Nezha Auto Dealers Rally to Demand Answers Amid Rumors of CEO Zhang Yong's Abroad Absence

![]() 04/15 2025

04/15 2025

![]() 682

682

By Wang Desheng

On April 14, 2025, over 20 dealer representatives gathered outside Nezha Auto's Tongxiang factory in Zhejiang, holding banners and chanting, "We don't want Nezha to fall; we just want an explanation."

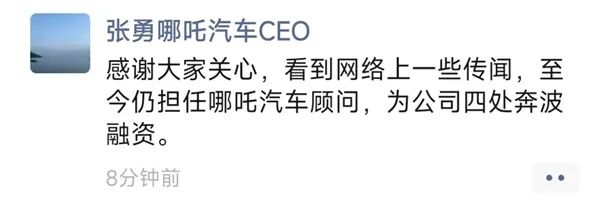

Meanwhile, social media buzzed with the news that "Nezha Auto's former CEO Zhang Yong is in the UK," further aggravating the company's already dire situation. Despite Zhang Yong's prompt response on WeChat Moments that he "still serves as a consultant and is actively fundraising for the company," his statement appeared feeble amidst the dealers' collective protest, factory shutdown, and unanswered customer complaints.

Nezha Auto's fortunes have taken a dramatic turn. In 2022, it emerged as the sales leader among emerging automakers with 152,000 vehicles sold, garnering significant market attention. However, just three years later, its deliveries in January 2025 plummeted to 110 vehicles, a year-on-year drop of 97.76%.

01

CEO 'Fleeing to the UK' and Internal Management 'Blowing Up'

Zhang Yong's career was deeply intertwined with BAIC BJEV. After joining Nezha Auto (formerly Hozon Auto) in 2018, he replicated BAIC's strategy of "focusing on the B-end market and offering high configurations at low prices." This approach initially succeeded: In 2022, Nezha swept the ride-hailing and third- and fourth-tier markets with two low-priced models, achieving sales of 152,000 vehicles.

However, hidden dangers emerged—over-reliance on the B-end market undermined brand value, and the low-price strategy squeezed profit margins. After sales halved in 2023, Nezha quickly found itself in a cash flow crisis.

More critically, Zhang Yong's unwavering faith in the BAIC model overlooked industry shifts. Since 2023, the new energy vehicle market has transitioned from "subsidy competition" to "technology competition." NIO's battery swapping network and XPeng's intelligent driving capabilities have become key differentiators, while Nezha remains mired in the "cost-effectiveness" quagmire.

Data underscores this analysis: In 2024, Nezha's sales fell to 64,500 vehicles, and its gross margin remained negative, whereas NIO and Li Auto achieved quarterly profitability during the same period.

As Zhang Yong emphasized on WeChat Moments that he was "busy fundraising everywhere," the capital market had already spoken with its actions—in early 2025, Nezha's three major factories were fully shut down, suppliers halted deliveries due to debt issues, and owners faced months-long shortages of spare parts for repairs.

02

Can the Founder's Return Reverse the Tide?

In December 2024, Zhang Yong stepped down as CEO, and founder Fang Yunzhou regained control. This "old classmate duo" was once hailed as a golden partnership, with Fang Yunzhou focusing on technology and Zhang Yong excelling in marketing. However, the power transition failed to arrest the decline and instead exposed internal conflicts.

In a letter to all employees, Fang Yunzhou proposed "six reforms," including accelerating the IPO, capturing a 50% share of the overseas market, and turning the gross margin positive in 2025. These ambitions stand in stark contrast to the current reality.

Domestic dealers have converged at the Tongxiang factory to demand answers, shouting, "We've paid tens of millions, but not a single car has been delivered." A dealer representative stated in a video, "We don't want Nezha to fall; we just want an explanation!"

Adding to the intrigue is Zhang Yong's role transformation. After being demoted from CEO to consultant, his "trip to the UK" was interpreted as an "escape route." While he insists it was for fundraising, insiders revealed he had already applied for a UK visa before departing.

03

When the 'Money-Burning Game' Meets the Reality of Survival

Nezha's collapse is not an isolated incident. In 2025, second-tier emerging automakers such as WM Motor and Aiways have also succumbed, revealing the brutal truth of the industry: The era of relying on PPT presentations for financing and subsidies for survival is over.

1. From 'Capital Infusion' to 'Self-Sustaining'

Nezha rapidly expanded through the "low prices for volume—financing to stay alive—listing to cash out" model, but this strategy collapsed when IPO obstacles arose. In 2024, Nezha planned to list in Hong Kong but was rejected due to losses exceeding 10 billion yuan and declining sales.

2. The 'Domino Effect' of the Supply Chain

Nezha's crisis has reverberated through the entire supply chain. Due to payment arrears, some suppliers have ceased deliveries, leaving owners unable to get their cars repaired. A Nezha S owner complained, "The range extender broke down, so I can only drive it as a pure electric car with a reduced range of 100-200 kilometers. I spent over 100,000 yuan on a 'granny car.'"

3. The Survival Rules After Policy Retreat

In 2025, the exemption of new energy vehicle purchase taxes was completely abolished, and local subsidies were significantly reduced. The industry shifted from "policy-driven" to "market-driven," requiring enterprises to rely on product strength and cost control for survival. Nezha's downfall underscores that companies ignoring core technology and blindly expanding scale are destined to become casualties in the competitive landscape.

Conclusion

Why Did Nezha's 'Fire-and-Wind Wheels' Stall?

Nezha Auto's collapse is a tragedy rooted in strategic shortsightedness, management imbalance, and industry changes. Zhang Yong's "UK mystery" may be the spark, but the real illness has long been entrenched: blind faith in outdated business models, ignoring user needs, and underestimating supply chain risks.

For the industry, this crisis serves as a wake-up call: The new energy vehicle sector has entered a phase of "fierce competition," where financing and low prices alone cannot build a sustainable moat. Enterprises need a stronger technological foundation, a healthier financial model, and a genuine commitment to addressing users' pain points.