Let Dongfeng and Changan Forge Their Own Paths: A Testament to Strategic Wisdom

![]() 06/09 2025

06/09 2025

![]() 600

600

Author | Zhen Yao

Editor | Li Guozheng

Produced by | Bangning Studio (gbngzs)

After four months of speculation, the restructuring rumors surrounding Dongfeng Automobile and Changan Automobile have finally been clarified. (See "Changan Automobile's Largest Shareholder Elevated to a Tier-1 Central Automobile Enterprise, Yet Structure Remains Unclear")

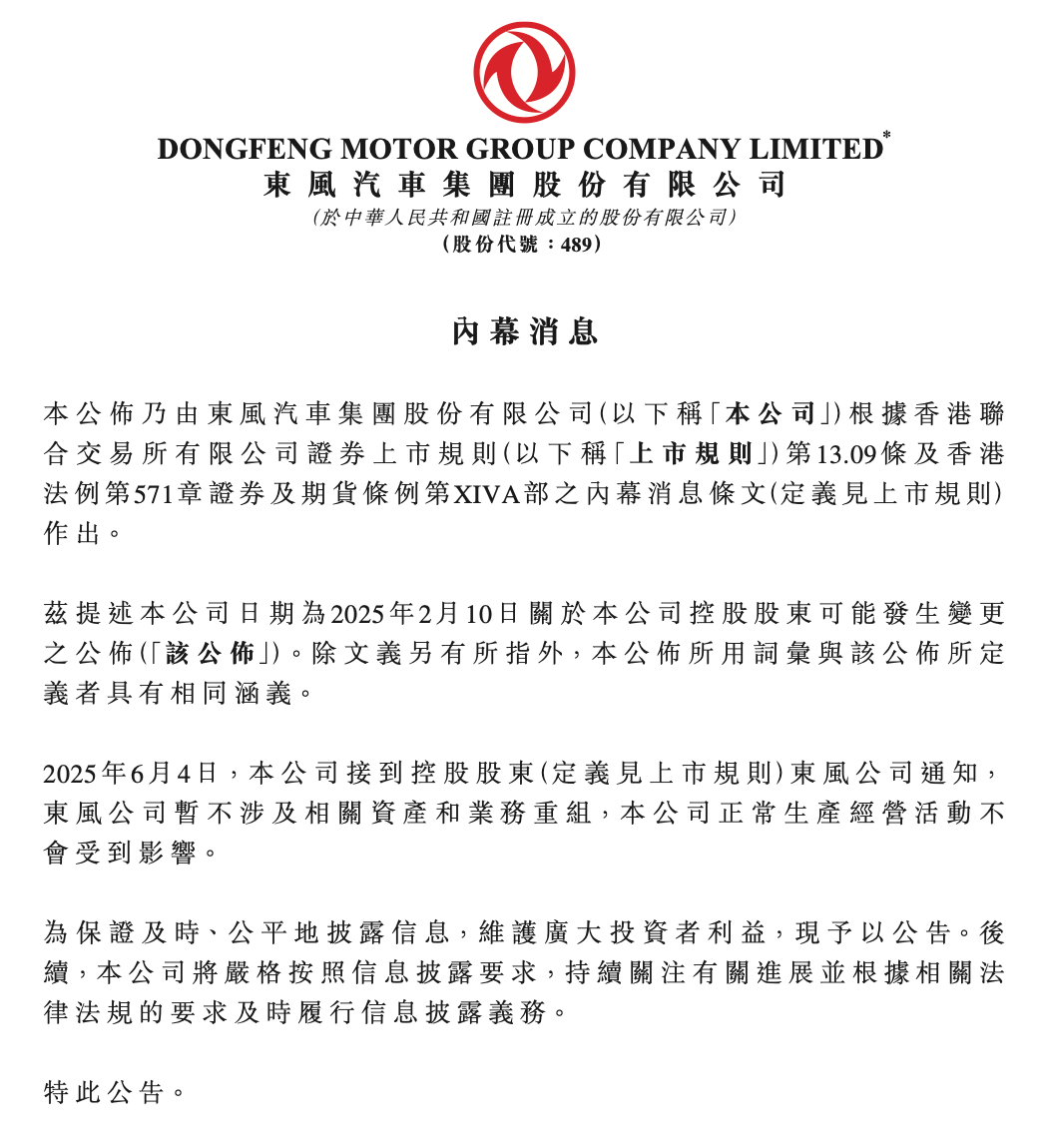

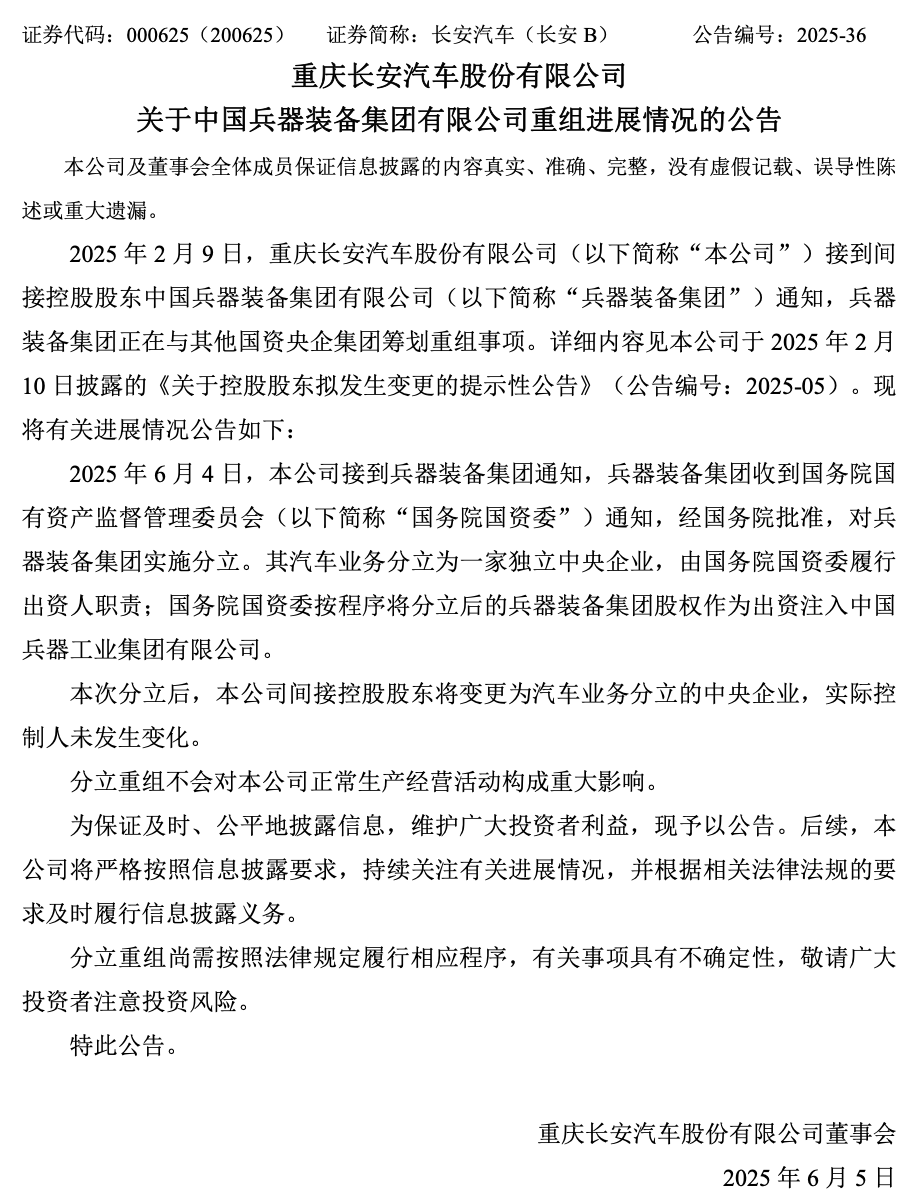

On June 5, Dongfeng and Changan Automobile, both listed companies, issued separate announcements detailing the restructuring.

Dongfeng stated that its indirect controlling shareholder, Dongfeng Motor Corporation Limited (commonly referred to internally as "Dongfeng Automobile"), is not currently involved in any relevant asset or business restructuring. This effectively denies Dongfeng's participation in the restructuring.

Changan, on the other hand, announced that with the approval of the State Council, its indirect controlling shareholder, China South Industries Group Corporation Limited (CSGC), will undergo a split. CSGC's automotive business will become an independent central enterprise, with the State-owned Assets Supervision and Administration Commission of the State Council (SASAC) assuming investor responsibilities. Following the split, Changan Automobile's indirect controlling shareholder will change to this newly formed central enterprise with a dedicated automotive business, while the actual controller remains unchanged.

Upon release, the news sparked heated debates across society. Netizens indulged in wild speculation, flooding the comments section with varied opinions and conjectures. Some harbored positive expectations for integration, while others left intentionally misleading comments.

Bangning Studio believes that this adjustment will yield a win-win situation, bolstering the strategic prowess of the automotive sector.

For Changan Automobile, the new independent central enterprise as its indirect controlling shareholder will focus solely on the automotive main business. This is expected to enhance Changan's decision-making and resource allocation efficiency. Currently, Changan has invested in and achieved results in autonomous brands, new energy, and intelligence. With the new controlling shareholder in place, it could further gain new development momentum.

For Dongfeng Automobile, not being immediately involved in the restructuring avoids the risks associated with integration, unleashing the vitality of independent development. This is conducive to Dongfeng's steadfast advancement in its new energy and intelligent strategic layout, adhering to the strategic goal of "three transitions (in new energy, intelligence, and internationalization) and one renewal (pushing forward a brand-new Dongfeng)". Rooted in industrial changes, Dongfeng will accelerate innovation and upgrading, consolidating the competitiveness of its entire industry chain.

Win-Win Situation

Over decades of development, both Dongfeng and Changan Automobile have cultivated unique industrial ecosystems.

Changan Automobile, with its indirect controlling shareholder transitioning to an independently managed central enterprise, has formed a comprehensive industrial chain system centered in Chongqing, encompassing vehicle research and development, new energy technology, and intelligent layout. Its brand matrix includes three brands (Changan, Deep Blue, and AVATR), three series (Gravity, Origin, and Kaicheng), and commercial vehicles.

Dongfeng Automobile, relying on the Wuhan industrial base, has constructed a "4+2" business model centered around the entire automotive value chain. The "4" refers to four autonomous business units: autonomous passenger vehicles, commercial vehicles, auto parts, and automotive finance. The "2" denotes the two joint venture brands, Dongfeng Nissan and Dongfeng Honda.

The autonomous passenger vehicle business includes brands such as Mengshi, HOVO, Aeolus, Yipal, Nano, and Fengxing, forming a full-spectrum new energy brand layout encompassing the luxury, high-end, and mainstream markets. Since May this year, products such as Nano 06, HOVO FREE+, Mengshi 817, Aeolus L8, new Yipal 007, and new Yipal 008 have been successively launched.

The latest data reveals that in May, Dongfeng Automobile sold (retail) 206,000 vehicles, marking a year-on-year increase of 1.3%. Among these, 81,000 were new energy vehicles, up 26.5% year-on-year. HOVO sold 10,022 vehicles, a year-on-year increase of 122%, marking the third consecutive month of sales exceeding 10,000 vehicles.

From January to May, Dongfeng Automobile delivered a total of 905,000 vehicles. Among these, 318,000 were new energy vehicles, and 536,000 were autonomous brand vehicles. Dongfeng Automobile ranks first in domestic market share for medium and heavy trucks, exhibiting a steady and upward development momentum.

Dongfeng Automobile is a leading central enterprise in the commercial sector, with automobile manufacturing, sales, services, and technology research and development as its core businesses. Its predecessor was the Second Automobile Works, founded in 1969. After over 50 years of development, it has produced and sold nearly 60 million vehicles and contributed over 670 billion yuan in taxes and fees, significantly contributing to national economic growth.

While direct data on Dongfeng Automobile's contribution to Wuhan's GDP is scarce, related figures offer indirect insights.

For instance, along Dongfeng Avenue in Wuhan City, Hubei Province, there are seven vehicle manufacturers and over 500 auto parts enterprises, forming the world's highest density of the automotive industry with an annual industrial output value exceeding 340 billion yuan.

The Dongfeng Automobile industrial chain directly creates 160,000 jobs and drives employment for over one million people upstream and downstream, playing a crucial role in supporting local economic development and social stability.

On June 6, the SASAC released the 2024 Annual Report on the Brand Construction and Development of Central Enterprises. Dongfeng Automobile ranked seventh among central enterprises in the 2024 Annual Central Enterprise Brand Construction Benchmarking Ranking, maintaining its top position in the automotive industry for four consecutive years.

Promoting the transformation from Made in China to Created in China, from China Speed to China Quality, and from Chinese Products to Chinese Brands – on the occasion of the 10th anniversary of the "Three Transformations" proposal, Dongfeng Automobile, as the national team of China's automotive industry, has delivered an answer to high-quality brand development.

Overall, this adjustment allows both parties to continue with their established strategies: Changan Automobile can accelerate its transition to new energy, such as advancing the Shangri-La Plan; Dongfeng Automobile can focus on the intelligent upgrading of commercial vehicles and the reform of the joint venture sector, avoiding the risks brought by integration.

Strengthening the Strategic Power of Automobile Power

Broadening our perspective, the adjustment will lead to the establishment of a new central automobile enterprise, further influencing and reshaping China's automotive market landscape.

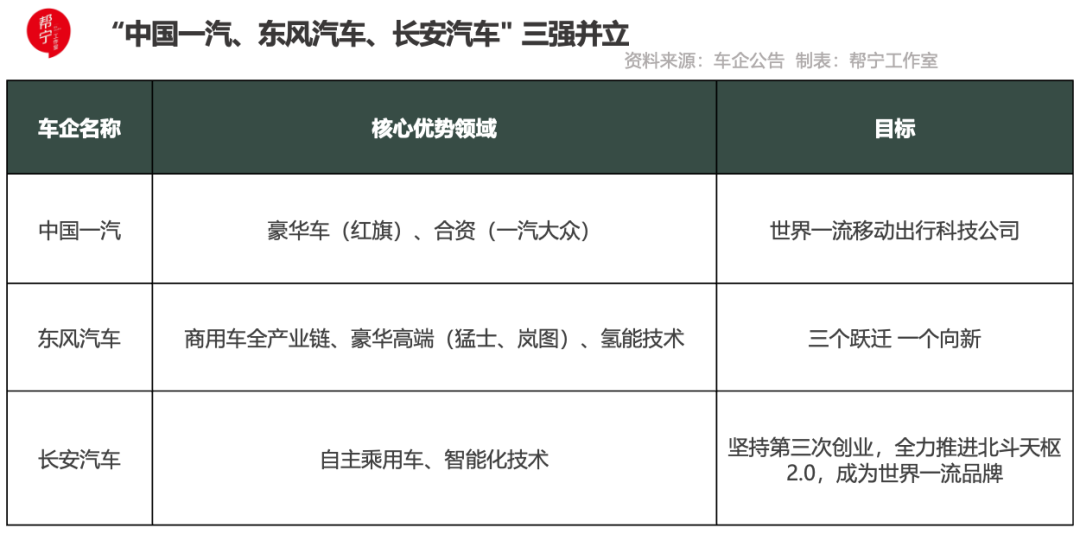

At that time, the central automobile enterprises under the SASAC – FAW Group, Dongfeng Automobile, and the new central automobile enterprise – will form a balanced triangle of power.

This matrix of central automobile enterprises holds multiple strategic values:

Firstly, it fosters internal competition. Through benchmarking assessments on revenue scale, new energy penetration rate, and patent conversion rate, it urges each central automobile enterprise to enhance operational efficiency.

Last March, Zhang Yuzhuo, Secretary of the Party Committee and Director of the SASAC, stated that state-owned automobile enterprises have not developed fast enough in the field of new energy vehicles. The SASAC has decided to separately assess the new energy vehicle business of FAW, Dongfeng, and Changan, the three central automobile enterprises directly supervised by the SASAC.

Secondly, it deepens industrial synergy. The three central automobile enterprises can explore non-competitive cooperation in areas such as chip research and development, charging infrastructure, and mobility services, thereby avoiding duplicate construction.

In March this year, Gou Ping, Deputy Director of the SASAC, stated at the 2025 China Electric Vehicle Hundred People Forum that the SASAC will carry out strategic restructuring of central enterprises in the vehicle sector, improve industrial concentration, concentrate advantageous resources such as research and development, manufacturing, and marketing, and accelerate the creation of world-class automotive groups with global competitiveness, independent core technologies, and leadership in intelligent networking transformation.

Thirdly, it bolsters international competitiveness. By forming a "multi-brand matrix + technology middle platform" model akin to international groups like Toyota and Volkswagen, it enhances the bargaining power of the three central automobile enterprises in the global market.

Judging from current developments, the three central automobile enterprises exhibit differentiated synergy in strategic positioning, technology paths, and market layout:

With the establishment of the new central automobile enterprise, the strategic power of the automotive sector will be further refined and strengthened.

In terms of central enterprises, the national team comprising FAW Group, Dongfeng Automobile, and the new central automobile enterprise will undertake strategic tasks such as technological breakthroughs (e.g., intelligent driving chips) and industrial chain security (e.g., power battery recycling).

In terms of local state-owned enterprise clusters, such as SAIC (Yangtze River Delta), GAC (Pearl River Delta), and BAIC (Beijing-Tianjin-Hebei), relying on regional industrial advantages, they are deeply engaged in niche markets and continue to make strides in the fields of new energy and intelligent networking.

In the private sector, BYD leads the new energy vehicle field with a vertically integrated model, achieving full-chain control from batteries to complete vehicles. Geely enhances its strength by integrating international resources through global mergers and acquisitions. Great Wall Motors has been deeply entrenched in the off-road market for years, continuously innovating off-road technology and building a technological moat...

In the realm of new forces, NIO, Li Auto, XPeng, and Zero Run have garnered a significant following in the market by innovating in user operations. Technology companies such as Huawei's HarmonyOS Intelligent Driving series and Xiaomi Automobile have entered the industry, bringing fresh ideas and technologies to the automotive sector. They accelerate the integration of "automobile + electronics" and give birth to new business models, such as smart cockpits and vehicle networking services, providing consumers with a brand-new travel experience.

This pattern of China's automotive industry, dominated by the state-owned economy, innovated by the private economy, and supplemented by mixed ownership, not only aligns with the strategic orientation of becoming stronger, better, and bigger but also continuously stimulates innovation vitality through market competition.

From integration speculation to independent resolution, this adjustment not only allays integration concerns for Changan Automobile and Dongfeng Automobile but also reconstructs China's automotive industry landscape with the wisdom of divide and rule, strengthening the strategic power of the automotive sector.

As of now, Changan Automobile has embarked on a new journey of independent operation, while Dongfeng Automobile steadfastly advances along its established strategy. The two are akin to two carriages on the automotive industry track, racing towards the goal of high-quality development along different paths.

In the audience, some anticipate Changan Automobile's comeback as a dark horse, while others favor Dongfeng Automobile's steady wins as a veteran. Regardless of the outcome, this drama of the "three giants of central automobile enterprises" will become a vivid footnote in China's automotive industry's journey from following to accompanying and ultimately leading.

After all, true strength has never been about uniform replication but about symbiotic growth with distinct edges.