A 120-Million-Yuan Capital Increase! Controlling Shareholder Shifts for This Optical Enterprise

![]() 11/20 2025

11/20 2025

![]() 653

653

On the evening of November 18, Junyi Digital issued a public announcement stating that it had inked a capital increase agreement with Guangdong Guanghong Precision Technology Co., Ltd. (hereinafter referred to as "Guanghong Precision"). The company declared that it would invest 120 million yuan of its own funds to boost Guanghong Precision's capital, thereby acquiring a 60% stake post-capital increase.

According to the capital increase agreement, Guanghong Precision's registered capital will surge from the original 22.102 million yuan to 55.255 million yuan. Of this increase, Junyi Digital will fully subscribe to the newly added registered capital of 33.153 million yuan, with the remaining 86.847 million yuan being credited to the capital reserve. Junyi Digital is required to complete the full capital contribution within 60 days after signing the agreement, with the first installment of 20 million yuan to be paid within 10 days.

Once the transaction is finalized, Guanghong Precision will transform into a controlled subsidiary of Junyi Digital and will be incorporated into Junyi Digital's consolidated financial statements.

Guanghong Precision specializes in the research and development, production, and sales of precision optical components and assemblies. Its primary offerings include precision optical components and assemblies, which form the bedrock for various fiber optic devices, camera modules, and optical modules. By combining optical components in different ways, fiber optic devices, camera modules, and optical modules can fulfill a range of specific functions. These products find extensive applications in consumer electronics, automotive electronics, security, optical communications, and other sectors.

From a financial standpoint, the audited financial data reveals that the company generated revenue of 16.6553 million yuan and a net profit of 2.5724 million yuan in 2024. From January to August 2025, its revenue climbed to 20.0425 million yuan, accompanied by a net profit of 3.8960 million yuan. As of the end of August 2025, Guanghong Precision's total assets stood at 31.7131 million yuan, with total liabilities of 11.3439 million yuan and net assets of 20.3692 million yuan.

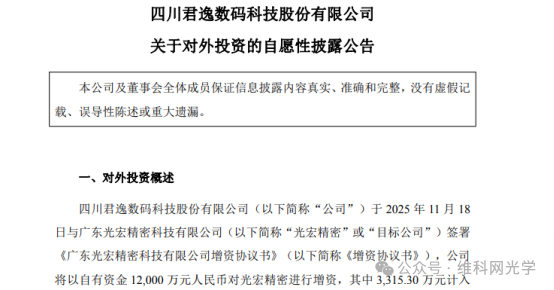

Prior to the capital increase, Guanghong Precision's equity structure was relatively fragmented, with shareholders including Foshan Guangchuang Enterprise Management Partnership (Limited Partnership), Zhang Yehui, Zhongshan Dingye Technology Investment Enterprise (Limited Partnership), Guangdong Jinding Optical Technology Co., Ltd., Jiang Tingxuan, Yang Limin, Foshan Guanghong Enterprise Management Partnership (Limited Partnership), Zhang Haolai, and Wan Guanghui. Among them, the top two shareholders held stakes of 36.52% and 19.80%, respectively.

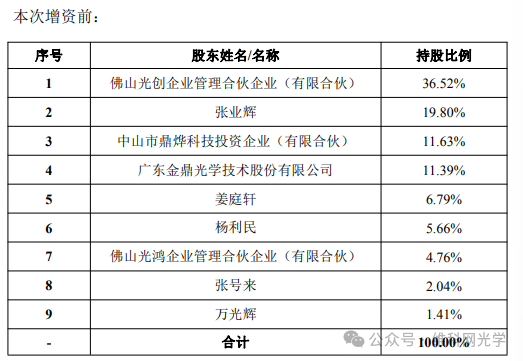

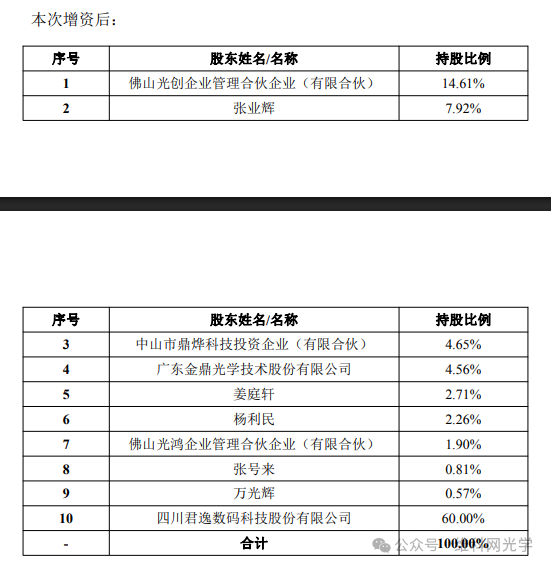

Post-capital increase, Junyi Digital will own a 60% stake in Guanghong Precision, emerging as the controlling shareholder. The shareholding ratios of the original shareholders will be diluted accordingly, with the previously top two shareholders, Foshan Guangchuang Enterprise Management Partnership (Limited Partnership) and Zhang Yehui, seeing their stake percentages plummet to 14.61% and 7.92%, respectively.

Regarding the governance structure, following the capital increase, Guanghong Precision's board of directors will comprise three directors. Junyi Digital will recommend two (one of whom will serve as the chairman), while the original shareholder Zhang Yehui will recommend one. The general manager of Guanghong Precision will be recommended by Zhang Yehui, and the head of the finance department will be recommended by Junyi Digital, both to be appointed by the board of directors.

Upon completion of this capital increase, without the consent of Junyi Digital, the founding team and core personnel—Zhang Yehui, Xu Jiyuan, Yi Jianjun, Jia Hejun, Ren Shaoyang—as well as their spouses, children, or any enterprises invested in by the aforementioned individuals, shall not directly or indirectly own, manage, control, invest in, or engage in any business that is identical to or constitutes horizontal competition with the target company in any other manner.

Junyi Digital stated that this external investment represents a crucial step in forging a synergistic ecological strategy centered around "Intelligent IoT + Big Data + AIGC Applications." The decision was made based on a forward-looking consensus on the development of the optical instrument field, future market demand, and the company's diversified development strategy, among other considerations. This investment, funded by the company's own resources, will not negatively impact the company's existing financial standing or normal operations.

This transaction will bring about changes to the company's consolidated financial statements. In the long run, this investment is poised to generate positive strategic driving effects, aligning with the company's overarching development plan and the interests of all shareholders.