European Auto Market | Germany May 2025: Stability Amidst Change, Chinese Brands Steadily Gaining Ground

![]() 06/10 2025

06/10 2025

![]() 642

642

In May 2025, despite a modest 1.4% increase in overall sales, Germany's passenger car market saw a remarkable surge in new energy vehicle (NEV) sales. Pure electric vehicles (EVs) and plug-in hybrids (PHEVs) experienced year-on-year growth of 44.9% and 79.4%, respectively, bringing the combined market penetration of NEVs close to 30%.

Volkswagen retained its market leadership, while Skoda set a new record with impressive performance. Chinese brands continued to strengthen their presence, with BYD surpassing Tesla for two consecutive months, and Xpeng and Leapro quietly entering the market. Despite their small overall share, Chinese brands are making steady progress amid the electrification wave.

01

Overall German Market Overview:

NEVs Lead Growth, Volkswagen Group Shows Steady Improvement

In May 2025, Germany sold 239,000 new vehicles, marking a slight 1.4% increase year-on-year. However, cumulative sales for the first five months of the year still declined by 2.2%.

Amidst an overall stable or slightly declining market, NEVs stood out:

◎ EV sales reached 43,060 units, a 44.9% year-on-year increase, with market share rising to 18%.

◎ PHEV sales surged to 25,191 units, a 79.4% year-on-year increase, with market share rising to 10.5%.

This underscores the growing acceptance of electrified vehicles among German consumers, fueled by policy incentives and the introduction of new products.

From a Brand Perspective:

◎ Volkswagen maintained its leadership with a 20.9% market share, up 5.1% year-on-year.

◎ Mercedes-Benz and BMW followed closely, capturing 9.1% and 8.5% of the market, respectively, with nearly 10% year-on-year growth.

◎ Skoda emerged as the month's biggest winner, with sales increasing by 13.1% year-on-year and a market share of 8.3%, setting a new record in the German market.

◎ In contrast, Audi and Opel saw sales declines of 2.6% and 22.2%, respectively, with Opel continuing its downward trend and market share falling to 4.4%.

◎ Ford, Toyota, and Hyundai showed steady growth, while Seat experienced a steep decline, with sales falling by 39.1% year-on-year.

In Terms of Specific Models:

◎ Despite a 16.5% year-on-year sales decline, the Volkswagen Golf remained the best-selling single model for the eighth consecutive month.

◎ The T-Roc and Tiguan followed closely, with declines of 13.2% and 6.3%, respectively, reaffirming Volkswagen's dominance in the compact SUV market.

◎ The Audi A6 saw a massive 113.1% increase, driven by the e-tron EV, rising to a historic high of fourth place, indicating the structural transformation of the luxury mid-to-large car market due to electrification.

◎ Additionally, the Volkswagen ID.7 recorded a growth rate of 562.3%, while the Mercedes-Benz GLC and BMW 5 Series both experienced over 50% year-on-year growth, signifying traditional luxury brands' active expansion in the NEV sector.

◎ The Volkswagen Tayron (18th place) and Skoda Elroq (20th place) also debuted in the top 20 sales list, further enriching the German electric SUV product line.

02

Emergence of Chinese Brands in Germany:

BYD Leads, New Entrants Gradually Making Their Mark

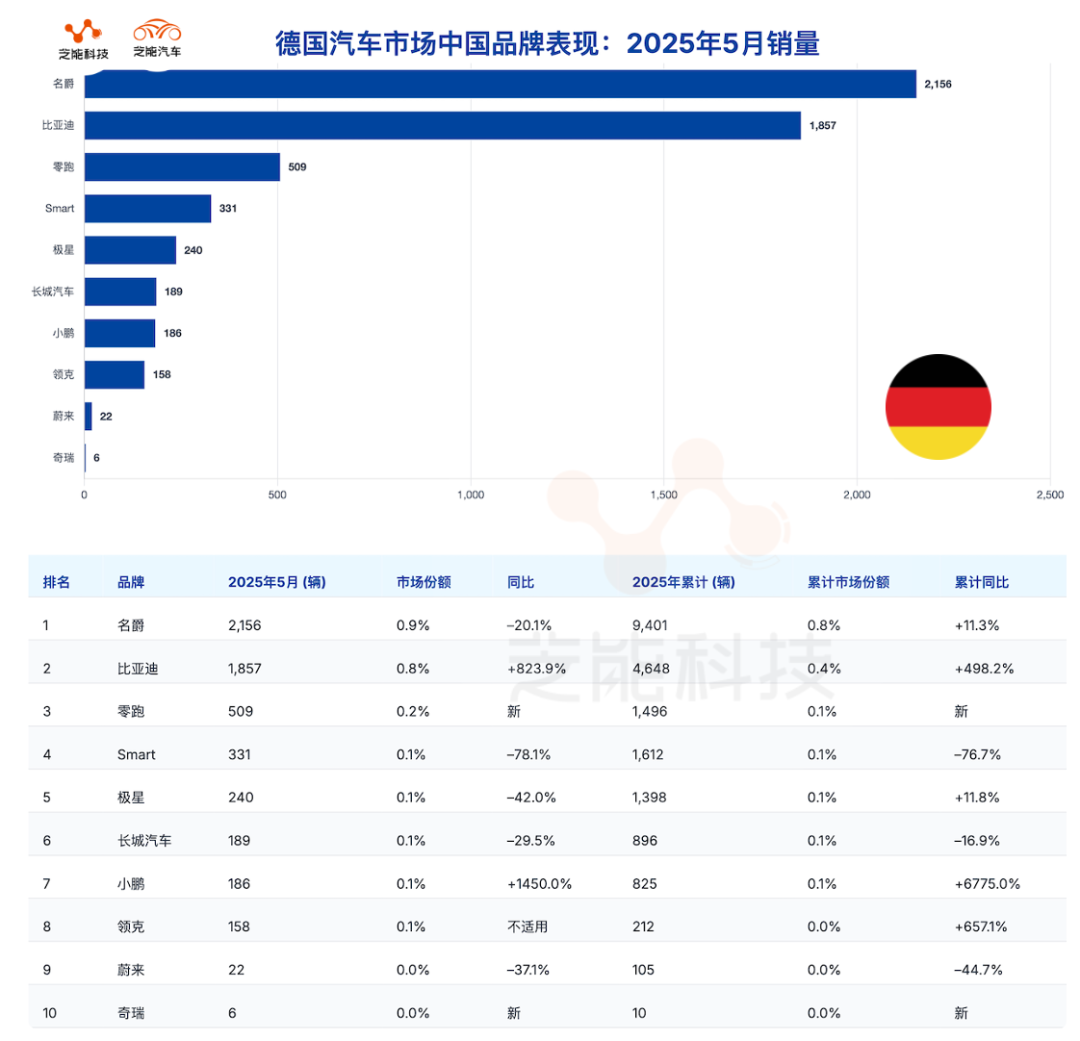

Chinese brands are gradually gaining traction in the German market.

◎ BYD sold 1,857 vehicles in May, an astonishing 823.9% year-on-year increase, with a market share approaching 0.8%. Following its first surpass of Tesla in April, BYD once again emerged as the best-selling pure electric Chinese brand in the German market.

Its main models, the Han EV and Seal, have gradually gained recognition from local consumers due to their high cost-effectiveness, differentiated design, and rich configurations.

◎ Xpeng Motors recorded an astonishing year-on-year growth rate of 1450%, with sales of 186 vehicles in May, thanks to a low base.

◎ Leapro also achieved sales of 509 vehicles, demonstrating the initial acceptance of Chinese electric vehicle brands in the European market.

While still considered "marginal players," these companies are aiming to replicate their success in markets like Norway and the Netherlands through channel development, product localization, and brand operations.

◎ MG, an established European brand under SAIC, sold 2,156 vehicles in May, a 20.1% year-on-year decrease, but cumulative sales for the first five months increased by 11.3%, indicating stable performance.

◎ GAC Motor and Great Wall Motor are facing considerable pressure, with sales of 189 and single-digit units in May, respectively, indicating that they are still in the early stages of market expansion.

Overall, Chinese brands currently hold a low market share of less than 1% in the German passenger car market, but their offensive in the electric vehicle segment is becoming increasingly evident.

◎ BYD is laying the foundation for long-term competitiveness by stabilizing its supply chain, entering mainstream distribution channels, and operating with local teams.

◎ The entry of Xpeng and Leapro signifies that Chinese new forces are beginning to test the waters in Europe's core markets, and future attention should be focused on their product acceptance and brand building progress.

Summary

The German market is undergoing a critical transformation towards new energy vehicles. The rapid growth of EVs and PHEVs coincides with structural adjustments by traditional brands, with Volkswagen and BMW actively promoting electrification while maintaining their share of fuel vehicles.

Skoda, Mercedes-Benz, Audi, and others are striving to attract younger consumer groups through new platforms and electrified sub-brands. Chinese brands, especially BYD, are seizing this period of transition as an entry point, quickly opening up niche markets with cost-effective pure electric products, and driving new entrant brands to test the waters in core European countries.