Terrifying! Net Profit Soars by 1895%

![]() 07/18 2024

07/18 2024

![]() 643

643

The boss pulls out 30 billion to invest in this!

Recently, Will Semiconductor released its 2024 first-half earnings forecast.

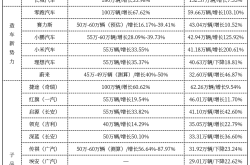

Revenue is expected to reach between 11.904 billion and 12.184 billion yuan in the first half of the year, representing a year-on-year increase of 34.38%-37.54%.

Net profit is expected to reach between 1.308 billion and 1.408 billion yuan, a year-on-year increase of 754.11%-819.42%; non-recurring profit is projected at 1.318 billion to 1.418 billion yuan, reversing a loss of 78.9613 million yuan in the same period last year, for a year-on-year increase of 1769.15% to 1895.79%.

It is worth noting that the first-half net profit has far surpassed the entire year of 2023.

In 2023, Will Semiconductor's revenue was 21.021 billion yuan, up 4.69% year-on-year; net profit attributable to shareholders was 556 million yuan, and non-recurring profit was 138 million yuan, up 43.70% year-on-year.

As of press time, Will Semiconductor's market value stands at 132.8 billion yuan.

Regarding the reasons for the significant year-on-year increase in first-half 2024 earnings, Will Semiconductor stated that the introduction of products into the high-end smartphone market and the continuous penetration of autonomous driving applications in the automotive market have led to notable growth in the company's operating revenue.

Semiconductor design is the pillar of Will Semiconductor, accounting for 85.57% of total revenue last year. Among them, image sensors (CIS chips) accounted for 74.1%, while touch chips and analog chips each accounted for nearly 6%.

CIS chips are the core components of camera modules, primarily used to capture light and convert it into digital signals. They account for half of the cost of camera modules and are one of the most critical factors affecting imaging quality. Will Semiconductor is China's leading CIS chip manufacturer, ranking third globally, after Sony and Samsung.

Will Semiconductor's CIS chip products are primarily used in mobile phones, especially high-end flagship models, as well as in-vehicle cameras. The significant increase in Will Semiconductor's performance is related to the improved inventory situation of downstream mobile phone manufacturers and the popularity of autonomous driving, Internet of Vehicles, and smart car applications.

Renrong Yu, the founder of Will Semiconductor, is known as China's richest chip tycoon. Born in Ningbo in 1966, he graduated from Zhenhai High School in 1985 and was admitted to Tsinghua University's Department of Wireless Communications (now the Department of Electronic Engineering) that same year. Many of his classmates from that year have become influential figures in the semiconductor industry, including Weiguo Zhao, Chairman of Tsinghua Unigroup and Yangtze Memory Technologies, Chenhui Feng, co-founder of RF chip leader Rise Microelectronics, and Qingming Shu, one of the founders of GigaDevice Semiconductor.

After graduating from Tsinghua University, Yu Renrong first worked as an engineer at Inspur Group before joining the Beijing office of Hong Kong-based Longyue Electronics as a salesperson, selling electronic components. In 1998, Yu founded Beijing Huaqing Xingchang Science and Trade Co., Ltd., continuing to sell electronic components. Later, by acting as an agent for ON Semiconductor products, he earned considerable profits.

In 2003, under the guidance of an ON Semiconductor executive, Yu adjusted his approach, providing customers with various product application solutions in addition to distribution and supply, helping them reduce R&D costs. This laid the foundation for his future entry into the semiconductor design business.

In 2007, Yu founded Will Semiconductor and entered the semiconductor design business. His previously successful electronic component sales business continued to operate.

In 2013, Will Semiconductor integrated several companies founded by Yu previously that sold electronic components.

Starting in 2014, it successively acquired Beijing Taihe Zhiheng Technology, Wuxi Zhongpu Microelectronics, and Wuhan Guohe Technology, invested in Wuxi Zhongpu Micro, expanded its industrial layout, and developed Lenovo, ZTE, and Xiaomi as customers.

Despite its efforts, Will Semiconductor was still seen as an electronic component distributor until its listing in 2017. This is not surprising, as electronic component distribution revenue was 1.675 billion yuan, accounting for 69.9% of total revenue, while semiconductor design revenue was 721 million yuan, accounting for 30.1%.

Will Semiconductor's most significant milestone was its acquisition of Beijing OmniVision, the world's third-largest image sensor chip manufacturer.

Beijing OmniVision's total assets were almost five times that of Will Semiconductor, and its net assets were nearly eight times higher. Over two years, Will Semiconductor spent 13.5 billion yuan to complete the acquisition in 2019. Through this acquisition, Will Semiconductor shed its distributor label and acquired the status of a major image sensor chip manufacturer. Will Semiconductor's revenue also underwent significant adjustments, with image sensor revenue becoming the primary source of income.

In 2020, Yu Renrong ranked among the Hurun China Rich List with a net worth of 55 billion yuan, earning the title of China's richest chip tycoon. In the 2023 Hurun Rich List, Yu's net worth remained as high as 44 billion yuan.

Yu Renrong not only runs businesses but also invests – both through Will Semiconductor and personally.

In 2022, Will acquired Zhuhai Siruibo for 233 million yuan to layout display solution products.

Yu's personal investments include direct funding of enterprises and serving as a limited partner (LP) in over 10 private equity investment funds focused on the semiconductor sector.

For example, Zhongke Feice, a semiconductor quality control equipment company previously reported by PencilNews, is personally invested in by Yu Renrong. In 2020, he invested nearly 10 million yuan in Zhongke Feice and held 1.1494 million shares, or 0.48%, before the IPO.

Xinhenghui, which focuses on integrated circuit packaging and testing, was jointly acquired by Yu Renrong at the invitation of Ren Zhijun, an alumnus of Tsinghua University's Department of Electronic Engineering. Before the IPO, Yu directly and indirectly held 31.96% of Xinhenghui's shares, making him the largest shareholder.

As an LP, Yu has invested in funds such as Huixin Capital, Zhiyudongwei Venture Capital Partnership (Limited Partnership), Hefei Fengyuanrenchin Equity Investment Partnership (Limited Partnership), among others. According to Venture Capital Daily statistics, the funds in which Yu serves as an LP have successively invested in listed companies such as Dongwei Semiconductors, Nanxin Semiconductor, Weidao Technology, Depong Technology, and Grandchip.

Yu Renrong is also passionate about education and has donated to establish Ningbo Dongfang University of Science and Technology in his hometown. The Ningbo Municipal Government has contributed 16 billion yuan to select the school site and plan a total land area of approximately 2300 mu. Yu's foundation will invest 10 billion yuan in university infrastructure construction, and on this basis, it will invest more than 20 billion yuan in school operating funds to ensure the university's development.

Ningbo Dongfang University of Science and Technology plans to enroll undergraduate students in 2025, aiming to become a globally influential new research university.

Mingshan Yongshui nurtured Yu Renrong, and he, in turn, contributes to his hometown through education, earning respect from all quarters.

This article does not constitute any investment advice. This article also references reports from Market Value Observation, Venture Capital Daily, and Brocade, to whom we express our gratitude.