Intel Concedes: A Turn of Events Amidst Capital Maneuvers and Political Pressures

![]() 08/21 2025

08/21 2025

![]() 497

497

Source: Byte Source

In the midst of summer 2025, a flurry of significant capital maneuvers descended upon Intel, reshaping its fortunes dramatically.

On August 19, Masayoshi Son of SoftBank Group unexpectedly announced a strategic investment of $2 billion in Intel, setting the subscription price at $23 per share.

Shortly thereafter, an even more astonishing revelation emerged from Washington: the Trump administration was contemplating acquiring a direct equity stake in Intel, planning to convert the approximately $10.9 billion in federal subsidies promised under the Chips and Science Act into a stake of up to 10% in the company.

This revolutionary "government equity stake" scheme transformed the Trump administration's role from mere "funder" to "shareholder," immediately altering the narrative.

For a time, the public and the market widely believed that the United States was intervening with national resolve to preserve its sole domestic company capable of mass-producing cutting-edge logic chips.

However, if the story ended here, it would be too ordinary.

The 'Stargate' initiative, cleverly woven into a series of maneuvers, reshaped Intel's fate in ways no one could have foreseen.

01

An Architect's Anxiety

Masayoshi Son was overturning his past self.

When SoftBank announced its investment in Intel, the entire market was taken aback. It wasn't the money from SoftBank that surprised people but the target itself. Intel is a factory, a traditional, asset-heavy manufacturer being left behind by the times.

Masayoshi Son dislikes factories.

Back in 1996, SoftBank invested heavily in acquiring memory manufacturer Kingston Technology, an attempt that ultimately ended in disaster and nearly bankrupted SoftBank. Later, Masayoshi Son admitted that this acquisition was a failure, and since then, he has repeatedly emphasized in numerous public forums:

'I am not interested in manufacturing.'

However, a person who has adhered to the creed of 'anti-manufacturing' for nearly three decades has now directly contradicted himself.

The answer stems from a dream, also an obsession.

Masayoshi Son's vision of the future is a world composed of 'Artificial Super Intelligence' (ASI), and he has preached to the world more than once: in 2035, ASI will be born, with intelligence 10,000 times that of humans. SoftBank aims to become the 'number one platform provider' of this new era.

To achieve this ultimate goal, he drew a massive blueprint, with the cornerstone being the 'Stargate,' a U.S. data center network supported by giants like OpenAI and Oracle, capable of sustaining the entire AI civilization.

Screenshot from OpenAI's official website

However, cracks in this grand plan had already emerged. According to reports, six months after the project's launch, progress was sluggish, with one of the core reasons being disagreements between SoftBank and OpenAI, the main user of the planned computing power, on key terms such as site selection. Desperate for computing power, OpenAI bypassed SoftBank and privately signed a significant data center agreement with another ally, Oracle.

As the leader of the plan, Masayoshi Son faced the risk of being 'sidelined.' The sense of loss of control had sharply increased.

Anxiety and loss of control resonated with his deep-seated obsession.

In 2019, SoftBank liquidated its holdings in NVIDIA, a transaction seen as a masterstroke at the time. However, NVIDIA's stock price soared, reaching $4 trillion, and SoftBank missed out on an opportunity worth over $200 billion.

A staggering figure that Masayoshi Son found hard to let go for some time.

At a summit in November 2024, NVIDIA CEO Jensen Huang even half-jokingly made a 'hugging and crying' gesture to Masayoshi Son in public.

He couldn't miss out again.

His past methodology for success also seemed to be failing, and the philosophy of seeking entrepreneurial 'madmen' was out of place in the AI era. Masayoshi Son once said to WeWork founder Adam Neumann, 'In a battle, madmen are more likely to win than smart people.' Ultimately, this 'madman' he nurtured blew himself up, causing WeWork's valuation to plummet from a peak of $47 billion, with SoftBank's nearly $19 billion investment almost wiped out.

As for Builder.ai, another star AI company invested in by Masayoshi Son with a valuation of $1.5 billion, it was an even bigger joke from hell, with little intelligence behind its core product 'Natasha.' The so-called 'artificial intelligence' was an outsourced programmer team far away in India. This company, which claimed an annual revenue of $220 million but actually only had $55 million, went bankrupt due to financial fraud.

Dreams shattered, inner anxiety, and old paths blocked.

Against this backdrop, investing in Intel and forging a new alliance of 'Arm design + Intel manufacturing' became Masayoshi Son's logically inevitable choice. Arm, which SoftBank owns 90% of, once had a market value exceeding $150 billion and is the king of global semiconductor design, but it does not manufacture chips.

Coincidentally, Intel has factories, creating a business synergy.

This was Masayoshi Son's pragmatic move to control the core links of the industrial chain after the grand narrative failed. After all, everyone knows that in the world of AI, the weight of the CPU pales in comparison to the parallel computing power of the GPU.

02

Trump's PUA Tactics

A coincidence?

To be honest, it doesn't seem so.

The two protagonists of this script – Trump and Masayoshi Son – had already reached an unspoken understanding under the blueprint of the 'Stargate.'

On January 22, shortly after the Trump administration took office, it announced the 'Stargate' initiative aimed at ensuring U.S. leadership in AI. At that time, Masayoshi Son stood beside Trump, jointly endorsing this $500 billion grand plan and promising that SoftBank would invest heavily and create jobs.

It is evident that before the Intel incident, Trump and Masayoshi Son were already deeply bound allies on national strategic projects.

Although Trump frequently threatens to ban sales of A and choke B's neck with his words, and occasionally imposes tariffs to stir up the global economy, his actions are even more unpredictable, but he is deeply anxious about the U.S. chip manufacturing industry.

Data from the Semiconductor Industry Association directly touched Trump's nerves: in 1990, the United States produced 37% of the world's total chip output, but today, that figure is only 12%, with East Asia accounting for 75% of global chip manufacturing.

The proposition of manufacturing returning is a mantra that Trump often has hanging on his lips, but the implementation of the 'Stargate' is still a long way off.

With the atmosphere already hyped up to this point, Trump and Masayoshi Son's 'double act' began.

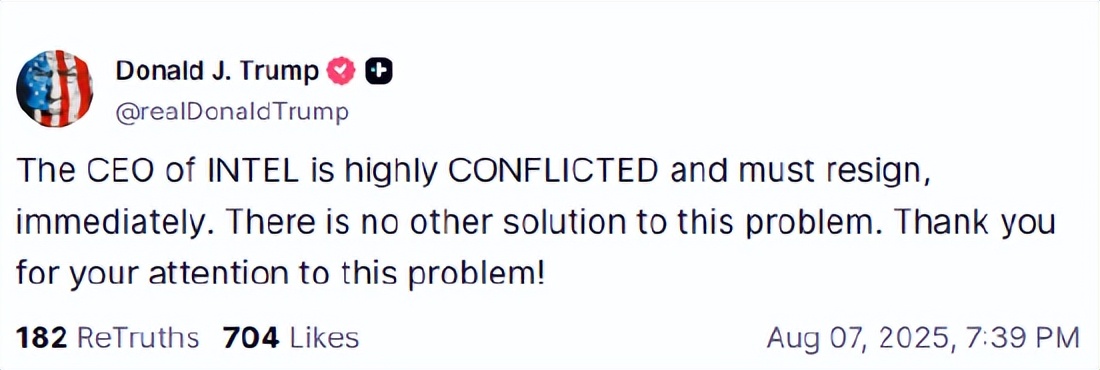

The script opens with a presidential directive filled with gunpowder, as Trump, as always, takes a seemingly random approach to attack Intel on social media.

'The CEO of Intel has a serious conflict of interest and must resign immediately.'

Screenshot from Twitter

On the evening of August 7, Trump posted this tweet. The target was Pat Gelsinger, who had only been CEO of Intel for four months. The ammunition for the attack came from a letter from Republican Senator Tom Cotton, which directly pointed out that Gelsinger had past connections with multiple Chinese semiconductor companies through Walden International, which he founded.

There's no way around it; Gelsinger's previous investment portfolio is almost a history of the growth of China's semiconductor industry: CR Microelectronics, AMEC, ACM Research, VeriSilicon, GigaDevice, these names renowned on the STAR Market, all have his fingerprints on them.

Targeting the CEO personally as a target for political pressure is a consistent style of Trump's. He has publicly criticized Apple multiple times for setting up production lines in China, forcing its CEO Tim Cook to promise to invest heavily in the United States and even gift special presents as a gesture of goodwill.

In Trump's world, CEOs and national champion enterprises are merely tools for him to achieve his agenda, even Tesla founder Elon Musk, who was once as close as brothers.

With political pressure in place, the final chapter of the script unfolded. On August 11, Gelsinger was forced to fly to Washington for a closed-door meeting with Trump at the White House.

The outcome of the meeting was highly dramatic.

A few days later, Trump posted a tweet praising Gelsinger as 'an amazing story.'

'Mr. Gelsinger and my cabinet members will exchange views next week and make recommendations to me.' With Trump's golden mouth open, capital immediately began to move.

On August 19, Masayoshi Son acted decisively, and his $2 billion injection played a dual role at this moment. It was both a self-rescue based on his own commercial considerations and a crucial support for his ally's political actions.

This investment sent a key signal to the market: a global capital giant with close ties to the White House had taken the lead in 'entering the game.'

The next day, the White House's reinforcement further transformed Gelsinger's identity from the CEO of an independent company to a partner who needs to report to the White House and execute its agenda.

03

Fading Crown

What Gelsinger inherited was a mess.

A veritable twilight of the empire.

Technology is the root of all problems. This once-undisputed semiconductor giant, the blue giant that proclaimed dominance with 'Intel Inside,' is now far behind its competitors in the most critical chip manufacturing processes.

On the financial statements, it's even more of a bloodbath.

In 2023, the much-anticipated foundry business was like a huge gold-swallowing beast, devouring $7 billion in profits and leaving only a ruin of losses. Money was needed everywhere, and to conserve cash, the company was forced to make the most painful decisions: massive layoffs and suspending the dividend that had been paid for a full 30 years.

With the bleeding unstoppable, blood transfusions were the only option.

As a result, Intel became fatally dependent on government funds. As the largest single beneficiary of the Chips and Science Act, Intel received direct financial subsidies of up to $8.5 billion.

As the saying goes, 'one who takes another's hand is short of elbow room.' What Intel took was real money from the country and the biggest bet of American taxpayers.

This weakness is particularly glaring when compared to the new industry king.

NVIDIA CEO Jensen Huang has been described as a natural performer who can wear a crisp suit to meet Trump or change into a Northeast floral jacket to yangko dance at a Chinese company's annual meeting, navigating effortlessly between China and the United States.

Facing all kinds of tricky questions from Chinese and American media, Huang can frankly express, 'I'm not balancing anything,' without any trace of performance. He has portrayed himself as a technical hub that everyone needs to court, as if declaring that he is not adapting to the rules but is part of the rules themselves.

The core reason he can do this lies in NVIDIA's unshakable 'hard currency' in the AI era: GPUs and the CUDA ecosystem. From OpenAI to Google, the ambitions of all AI giants are built on NVIDIA's computing power foundation.

In contrast, the golden age of Intel's x86 architecture is coming to an end with the decline of the PC market, and the absence of hard-core technology leaves Gelsinger lacking irreplaceable strategic value.

Wall Street sees this clearly.

Stacy Rasgon, an analyst at investment bank Bernstein, pointed out the core of the problem incisively: 'Intel needs customers in addition to money.'

The fundamental problem for Intel is that its foundry business has yet to prove it can compete with TSMC. In a performance-oriented market, even with government pressure, it is impossible to force 'hyperscale customers' like Google to purchase inferior chips, as it would weaken these customers' own global competitiveness.

Some even believe that the $10.9 billion the government plans to inject is widely questioned as being merely a drop in the bucket compared to the $40 billion needed to develop the next generation of technology.

Amid the triple crisis of internal decline, lack of external bargaining chips, and loss of market confidence, when Masayoshi Son's capital and the will of the Trump administration arrive simultaneously, this seemingly passive 'arranged marriage' is not a choice for Gelsinger and Intel.

But the only way out.

Some images are sourced from the internet. Please inform us for deletion if there is any infringement.