Hunting for Model Y: Success or Failure?

![]() 06/16 2025

06/16 2025

![]() 573

573

Introduction

“Given the current scenario, at least a substantial chunk has been taken.”

Last September, with the密集 release of the Ledao L60, Zeekr 7X, Zhidian R7, and Avita 07, there emerged a sentiment within the industry: “The reign of Tesla Model Y, the unassailable leader in this segment and the benchmark in China's automotive market, is nearing its end.”

These four newcomers, affectionately dubbed the "Four Little Dragons," were initially seen as formidable challengers.

However, as time progressed, it became evident that despite their intentions to outshine Model Y, they themselves fell short. In terms of subsequent sales performance alone, the impact of the "Four Little Dragons" on Model Y was negligible.

As compelling evidence, Model Y's domestic retail sales in the last three months of last year stood at 36,204, 44,576, and 61,881 units respectively, depicting a stark upward trajectory.

The reasons behind its popularity are multifaceted. Firstly, it is intrinsically tied to the model's comprehensive user experience. Secondly, Tesla's year-end promotions, offering free insurance and a five-year interest-free policy for Model Y, coupled with the brand's allure, served as potent catalysts.

In summary, at that juncture, it was apparent that the "hunt" was both lengthy and arduous.

Particularly concerning the upgraded version of Model Y, precisely tailored to address existing pain points and poised for launch, I harbored genuine concerns for domestic pure electric SUVs, spearheaded by the "Four Little Dragons."

However, the plot unfolded somewhat unexpectedly. Judging by the interim results, these concerns seem unwarranted. Even with the upgraded version, Model Y stumbled in China's automotive market this year. Capitalizing on this, domestic competitors voraciously shared the spoils.

Let's delve deeper with data.

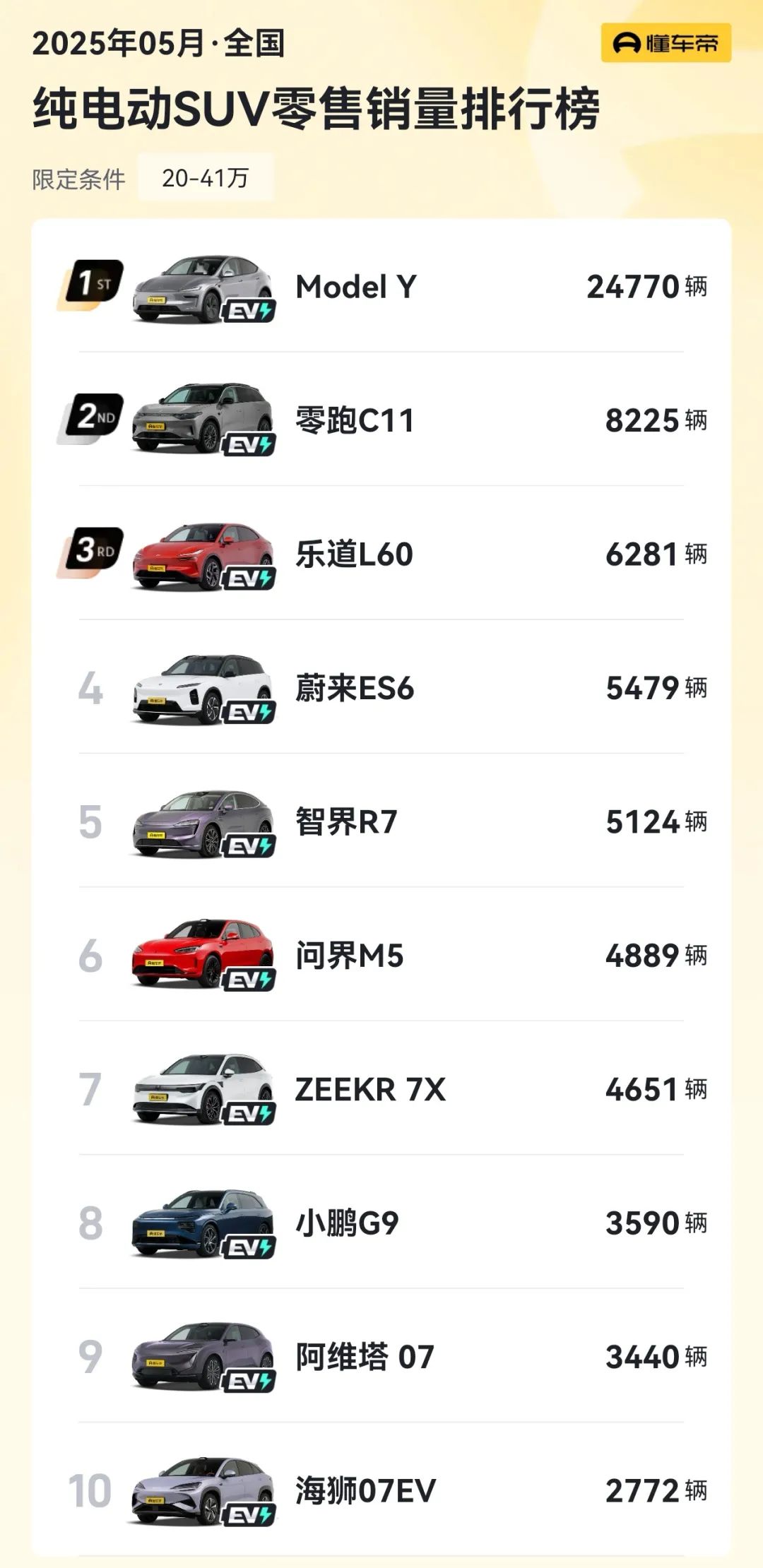

In the first five months, Model Y's retail sales in China were 25,694, 8,006, 48,189, 19,984, and 24,770 units respectively, all witnessing significant year-on-year declines.

Take May as an example; last year's retail sales amounted to 39,985 units.

Conversely, the "Four Little Dragons," albeit none achieving outstanding performance individually and some even experiencing declines, demonstrated the power of collective effort. Within the 200,000-300,000 yuan price bracket, products like the 2025 NIO ES6, 2025 XPeng G9, and 2025 AITO M5 continued to emerge.

Whether one admits it or not, the intensifying hunt has rendered the upgraded version of Model Y increasingly unable to stand alone.

Moreover, it's noteworthy that post the official release of the upgraded version, Model Y increased its terminal selling price. Despite the swift introduction of a five-year interest-free policy, the diminished cost-effectiveness inevitably fostered a wait-and-see attitude among potential buyers.

To borrow the exact words of a friend avidly interested in this model, “Firstly, there are now numerous options; Model Y is no longer the sole choice. Furthermore, based on Tesla's pattern, if sales falter, they'll surely slash prices. No need to rush with the upgraded version just out. I predict a price change soon.”

In essence, the "waiting game" often pays off.

Additionally, since the beginning of this year, Elon Musk's appointment as "Minister Ma" has inevitably distracted him from operational oversight at Tesla. Coupled with the tense Sino-US relations, this has undoubtedly tarnished the brand image of the American EV maker in China.

Collectively, these serious "internal and external troubles" have indeed caused the retail sales of the upgraded Model Y to fall far short of expectations.

This week, I happened to attend the global debut of the XPeng G7.

With a pre-sale price of 235,800 yuan, coupled with comprehensive configurations that are nearly flawless, and even the Ultra version equipped with three self-developed Turing AI chips boasting over 2,200 TOPS of computing power, positioned as an "intelligent family pure electric SUV," it will officially enter the market next month, potentially impacting the upgraded Model Y.

Coincidentally, Xiaomi YU7, an absolute top performer in the Chinese automotive market, will also be officially launched next month. Rationally and objectively, it could be the most formidable adversary the upgraded Model Y faces on its hunt.

After all, in the mid-sized pure electric sedan segment, since deliveries commenced in the second quarter of last year, Xiaomi SU7, with its capacity fully ramped up, has utterly dominated the upgraded Model 3 with a crushing force.

In May, Xiaomi SU7's retail sales reached 28,013 units, whereas the upgraded Model 3 managed only 13,818 units. Simply put, there's a gap of nearly 15,000 units, and the victor is clear.

Should a similar scenario unfold in the mid-sized pure electric SUV segment – Xiaomi YU7 "besting" the upgraded Model Y – the result would be unacceptable for Tesla. For once this crucial pillar begins to waver, the entire edifice could gradually crumble.

Expanding the view, Tesla this year, beset by "bad timing, unfavorable ground, and disharmony among people," has seen a sluggish European market, a tumultuous American market, and China as its sole bastion of dignity.

However, even here, it faces formidable competition and immense pressure.

Against this backdrop, if Tesla aims to avoid the stark year-on-year decline witnessed last year and ultimately achieve the 20%-30% countertrend increase promised by Musk, it must take more genuinely effective actions to stimulate potential buyers.

Thus, another official price reduction may not be far off. Similarly, rumors of seven-seater or cheaper versions are likely not unfounded.

Having discussed the upgraded Model Y, let's turn our focus back to ourselves.

In reality, examining the entire mid-sized pure electric SUV segment, no single model consistently achieves monthly sales exceeding 10,000 units. From this perspective, Chinese automakers still need to continue bolstering their brands and refining their products.

The incremental progress in hunting the upgraded Model Y is more a result of the "sea of cars" tactic dragging it into a quagmire. In terms of individual combat capability, few can yet compete.

Therefore, we must acknowledge the existing gap.

The so-called "six sects besieging Guangmingding" battle will undoubtedly intensify. Following XPeng G7 and Xiaomi YU7, numerous new cars will eye the lucrative profits of the upgraded Model Y.

This scenario indirectly underscores the ferocity of competition in China's automotive market, as previously mentioned, "There is no niche blue ocean." Moreover, the most intense phase has yet to fully unfold.

Of course, it's said, "Strike while the iron is hot."

Tesla's current trough period presents Chinese electric vehicles with a window to stride forward and conquer the world. While hunting domestically, they should also expand overseas. Seize this hard-earned opportunity and forge ahead relentlessly.

Responsible Editor: Yang Jing, Editor: Wang Yue