Airbnb: Not Bad Performance, But Has It Become a Cyclical Stock?

![]() 02/13 2026

02/13 2026

![]() 438

438

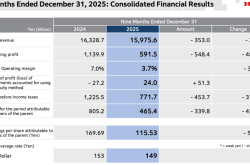

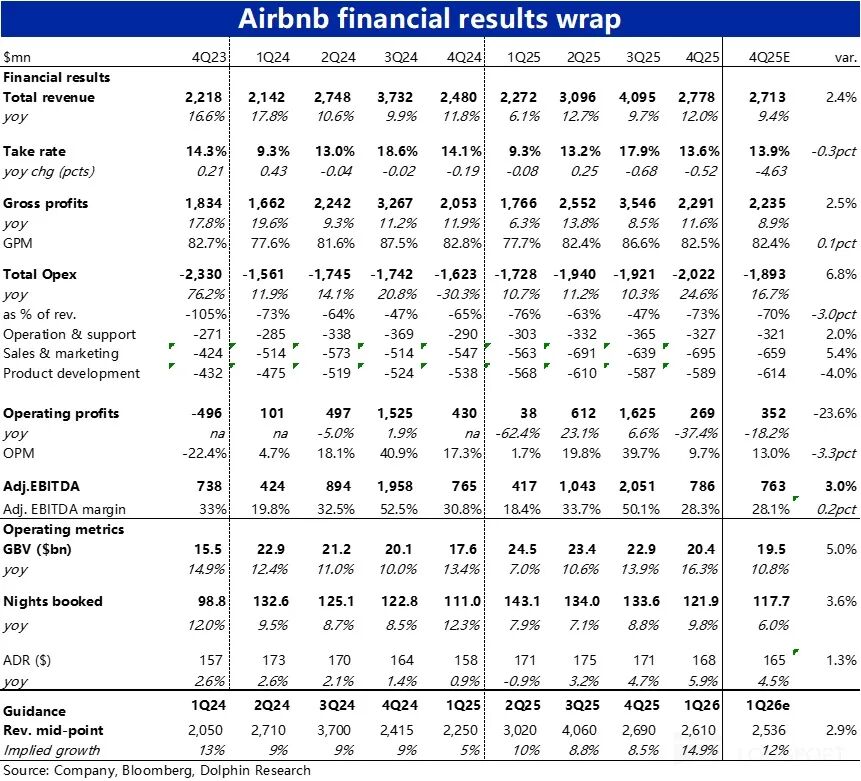

Airbnb, the leader in alternative accommodations, released its financial report for the third quarter of fiscal year 2025 this morning. Overall, the company's performance exceeded expectations. Contrary to previous guidance suggesting a potential slowdown in growth, booking value and revenue growth accelerated across the board this quarter, reaching a 25-year high. The only slight shortfall was the significant expansion in expenses, leading to a noticeable decline in profit margins—revenue increased, but profits did not rise proportionally.

Let's take a closer look:

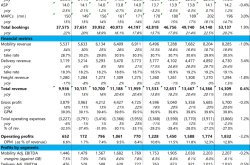

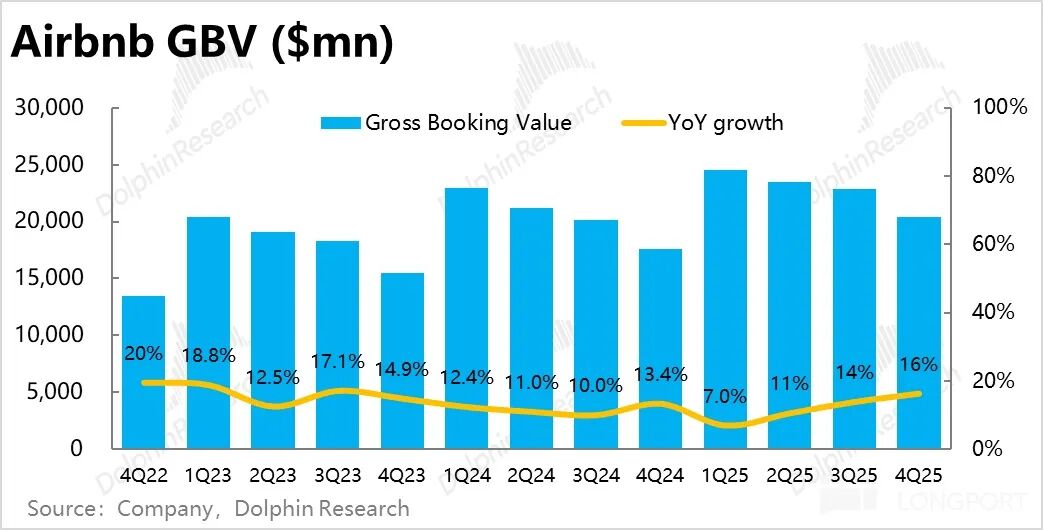

1. Price and volume both increased, indicating strong demand for travel and hospitality: Compared to the previously pessimistic guidance, actual booking growth this quarter was much more resilient. Gross Booking Value (GBV) increased by 16% year-over-year, accelerating significantly by 2.4 percentage points quarter-over-quarter, reaching a two-year high.

In terms of price and volume drivers, the more critical volume metric—total nightly bookings—increased by 9.8% year-over-year, accelerating by about 1 percentage point from the previous quarter, also marking the highest single-quarter growth in 25 years, far exceeding the previous guidance of mid-single-digit percentage growth.

Based on research, this was primarily because demand in the travel and hospitality industry was weak when guidance was provided in October, but it significantly rebounded in November and December. Driven by favorable exchange rates and widespread price increases in hotels across various markets, the average daily rate (ADR) increased by nearly 6% year-over-year this quarter, also accelerating from the previous quarter.

2. North America remained flat, while Europe accelerated: Regionally, the better-than-expected growth in bookings this quarter was partly due to the largest market—North America—not performing as poorly as feared, with nightly booking growth remaining in the mid-single digits percentage range.

Surprisingly, Europe was the main driver of acceleration, with nightly booking growth improving from mid-single digits in the previous quarter to high-single digits this quarter (the only region described as accelerating).

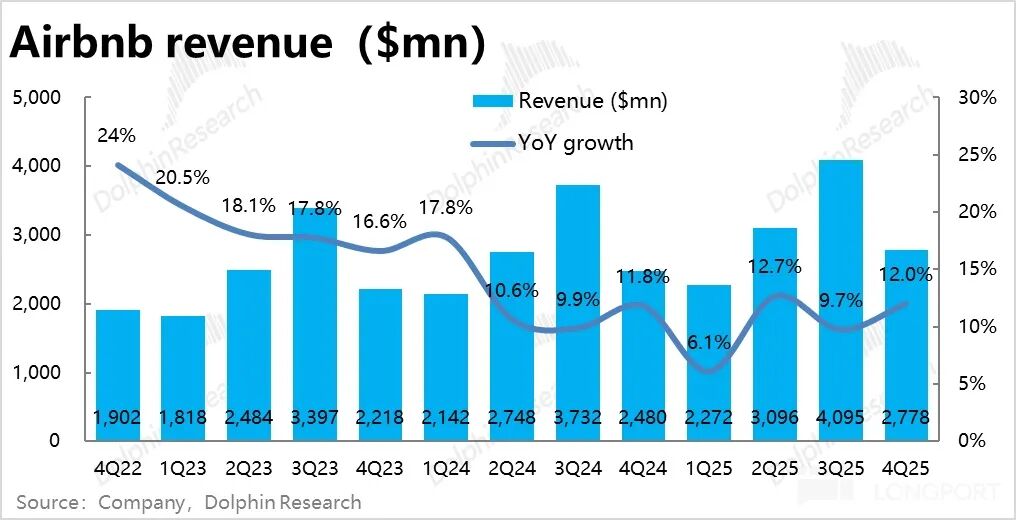

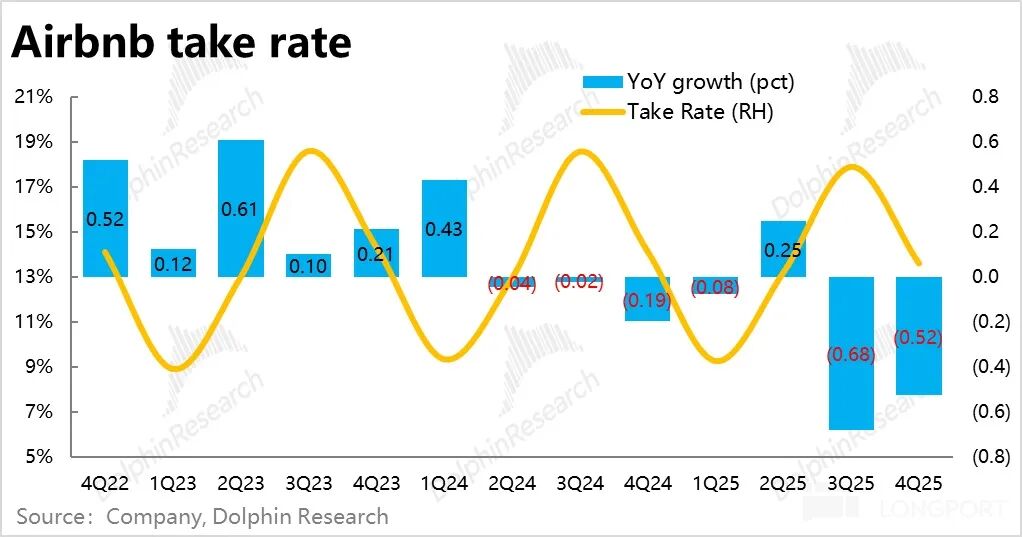

3. Declining monetization rate and relatively lackluster financial metrics: Driven by strong bookings, Airbnb's revenue increased by 12% year-over-year this quarter, accelerating by more than 2 percentage points from the previous quarter and exceeding expectations. Favorable exchange rates contributed about 1 percentage point to this growth.

However, the net monetization rate continued to decline this quarter (by about 52 basis points), with a larger-than-expected drop, causing revenue growth to lag behind GBV growth. According to the company, the decline in monetization rate was primarily due to changes in the time interval between booking and check-in.

However, with two consecutive quarters of significant declines in monetization rate, Dolphin Research suspects that longer-term factors, such as changes in the product mix of bookings, may also be at play.

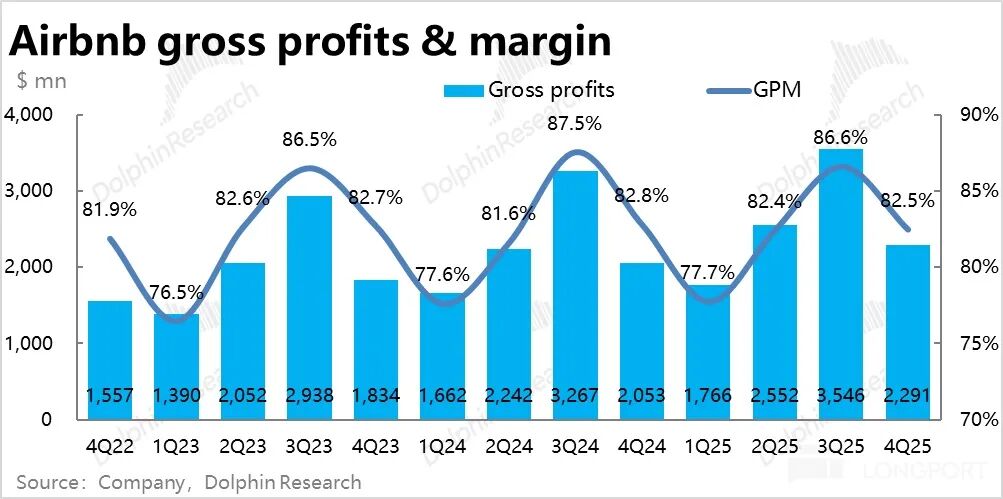

Due to the declining monetization rate, the gross profit margin narrowed by about 0.3 percentage points year-over-year this quarter, causing gross profit growth to slow further compared to revenue growth, though it still slightly exceeded Bloomberg's expectations.

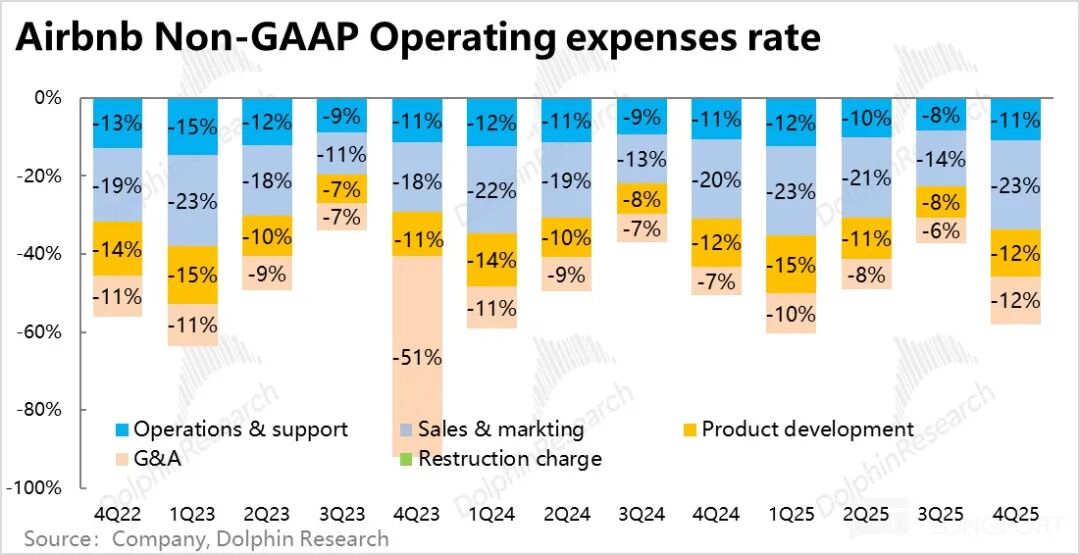

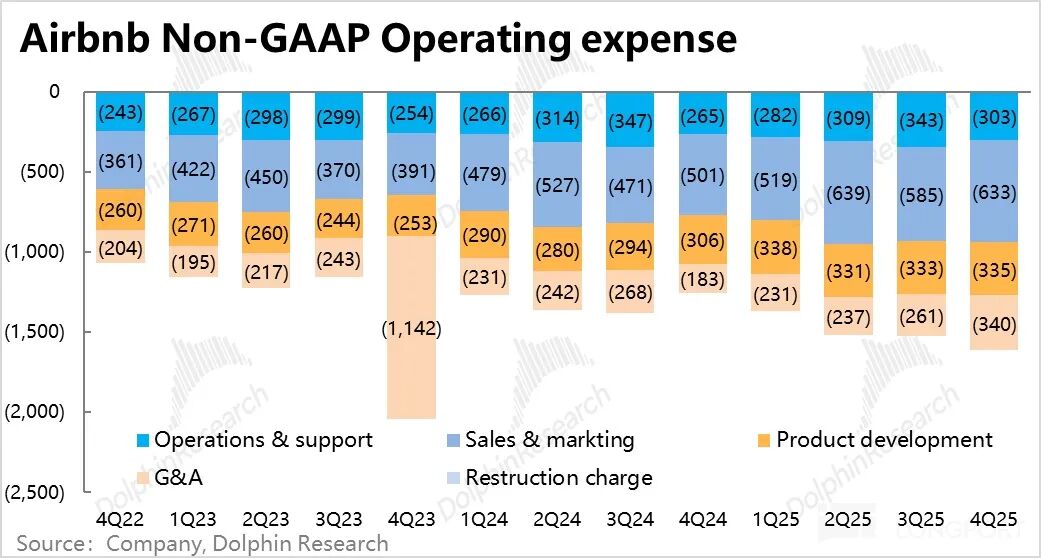

4. Significant expense growth, with revenue increasing but profits stagnant: Another issue for Airbnb is the management's repeated claims that increased investment in new businesses has led to rising expenses and shrinking profit margins. Total expenses surged by nearly 25% year-over-year this quarter, accelerating significantly from the typical growth rate of just over 10% in the first three quarters of 2025.

Specifically, expense growth across all categories accelerated from the previous quarter. Marketing expenses increased by 25% year-over-year, while product development expenses grew by 21%, reflecting the company's increased investment in customer acquisition and new business promotion. Additionally, general and administrative expenses surged by 66% year-over-year due to a low base last year, further highlighting the company's aggressive approach to expense investment.

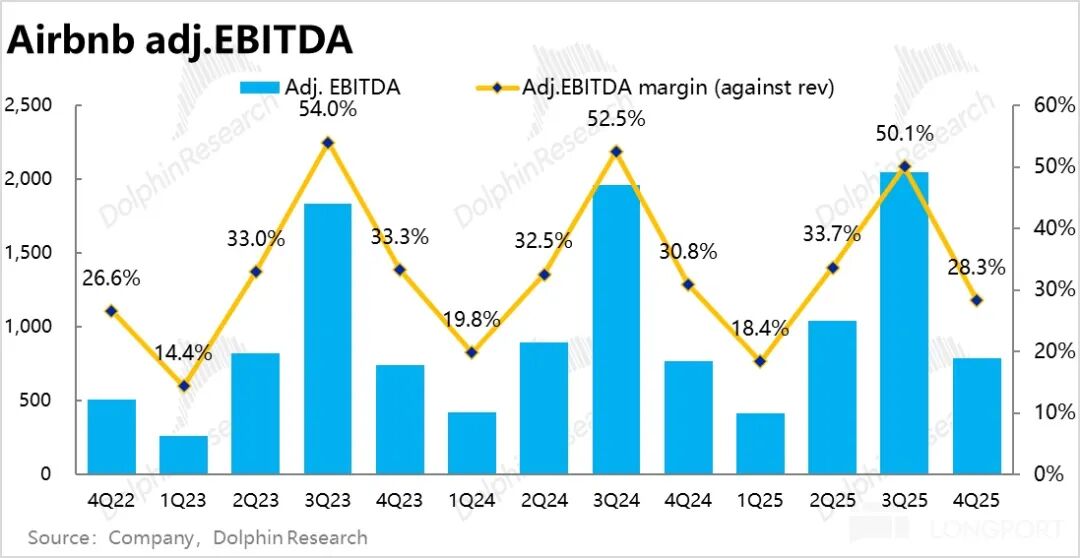

As a result, the company's profit margin (adjusted EBITDA) contracted by about 2.6 percentage points year-over-year (a larger decline than in the previous quarter), causing net profit to increase by only 2.7% year-over-year—typical of revenue growth without proportional profit growth.

Dolphin Research's View:

1. Current performance and guidance are decent

Airbnb's performance this quarter was significantly better than the pessimistic guidance provided in the previous earnings report. Growth in core businesses not only failed to slow down but instead reached multi-year highs. However, the trade-off was significant expense expansion, resulting in almost no profit growth—a notable shortcoming.

Additionally, after the stock price hit a low of around $110 following last quarter's earnings and subsequently rebounded to about $140, the market had already priced in and digested the fact that actual performance was not as pessimistic as guidance suggested. Therefore, overall, the single-quarter performance was undoubtedly positive, though not significantly exceeding expectations.

Furthermore, the company's guidance for the next quarter is relatively optimistic. Specifically, the company expects revenue to grow by 14%-16%, with a 3 percentage point tailwind from favorable exchange rates, implying a midpoint of 12% growth at constant exchange rates—accelerating by 1 percentage point from this quarter and exceeding expectations.

In terms of operating metrics, the company expects nightly bookings to continue growing in the high-single digits percentage range next quarter, while ADR will continue to rise driven by exchange rates, indicating sustained strong demand in the travel and hospitality sector.

For the full year 2026, the company guides revenue to grow by at least 10%, though profit margins are expected to remain flat year-over-year due to investment-related factors.

2. Market sentiment has shifted from pessimistic to neutral-to-optimistic

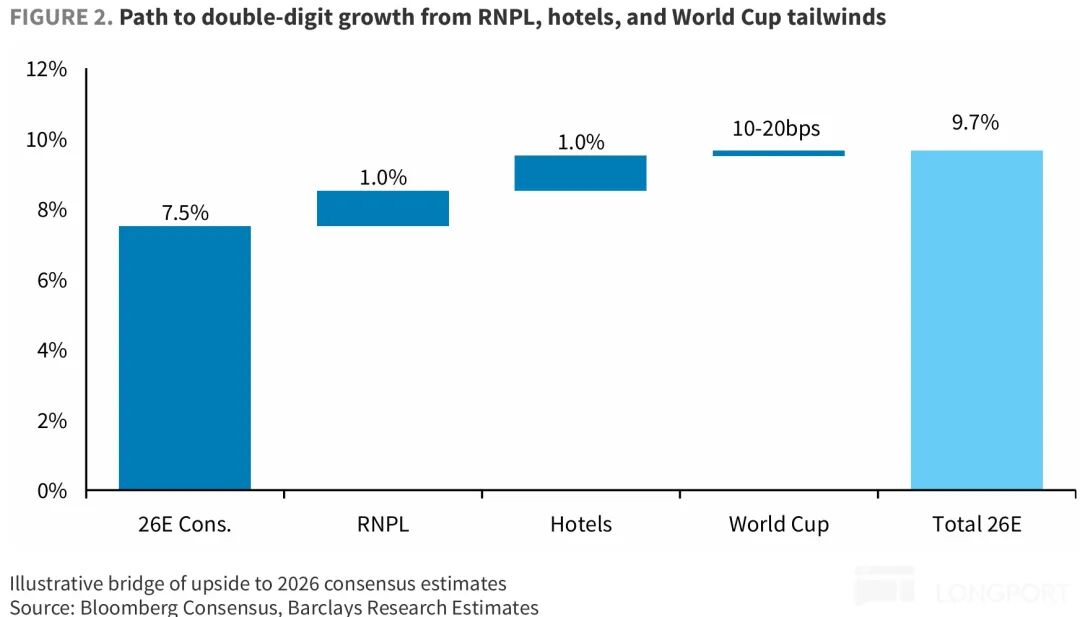

As the company's stock price has stagnated for a considerable period (generally declining or trading sideways since its 2021 peak), and the market has fully digested the negative narrative (primarily that the relative growth advantage of alternative accommodations has dissipated), Dolphin Research notes that major sell-side analysts have generally shifted their views on Airbnb from bearish to neutral.

The reasons for the shift in market sentiment include: On one hand, demand for travel in the core North American market has not deteriorated as significantly as feared, with the market now generally expecting the travel and hospitality industry to maintain steady growth in the coming years—meaning macro/industry-related downside risks have been (perceived as) eliminated.

On the other hand, from the company's perspective, with its valuation already at a relatively low level, the market's attitude has shifted from finding faults to seeking potential opportunities.

Specifically, the market currently sees three potential opportunities for the company:

a. Reserve Now Pay Later (RNPL): The company recently launched a new feature allowing some bookings in North America to defer payment from immediately after booking to one week before check-in (a simple feature). According to the company, this feature helped boost nightly booking growth by 2-3 percentage points in applicable regions.

In Dolphin Research's view, this feature clearly does not fundamentally enhance the user experience, and its boost to growth is likely temporary. However, it could still stimulate growth in the medium term.

b. Travel and hospitality demand driven by the 2026 FIFA World Cup: While this is a one-time event-driven tailwind, the fact that the tournament will be jointly hosted by the United States, Canada, and Mexico—right in the company's largest market, North America—makes it a valid short-to-medium-term catalyst.

c. Increasing hotel supply: The only factor that could bring long-term benefits is a significant increase in hotel supply, coupled with widespread adoption of paid recommendations (i.e., advertising monetization). Sell-side analysts have long anticipated this possibility, but during the last earnings call, management explicitly expressed a cautious attitude toward increasing hotel supply.

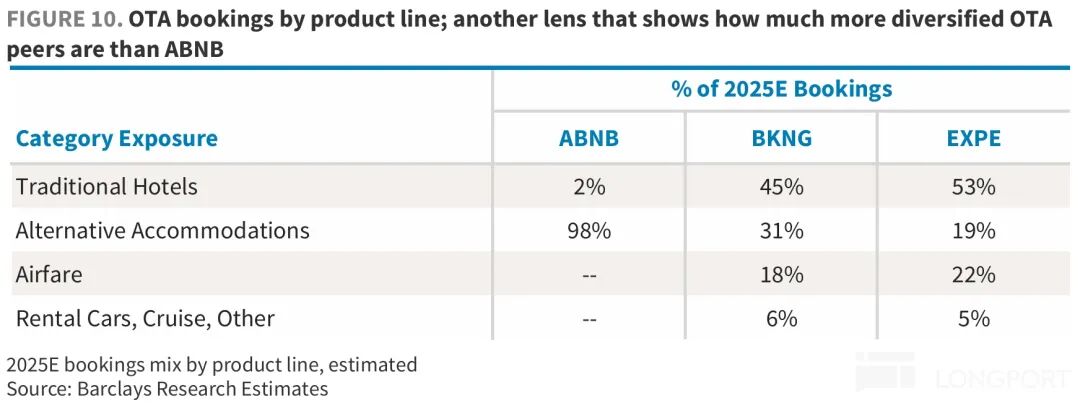

Dolphin Research believes this is fundamentally because while increasing hotel supply could immediately boost GBV and nightly booking growth, it would undermine Airbnb's brand positioning as synonymous with alternative accommodations. Management is skeptical whether the net effect would be positive or negative.

With competitors like Booking and Expedia already offering substantial alternative accommodations, Airbnb's true differentiation currently lies not in having a large volume of alternative accommodations but in having almost no traditional hotel listings. Analogous to the domestic e-commerce example, adding new supply is relatively straightforward, but the question is how to allocate traffic?

If allocated fairly, Airbnb would lose its unique identity; if alternative accommodations are prioritized, the addition of hotel listings becomes meaningless. Therefore, we remain highly skeptical about driving growth through increased hotel supply.

3. Potential impact of AI

Additionally, the transformation of industries by AI is one of the market's top concerns. Dolphin Research believes that, logically, the OTA sector is likely to be significantly impacted by AI. This is because the low-frequency, non-standardized, and complex decision-making nature of travel and hospitality makes AI-assisted decision-making more valuable. (In contrast, high-frequency, goal-oriented daily necessities shopping is less reliant on AI assistance.)

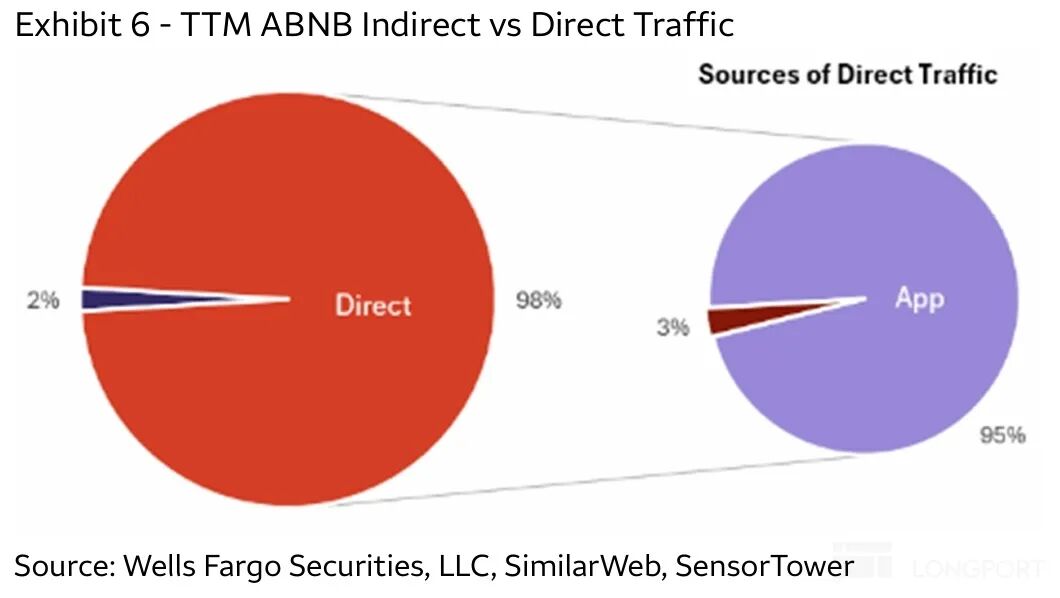

However, compared to peers, Airbnb's brand positioning as synonymous with alternative accommodations means the vast majority of its users come from organic channels, without reliance on external search or social media. Therefore, it theoretically has lower dependence on external AI entry points and should logically face less impact as AI agents grow in prominence.

However, Dolphin Research believes this advantage primarily applies to existing customers with strong demand for alternative accommodations. If AI agents indeed become the primary entry point for travel planning and hospitality bookings, Airbnb could still face competition from AI in acquiring new users.

A more detailed value analysis has been published in the article of the same name under the "Insights - Deep Dive (Research)" section of the Longbridge App.

Below is a detailed review:

I. GBV growth hits a two-year high amid synchronized price and volume increases

Compared to the previously pessimistic guidance, actual growth this quarter was much more resilient. The platform's Gross Booking Value (GBV) increased by 16% year-over-year, accelerating significantly by 2.4 percentage points quarter-over-quarter, reaching a near-two-year high. Even factoring in the tailwind from favorable exchange rates, this remains a positive signal.

In terms of price and volume drivers, total nightly bookings increased by 9.8% year-over-year this quarter, accelerating by about 1 percentage point from the previous quarter, far exceeding the previous guidance of mid-single-digit percentage growth. Based on research, this was primarily because demand in the travel and hospitality industry was weak when guidance was provided in October, but it significantly rebounded in November and December.

Driven by favorable exchange rates and widespread price increases in hotels across various markets, the average daily rate (ADR) increased by nearly 6% year-over-year this quarter, also accelerating from the previous quarter.

Based on disclosed regional performance, nightly booking growth in the largest market, North America, remained roughly flat quarter-over-quarter at mid-single-digit percentage growth, without weakening as feared.

The main region driving acceleration was Europe, improving from mid-single digits in the previous quarter to high-single digits this quarter.

Across all regions where the company operates, ADR generally increased by 2%-5% year-over-year this quarter, with the Latin American market seeing a notable 9% rise. This indicates a global trend of rising prices in the travel and hospitality sector.

II. Monetization rate continues to decline, but revenue and gross profit still exceed expectations

Driven by strong bookings, Airbnb's revenue increased by 12% year-over-year this quarter, accelerating by more than 2 percentage points from the previous quarter and exceeding expectations. Favorable exchange rates contributed about 1 percentage point to this growth. However, the net monetization rate continued to decline, by about 52 basis points, with a larger-than-expected drop, causing revenue growth to lag behind GBV growth.

According to the company, the decline in monetization rate was primarily due to changes in the time interval between booking and check-in (revenue in the current quarter corresponds to bookings made earlier, while the monetization rate is calculated by dividing current-quarter revenue by current-quarter bookings, so the time interval between booking and check-in affects the monetization rate).

However, with two consecutive quarters of significant declines in monetization rate, Dolphin Research suspects that longer-term factors, such as changes in the product mix of bookings, may also be at play.

Due to the declining monetization rate, the gross profit margin narrowed by about 0.3 percentage points year-over-year this quarter, causing gross profit to increase by 11.6% year-over-year—further slowing from revenue growth but still slightly exceeding market expectations.

III. Significant expense expansion and narrowing profit margins: Revenue increases, but profits stagnate

Another issue for Airbnb is the management's repeated claims that increased investment in new businesses has led to rising expenses and shrinking profit margins.

This quarter's expense outlay has indeed seen a substantial increase, with total expenses surging nearly 25% year-on-year, markedly accelerating from the modest growth rates of just over 10% commonly observed in the first three quarters of the previous 25 years. Excluding SBC, the situation remains consistent, with a year-on-year growth rate as high as 28%.

Specifically, the growth rates of various expenses this quarter have all increased compared to the previous quarter. The main drivers include a 25% year-on-year increase in marketing expenses, reflecting the company's strong commitment to customer acquisition and new business promotion. Similarly, the growth rate of product R&D expenses also reached 21%.

Additionally, due to a low base last year, administrative expenses surged by 66% this quarter, and this was not influenced by equity incentive expenses. From this internal expense perspective, it is clearer that the company's current attitude towards expense investment is relatively aggressive.

Consequently, the company's profit margin (adj. EBITDA basis) contracted by approximately 2.6 percentage points year-on-year (a larger magnitude than the previous quarter), resulting in a mere 2.7% year-on-year increase in profit, a classic case of revenue growth without corresponding profit growth.

Of course, from the perspective of expectation deviations, it is still better than the more conservative Bloomberg consensus estimate.

- END -

// Reprint Authorization

This article is an original piece from Dolphin Research. Reprinting is only allowed with authorization.

// Disclaimer and General Disclosure Notice

This report is intended solely for general comprehensive data purposes, designed for general reading and data reference by users of Dolphin Research and its affiliated institutions. It does not take into account the specific investment objectives, investment product preferences, risk tolerance, financial situation, or special needs of any individual receiving this report. Investors must consult with independent professional advisors before making investment decisions based on this report. Any person making investment decisions based on the content or information referenced in this report assumes all risks. Dolphin Research shall not be liable for any direct or indirect responsibilities or losses that may arise from the use of the data contained in this report. The information and data contained in this report are based on publicly available sources and are intended for reference purposes only. Dolphin Research strives to ensure, but does not guarantee, the reliability, accuracy, and completeness of the relevant information and data.

The information or opinions mentioned in this report shall not, under any jurisdiction, be considered or construed as an offer to sell securities or an invitation to buy or sell securities, nor shall they constitute advice, inquiries, or recommendations regarding relevant securities or related financial instruments. The information, tools, and data contained in this report are not intended for, nor are they intended to be distributed to, jurisdictions where the distribution, publication, provision, or use of such information, tools, and data would conflict with applicable laws or regulations, or would result in Dolphin Research and/or its subsidiaries or affiliated companies being subject to any registration or licensing requirements in such jurisdictions, nor to citizens or residents of such jurisdictions.

This report merely reflects the personal views, insights, and analytical methods of the relevant creators and does not represent the stance of Dolphin Research and/or its affiliated institutions.

This report is produced by Dolphin Research, and the copyright is solely owned by Dolphin Research. Without the prior written consent of Dolphin Research, no institution or individual shall (i) make, copy, reproduce, duplicate, forward, or create any form of copies or reproductions in any manner, and/or (ii) directly or indirectly redistribute or transfer them to other unauthorized persons. Dolphin Research reserves all related rights.