Vehicle-Mounted Lens Shipments Soar by 40% Year-on-Year! Sunny Optical Unveils Latest Figures

![]() 11/11 2025

11/11 2025

![]() 723

723

On the evening of November 10, Sunny Optical publicly released its shipment data for key products in October 2025.

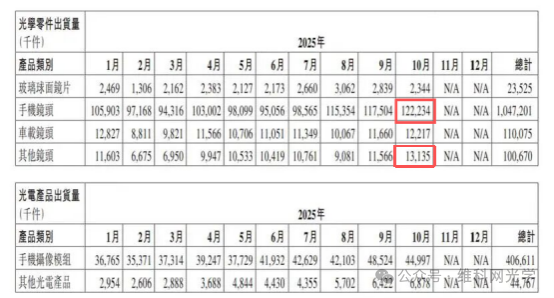

The data indicates that, concerning optical components, in October 2025, the shipment volume of glass spherical lenses stood at approximately 2.344 million units, marking a 5.1% decrease year-on-year. Conversely, the shipment volume of mobile phone lenses reached around 122 million units, a 5.7% increase year-on-year. Notably, the shipment volume of vehicle-mounted lenses surged to approximately 12.217 million units, representing a remarkable 40.3% increase year-on-year. Meanwhile, the shipment volume of other lenses was approximately 13.135 million units, experiencing a 6.7% decrease year-on-year.

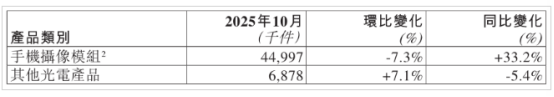

Regarding optoelectronic products, in October 2025, Sunny Optical's camera module products shipped approximately 44.997 million units, a 33.2% increase year-on-year. In contrast, the shipment volume of other optoelectronic products was approximately 6.878 million units, a 5.4% decrease year-on-year.

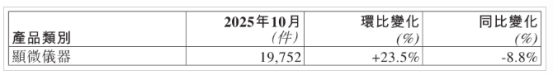

In the realm of optical instruments, in October 2025, the shipment volume of microscopic instruments was approximately 19,800 units, an 8.8% decrease year-on-year.

Among these figures, the shipment volumes of mobile phone lenses and other lenses reached their highest monthly levels for the year, successfully setting a new annual record.

Sunny Optical attributed the year-on-year increase in shipments of mobile phone camera modules and vehicle-mounted lenses primarily to heightened client demand.

Industry experts have noted that the latter half of the year is a period characterized by the concentrated launch of new consumer electronics products. Leading optical module manufacturers, exemplified by Sunny Optical, collectively experienced a shipment peak, with second-tier manufacturers also witnessing a buoyant sales market.

Sunny Optical's 2025 interim report highlighted that in the first half of 2025, the global smartphone market achieved moderate overall sales growth, albeit at a slower pace. Nevertheless, the rapid advancement of AI technology, coupled with smartphone manufacturers' continuous investment in high-end smartphones, has propelled the market sales of high-end models to outperform the overall market. The trend towards high-end products has also fueled innovation in imaging capabilities. Smartphone manufacturers are now evolving their requirements for mobile phone cameras towards ultra-compact dimensions and professional shooting capabilities, leading to escalating challenges in product material selection, structural design, process optimization, and cost control. This has conferred a greater advantage to leading manufacturers with vertical integration capabilities.

During the interim results briefing, Sunny Optical stated that in the first half of the year, for the mobile phone lens business, the revenue from 6P and above products increased by over 9% year-on-year, and the revenue from glass-plastic hybrid mobile phone lenses also witnessed a significant year-on-year surge. In terms of gross margins, mobile phone lenses achieved 25% to 30%, aligning with the annual guidance, and it is anticipated that the annual gross margin will remain within this range. The revenue share of high-end products in mobile phone camera modules exceeded 20%, with gross margins maintained within the guidance range of 8% to 10%, and it is expected that this level will be sustained throughout the year.

It is worth noting that some research reports have cautioned that although the increase in the number of smart car cameras from companies like BYD is anticipated to directly drive the development of Sunny Optical's automotive lens business, Sunny Optical still lacks catalysts from the automotive lens business in the latter half of 2025, and shipments may continue to be sluggish.

Based on the shipment situation in October, Sunny Optical still possesses businesses that continue to grow, and the overall scenario in the latter half of the year will hinge on its subsequent market performance.