Intel: Holding onto NVIDIA's 'Thick Leg', Who is the Real Winner?

![]() 09/26 2025

09/26 2025

![]() 595

595

As the undeniable blockbuster event in the U.S. chip industry for the year, with the U.S. government exchanging equity for over $8 billion in subsidies and SoftBank also expressing interest in investing, NVIDIA's $5 billion investment was finally secured last night. The U.S. version of 'SMIC' has finally embraced a 'thick-legged' financial backer.

So, in this deal, who wins and who loses, and who will have the last laugh?

Let's take a detailed look at the sequence of events:

I. Sudden Development: NVIDIA Invests $5 Billion in Intel

On September 18, 2025, NVIDIA and Intel announced a collaboration to jointly develop multiple generations of custom data center and PC products, aimed at accelerating applications and workloads in hyperscale, enterprise, and consumer markets.

The specifics are as follows:

① In the data center sector, Intel will customize x86 data center CPUs for NVIDIA, integrating NVLink interfaces, which NVIDIA will then incorporate into its AI infrastructure platforms and bring to market;

② In the PC sector, Intel will launch x86 system-on-chips (SoCs) integrating NVIDIA RTX GPU chips.

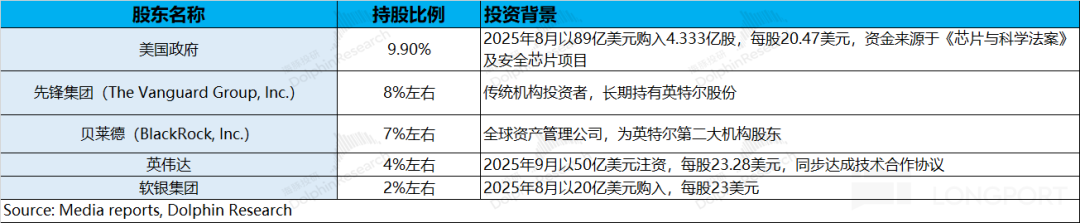

③ NVIDIA will invest $5 billion in Intel's common stock at $23.28 per share (a 6.5% discount from the closing price the day before the announcement).

II. Background: 'The Un Can lift it up Ardor' - Intel

Could Intel, once glorious in the PC era, really fall to the point of needing successive joint investments from giants? In Dolphin Tab's view, the core issue is that in the cloud and AI era, Intel has been effectively 'pierced by three arrows':

① Being 'Kicked Out' of the Data Center Battlefield:

Data Center GPUs: Intel completely missed the market opportunity for GPUs in the AI wave, lacking any presence in the data center market;

Data Center CPUs: Due to increased GPU investment, CPU updates have slowed. Intel's core customers—cloud providers—are also extending the depreciation cycles of traditional CPU servers, weakening the demand for CPU replacements.

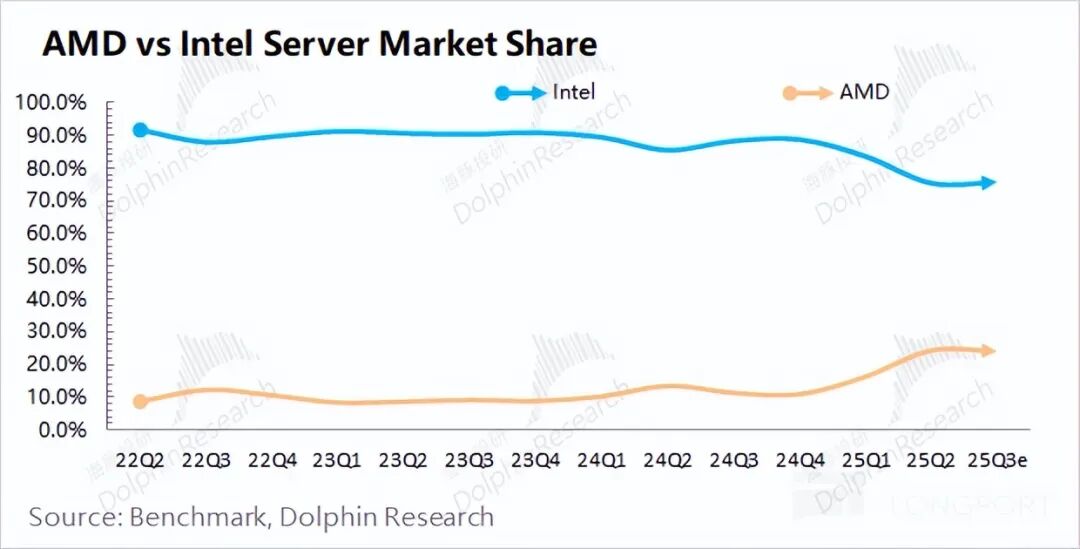

With its GPU products failing, Intel's original stronghold—data center CPU servers—has seen its market share slip from 80-90% to around 75%, as competitors AMD and NVIDIA bundle their self-developed ARM-based CPUs with rack and system integration solutions when selling GPUs.

As a result, while normal data center suppliers are thriving in the AI era, only Intel remains stagnant amid cloud providers' capital expenditures.

② PC Market:

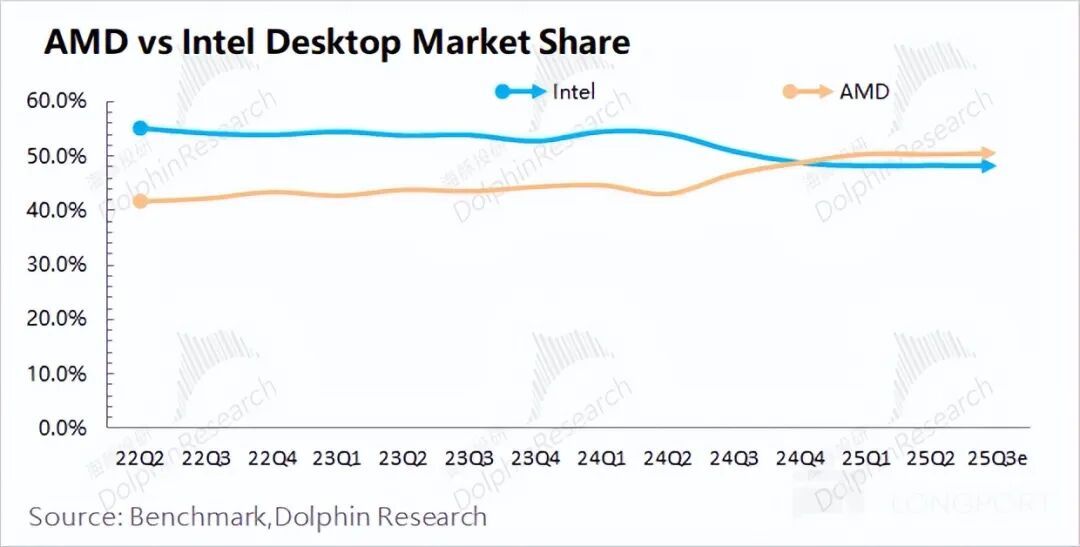

Intel is also facing significant pressure from AMD in the PC market, especially in the desktop CPU segment, where AMD has overtaken Intel in market share.

The client business, a traditional strong area and major profit source for the company, is crucial. Losing this foundation would make it difficult for the company to inspire market confidence.

Moreover, with the impending AI PC era, ARM architecture's simpler instruction set offers lower power consumption and faster speeds for GPU, CPU+NPU operations. As ARM-based computer performance improves, Intel's position in the traditional PC CPU market faces even greater threats;

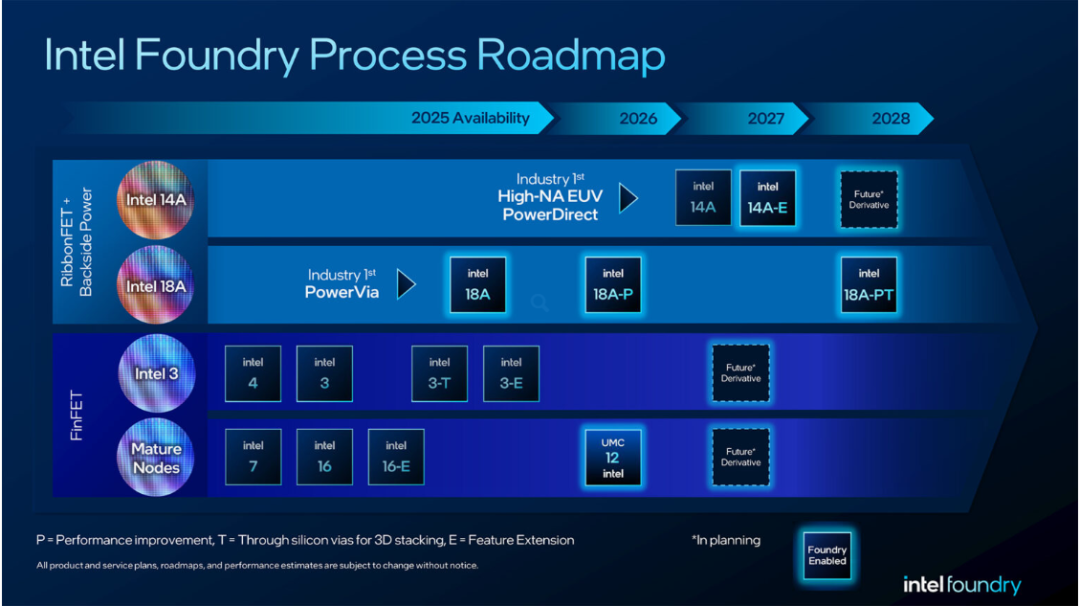

③ Slow Progress in External Foundry Services: Under a heavy asset, vertically integrated layout for self-developed and self-produced chips, Intel's internal CPU business faces diminishing prospects, with shrinking orders and a lagging foundry service. External foundry progress has not gained market trust, with the company hoping for a breakthrough at the 18A node. From a transistor density perspective, 18A remains significantly lower than TSMC's N3P, though the market accepts this lag.

The market's main concern regarding Intel's 18A is its usability. Currently, 18A has not yet won market trust. The company plans to first use the 18A process for its Panther Lake before observing market reactions.

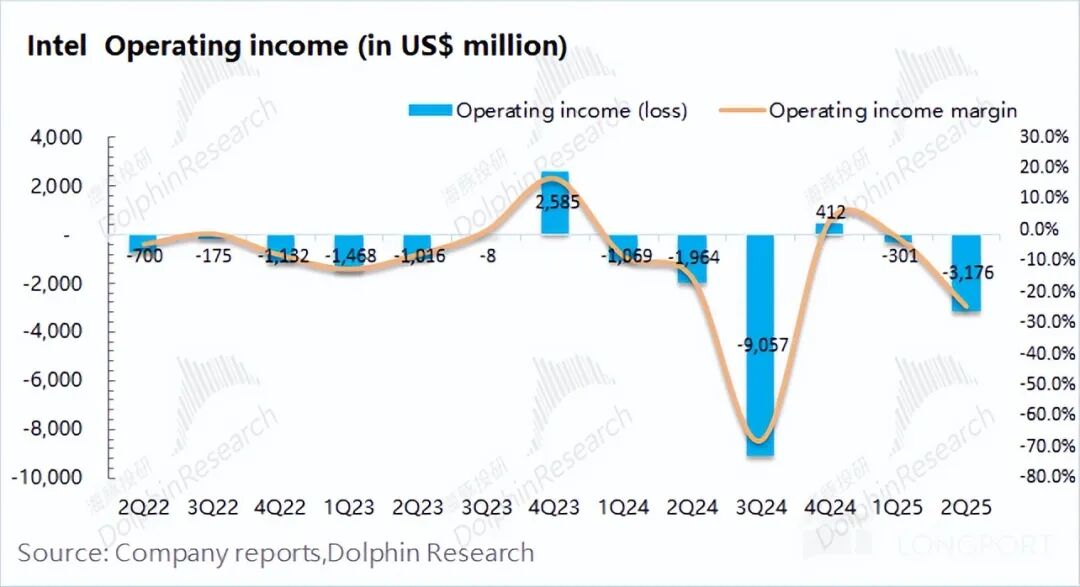

The combined effect of the above (①—③) is that Intel has faced persistent operating losses since 2022. Although it still has $9.6 billion in cash and equivalents, it cannot sustain continuous losses. At a rate of $4 billion in losses per year, this money would only last about two years.

With no improvement in business prospects, the company has resorted to layoffs, cost-cutting, and asset sales to reduce losses. Persistently struggling at the bottom, its stock price has continued to decline, with its price-to-book ratio falling to around 1x.

III. Background: 'The Inexhaustible Father' - The U.S. Government

The problem is that although Intel's asset quality is not impressive in the cloud and AI era, its foundry business is a scarce asset for the U.S. government, practically the only 'logic chip manufacturing' at the high end. Other U.S. semiconductor manufacturing assets, such as Micron and Texas Instruments, focus more on lower-end memory and automotive chips.

Thus, Intel has become a major recipient of U.S. government subsidies, receiving over $8 billion in subsidies (with $5.7 billion already received and $3.2 billion pending approval from the Trump administration), effectively becoming a 'subsidy king.' This has created a situation where an 'un Can lift it up Ardor' is paired with an 'inexhaustible U.S. government father.'

However, the Trump administration realized that constant subsidies were not a sustainable solution and adjusted its strategy to exchange subsidies for equity, thereby gaining substantial influence over the company.

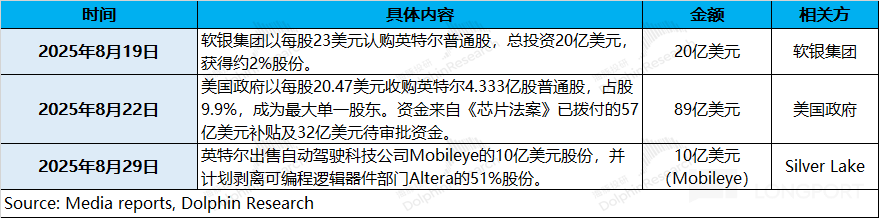

Since August, Intel has undertaken a series of moves, introducing SoftBank, the U.S. government, and NVIDIA as shareholders while selling its stake in Mobileye.

The U.S. government's equity acquisition is particularly interesting. The funds used actually come from the $5.7 billion in subsidies already allocated under the Biden administration's CHIPS Act, plus an additional $3.2 billion in pending subsidies, totaling $8.9 billion, in exchange for a 9.9% stake.

After this round of financing, a review of Intel's current equity structure reveals that while existing major shareholders like Vanguard Group and BlackRock remain primarily financial investors without controlling stakes, the U.S. government has emerged as the single largest shareholder. In other words, Intel has effectively become a U.S. state-owned enterprise.

You may recall that in previous earnings reviews, Dolphin Tab compared Intel to the American 'SMIC.' Indeed, after Trump's subsidy-for-equity maneuver, the relationship between enterprise and government resembles that of SMIC even more closely!

SMIC's substantial investments have primarily come from government and state-owned enterprise 'infusions.' In reality, both countries continue to pursue 'localization of semiconductor production and autonomous control.'

Even SoftBank and NVIDIA's involvement reeks of 'government-orchestrated' deals: the pricing of NVIDIA's equity stake offers clues—both NVIDIA's $23.28 subscription price and SoftBank's $23 subscription price are discounted from the previous day's trading price.

Typically, assets sought after by investors command a premium, while discounts are usually associated with sellers desperately seeking capital.

IV. Can Intel Truly Turn Its Fortunes Around and March Toward Prosperity?

Through recent capital maneuvers, Intel has not only replaced its CEO but also secured deep-pocketed backers like the U.S. government, SoftBank, and NVIDIA. These moves ensure that even if Intel continues to incur losses, it can sustain operations, avoiding a return to 'bankruptcy valuation' territory.

Compared to the U.S. government's previous equity stake, NVIDIA's investment brings greater confidence. NVIDIA offers not just financial support but also new business opportunities, potentially reversing Intel's decline across 'three fronts.'

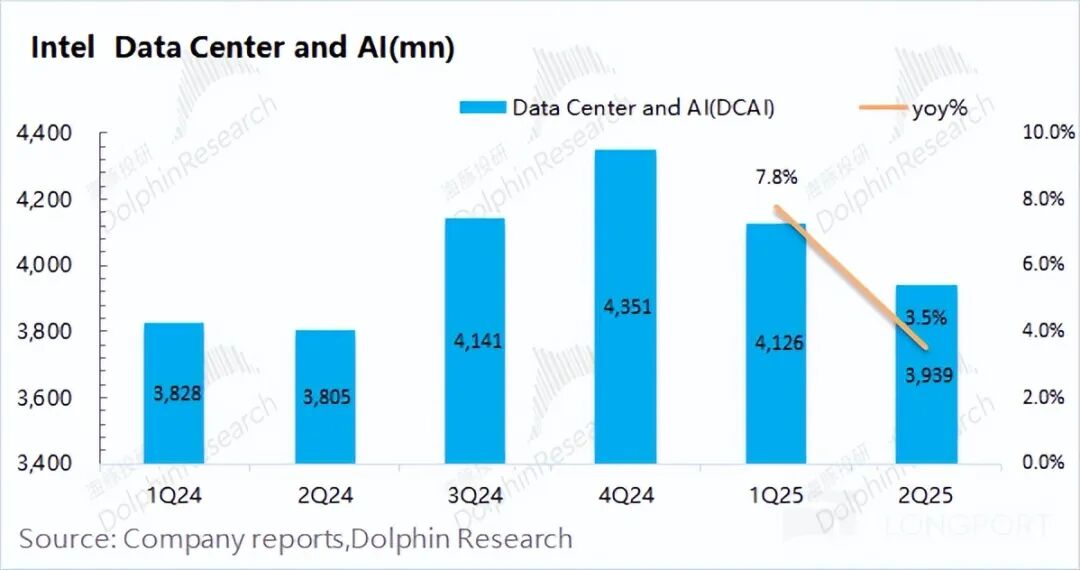

① Data Center Battlefield: Amid the current AI boom, Intel's quarterly data center revenue has hovered around $4 billion, indicating its failure to penetrate the AI mainstream. In contrast, NVIDIA is a leader in the data center market.

Previously, NVIDIA's GPU interconnection with x86 CPUs relied mainly on the PCIe protocol. After the collaboration, dedicated x86 CPUs integrate NVIDIA's NVLink interface, boosting interconnection bandwidth by 14x and directly incorporating it into NVIDIA's Rubin and Vera architecture cabinets. This effectively helps Intel's CPUs re-enter the AI data center battlefield.

② CPU Market: Intel plans to launch x86 SoCs integrating NVIDIA RTX GPU graphics cards for AI PCs and workstations, revitalizing competitiveness in the traditional PC market and challenging AMD's integrated graphics chips.

③ External Foundry Clients: NVIDIA's foundry services primarily rely on TSMC, while Intel's external foundry progress has been slow. Although NVIDIA stated that joint products might not launch before 2027 and that collaboration chips would not be manufactured at Intel's foundries, future foundry cooperation remains a possibility.

Previously hindered by persistent business 'slumps,' Intel reduced capital expenditures from $24 billion last year to $18 billion this year, roughly maintaining operational levels. As a U.S. 'state-owned enterprise,' Intel may now gain 'expand investment' confidence.

Overall, while this collaboration does not guarantee Intel's revival, it offers a chance for a turnaround through NVIDIA's support. Considering the government's focus on foundry assets—though NVIDIA made no foundry commitments this time—future foundry improvements could lead to further revaluation.

With the government investing its own funds and enlisting industry leaders, Intel clearly represents an 'untouchable' entity with assured bottom value. The government's entry price of $20 per share implicitly sets a valuation floor from a policy perspective.

V. NVIDIA: Minimal Direct Impact, but Vast Imagination Space?

For NVIDIA, this investment fulfills its commitment to the U.S. government to invest in American semiconductors. Even if the investment fails, $5 billion is a negligible sum for a company with a market capitalization exceeding $4 trillion.

From a purely business standpoint, the impact is minimal:

Whether for data center or AI PC CPUs, the collaboration primarily enhances customer experience and solutions. Given NVIDIA's current business scale, CPU revenue is unlikely to significantly boost earnings.

Direct comparison: Intel's latest quarterly data center revenue was $4 billion versus NVIDIA's $41.1 billion in the same period. Even if Intel transferred all its data center revenue to NVIDIA, it would barely make a dent.

Where NVIDIA might see meaningful impact is in NVLink ecosystem penetration:

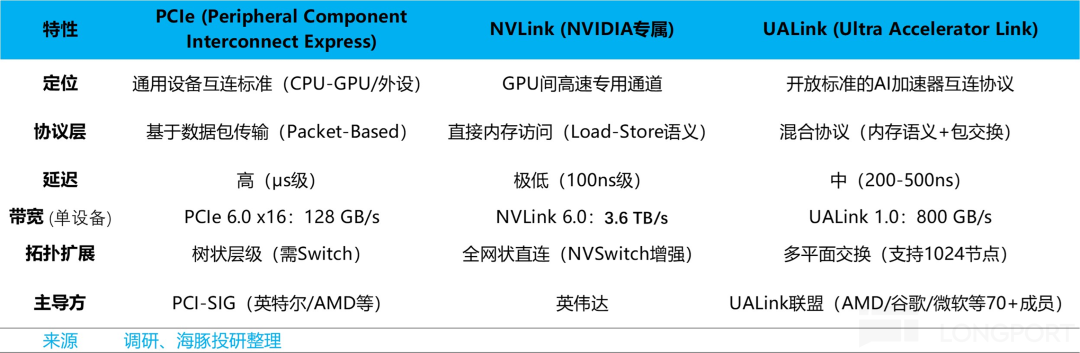

a. PCIe: A traditional interconnection protocol, PCIe is the industry-standard I/O bus for connecting CPUs to peripherals (GPUs/accelerators, network cards, SSDs). However, its bandwidth is insufficient for current AI demands.

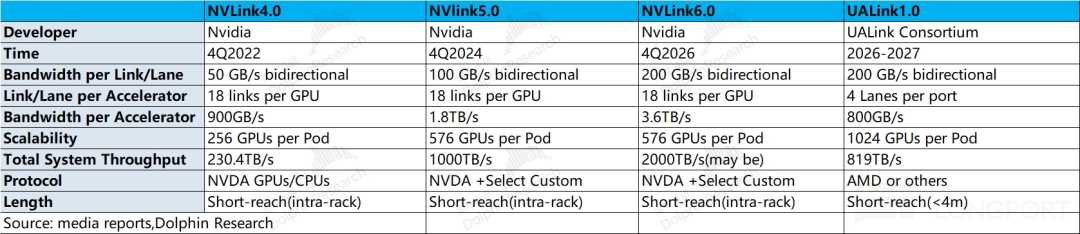

b. NVLink: Originally designed for GPU-to-GPU connections under PCIe standards (GPU-CPU-GPU), NVIDIA's NVLink enables direct GPU interconnection. The current NVLink 5.0 increases connection bandwidth by 14x. However, its drawback lies in being a high-performance but closed ecosystem, requiring binding to NVIDIA's hardware.

c. UALink: Thus, dozens of members led by AMD, such as Broadcom + CSP, etc., launched a new open ecosystem alliance standard—UALink—in 2024. Its design performance approaches that of NVLink, and the ecosystem is open, but the software ecosystem is not yet mature enough.

In response to competition, NVIDIA has also started to open up some of its NVLink technology, allowing specific partners such as Qualcomm and Marvell to use it, but competitors like Intel and Broadcom are excluded.

Currently, NVLink 6.0 is expected to be released in the second half of 2026, with its bandwidth doubling to 3.6TB/s, while UALink is set to launch in 2026-2027.

This time, Intel's custom CPU adopts the NVLink standard, which is equivalent to NVIDIA turning another member from the opposing camp, thereby strengthening the stability of its own NVLink ecosystem.

Besides the short-term impact of the NVLink ecosystem, the business impact itself is minimal. The real long-term impact on NVIDIA may not be overt but rather something that leaves more room for speculation.

For example, will Trump, in future national trade negotiations, have the U.S. government require countries (such as those in the Middle East and Europe) to purchase more advanced U.S. semiconductor products, helping NVIDIA secure orders (the Middle East deal is an example)?

Could it even go so far as to open a bigger door for NVIDIA, which has shown its 'allegiance,' in trade with China, rather than selling severely crippled and weakly competitive versions like the current H20 and RTX PRO 6000D?

VI. Derivative Shockwaves: AMD Suffers Most, Capex Stocks Benefit

①AMD: Significant negative impact. After losing its position as the 'second-in-command' in AI chips to Broadcom, it has now been dealt another blow by the collaboration between Intel and NVIDIA. As the two companies collaborate to provide x86 solutions for data centers, they will also jointly enter the AI PC market, posing a threat to AMD's PC market share.

②Semiconductor Equipment (ASML, AMAT, Synopsys, etc.): Potential positive impact. Although the current collaboration between Intel and NVIDIA focuses on x86 architecture and AI PC integrated SoCs, it may extend to the foundry sector in the future.

Especially from a governmental perspective, the core reason for bailing out Intel lies in the scarcity of wafer manufacturing capabilities. Ultimately, there is hope that Intel can restore its foundry capabilities.

Intel, previously affected by its 'triple collapse,' has significantly reduced its capital expenditures this year. If business conditions improve or foundry breakthroughs occur, there is potential for increased capital expenditures, which would be relatively beneficial for upstream equipment manufacturers, especially Synopsys, AMAT, and ASML.

These companies have all, to varying degrees, seen their performance and stock prices stagnate or even decline since 2025 due to Intel's reduced capital expenditures. The prospect of Intel restarting its capital expenditures could provide an effective boost, especially given that these companies' stock prices are not currently high.

③TSMC: Minimal impact at present. The current collaboration focuses on x86 architecture and integrated SoCs and does not involve significant foundry business, so the impact on TSMC's current foundry operations is minimal. However, as the collaboration progresses, if Intel secures large foundry orders or achieves foundry breakthroughs, it could pose a challenge to TSMC.

VII. Overview: Some Rejoice, Others Worry

In summary, Intel stands to be the biggest beneficiary of this collaboration with NVIDIA. With the U.S. government, NVIDIA, and SoftBank as shareholders, Intel is unlikely to face 'bankruptcy valuations' again. The extent of the company's subsequent recovery will primarily depend on the performance of the collaborative products and breakthroughs in its foundry business.

For NVIDIA, although it is the main participant, there will not be a significant boost to its performance. Instead, it offers more imagination for future broader market business expansion.

On the other hand, this collaboration helps NVIDIA promote the NVLink ecosystem as its second moat alongside CUDA. Among the three main giants in the device segment of UALink (AMD/Intel/Broadcom), Intel has now been pulled over to NVIDIA's side.

AMD is expected to face the most significant negative impact, as the collaboration between Intel and NVIDIA reshapes the CPU+GPU market. AMD now finds itself under pressure from both sides: the combined forces of Intel and NVIDIA ahead and ASIC leader Broadcom behind.

Semiconductor Capex stocks, which have been languishing, may see a resurgence in capital expenditures after Intel receives support from the U.S. government and other sources. Regardless of whether the foundry efforts succeed, they will need to 'buy the shovels' first, thus benefiting semiconductor equipment companies.

As for TSMC, the impact of this collaboration is minimal, but attention should still be paid to breakthroughs in foundry and process technologies.

- END -

// Reprint Authorization

This article is an original piece by Dolphin Research. Reproduction requires authorization.

// Disclaimer and General Disclosure

This report is intended solely for general comprehensive data purposes, designed for users of Dolphin Research and its affiliated entities for general reading and data reference. It does not take into account the specific investment objectives, investment product preferences, risk tolerance, financial situation, or special needs of any individual receiving this report. Investors must consult with independent professional advisors before making investment decisions based on this report. Any person using or referring to the content or information in this report for investment decisions does so at their own risk. Dolphin Research shall not be liable for any direct or indirect responsibilities or losses that may arise from the use of the data contained in this report. The information and data in this report are based on publicly available sources and are intended for reference purposes only. Dolphin Research strives to ensure but does not guarantee the reliability, accuracy, and completeness of the information and data.

The information or opinions expressed in this report may not be used as, or considered as, an offer to sell securities or an invitation to buy or sell securities in any jurisdiction. They also do not constitute advice, inquiries, or recommendations regarding relevant securities or related financial instruments. The information, tools, and materials in this report are not intended for, or intended to be distributed to, jurisdictions where the distribution, publication, provision, or use of such information, tools, and materials contradicts applicable laws or regulations or results in Dolphin Research and/or its subsidiaries or affiliated companies being subject to any registration or licensing requirements in such jurisdictions, or to citizens or residents of such jurisdictions.

This report merely reflects the personal views, insights, and analytical methods of the relevant authors and does not represent the stance of Dolphin Research and/or its affiliated entities.

This report is produced by Dolphin Research, and all copyrights are reserved by Dolphin Research. Without prior written consent from Dolphin Research, no institution or individual may (i) make, copy, reproduce, duplicate, forward, or distribute in any form any copies or replicas, and/or (ii) directly or indirectly redistribute or transfer them to other unauthorized persons. Dolphin Research reserves all related rights.