DJI Plunges into Price Cuts, Insta360 Rolls Out Coupons, OPPO & Vivo Step In: Smart Imaging Market Heats Up with a 'Three-Way Showdown'

![]() 10/15 2025

10/15 2025

![]() 587

587

The smart imaging market is on the verge of a lively transformation.

There's nothing more disheartening than purchasing a device, only to witness its price plummet by a thousand yuan before you've even grown accustomed to it. Especially following the recent 8-day National Day holiday, when numerous individuals splurged on new DJI drones or Pocket 3 cameras specifically for their travels, only to be greeted with 'disastrous news' from the official website: a major sale has commenced.

Among the discounted offerings, the star product Osmo Pocket 3 experiences its first price reduction since its launch: the standard version drops by 700 yuan, while the all-inclusive set sees a 900 yuan decrease. The sports camera Osmo Action 4 enjoys a maximum price drop of 1,129 yuan. The Mini 4 Pro drone's price is slashed by 1,478 yuan, and the entire Osmo Mobile series witnesses price reductions exceeding 20%. This promotional sale spans from October 9th to 14th, lasting a total of six days.

Image Source: DJI

While this round of promotions has nearly overwhelmed DJI's stores, with the Pocket 3 selling out once again, it has also ignited widespread online backlash, with many demanding 'an explanation' from DJI. In response, DJI's official reply was prompt, stating that this promotion is a regular feature for the Double 11 event. As for the request from some netizens for 'price difference refunds,' they largely turned a deaf ear.

Rationally speaking, the blame can only be attributed to this year's Double 11 promotions kicking off too early, shifting from mid-October in previous years to the first day after the National Day holiday. However, from a consumer's standpoint, this feels like a betrayal. After all, in previous years, even if DJI had promotions during Double 11, the discounts were minimal, and some popular products like the Pocket 3 rarely saw any price cuts.

Of course, to be fair, DJI did drop hints (or tease) about this round of price cuts through some channels. Nevertheless, for many netizens who don't typically follow consumer electronics news, it's understandable that they missed these hints. Based on past experiences, DJI usually only offers a token coupon as compensation, with little else.

As for consumers who feel betrayed, those who made online purchases might be able to recoup some compensation through price protection services, while those who bought from physical stores have fewer options, as returns and price protection are generally not available (the 7-day no-reason return policy doesn't apply to offline purchases).

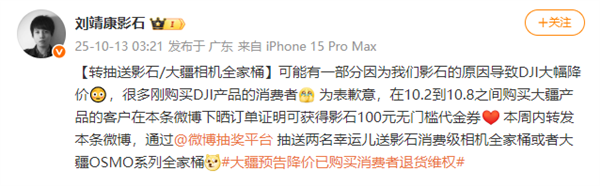

However, in a more absurd twist, Insta360's CEO suddenly announced 'an apology on behalf of DJI,' stating that consumers who purchased DJI products between October 2nd and October 8th could receive a 100 yuan no-threshold voucher from Insta360 by sharing their order proof on Weibo. Additionally, they announced that two lucky users would be drawn by retweeting the post, with prizes including a valuable 'full-set' grand prize—either a complete set of Insta360 consumer cameras or a full set of DJI OSMO series products, with winners choosing whichever they prefer.

Image Source: Weibo

To this, I can only remark: Sometimes, business warfare is as straightforward as throwing money around.

DJI vs. Insta360: A Dual-Power Rivalry, with a Price War Quietly Igniting

The rivalry between Insta360 and DJI is no secret. Both are titans in the smart imaging field, but DJI, long focused on drones and action cameras, suddenly announced two new products this year—the Osmo Nano and Osmo 360—with performance and pricing directly targeting Insta360's popular GO and X series products.

In response to DJI's offensive, Insta360 has begun constructing a defensive 'moat' through its ecosystem. They first enhanced the experience of their app and other creative and usage software, then forged an ecosystem partnership with Huawei, enabling Huawei's smartwatches to effortlessly control Insta360's smart devices with a polished UI and seamless operation.

On the other hand, Insta360 also announced this year that it would venture into the drone market, establishing the 'Yingling Antigravity' sub-brand and preparing to launch the world's first panoramic drone. DJI is not sitting idle either, with rumors suggesting they are planning to deeply integrate the Osmo 360 with their drones to create a new panoramic drone product, expected to be released by the end of the year.

Image Source: Antigravity Official Website

The two giants are not only invading each other's strongholds but also competing for existing market share through price cuts and promotions. After the release of the Osmo 360, the Insta360 X5 witnessed a lightning-fast price drop of 500 yuan, nearly matching its launch price.

While consumers naturally welcome this, other brands in the smart imaging market are feeling the pressure. Except for a few budget-focused brands, products competing in the mid-range market have been left reeling.

Against this backdrop, DJI's large-scale price cuts are unlikely to be merely a Double 11 promotion—it seems more like a market counterattack amidst multiple competitive pressures. By offering discounts, DJI aims to boost sales, clear existing inventory, and secure market share while buying time for future product development and launches.

So, when Insta360's CEO claimed that DJI's price cuts were due to their competition, it wasn't entirely off the mark. Without competition, DJI's incentive for promotions wouldn't be as strong as it is now. Additionally, DJI's Pocket 4 release plan is likely on the agenda, with many sources hinting at a year-end launch, making Double 11 the perfect 'clearance' opportunity.

As competition in the smart imaging market intensifies, we may witness more frequent promotions and product iterations, especially with smartphone manufacturers entering the fray.

New Players Enter: Smartphone Giants Plot Their Move

Recently, a tech blogger hinted that two major Chinese smartphone giants, OPPO and Vivo, are brewing new product lines, with features and designs targeting DJI's Pocket series. Subsequent reports from Jiemian News largely confirmed the authenticity of this information.

Among them, Vivo's first product has entered the mold testing phase, and if all goes smoothly, it might launch alongside the X300 series' 'super cup' version next year. OPPO's product, meanwhile, is expected to be released no earlier than 2026, though considering its project timeline, a year-end launch alongside new phone releases is likely.

Image Source: Weibo

While OPPO responded in a low-key manner by stating that its imaging team has seen no recent changes, many tech bloggers are hinting that the entry of these two smartphone giants is 'a done deal,' with the only uncertainty being the launch timing. After all, the smartphone market has become saturated in recent years, with overall growth slowing down. OPPO and Vivo haven't gained much ground in their competition with Xiaomi, and both urgently need a new growth direction.

In contrast, the smart imaging market has only exploded in the past couple of years, especially for categories like handheld gimbal cameras, where brands like DJI, Insta360, and GoPro are fiercely competing. Moreover, from a user penetration perspective, the smart imaging market still has significant room for growth, making it an irresistible target for OPPO and Vivo.

Furthermore, OPPO and Vivo already have deep accumulation in mobile imaging, whether in imaging algorithms or supply chain management, which poses no major issues for these smartphone market veterans. Additionally, they boast nationwide sales channels and broader brand recognition, factors that alone can put pressure on DJI and Insta360.

Beyond that, OPPO and Vivo can leverage their position in the smartphone market to integrate smart cameras and phones into a cohesive ecosystem. Experiences like multi-angle shooting with 'phone + camera' integration or full-chain optimization for shooting, editing, and sharing come naturally to them, whereas DJI and Insta360 would face much higher costs and longer timelines to offer similar experiences.

However, smartphone manufacturers entering this cross-over arena face their fair share of challenges. Take the Pocket 3's mechanical gimbal, for example—the mechanical design, heat dissipation, power control, and optimization for intense scenarios like motion are all areas where smartphone manufacturers have little experience.

In a sense, the online uproar sparked by DJI's price cuts is merely a signal that the smart imaging market has entered a 'multi-power rivalry' phase. Once upon a time, GoPro nearly monopolized the action camera market, but now it's ceding ground under pressure from DJI and Insta360. Meanwhile, DJI and Insta360, though seemingly at odds, find themselves at a crossroads where they're being chased by newcomers.

Source: Leitech

Images in this article are from the 123RF licensed image library. Source: Leitech