Net Profit Soars in First Half of the Year! This Optical Firm Rushes to List on Hong Kong Stock Exchange

![]() 12/03 2025

12/03 2025

![]() 584

584

On November 28, 2025, Largan Precision Innovation Technology Co., Ltd. (hereinafter referred to as "Largan Precision Innovation"), a company specializing in providing precision optical solutions, officially filed an application to list on the main board of the Hong Kong Stock Exchange. The co-sponsors for this listing are CITIC Securities and CICC.

Established in 2018, Largan Precision Innovation primarily targets the mid-to-high-end optical module and system integration market. Its products cater to a diverse range of sectors, including global consumer electronics, automotive electronics, smart office applications, as well as emerging fields like intelligent robots, XR smart terminals, and smart glasses. The company's offerings are widely utilized in various smart work and life scenarios, and it has supplied products to over 320 customers worldwide.

According to Frost & Sullivan, based on the shipment volume in 2024, one in every six laptops globally is equipped with the company's camera module, highlighting its significant market presence.

In terms of financial performance, from 2022 to 2024 and the first half of 2025, the company reported revenues of RMB 12.753 billion, RMB 15.248 billion, RMB 27.914 billion, and RMB 14.186 billion, respectively. Its profits for the same periods were RMB 689 million, RMB 588 million, RMB 1.052 billion, and RMB 554 million, respectively.

In the first half of 2025, Largan Precision Innovation continued to experience rapid growth. Its revenue reached RMB 14.186 billion, marking a year-on-year increase of 53.4%. Meanwhile, its net profit surged by 101.5%, effectively doubling.

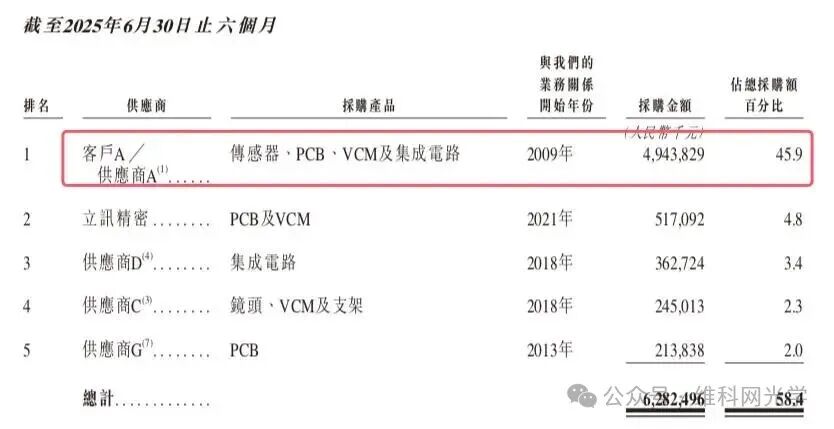

Largan Precision Innovation exhibits a high degree of customer concentration, with this trend becoming more pronounced. From 2022 to 2024 and the first half of 2025, revenue from its top five customers amounted to RMB 11.6 billion, RMB 11.9 billion, RMB 24.8 billion, and RMB 12.6 billion, respectively. These figures accounted for 90.7%, 77.8%, 88.7%, and 89.0% of the company's total revenue.

Among these customers, the sales proportion of "Customer A," the largest customer, to the total revenue has fluctuated. It decreased from 57.9% in 2022 to 39.9% in 2023, but then rebounded to 61.6% in 2024 and further rose to 67.6% in the first half of 2025. Notably, this customer is also Largan Precision Innovation's largest supplier, creating a bidirectional dependency relationship.

Largan Precision Innovation stated that it has maintained a stable business relationship with Customer A for over 15 years, and the probability of significant adverse changes in this relationship is low.

Since its inception, Largan Precision Innovation has attracted numerous renowned investment institutions. These include Sequoia Capital China, CPE Source Peak, Hillhouse, Legend Capital, Harvest Capital, China Merchants Zhiyuan Capital, CICC, GF Securities, China Mobile Fund, China Life Insurance, CITIC Securities, Cornerstone Capital, Taikang Life Insurance, 37 Interactive Entertainment, as well as other institutions, industry players, and local governments. The prospectus reveals that Largan Precision Innovation completed five rounds of financing prior to listing, with a cumulative financing amount exceeding RMB 5.2 billion.

It is worth mentioning that Largan Precision Innovation is also subject to a gamble agreement. This agreement stipulates that the company must complete an initial public offering (IPO) within seven years from March 1, 2022. Failure to do so would result in investors demanding the restoration of their redemption rights. Largan Precision Innovation finally commenced planning related actions this year. In January 2025, it completed its shareholding system reform, making it eligible to list on a stock exchange.

Largan Precision Innovation's listing application comes at a pivotal moment when the global optical industry is undergoing structural adjustments. As the prospectus process unfolds, the market will gain a clearer understanding of Largan Precision Innovation's technological prowess and growth potential. Its performance will also provide valuable market feedback for other optical companies. We eagerly anticipate its subsequent market performance.