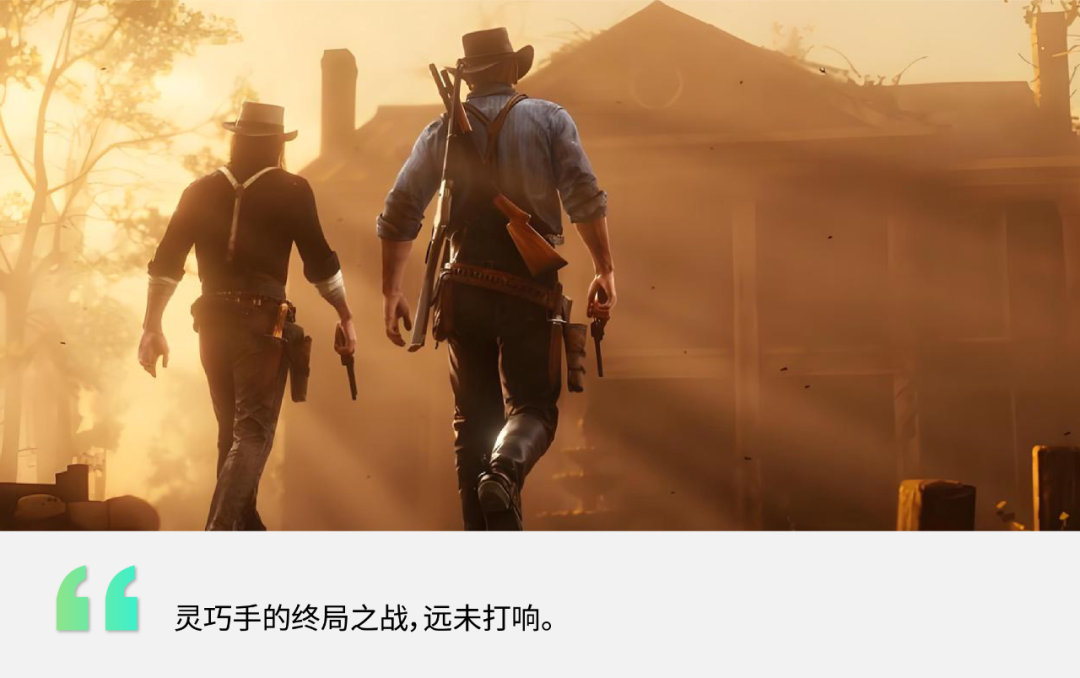

Dexterous Hand Battle: Three Types of Players, Six Strategies

![]() 08/21 2025

08/21 2025

![]() 556

556

Editor's Note: The key to robots achieving true "dexterity" lies in their hands—the final centimeters that integrate cutting-edge mechanical, sensing, and AI technologies. These dexterous hands transcend traditional grippers, evolving from industrial tools to more autonomous, human-like agents.

Amidst the wave of embodied intelligence, dexterous hands have come to the forefront. Xinghe Frequency has planned a series of articles dedicated to these hands, delving into the technological revolution encompassing "touch," "manipulation," and "creation."

We will not only spotlight the intricate technology behind their delicate joints but also reflect on the broader implications of "capability boundaries" and "human-machine symbiosis." Together with those concerned about the future, we will explore the new horizons of human-machine collaboration achievable through these "dexterous hands."

Author: Mao Xinru

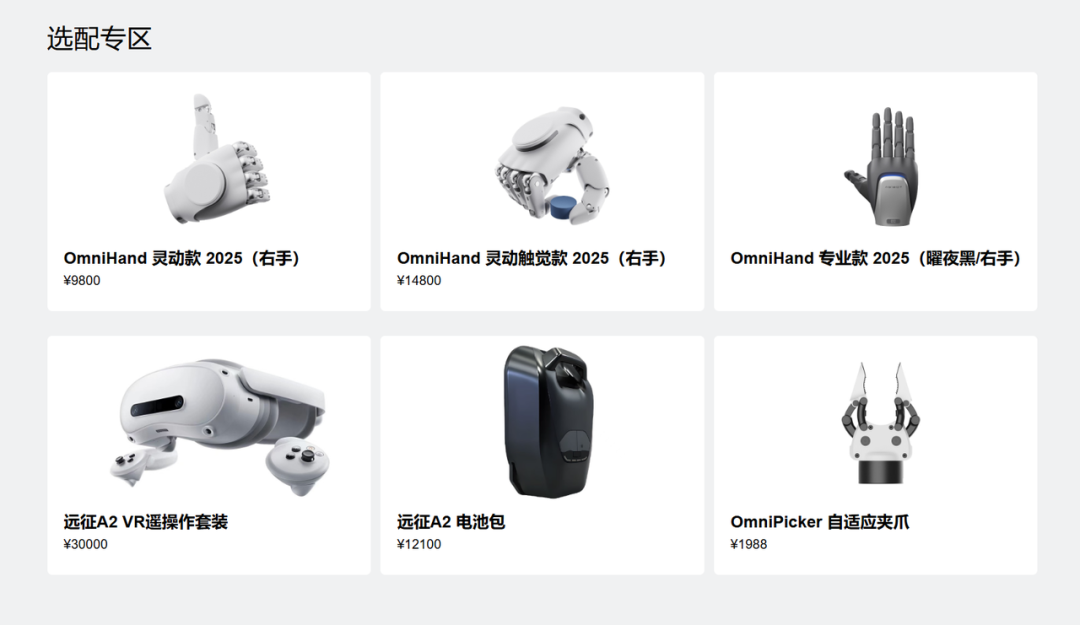

Although Zhiyuan, which did not participate in the World Humanoid Robot Games, officially launched its entire product line post-event. Besides the familiar humanoid robots Expedition, Lingxi, and Elf series, as well as the quadruped robot D1, its product portfolio also includes dexterous hands.

The OmniHand series comes in three versions: Agile, Agile Haptic, and Professional. Priced at 9,800 yuan and 14,800 yuan respectively, the Agile version boasts 10 active degrees of freedom, while the Professional version has 12. Their configurations and prices are quite compelling.

This is a rare instance of a robot manufacturer openly pricing and selling dexterous hands. Companies like Unitree, Magic Atom, and Xingdong Jiyuan also have self-developed dexterous hands but have not priced them openly, likely due to the lack of absolute advantages in pricing and parameters, as well as the effort required for subsequent product maintenance.

Besides showcasing its strength, Zhiyuan perhaps aims to expand beyond just whole robots. This underscores the fierce competition and diverse ecosystem within the dexterous hand field: diverse player types, product forms, and business models.

Currently, the domestic dexterous hand market comprises three main players, evolving six differentiated strategies.

Three Types of Players Dominate the Dexterous Hand Market

Domestic dexterous hands are burgeoning in the blue ocean of embodied intelligence. According to QYResearch, the Chinese dexterous hand market was valued at $255 million in 2024 and is projected to reach $3.739 billion by 2031, with a CAGR of 41.6%.

The domestic dexterous hand market has formed three main players vying for this multi-billion-dollar market.

The first type focuses on vertical specialization. They started with core components like dexterous hand bodies, electric grippers, or servo cylinders and now concentrate on body research and development without delving into whole robot manufacturing.

This vertical focus enables faster product iteration, greater variety, and more flexible detail design, such as supporting optional tactile/visual-tactile sensors and customized services. Domestic dexterous hand shipments primarily rely on this player type, with representative enterprises including InTime Robotics, Lingxin Qiaoshou, Aoyi Technology, Lingqiao Intelligence, and BrainCo.

These vertical vendors have launched several industry benchmark products, such as Lingxin Qiaoshou's Linker Hand research version with 42 degrees of freedom, BrainCo's Revo 2 weighing just 383g per hand, Huiling Technology's eHand-6 priced at 2,999 yuan, and InTime's FTP series and Dahuan's DH-5-6 dexterous hands with over one million cycles of service life.

The second type adopts a full-stack "hand + body" approach. Mostly manufacturers of whole robots, such as Unitree Technology, Zhiyuan Robotics, Xingdong Jiyuan, UBTech, and Magic Atom, they develop and integrate dexterous hands as a key component starting from the complete system.

Additionally, players like DMRobot and Pacini Perception use tactile sensors as their core technology to create a product matrix encompassing "core sensors - dexterous hands - robot bodies."

Their strength lies in system integration, enabling a closed loop between hands, arms, perception, and scheduling, thereby optimizing overall performance and user experience. It's also easier for them to make dexterous hands a "standard configuration" for their robots, providing end-to-end project landing services.

For instance, UBTech's self-developed dexterous hand, utilizing binocular vision + array tactile sensors, applied to the Walker S2 robot, effectively enhances production efficiency in industrial scenarios. Xingdong Jiyuan's XHand 1 not only handles multiple tasks on its Q5 and L7 robots but also garners positive reviews in overseas laboratories.

The third type comprises cross-border entrants. Their original business doesn't directly produce dexterous hands but has a background in manufacturing precision robot parts or servo motors. Representative enterprises include Zowee, RoboSense, Leadshine, and Jiangsu Leili.

These players bring manufacturing, supply chain, and cost control capabilities. Relying on the company's resource allocation, they have sufficient funds and resource integration advantages, enabling rapid entry into industrial scenario applications. However, most lack a first-mover advantage and have shortcomings in dexterous hand core areas like software, perception, and control algorithms.

Among them, Zowee released its new-generation dexterous hand ZWHAND in July this year, Leadshine introduced two dexterous hands, DH116 and DH2015, in March and June, respectively, and RoboSense also unveiled its second-generation dexterous hand Papert 2.0 earlier this year.

Six Strategies: A Diverse Landscape of Commercial Competition

Currently, the technical route for dexterous hands has not yet converged. There's no definitive conclusion on choosing direct drive, linkage, or tendon drive for transmission or on the number of degrees of freedom for products. Even the choice of three, four, or five fingers for dexterous hands hasn't fully formed a consensus.

With the technical route undecided, the choice of business model becomes crucial for enterprises' survival. The three player types have differentiated into six strategies.

The first strategy is the Professional strategy, focusing on supplying robot hands. These players concentrate on the R&D, production, and sales of dexterous hands, making them replaceable modules, emphasizing standardization, stability, scalability, and rapid integration. Target customers typically include whole robot manufacturers, automation system integrators, and companies with customized needs.

A typical representative of this strategy is Lingxin Qiaoshou, whose Linker Hand series currently has a monthly sales volume exceeding 1,000 units. Its high-degree-of-freedom dexterous hand accounts for 80% of the global market share in this category, with an expected overall shipment volume of over 5,000 units this year.

The second strategy is the Integrated strategy, balancing the medical and robotics fields. The business spans both bionic hands and dexterous hands, with the former focusing on brain-muscle electrical technology and the latter relying on robotics technology.

Representatives of this strategy are Aoyi Technology and BrainCo, which started with bionic hands and expanded into dexterous hands as a second growth curve. Bionic hands and dexterous hands share underlying technologies, providing a natural advantage of technology spillover.

Undoubtedly, both companies have identified two promising directions—medical and embodied intelligence. Dexterous hands are not only a leverage point for incremental markets but also provide financial feedback for bionic hand technology. Additionally, Lingqiao Intelligence also ventured into the medical field by opening up the brain-computer interface link at the end of 2024.

Left is Aoyi Technology's ROH-AP001, and right is BrainCo's Revo 2

The third strategy is the Supporting strategy, serving the company's own robot bodies. This is a common business model for full-stack vendors, adopted by domestic companies like Unitree and Zhiyuan, as well as foreign companies like Tesla's Optimus and Figure AI. Among them, Optimus's third-generation dexterous hand has garnered attention for its human-like high degrees of freedom and "linkage + tendon" multi-stage transmission scheme.

This model not only ensures product compatibility and stability but also facilitates rapid response and problem-solving, improving product development efficiency and quality.

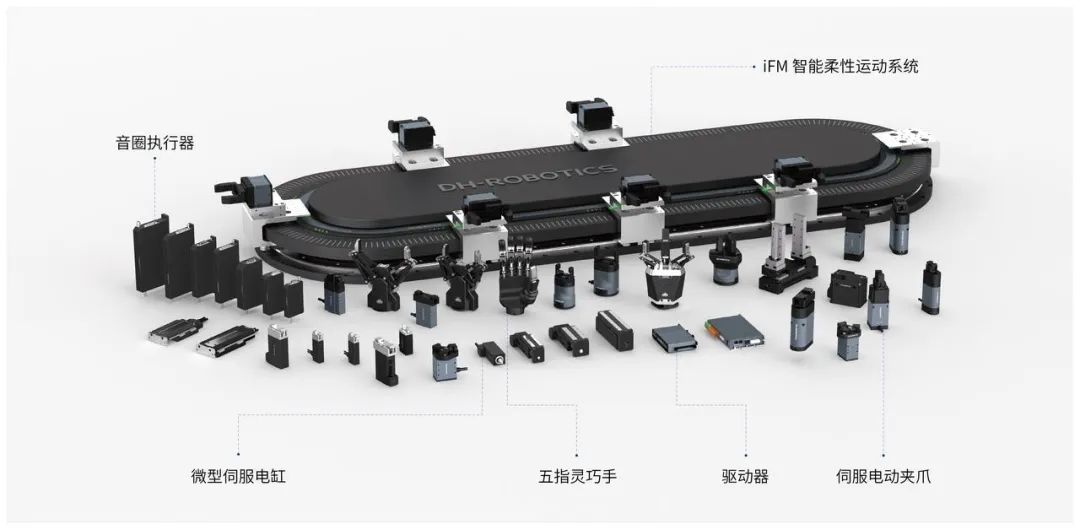

The fourth strategy is the Full Industry Chain strategy, emphasizing both core components and complete machines. These companies not only produce core dexterous hand components like motors and sensors for the market but also manufacture complete dexterous hand products based on these components. By spanning the entire industry chain, they enhance profitability and market competitiveness.

A representative of this strategy is InTime Robotics, which simultaneously supplies dexterous hands and micro servo cylinders. Currently, the cumulative shipment of micro servo cylinders exceeds 10,000 units, and dexterous hand sales surpassed 4,000 units in the first half of this year, firmly occupying the top spot in domestic dexterous hand shipments, with a target of 10,000 units for the year.

The fifth strategy covers a full product line of traditional and advanced technologies, i.e., simultaneously deploying electric grippers and dexterous hands. Enterprises with an industrial automation background, such as Dahuan Robotics, Jundo Robotics, and Huiling Technology, adopt this strategy.

Relying on their foundation in the electric gripper market, they gradually extend into the field of dexterous hands, catering to the diverse gripping needs of different customers through a rich product line. For example, Dahuan Robotics is currently the domestic sales leader in the field of electric actuators and recently launched its second-generation tactile dexterous hand DH-5-6 at the WRC.

The last strategy is the Algorithm-led Hardware-Software Integration strategy, providing integrated services of "hardware + algorithm + model + application cases." The algorithm, serving as the "brain of the hand," calculates motion parameters based on environmental information and operation commands obtained by sensors, achieving precise grasping operations.

Currently, Lingchu Intelligence and Sino-Silicon are representative players. Lingchu Intelligence's dexterous hand Psi H1 is the only one in the industry that comes with a deeply coupled operation algorithm. Sino-Silicon showcased multiple intelligent dexterous hands and embodied intelligence complete machines at the WRC, demonstrating the path of combining the physical capabilities of manipulators with large models and multi-modal perception algorithms.

Who Will Lead in the Commercial Competition?

For dexterous hands to transition from the laboratory to the market is not just a competition of parameters but a race to see who can solve the core challenges of commercialization faster.

From a product ecosystem perspective, any manufacturer needs to establish a complete product matrix and create an ecosystem that covers all needs, catering to the diverse demands of the market.

First, designing product degrees of freedom to cover the full spectrum from low to high meets the needs of different fields such as SMEs, scientific research and education, and high-end manufacturing, forming differentiated competitiveness. For instance, 6 degrees of freedom can meet basic handling needs, emphasizing low cost and high reliability, while more than 15 degrees of freedom are suitable for precision assembly, balancing reliability and flexibility.

Second, focusing on tendon drive solutions in transmission schemes is crucial. Currently, there's a coexistence of direct motor drive, linkage transmission, and tendon transmission, and this situation will persist. While most manufacturers currently choose the linkage solution, exploring the tendon direction is a necessary path forward.

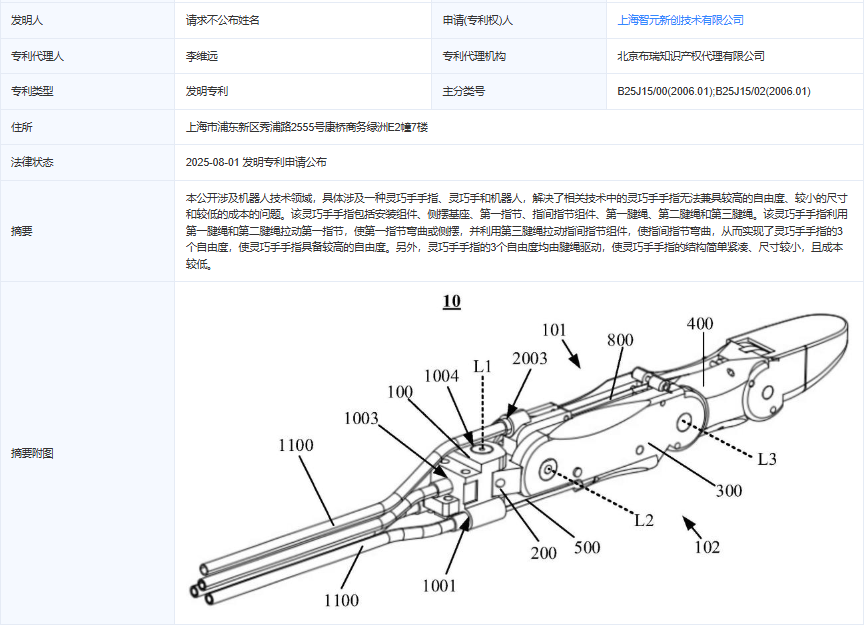

The tendon solution stands out as the most promising approach, both theoretically and practically, to breaking the "impossible triangle" of agile and dexterous robotic hands. This year's World Robot Conference (WRC) showcased two notable examples: the Cyborg-H01 cyborg robot and the Xynova Flex 1, both of which adopted this innovative tendon solution. Additionally, Zhiyuan, which recently launched a linkage solution product, also unveiled a tendon-based dexterous hand patent earlier this month, indirectly confirming the growing trend towards tendons in robotic design.

Moreover, manufacturers face significant hurdles in reducing costs and enhancing mass production capabilities. Currently, most dexterous hands on the market, particularly those equipped with tactile sensors, are priced above 30,000 yuan, whereas the market anticipates a more affordable price range within 10,000 yuan.

To address this, a multi-faceted approach to cost reduction is essential, encompassing materials, production processes, and beyond. Firstly, promoting the localization and mass production of sensors and drivers is crucial. Secondly, leveraging mature molds and processes ensures the stability and consistency of flexible materials, stabilizing yield rates. Lastly, modular and standardized design strategies minimize assembly labor and time consumption, addressing the complexity inherent in dexterous hand structures.

Mass production capability is equally vital. It signifies the transition from prototypes to real-world applications, while also testing supply chain management, production processes, and quality control. Scaling up production has the added benefit of a "snowball effect," driving down costs and enhancing market trust.

Establishing a closed data loop and achieving software-hardware coupling pose significant challenges for manufacturers. The core value of dexterous hands lies not only in their mechanical structure but also in their ability to perform complex tasks. These tasks involve uncertainty in handling unknown objects, complex environments, and dynamic interactions.

Data is the key to overcoming these challenges: grasping data, contact force data, and real-world success/failure data. Sufficient data support enables algorithms to generalize, making dexterous hands "smarter with use."

Creating a closed data loop involves three crucial steps:

- Data Collection: Deploy in real-world scenarios to continuously gather sensor and control data.

- Data Training and Modeling: Utilize machine learning, reinforcement learning, and other advanced methods for modeling.

- Feedback to Hardware: Through software updates, enhance existing hardware with new grasping capabilities.

Another prerequisite for a closed data loop is a high degree of software-hardware coupling. Dexterous hand algorithms are not "one-size-fits-all" cloud solutions; they must be tailored to specific sensors, actuators, and drive methods. Without deep integration between software and hardware, even the most sophisticated algorithms may struggle to perform effectively.

Beyond these three points, there is a hidden challenge: reliability and maintainability. In industrial settings, dexterous hands must endure high-frequency, long-duration repetitive tasks. Therefore, mean time between failures, maintenance costs, and spare part replacement cycles are crucial considerations.

Those who pioneer breakthroughs in reliability will gain a first-mover advantage in commercialization. This has been evidenced by the success of electric gripper manufacturers, which quickly entered the market not due to being "the most advanced" but rather "the most stable".

The allure of dexterous hands lies in their dual nature as cutting-edge technology and practical components that profoundly impact robot commercialization. No single advantage determines success; rather, it is those who can master engineering, commercialization, and ecosystem development simultaneously who will emerge as true winners.