Chairman Commits 50 Million Yuan Personally to Back Lante Optics' 1 Billion Yuan AR Optics Venture

![]() 01/15 2026

01/15 2026

![]() 561

561

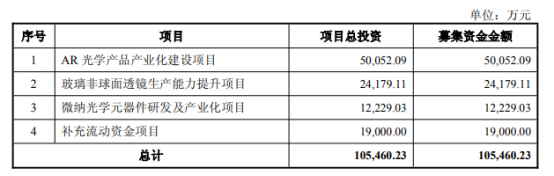

On January 14, Lante Optics convened the 25th session of its fifth board of directors, greenlighting a proposal to issue A-share stocks to select investors in 2026. The total capital raised from this issuance will not surpass 1.0546 billion yuan and is earmarked for pivotal business initiatives, including the industrialization of AR optical products and the augmentation of glass aspheric lens production capabilities.

The company clarified that all projects financed by this issuance are intricately linked to its core business. They are poised to substantially boost the production capacity of key products, diversify the product portfolio, elevate technological R&D and industrialization prowess, fortify risk resilience and profitability, and aid the company in solidifying its market dominance in the precision optical components sector.

Specifically, the AR optical product industrialization project will channel 500.5 million yuan into expanding the mass production and delivery capabilities of AR products. Simultaneously, it will accelerate the transformation of technological achievements and the industrialization process in the AR realm, continually refining the product mix and broadening the product range.

The glass aspheric lens production capacity enhancement initiative will allocate 241.8 million yuan. By acquiring cutting-edge production and testing equipment, it aims to elevate the company's manufacturing standards and efficiency, thereby scaling up the production capacity of glass aspheric lenses to cater to the burgeoning downstream market demand. Moreover, leveraging the company's existing technological prowess and industrial base, it will persistently enrich the product structure and business ecosystem.

The micro-nano optical component R&D and industrialization project will invest 122.3 million yuan. It will reconfigure the existing production line layout, enhance the company's mass production capabilities for wafer-level microlens arrays, and fulfill the downstream market's demands for high precision, miniaturization, and integration of optical components, thereby bolstering the company's business competitiveness and market presence. Furthermore, it will intensify R&D efforts in applying semiconductor processes such as nanoimprint lithography and etching in the optical domain, fostering technological advancements and innovation upgrades for micro-nano optical component-related products.

This issuance will employ a targeted investor issuance approach. The recipients will be no more than 35 specific investors who fulfill the criteria set by the China Securities Regulatory Commission and the Shanghai Stock Exchange, encompassing securities investment fund management firms, securities companies, and insurance institutional investors. Among them is the company's controlling shareholder, actual controller, chairman, and general manager, Xu Yunming. Xu Yunming plans to subscribe with up to 50 million yuan in cash, abstaining from the inquiry process but accepting the inquiry outcomes. The subscription price will align with that of other issuing entities. This issuance will not precipitate a change in the company's control structure.

Regarding the lock-up period, shares subscribed by Xu Yunming will be non-transferable for 36 months post-issuance. The lock-up period for shares subscribed by other specific investors is 6 months, with the same lock-up arrangements applying to shares derived from them. The validity of this issuance resolution spans 12 months from the date of shareholders' meeting approval. Upon completion of the issuance, the stocks will be listed and traded on the Shanghai Stock Exchange.

Prior to the funds raised from this targeted investor issuance being secured, the company may utilize its own funds to invest in advance, based on the actual progress of the proposed investment projects. Once the funds raised are in place, they will be substituted in accordance with the procedures outlined in relevant laws and regulations.

The company emphasized that the investment directions of the funds raised in this issuance are all centered around the company's existing core business. Post-project implementation, it will amplify the revenue scale and profitability of the company's main business and will not precipitate substantial alterations in the company's business structure.

Meanwhile, Lante Optics highlighted in the announcement that this fundraising project will introduce new production capacities for precision optical components, including high-index glass wafers, crystalline wafers, glass aspheric lenses, and wafer-level microlens arrays. The overall future market landscape and supply-demand dynamics remain uncertain. If significant adverse shifts occur in macroeconomics, industrial policies, or the market environment during the project's execution, if there are major technological route shifts in products, or if the company fails to expand the market, meet downstream customer demands, or encounters other unforeseen circumstances, it could adversely impact the smooth implementation of the company's fundraising project and capacity utilization, potentially leading to the risk that the actual benefits of the fundraising investment project fall short of expectations.

As a pivotal supplier of optical components, Lante Optics' 1 billion yuan investment in core businesses such as AR optics underscores a robust anticipation for the future growth of the AR terminal market. It will instill confidence in the industry and may spur further coordinated investments along the industrial chain's upstream and downstream.

For the entire industry, this signifies a positive capacity and technological reserve. However, there is also a need to remain vigilant against the risk of over-investment and a disconnect from market demand.