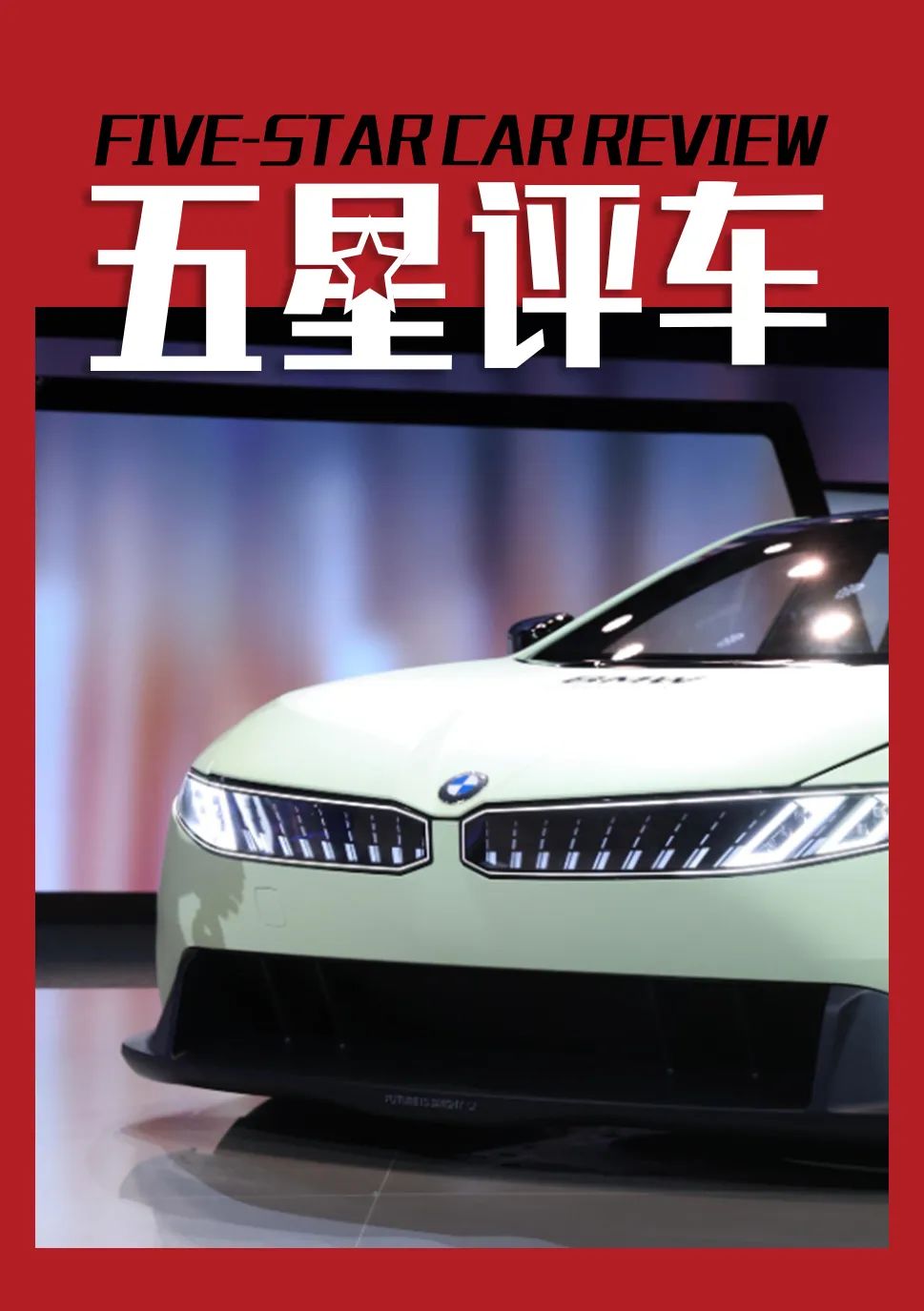

BMW Adjusts EV Sales Forecasts to Mitigate Future Pricing Challenges

![]() 06/06 2025

06/06 2025

![]() 481

481

By Li Shuo

Produced by Five Star Car Review

BMW China has recently revised its projected sales figures for electric vehicle (EV) models, slashing them by over 20%. This strategic shift might prompt some component suppliers to seek compensation from the automaker. The reduction applies to both current BMW and MINI brand EVs, as well as the forthcoming BMW next-generation EVs scheduled for release in 2026.

Since 2024, BMW has progressively scaled back its sales projections, with the most recent adjustment, spanning from the second half of last year to the first quarter of this year, marking a significant escalation compared to previous reductions. BMW emphasizes that this proactive measure aims to "swiftly adapt to market dynamics" rather than a reactive response to a crisis.

While easing sales targets for EVs, BMW China has concurrently increased the estimated sales of certain internal combustion engine (ICE) models. This can be interpreted as a preemptive pricing strategy ahead of the next-generation models' arrival, aiming to avert the current scenario where "every EV sold incurs a loss." The decline in EV sales is being compensated by fierce price competition among ICE vehicles, thereby sustaining overall sales volume.

Additionally, this adjustment aims to prevent the upcoming next-generation EVs from encountering pricing dilemmas in the terminal market, thereby avoiding the pitfalls of the current models.

BMW's electrification transformation goals envision pure EVs accounting for 30% of total sales by 2025 and over 50% of global annual deliveries by 2030. However, in 2024, BMW sold 427,000 pure EVs globally, constituting approximately 17.4% of total sales. Despite a 32.4% year-on-year sales increase in the first quarter of this year, the proportion remains at 18.4%, significantly lagging behind the 30% target.

In the first quarter of 2025, BMW's sales in the Chinese market declined by 17.2% year-on-year, marking the largest sales drop globally among single markets. EVs accounted for merely 15% of sales, lower than the global ratio.

To sustain sales, BMW has resorted to significant price reductions. The current terminal price of the i3 model has dropped to around 170,000 yuan, while the iX1 model is available through channels for as low as 150,000 yuan or less, reflecting a nearly 50% price reduction. The once-humorous "70% off for Tigers, 80% off for Leopards" now seems like a reasonable price compared to BMW's current EV offerings.

This strategy of exchanging volume for price not only erodes brand premium but also places immense pressure on dealers. More crucially, it sets a precedent that could hinder the next-generation models. If consumers develop a psychological expectation for the pricing of the next-generation models, it will be challenging to enhance product value and recognition later.

In response, BMW has attempted adjustments. In 2024, the company announced it would "exit the price war," with market prices for the i3, iX3, and some ICE models gradually recovering. However, market feedback was immediate and stark, with sales of the relevant models declining significantly as prices recovered, and the impact lingered even after prices hit new lows again. Escaping the price war unscathed seems an uphill battle.

The current "quandary" of BMW's EV models is straightforward. In the mid-to-high-end new energy market, traditional luxury brands struggle to demonstrate their premium pricing power. Furthermore, BMW's current EV lineup has been criticized for their "oil-to-electric" conversion, with intelligence levels lagging behind the average in the 200,000-300,000 yuan market.

As mentioned, BMW's sales decline in the Chinese market in the first quarter of this year was not solely due to EV models; ICE vehicles also faced challenges. Therefore, the plan to increase the estimated sales of some ICE models is likely to focus on pricing adjustments.

At the end of 2024, the BMW X3 was firmly positioned at the top of the luxury mid-size SUV market with monthly sales of 11,000 units. However, sales took a sharp downturn in 2025, falling to 8,542 units in January and showing no improvement after the new generation was launched in February, with sales in April plummeting to just 2,742 units. This data not only placed the BMW X3 behind its "German Big Three" rivals but also hit a new low in nearly five years.

The 5 Series has maintained sales levels close to 10,000 units in the past two months, but at the expense of entry-level models priced below 300,000 yuan, cheaper than the 3 Series during the chip shortage. Judging from mainstream online opinions, the market performance of the 5 Series and X3L is closely tied to design changes after the new generation. Considering the product cycle, these two main models still have over five years left.

Currently, the domestically produced X5L is performing robustly, achieving impressive sales despite market fluctuations and minimal impact from domestic flagship new energy vehicles. This 600,000-yuan mid-to-large SUV offers substantial profits, undoubtedly serving as BMW's "cash cow" in the Chinese market. However, its long-standing rival, the GLE, will soon be locally produced with an extended wheelbase.

Dr. Mike Reichelt, head of BMW's new-generation product line, previously emphasized in media interactions that "new generation" does not refer to a specific model but represents the core architecture underpinning BMW's development over the next decade. Six BMW new-generation models will be successively launched within the next two years.

Starting in the second half of this year, the new-generation iX3 (code name NA6), the inaugural model of BMW's next-generation EVs, will be mass-produced at the Hungarian plant. Domestic efforts are even more expeditious; according to BMW officials, the first domestically produced BMW new-generation model has rolled off the assembly line at the BMW Brilliance Rida plant and commenced comprehensive testing.

Next year, NA0 (corresponding to i3), NA6, and its long-wheelbase version (code name NA8) will be mass-produced and launched in China. Both NA0 and NA6/NA8 will be available exclusively as pure electric versions (BEV).

Based on available information, the product capabilities of the new-generation EVs are expected to leapfrog. The new models will adopt an 800V high-voltage platform and the sixth-generation eDrive electric drive system, particularly addressing intelligence shortcomings. The electronic architecture integrates central computing (BMW Brain) with four regional controllers, offering nearly 10 times the computing power of current models.

It is anticipated that the synergy of the new pure electric architecture with BMW's renowned vehicle manufacturing expertise will undoubtedly lead to notable improvements in the new-generation models. Whether they can achieve the goal of pure EVs accounting for 50% of deliveries by 2030 undoubtedly hinges on the performance of these next-generation models.

However, predicting the evolution of the domestic new energy market over the next two years is fraught with uncertainty. To avoid pricing issues for the next-generation EVs, in addition to continuously enhancing the hard power of new products, maintaining the current market environment and brand value is arguably even more crucial.