation range, and the DCF perspective also presents a potential upside of over **%.

In the first quarter, Dell secured $12.1 billion in AI server orders, essentially establishing a definitive trend of robust growth in its AI server business this year.

Despite maintaining its full-year revenue guidance of $15 billion for AI servers, given the current surge in orders, Dell is expected to surpass expectations further in the second half of the year.

Considering Dell's ongoing success in securing AI-related orders, the company's market capitalization has the potential to move towards a relatively optimistic direction of ** billion dollars.

- END -