Nearly 100 Million Yuan Poured In! This Optical Firm Ramps Up Investment in Core Material Sector

![]() 01/14 2026

01/14 2026

![]() 638

638

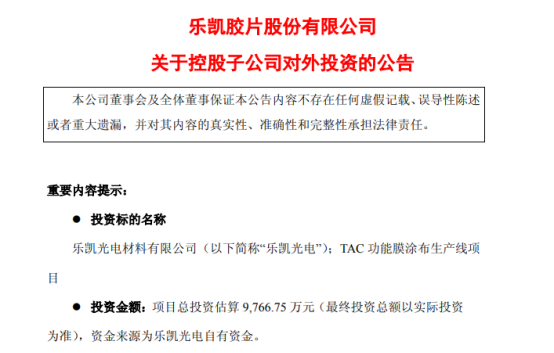

On January 13th, Lucky Film issued an announcement detailing the overseas investment plans of its majority-owned subsidiary. Lucky Film Optoelectronic Materials Co., Ltd. (hereinafter referred to as 'Lucky Film Optoelectronics'), a subsidiary under Lucky Film's wing, intends to allocate its own funds towards constructing a production line for TAC functional film coating.

As per the announcement, the total projected investment for this endeavor stands at 97.6675 million yuan (with the final figure subject to actual expenditures), all financed through Lucky Film Optoelectronics' internal resources. The blueprint includes setting up one precision coating line and incorporating 17 sets of primary process equipment, comprising 3 imported units and 14 domestically produced ones.

The project's flagship product will be TAC functional film (specifically, Anti-Glare Hard Coating Film, or AG). Designed with a maximum product width of 1,540 mm and a production speed of 30 m/min, this venture is poised to achieve an annual output capacity of 18 million square meters of TAC functional film once it reaches full throttle.

Lucky Film Optoelectronics articulated that the project's primary objectives are to expedite the execution of the company's growth strategy, meet market demands, solidify its leadership in the optical film sector, effectively bolster the flat-panel display supply chain, cut down domestic polarizer production costs, elevate the industry's overall competitiveness, and cement the company's preeminent position within the industry.

This investment initiative is grounded in the company's strategic development imperatives and its assessment of the TAC functional film material industry's trajectory. Nevertheless, factors such as industry development trends, market dynamics, price volatility, fluctuations in raw material costs, as well as internal company management and process technology, all harbor inherent uncertainties that could potentially influence the investment project's construction, operation, and anticipated returns. The company will proceed with the investment prudently and systematically, adhering to the plan, and aiming to secure favorable investment outcomes.

Lucky Film Optoelectronics specializes in manufacturing TAC cast optical film products, with its flagship offerings being TAC films and their further processed derivatives. It stands as a domestic producer of TAC films for polarizers and TAC films for polarized sunglasses. Dedicated to developing high-end TAC cast optical film products, it is the sole entity in China capable of mass-producing TFT-type optical TAC films. In September 2025, Lucky Film Optoelectronics was recognized as one of the 2025 Potential Unicorn Enterprises in Jiangsu Province.

Lucky Film Optoelectronics' foray into expanding AG functional film production signifies a strategic pivot from supplying general-purpose base materials to delivering functionalized solutions boasting specific optical attributes for downstream clients like display module manufacturers. This move represents an incursion into higher value-added segments of the industrial chain. It also underscores that achieving technological breakthroughs and large-scale production in critical 'bottleneck' material domains is not merely a commercial venture but also a national strategic imperative, eligible for dual support from policies and the market.

Lucky Film Optoelectronics' investment embodies the broader transition of Chinese optical material enterprises from import substitution to technological leadership and from single-product offerings to platform-based solutions. For optical firms, the future necessitates a seamless integration of core technological advancements, industrial chain collaboration, large-scale manufacturing capabilities, and market demand insights, constructing enduring competitive barriers through sustained strategic investments amidst an uncertain landscape.