Eight Automakers Commit to 60-Day Payment Terms, but Skepticism Reigns in Comments

![]() 06/11 2025

06/11 2025

![]() 478

478

Introduction

Businessmen have long been burdened by extended payment terms, and the question "Can this really be implemented?" echoes their skepticism.

In the automotive industry, the biggest news overnight was the announcement that "various automakers are actively responding to the national call and unifying payment terms for suppliers' goods to within 60 days."

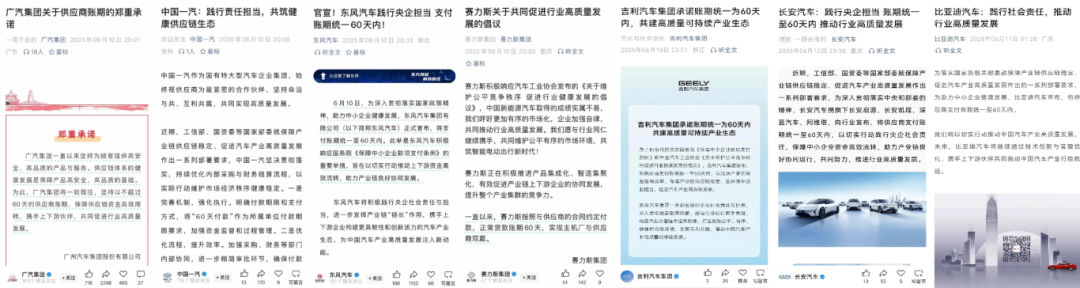

On June 10, GAC Group was the first to release this news around 8 pm, solemnly committing to suppliers' payment terms.

Subsequently, two state-owned enterprises, FAW and Dongfeng, also announced this decision on their official Weibo accounts, emphasizing their commitment to social responsibility. While state-owned enterprises may not lead in market volume, they take the lead in social impact and responsibility.

Following that, Thalys announced the news around 9 pm, focusing on promoting high-quality industry development without explicitly mentioning payment terms or supply chain ecology. Thalys also boasted that it "has always maintained a normal payment term of 60 days for goods."

As netizens tagged Geely and Changan, these leading automakers quickly responded positively after 11 pm. Notably, Changan, recently upgraded within state-owned enterprises, felt that just the parent company's commitment was insufficient and included Changan Qiyuan, Changan Kaicheng, Deep Blue Automobile, and AVATR in the commitment.

At around 1 am on June 11, BYD issued a statement in response to netizens' calls, stating its commitment to social responsibility, promoting industry development, and unifying payment terms to 60 days.

As of press time, eight automakers—GAC, FAW, Dongfeng, Thalys, Geely, Changan, BYD, and Chery—have expressed their positions. On June 11, under public pressure, more automakers are expected to follow suit. Non-compliance would be embarrassing, and regardless of cash flow capabilities, adhering to the political direction is crucial to avoid public opinion backlash.

Upon the 60-day payment term announcement, many people discussed it on the author's WeChat Moments, and comment sections on various social platforms were flooded. Why is there such concern?

Everyone in this chain feels deeply about it. Parts suppliers, public relations companies, advertising companies, media companies, and practitioners in operations and finance have all suffered from long payment terms. Many small companies have faced tight to depleted cash flows, forcing them to close down, leaving a trail of lawsuits and bad debts.

While the country's move on this issue is applauded, more voices focus on implementation and whether it can truly solve delayed payment issues.

01 Solving Payment Term Issues: The First Step Against Involution

If implemented, unifying payment terms within 60 days could revolutionize capital turnover in the automotive supply chain.

Supplier payment terms are an adverse consequence of involutionary competition in the automotive industry. Previously, domestic automakers had relatively good payment cycles, averaging around 45 days a decade ago. However, as market competition intensified and OEMs demanded more profits and expansion, especially under sales slowdowns and price wars, payment term issues worsened.

From an industry perspective, many domestic automakers transfer financial pressure through acceptance bills, while state-owned banks profit from discount interest. Automakers often treat suppliers as an "interest-free capital pool" to compensate for profits lost in price wars, transferring operational pressures to suppliers.

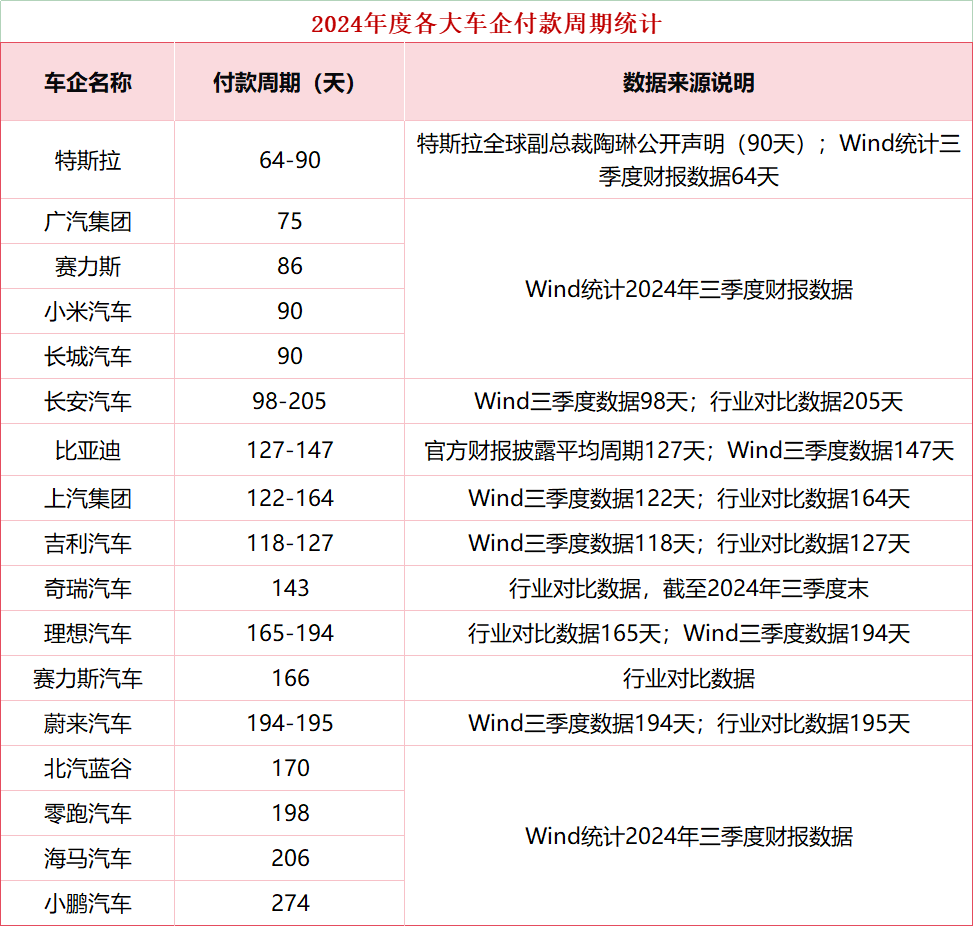

An analysis of major automakers' 2024 annual reports found that domestic automakers' average supplier payment term exceeds 170 days, with some exceeding 240 days. In contrast, international giants like Toyota, Ford, and General Motors had accounts payable turnover days of 54.84, 56.94, and 64.1 days, respectively, in 2024.

According to overseas automakers' conventions, payment terms generally fluctuate between 50 and 70 days, with German automakers having even shorter terms. In 2024, Mercedes-Benz, BMW, and Volkswagen had accounts payable turnover days of 37.91, 42.45, and 41.10 days, respectively.

Domestic automakers' complex payment term designs prolong them. For example, a 60-day payment term may be fine, but upon expiration, commercial bills, drafts, or various chains issued independently by enterprises are used for payment, extending the collection cycle to 8 months or more. Many automakers also adopt a combined design of "90-day or 120-day payment term + 180-day bank acceptance," freezing suppliers' funds throughout the year.

Besides excessively long payment terms, "consignment" requirements and suppliers advancing funds have worsened upstream and downstream suppliers' survival conditions. This pressure transmission intensifies involution.

From last year to present, the national level has called for anti-involution. Substantial actions have finally been taken. As one of the few major industries supporting economic development, the automotive industry's health and sustainability are crucial.

On the surface, automobile consumption is doing well, with sales growth around 10% in the first five months of this year. Leading enterprises' market capacity and growth are impressive, pushing China's auto share to 70%. Moreover, first-quarter profits were good, with half of Chinese listed automakers seeing revenue growth and 70% achieving positive net profit growth.

However, internal problems persist. Leading enterprises' conflicts have escalated, revealing the industry's harsh environment. Especially with the price mess, expected profit margins have worsened, sliding from 5-6% to the 3s level. In the supply chain, parts suppliers state that their days are "very difficult," with nationwide dealers losing over 70% in the first four months.

Pressuring payment terms is essentially OEMs using their dominant position to occupy suppliers' funds for free. In the current economic environment, if this pressure continues, some enterprises may not survive. Suppliers will inevitably reduce quality, leading the entire automotive industry into a vicious cycle of low quality and prices. Large-scale delayed payments will affect not only suppliers but also the entire economic cycle. This obstruction must be cleared.

Therefore, in late May, Wei Jianjun of Great Wall Motor proposed the "Evergrande Theory" and automotive industry irregularities, receiving a high-level response under public pressure. In late May, the Ministry of Industry and Information Technology and the China Association of Automobile Manufacturers issued initiatives opposing disorderly price wars and maintaining the industry's healthy and stable development.

Immediately after, in March this year, the state issued the revised "Regulations on Guaranteeing Payment for Small and Medium-sized Enterprises" (hereinafter referred to as the "Regulations"), effective June 1. This revision addresses issues like excessively long payment cycles, unclear responsibility entities, and insufficient supervision, building a full-chain guarantee system for SMEs' accounts receivable recovery through institutional reconstruction and mechanism innovation.

However, it took 10 days after this regulation came into effect for major automakers to start expressing their positions. This represents that after involution, price wars, and public opinion wars, the national level could no longer stand by. Through talks and meetings, automakers were asked to express their positions to resolve public opinion trends.

02 Trust and Confidence Behind Success

So far, eight automakers have committed to defending the 60-day payment term requirement, with mainstream large enterprises joining in. This indicates that the problem of payment terms for automotive suppliers' goods is expected to be resolved. In the short term, automakers' finances will bear greater pressure, but in the medium to long term, it will greatly benefit the industrial chain's resilience, significantly reducing suppliers' capital chain disruption risks and releasing liquidity. This benefits corporate development and economic turnover.

What changes will come after implementation? Some predictions can be made. For example, payment term requirements will restrict automakers' rapid expansion, demanding stronger cash flow, financing capabilities, and profitability. Capable automakers can launch several models at once, set reasonable prices, and maintain a stable capital chain to capture the market.

However, isn't there too much money in bank deposits with nowhere to spend? If short on funds, go to the bank for a loan, increasing the proportion of the enterprise's interest-bearing liabilities. This not only alleviates bank capital flow issues but also exposes financially and operationally unhealthy automakers, accelerating their elimination. This will negatively impact small and medium-sized enterprises with tighter cash flows, like new forces, while benefiting leading enterprises with stronger financing and profitability.

However, various news reports' comment sections reveal that while most netizens hope and applaud this move, they and industry practitioners have doubts:

"Monthly settlement within 60 days, then a 90-day commercial acceptance bill to circumvent it. If you want a bank acceptance bill, sorry, if you don't want a commercial acceptance bill, there's none. If you want to discount it, come to me, and interest will still be calculated." A financial person in charge explained the differences between telegraphic transfer, bank acceptance, and commercial acceptance.

"Does 60 days refer to after issuing the invoice? Before issuing, there are four time points: project material acceptance, business project summary, settlement contract signing, and business execution and landing. You can delay acceptance, refuse to sign the settlement contract, ignore summary materials, and only settle after bargaining for a 10-20% discount. There are too many operational methods in terms of wording."

"The regulations state payment within 60 days from the delivery date, but there's also a sentence saying 'except for reasonably agreed payment terms in accordance with industry norms and trading habits.'"

"It can be predicted that suppliers requiring payment within 60 days will have smaller business, while those breaking through 60 days will increase. Under market competition, the problem cannot be fundamentally solved."

"Cash flow is an enterprise's lifeblood. In the current environment, more people emphasize the importance of cash in hand. There are too many cases of 'upper-level policies and lower-level countermeasures.' Ultimately, it depends on implementation."

...

These doubts stem from businessmen's long-suffered extended payment terms. The question "Can it really be implemented?" reflects their skepticism and the chain's trust in OEMs and large factories' business practices, as well as policy enforcement confidence.

Fortunately, the "Regulations" have proposed a clear "collaborative supervision system to consolidate primary responsibility," systematically delineating the division of responsibilities between national and local levels for the first time. This establishes a "central coordination + local primary responsibility" supervision framework, effectively eliminating blind spots caused by ambiguous power and responsibility boundaries, and enhancing policy enforcement.

Furthermore, the revised "Regulations" not only impose a rigid 60-day requirement but also standardize payment forms. It prohibits forcing small and medium-sized enterprises to accept non-cash payment methods, such as commercial bills, to prevent disguised payment cycle extensions. For undisputed portions, priority payment is mandated to avoid uniform delays.

Additionally, the "Regulations" underscore the need for a closed-loop management mechanism of "complaint - acceptance - disposal - feedback" to enhance governance efficiency. They also propose the use of credit punishment to significantly increase the cost of breach of contract, including daily overdue interest of 0.05%, fines ranging from 3 to 5 times the amount due, and credit disclosure. This measure aims to steer automakers away from a "zero-sum game" mindset towards a "symbiotic and win-win" approach, fostering coordinated development of the industrial chain.

The implementation of the new 60-day payment term policy represents a pivotal shift in China's automotive supply chain, transitioning from "OEM hegemony" to "fair collaboration." While short-term challenges are inevitable, this policy will compel automakers to optimize fund management, elevate supply chain efficiency, and create a healthier environment for small and medium-sized enterprises.

In summary, both national and policy-level efforts demonstrate the necessity and commitment to addressing involution. These endeavors are commendable. However, as many stakeholders have noted, the true test lies in the results.

Responsible Editor: Yang Jing

Editor: He Zengrong