China's leading lens brand sees significant slowdown in growth despite AI investments, struggles to maintain high-end positioning

![]() 10/11 2024

10/11 2024

![]() 708

708

Produced by | Zidan Finance

Art Directed by | Qian Qian

Edited by | Song Wen

On September 11, Mingyue Optical Co., Ltd. (hereinafter referred to as "Mingyue Optical") announced that its director Peng Yunfei has resigned from his position as director and member of the Strategy and Investment Committee due to personal reasons.

In fact, in addition to the change in directors, Mingyue Optical, as a leading domestic lens manufacturer, currently faces numerous challenges, including intense competition both domestically and internationally, declining growth rates, immature integration of AI and eyewear technology, and delays in fundraising projects.

According to Mingyue Optical's 2024 interim report, the company achieved revenue of RMB 385 million in the first half of this year, an increase of 5.21% year-on-year; net profit attributable to shareholders was RMB 88.97 million, an increase of 11.04% year-on-year. While both revenue and net profit increased, they were the lowest growth rates since the company's listing in 2021.

In the same period last year, the company's revenue and net profit growth rates were as high as 27.78% and 53.38%, respectively.

Furthermore, after Chairman Xie Gongwan announced the company's "permanent withdrawal from the price war," it remains to be seen whether Mingyue Optical can maintain its high-end positioning amidst declining consumer spending trends.

1. The Xie Family's Wealth Shrinks by 40%

When it comes to optical lenses, many consumers think of well-known foreign brands such as Zeiss and Essilor. Domestically, Mingyue Optical is also a leading brand in optical lenses.

Mingyue Optical was founded by Xie Gongwan. Public information shows that in 1986, at the age of 18, Xie Gongwan traveled to northeast China to sell spectacles and frames as a hawker, earning his first pot of gold.

Afterwards, Xie Gongwan continued his entrepreneurial journey in the eyewear industry in Danyang City, Jiangsu Province. According to the Danyang Municipal People's Government website, Danyang is the largest production base for optical lenses in China, accounting for about 70% of the country's total output and half of the world's total output.

In 2002, Xie Gongwan, along with his brother Xie Gongxing and sister Xie Weiwei, founded Mingyue Optical. Since then, the business has grown significantly, and Mingyue Optical has successfully entered the capital market.

On December 16, 2021, Mingyue Optical was listed on the ChiNext board of the Shenzhen Stock Exchange, with Xie Gongwan, Xie Gongxing, and Xie Gongwan's brother-in-law Zeng Shaohua as the actual controllers. Mingyue Optical is also the first domestic lens manufacturer to list on the A-share market.

From a hawker selling spectacles on the street to the chairman of a renowned listed eyewear company, Xie Gongwan can be said to have created a business "miracle."

According to Frost & Sullivan data, in the 2023 retail landscape of the Chinese brand lens industry, Mingyue Optical ranked first with a 12.4% market share in terms of retail sales.

However, in recent years, Mingyue Optical's performance in the capital market has been disappointing.

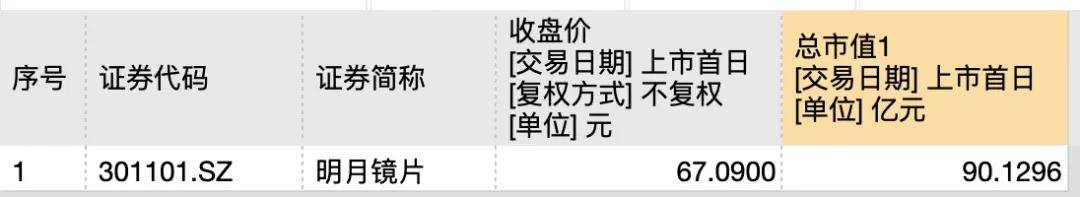

Mingyue Optical's IPO price was set at RMB 26.91 per share. On its listing day, the company's share price surged 149.31% to close at RMB 67.09 per share, giving it a total market value of RMB 9.013 billion. At that time, based on the actual controllers' shareholding ratio of 61.21% after the IPO, the Xie family's wealth exceeded RMB 5.5 billion.

(Image / Wind)

However, the share price surge on the listing day did not last long. Affected by market conditions and other factors, Mingyue Optical's share price has been on a downtrend.

To boost market confidence, Mingyue Optical has made adjustments.

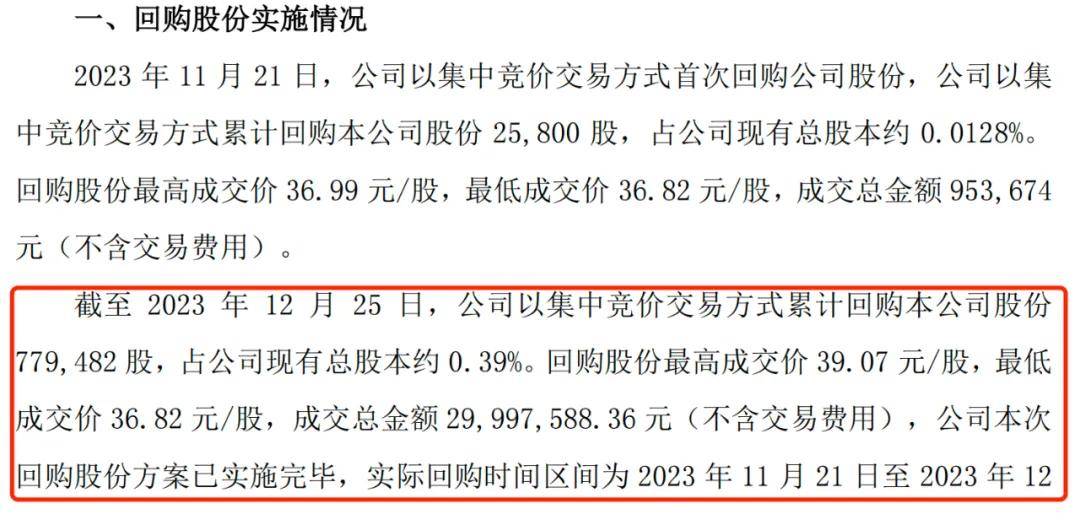

In October 2023, Mingyue Optical announced its first share repurchase plan since going public. On December 25 of the same year, the share repurchase plan was completed, with a total of 779,500 shares repurchased, accounting for approximately 0.39% of the company's total share capital, at a total cost of RMB 29.9976 million.

(Image / Mingyue Optical Announcement)

However, the company's share price rose briefly before falling again. As of the close on October 10, Mingyue Optical's share price was RMB 26.74 per share, with a market value of only RMB 5.388 billion. Since the beginning of the year, the company's share price has declined by 35.39%.

According to the 2024 interim report, Xie Gongwan, Xie Gongxing, and Zeng Shaohua directly and indirectly hold 62.948% of Mingyue Optical's shares. Based on this, the Xie family's current wealth has fallen to around RMB 3.3 billion, a decrease of nearly 40% from the initial RMB 5.5 billion at the time of the IPO.

However, on September 24, a series of significant positive announcements were released at a press conference held by the State Council Information Office, leading to a collective surge in China's A-share indices. After the National Day holiday, the Shanghai Composite Index briefly reached a high of 3,600 points.

Whether Mingyue Optical can ride this bull market wave to achieve a share price "comeback" remains to be seen.

2. Higher Sales and Marketing Expenses Than Peers, Fundraising Projects Delayed by Three Years

Mingyue Optical's primary business is optical lenses. Unlike other consumer goods, eyewear retail is a low-frequency purchase. According to an iResearch survey, consumers spend between RMB 400 and RMB 2,000 on glasses, with an average replacement cycle of about 15 months.

(Image / "iResearch: China Eyewear Industry White Paper")

Due to the low frequency of consumption, the lens industry relies on "high margins" to maintain profitability. Public data shows that from 2021 to the first half of 2024, Mingyue Optical's gross profit margins were 54.69%, 53.97%, 57.58%, and 59.40%, respectively. Overall, the company's gross profit margin has remained at a high level.

(Image / Wind)

To increase brand awareness, Mingyue Optical has continued to invest in advertising. As early as 2017, Mingyue Optical invited Chen Daoming as its brand ambassador. In 2022, the company signed Liu Haoran as its brand ambassador.

(Image / Mingyue Optical Announcement)

As a result, Mingyue Optical's sales and marketing expenses are also substantial. According to the 2023 financial report, the company's sales and marketing expenses were RMB 147 million, an increase of 46.02% over 2022. Among them, advertising expenses amounted to RMB 53.4342 million, an increase of 46.02% year-on-year. In 2023, Mingyue Optical's sales and marketing expenses accounted for 19.69% of its revenue.

(Image / Mingyue Optical 2023 Financial Report)

Furthermore, in the first half of 2024, Mingyue Optical's sales and marketing expenses were RMB 73.5828 million, an increase of 9.51% year-on-year, accounting for 19.11% of revenue.

(Image / Mingyue Optical 2024 Interim Report)

In comparison, one of Mingyue Optical's competitors, Conant Optics (2276.HK), reported sales and distribution expenses of RMB 103 million and RMB 53.6 million in 2023 and the first half of 2024, respectively, with revenues of RMB 1.76 billion and RMB 976 million, respectively. Sales and distribution expenses accounted for 5.86% and 5.49% of revenue in the corresponding periods, significantly lower than Mingyue Optical's ratios.

(Image / Conant Optics 2023 Financial Report, 2024 Interim Report)

While increasing marketing investments, Mingyue Optical has also emphasized R&D as its foundation, continuously investing in R&D and upgrading technology. However, in recent years, Mingyue Optical's R&D expenses have only been around RMB 20 million. In 2023 and the first half of 2024, Mingyue Optical's R&D expenses accounted for 3.74% and 3.82% of revenue, respectively.

(Image / Wind (unit: RMB 10,000))

In the first half of 2024, Conant Optics, a peer company, reported R&D costs of RMB 48.399 million, accounting for 4.96% of revenue, significantly higher than Mingyue Optical's ratio.

(Image / Conant Optics 2024 Interim Report)

It is noteworthy that the R&D and expansion projects that Mingyue Optical declared during its IPO have yet to be completed.

According to the announcement, Mingyue Optical intended to use RMB 568 million of the funds raised through its IPO primarily for projects such as expanding high-end resin lens production, expanding conventional resin lens production and technological upgrading, constructing a research and development center, and building a marketing network and product display center.

(Image / Mingyue Optical Announcement)

However, as of the end of July 2024, only RMB 118 million had been invested in Mingyue Optical's fundraising projects.

Among them, the high-end resin lens expansion project was intended to use RMB 300 million of the funds raised, with an expected completion date of March 20, 2024. However, as of the end of July 2024, only RMB 26.2002 million had been invested in the project, and the expected completion date had been postponed to March 20, 2027, a delay of three years.

In response, Mingyue Optical stated that the project delays were due to fluctuations in the macroeconomic environment in 2021 and 2022, which affected the company's industry in the short term.

Furthermore, the research and development center construction project was intended to invest RMB 62.1047 million of the funds raised, but only RMB 24.8492 million has been invested so far. The research and development center construction project is primarily intended to provide a research and development platform for the development of new technologies and products.

It is evident that nearly three years after its IPO, Mingyue Optical has not successfully completed the projects it planned to invest in during its IPO. According to the announcement, as of June 30, 2024, Mingyue Optical's fundraising account balance was RMB 532 million, earning interest on demand deposits in bank accounts.

(Image / Mingyue Optical Announcement)

Shen Meng, a director at Centurion Capital, once analyzed to the media that the delays or even terminations of fundraising projects were partly due to the poor market environment and weakening demand. On the other hand, some companies still aim to expand capacity when raising funds during IPOs, but overcapacity in the real world can render some fundraising projects inherently unreasonable.

Therefore, a comprehensive assessment and consideration are needed to determine whether Mingyue Optical's fundraising projects can be successfully completed.

3. Permanently Withdrawing from the Price War: What is the Effectiveness of Increased AI Investments?

As early as January 17, 2019, Mingyue Optical held its 2019 strategic conference titled "Reconstructing New Momentum in the Industry" at Shanghai Tower. During the conference, Xie Gongwan announced that Mingyue Optical would permanently withdraw from the price war.

It is understood that Mingyue Optical's decision to withdraw from the price war was based on the desire to exit the low-end, low-priced market characterized by excessive competition. The company hoped to maintain price stability by continuously improving its market supervision and management mechanisms and strictly regulating market order.

Mingyue Optical's products cover all commonly used refractive indices, including 1.56, 1.60, 1.67, 1.71, and 1.74. Generally speaking, under the same degree and diameter, the higher the refractive index of a lens, the thinner its edges, lighter its weight, and more aesthetically pleasing and comfortable its wear. Correspondingly, the price is also higher.

However, in reality, the "ideal" of permanently withdrawing from the price war is not easy to achieve.

First, there are many competitors with varying quality standards.

In China, with the exception of categories such as contact lenses, other eyewear products, including framed glasses, are not considered medical devices and have low industry entry barriers. A search for the keyword "eyewear" on Qichacha reveals that there are 2.6916 million enterprises established within the past year.

(Image / Qichacha)

Therefore, it may be challenging for Mingyue Optical to regulate market order and set industry standards by itself. Amidst declining consumer spending trends, many consumers may prefer cost-effective products. Mingyue Optical's decision not to engage in the price war does not mean that other companies will follow suit, potentially exposing the company to the impact of industry price competition.

Regarding Mingyue Optical's permanent withdrawal from the price war, Hu Shiqi, the founder of Jingfei Eyewear, told Jiemian News that overall, Mingyue Optical has done a commendable job in protecting its prices. However, in the context of intense domestic competition, there may still be external dealers using Mingyue Optical's lenses to engage in price wars.

Secondly, there is competition from foreign brands.

Currently, the domestic lens industry remains highly concentrated, with leading companies occupying a significant portion of the market.

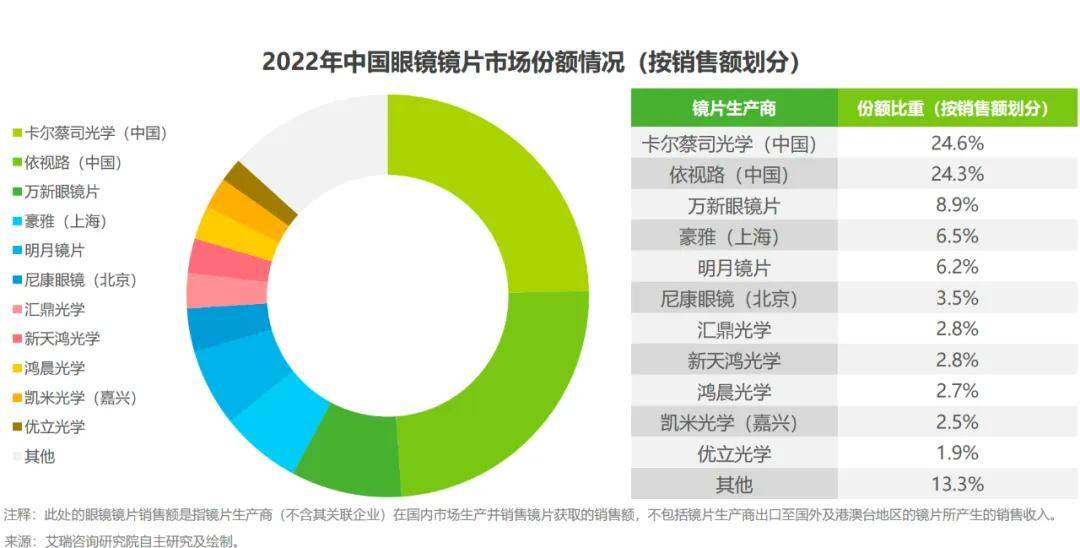

According to iResearch's "White Paper on China's Eyewear Industry," based on sales, the sales of leading companies accounted for 86.7% of the total industry sales in 2022. Among them, Carl Zeiss and Essilor both have shares exceeding 20%; Wanxin Optical Lens, representing domestic lens manufacturers, ranks third with a market share of 8.9%; followed by Hoya with a market share of approximately 6.5%. Mingyue Optical Lens, on the other hand, only has a sales share of 6.2%.

(Image / "iResearch: White Paper on China's Eyewear Industry")

It is evident that foreign brands enjoy a vast market in China. Domestic manufacturers, if not competing on price, must excel in product technology and research and development.

Hu Shiqi revealed that domestic lenses differ significantly from foreign brands like German Zeiss in terms of production processes, brand strength, formulations, and raw materials. Additionally, from a consumer perception perspective, Mingyue Optical Lens and German Zeiss are not on the same level.

Notably, the 2023 financial report indicates that Mingyue Optical Lens has just achieved mass production of its 1.60 and 1.71 freeform double-sided aspheric lenses, while the development of 1.80 ultra-high refractive resin monomers and lens preparation processes is still in the pilot testing stage.

(Image / Mingyue Optical Lens 2023 Financial Report)

Therefore, Mingyue Optical Lens may still lag behind leading foreign lens manufacturers to some extent.

It is worth mentioning that the integration of smart glasses and AI technology has continued to deepen in recent years, making glasses a gateway to information in the digital age. This, in turn, places higher demands on eyewear products.

In the first half of 2024, Meta Ray-Ban, an AI-powered glasses jointly developed by global eyewear giant Ray-Ban and Meta, unexpectedly achieved significant sales. According to GF Securities research reports, it is estimated that Meta Ray-Ban is expected to sell 2 million units in 2024, with global sales potentially exceeding 6 million units.

It is reported that Meta Ray-Ban AI integrates Meta AI technology, allowing users to perform hands-free control and information inquiries through voice commands. It offers various functions such as photography, reminders, translation, scanning, and more.

Domestic enterprises are also making significant moves in smart AI glasses.

On August 29, Thundercomm Innovation and domestic eyewear retailer Boshi Optical announced the establishment of a joint venture to collaborate on the development of a new generation of AI glasses.

In fact, Mingyue Optical Lens has also made achievements in smart AI glasses. The company's smart glasses, Sasky, feature a voice assistant that can activate Siri or Xiaoai, as well as functions for phone calls, navigation, and music relaxation.

However, compared to Meta Ray-Ban, Sasky still lags in terms of "AI intelligence," and consumers are not particularly receptive to it. According to Mingyue Optical Lens's Tmall flagship store, Sasky is priced starting at 559 yuan and has only sold 2 pairs.

(Image / Mingyue Optical Lens Tmall Flagship Store)

Nonetheless, Mingyue Optical Lens is about to make new moves. According to the company's investor Q&A, in April of this year, Mingyue Optical Lens entered into a comprehensive cooperation agreement with Leica, a German premium optics and camera manufacturer, in the field of lenses. The cooperation is currently underway. The company plans to hold a joint press conference with Leica at an opportune time in the second half of the year, where it will provide more detailed information on the partnership.

Whether Mingyue Optical Lens's increased focus on AI and cooperation with Leica will lead to new breakthroughs remains to be seen by the market.

*Images in this article are sourced from Shutterstock and used under the VRF agreement.