Changan Auto Faces Transformation Challenges: Deep Blue and AITO Incur Combined Losses of Over 5.5 Billion Yuan in 2024

![]() 04/16 2025

04/16 2025

![]() 583

583

The glow of Changan Auto's (000625.SZ) 2024 annual report has barely faded when the company promptly released its 2025 first-quarter performance forecast. Unlike 2024, when revenue surged but profits declined, Changan Auto is anticipated to record a net profit attributable to shareholders of 1.3-1.4 billion yuan in the first quarter of this year, marking a year-on-year increase of 12.26% to 20.89%. The corresponding net profit, excluding non-recurring gains and losses, is expected to range from 730 to 830 million yuan, reflecting a year-on-year jump of 553.54% to 643.06%.

Securities Star observed that despite the expected performance boost, the pressure of transformation remains significant. Changan Auto's core independent brands, Deep Blue and AITO, are grappling with profitability challenges. Despite substantial sales growth in 2024, their combined net profits amounted to a loss of over 5.5 billion yuan, with cumulative losses exceeding 14 billion yuan over the past three years. Additionally, Changan Auto's operating cash flow declined by over 70% in 2024, underscoring its financial strain.

Since embarking on its electrification transformation, Changan Auto's sales and revenue from new energy vehicles have yet to surpass the 50% mark, making the goal of ceasing sales of traditional fuel vehicles by 2025 particularly pressing. Furthermore, declining sales and gross profit margins in the domestic market have dragged down overall performance, with the company's automobile gross profit margin falling again since 2023. Amid the departure of Wang Jun, President of Changan Auto, and the impending reorganization of the group, its strategic adjustments have garnered considerable market attention regarding the future trajectory of its new energy business.

01. Core Independent Brands Incur Heavy Losses, Cash Flow Takes a Hit

Changan Auto attributed the significant first-quarter performance uptick primarily to the firm advancement of its third entrepreneurial plan, emphasizing innovation and entrepreneurship, brand upgrading, product structure optimization, improved new energy benefits, increased overseas revenue and profits, and steady progress in the profitability of independent brands.

However, in 2024, Changan Auto experienced a revenue increase without a corresponding profit uptick. The company reported revenue of 159.733 billion yuan during the reporting period, up 5.58% year-on-year, while the net profit attributable to shareholders stood at 7.321 billion yuan, down 35.37% year-on-year, marking the first negative growth since 2019.

According to data, Changan Auto operates three major brands: Changan, Deep Blue, and AITO. Within the Changan brand, there are three sub-brands: Changan Yinli, Changan Qiyuan, and Changan Kaicheng, forming a differentiated independent brand matrix. Additionally, it has deployed joint venture brands through partnerships such as Changan Ford and Changan Mazda.

In terms of sales, Deep Blue delivered approximately 243,900 vehicles in 2024, a year-on-year increase of over 70%, while AITO delivered 73,600 vehicles, doubling year-on-year. However, neither met their annual sales targets.

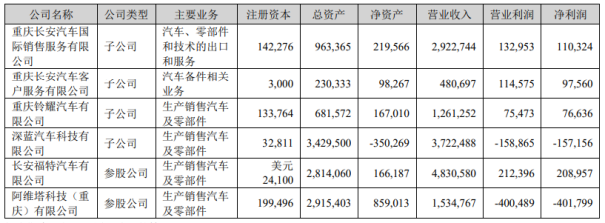

Moreover, both brands lack profitability. Deep Blue generated revenue of 37.225 billion yuan in 2024 with a net loss of 1.572 billion yuan, while AITO reported revenue of 15.348 billion yuan and a net loss of 4.018 billion yuan.

Changan Auto explained that Deep Blue's profit losses narrowed year-on-year due to improved product mix, increased sales, and the company's proactive cost reduction and efficiency enhancement efforts. AITO's sales rose due to new product launches and updates, gradually improving product efficiency. However, to further enrich the product matrix, high investments were sustained in product research and development, brand promotion, and channel construction, leading to losses.

Over a longer period, AITO incurred losses of 2.015 billion yuan in 2022 and 3.693 billion yuan in 2023, accumulating losses of 9.726 billion yuan in the past three years. Deep Blue lost 2.999 billion yuan in 2023, accumulating losses of 4.571 billion yuan over the past two years. This means their combined losses over the past three years have surpassed 14 billion yuan.

At the 2024 performance briefing, Zhang Deyong, Secretary of the Board of Directors of Changan Auto, mentioned that Deep Blue achieved monthly profitability in the fourth quarter of last year. According to a report by China Securities Times, AITO aims to break even in the third and fourth quarters of 2025.

It is noteworthy that due to consecutive years of losses and strategic investments, AITO faces considerable financial pressure, with a debt-to-asset ratio of 70.54% in 2024. The brand relies on financing to supplement working capital. In December last year, AITO completed a C-round of funding of 11.1 billion yuan, with Changan Auto among the investors. Since 2021, AITO has completed four funding rounds, raising a total of nearly 19 billion yuan. Currently, AITO has initiated preparations for its IPO, aiming for a public listing in 2026.

Securities Star noted that amid declining performance, Changan Auto's operating cash flow also plummeted. The company's net operating cash flow in 2024 fell by 75.58% year-on-year to 4.849 billion yuan, mainly affected by supplier payment policies, payment terms, and increased overseas export tariffs, leading to a higher "cash paid for purchases of goods and services" compared to the previous year.

At the 2024 performance briefing, Zhu Huarong, Chairman of Changan Auto, also revealed that Chang'an Kaicheng completed an A-round of funding of 2.08 billion yuan last year, and the company has clarified the path to listing Chang'an Kaicheng, with related work already underway.

02. New Energy Vehicle Revenue Accounts for Less Than Half, Domestic Market "Stalls"

With its two core independent brands deeply in the red, Changan Auto's electrification transformation has a long way to go.

In the first quarter of this year, Changan Auto sold 705,200 vehicles, up 1.89% year-on-year. The total revenue corresponding to these sales was approximately 62.3 billion yuan. Among them, sales of new energy vehicles amounted to 194,200 units, accounting for 27.53% of total sales.

Compared to the end of last year, the proportion of new energy sales has not significantly increased. In 2024, Changan Auto achieved annual sales of 2.684 million vehicles, a new high in the past seven years, with a year-on-year increase of 5.1%. Its sales of new energy vehicles reached 735,000 units throughout the year, up 52.8% year-on-year, accounting for approximately 27% of total sales.

In 2024, Changan Auto's total revenue was 276.72 billion yuan (including AITO), up 7.7% year-on-year. Among this, new energy revenue accounted for 46.5%, an increase of 16 percentage points year-on-year. This indicates that fuel vehicles still contribute more than half of the revenue.

One of the goals of Changan Auto's "Shangri-La Plan" is to cease sales of traditional fuel vehicles by 2025 and achieve the electrification of its entire product line. However, currently, both sales and revenue are dominated by fuel vehicles, highlighting the urgency of Changan Auto's electrification transformation.

In fact, the crisis facing fuel vehicles cannot be overlooked. The 2024 annual report reveals that among the projects funded by private placement in 2020, the adjustment and upgrade project of Hefei Changan Automobile Co., Ltd. did not achieve the expected benefits. It recorded a benefit of 279 million yuan in 2024 and a cumulative benefit of 1.578 billion yuan. The new models launched by this project are mainly the CS75 series, predominantly fuel vehicles. Changan Auto stated that the reason for not meeting the expected benefits was the continuous increase in the penetration rate of new energy vehicles in 2024, the decline in sales of traditional fuel passenger vehicles, and intensified competition in the industry.

Securities Star observed that the current acceleration of the Chinese auto industry's overseas expansion has made auto exports a new growth point for automakers. In 2024, Changan Auto sold 536,200 vehicles overseas, up 49.59% year-on-year, while sales in the domestic market amounted to 2.1476 million vehicles, down 2.14% year-on-year. The total revenue corresponding to these sales was approximately 271.2 billion yuan.

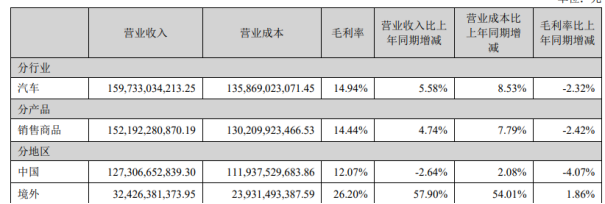

According to data disclosed in the annual report, regarding the listed company's consolidated enterprises, in terms of revenue, Changan Auto's domestic revenue fell by 2.64% year-on-year to 127.307 billion yuan, while its overseas revenue surged by 57.9% year-on-year to 32.426 billion yuan.

From a profitability perspective, the domestic market's performance is not optimistic. Its gross profit margin in 2024 was 12.07%, down 4.07 percentage points year-on-year. Affected by the domestic market's performance, Changan Auto's automobile gross profit margin declined by 2.32 percentage points year-on-year to 14.94%, continuing its downward trend since 2023.

Changan Auto stated that the company achieved its board's sales target in 2024, and its operating goal for 2025 is to strive to produce and sell more than 2.8 million vehicles. By 2030, Changan Auto aims to sell 5 million vehicles, including 4 million units in the independent segment, 3 million units of intelligent and digital new vehicles, and 1.2 million units overseas.

03. Management Adjustment and Reorganization with Dongfeng Group Largely Complete

On the same day as the annual report disclosure, Changan Auto also announced the resignation of a director. The announcement revealed that Wang Jun resigned from his positions as a director of the company's ninth board of directors, convener of the Strategy and Investment Committee, and President of the company due to work changes, and he will no longer hold any other positions.

Securities Star noted that Wang Jun took office as President of Changan Auto in October 2020. As one of the four major automotive group enterprises in China, Changan Auto is affiliated with China South Industries Group Corporation (hereinafter referred to as "CSGC"). Before leaving his post, Wang Jun was promoted to CSGC. On January 6 this year, the official website of CSGC updated its management team information, with Wang Jun serving as Vice President and member of the Party leadership group of CSGC.

In February this year, CSGC and multiple listed companies under Dongfeng Motor Corporation Limited (hereinafter referred to as "Dongfeng Group") announced that their parent companies were planning a reorganization with other state-owned enterprises and central enterprises.

At the 2024 performance communication meeting, the management of Dongfeng Group (00489.HK) stated that the integration with Changan is currently underway, and the controlling shareholder is planning to restructure the automotive segment under Changan.

At Changan Auto's 2024 performance briefing, Zhu Huarong also responded to the reorganization, stating that the relevant work team, in which Changan plays a significant role, has largely completed the plan.

Zhu Huarong emphasized that some online rumors are untrue, and Changan has not deliberately responded. This reorganization will not impact any of Changan's established strategies, including its existing brand, technology planning, and globalization plans.

As the core manager of Changan Auto's new energy strategy, Wang Jun's transfer has been interpreted by the market as an important signal of a phased adjustment in the company's strategy, attracting significant attention regarding the subsequent development of Changan Auto's new energy business. (This article was originally published on Securities Star, written by Lu Wenyan)

- End -