Why Is OpenAI Partnering with Luxshare Precision?

![]() 09/26 2025

09/26 2025

![]() 693

693

On September 22nd, shares of Luxshare Precision, a major consumer electronics manufacturer, soared with a rare early-morning surge to the daily limit, reaching a peak sealed order volume exceeding 4.6 billion yuan and a market capitalization of 442 billion yuan. According to The Information, OpenAI has entered into an agreement with Luxshare Precision—Apple's device assembler—to jointly develop a consumer-grade device anticipated to deeply integrate with OpenAI's AI models. Sources close to the matter also revealed that OpenAI's planned product lineup includes smart speakers without displays, with considerations for glasses, digital voice recorders, and wearable brooches. The company aims to launch its initial batch of devices by late 2026 or early 2027.

Currently, the global AI industry is undergoing a pivotal transition from software to hardware. Meanwhile, Luxshare Precision, a leader in China's manufacturing sector, faces growth bottlenecks in consumer electronics OEM and urgently needs to establish a second growth curve through the AI sector. Thus, the collaboration with OpenAI comes as a timely opportunity, though its long-term success remains to be validated.

Navigating the Highs and Lows Under Apple's Influence

Since its IPO in 2010, Luxshare Precision has delivered a generally satisfactory performance, with Apple playing a pivotal role in its growth and expansion over the years.

Wang Laichun, the founder of Luxshare Precision, was once a senior executive at Foxconn. Initially, her company generated a significant portion of its revenue (up to 56%) from subcontracting orders from Foxconn. However, this 'secondary subcontracting' business model offered relatively low value, was labor-intensive, and yielded modest profits.

As the market shifted from feature phones to smartphones, Wang Laichun made a decisive move in 2011 by acquiring Kunshan LianTao to enter Apple's supply chain (affectionately known as the 'fruit chain'). That year, the company achieved its highest and only triple-digit growth in revenue and net profit between 2008 and 2020, with increases of 152.89% and 185.33%, respectively. Later, in 2016, Wang invested in Suzhou Meite, securing AirPods orders. Apple CEO Tim Cook personally visited Luxshare Precision's Kunshan factory that year, offering high praise. Consequently, the company's stock price broke out of its previous consolidation phase and entered a high-growth stage, with its market capitalization leading the 'SME Board'. In 2020, its stock price continued to rise to an all-time high due to OEM manufacturing of iPhone 12 mini components.

Despite the comfort of relying on a major client, Luxshare Precision's dependence on Apple has deepened. Moreover, companies in Apple's supply chain generally exhibit a financial characteristic—remarkable growth but mediocre profitability. From 2021 to 2023, revenue from Apple accounted for approximately 75% of the total, declining slightly to around 70% in 2024. Due to Apple's dominant position, companies in the supply chain generally have thin profit margins, relying on high-volume sales.

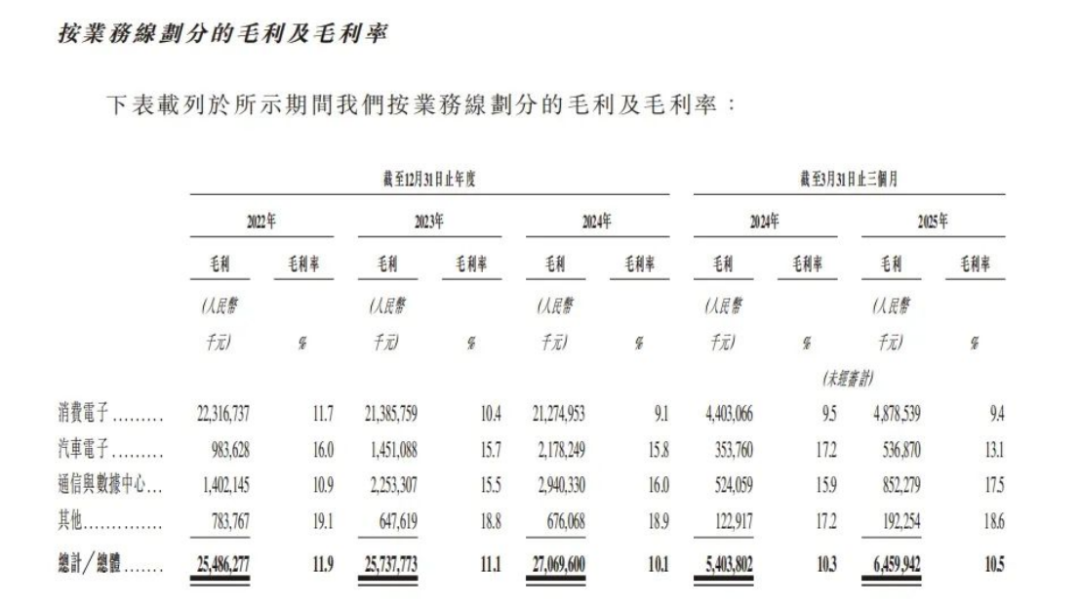

As domestic labor and raw material costs have risen annually, Luxshare Precision's gross profit margin has declined year by year, from 18.09% in 2020 to 10.41% in 2024. Reflecting on its stock price, since early 2021, Luxshare Precision's market capitalization has entered a downward trend after experiencing volatility, initiating a deep correction phase. This adjustment lasted nearly three years, with a significant market capitalization decline, at one point halving.

To break free from this shadow, Wang Laichun initiated the 'Three Five-Year Plans' in 2021, aiming to develop businesses in consumer electronics, automotive, communications, industrial, medical, and other sectors comprehensively. However, the results have been inconspicuous so far. Take the highly anticipated automotive components business as an example; the company has been laying out in this field for over a decade.

Benefiting from the accelerated domestic automotive electrification and intelligent transformation in the past two years, Luxshare Precision's automotive sector business grew from 4.1 billion yuan in 2021 to 13.8 billion yuan in 2024. However, last year, revenue from the automotive electronics business accounted for only 5.1% of the total, and in the first quarter of this year, it was merely 6.6%, remaining at a low level. Meanwhile, the gross profit margin of the automotive electronics business was 16% in 2022, 15.7% in 2023, and 15.8% in 2024. Although slightly higher than the overall level, by the first quarter of this year, the gross profit margin of the automotive electronics business had declined, from 17.2% in the same period of 2024 to 13.1%.

Image Source: AI

Therefore, Luxshare Precision's 'second growth curve' still faces numerous challenges and difficulties.

Why Is OpenAI Partnering with Luxshare Precision?

Undoubtedly, this collaboration represents a significant strategic breakthrough for both OpenAI and Luxshare Precision. For Luxshare Precision, it is a crucial battle to transition from a core supplier in Apple's supply chain to a core supplier in the 'AI supply chain'.

Firstly, as a core supplier for Apple, the company has extensive experience in the precision manufacturing of consumer electronics from a component perspective, with a comprehensive layout in mechanics, optics, acoustics, and electronics. From an OEM perspective, Luxshare Precision has rich experience in assembling wearable devices (AirPods, Apple Watch) and can leverage its mature supply chain management and large-scale mass production experience to rapidly introduce new AI products while ensuring high yields.

Take the currently popular AR glasses as an example. Luxshare Precision's Wuxi factory has initiated a production ramp-up for 500,000 units, achieving a 98.7% assembly yield for the complete device using a fully automated production line and shortening the supply cycle for Huacan Optoelectronics' Micro LED modules to 7 days. Through its technical experience accumulated in participating in the development of Meta Quest 3's interactive scenarios, Luxshare Precision has also entered the supply chain of Meta's new generation of consumer-grade AR glasses, Celeste, responsible for sensor integration and partial optical component assembly, with mass production expected to begin in the fourth quarter of 2025.

Meanwhile, Luxshare Precision continues to solidify and deepen its OEM business, constructing a whole industry chain ecosystem through vertical integration strategies. In the first half of this year, it acquired Wentai Technology's consumer electronics system integration business for 4.389 billion yuan to enhance its complete machine design and manufacturing capabilities. According to The Information, after the pre-sale performance of the iPhone 17 standard version exceeded expectations, Apple has requested Luxshare Precision, one of its major OEM factories, to increase the daily production volume of the standard iPhone 17 by approximately 40% and notified some non-electronic component suppliers to increase their daily supply volume by about 30%. This precision manufacturing capability, repeatedly validated in Apple's products, is precisely the technical assurance that OpenAI needs for mass-producing terminals.

Secondly, benefiting from the 'local innovation + global delivery' capacity configuration model, Luxshare Precision has 105 production bases and 28 R&D centers in 29 countries and regions worldwide, possessing global delivery capabilities. This model enables the company to flexibly allocate resources and provide customized solutions tailored to different markets and customer characteristics, significantly reducing tariff and political risks. For instance, by linking Leoni's German R&D center with Luxshare Precision's Dongguan precision manufacturing base, the production cost of high-voltage wiring harnesses can be reduced by 15%-20%. Meanwhile, by forming a 'US-Mexico + Southeast Asia' dual hub with its North American factory in Mexico and its Vietnam base, the company can circumvent the localization rate requirements of the North American Inflation Reduction Act (IRA). Furthermore, Wang Laichun's recent push for a Hong Kong listing plan is not only a strategic replenishment at the capital level but also a crucial leap towards becoming an internationally diversified manufacturing enterprise.

Finally, OpenAI chose Luxshare Precision because of a key figure: Jony Ive. The former Chief Design Officer of Apple, known as the 'Father of the iPhone,' became the core leader of 'Creativity and Design' at OpenAI after the latter acquired io for $6.5 billion. According to The Information, since announcing the acquisition of io, OpenAI has embarked on a frenzied talent poaching spree, luring over twenty hardware engineers from Apple this year alone, covering core areas from AirPods' audio architecture to Apple Watch's miniaturization technology. When these talents' design philosophies meet Luxshare Precision's engineering realization capabilities, the resulting synergy is immeasurable.

AI Hardware Track: Opportunities and Challenges Coexist

"Those who truly care about software should create their own hardware."

Fifty years later, the hardware community still adheres to this quote from Alan Kay, the 2023 Turing Award winner, as paraphrased by Steve Jobs. Jobs, driven by his vision for a graphical user interface operating system, led two eras of PCs and mobile terminals. OpenAI's collaboration with Luxshare Precision essentially represents a bet on the industrial revolution of AI 'landing' in terminals from the cloud. According to Precedence Research data, the global market size for smart wearable devices was approximately $72.1 billion in 2024 and is expected to grow to $431.7 billion by 2034, with a compound annual growth rate of 19.59% from 2024 to 2034. More importantly, each successful AI hardware product can become an endpoint for data collection, feeding model iterations with vast amounts of real-world data. The market is not investing in hardware but in the future's brand-new AI-native interaction paradigm.

However, in the view of investor Guo Xiaofei, the domestic supply chain is already mature enough that hardware can easily become homogeneous. Take AI glasses as an example; according to an incomplete statistic by Zhidx, in the first eight months of this year, 25 relatively well-known AI glasses products have been publicly reported, ranging in price from 999 yuan to 8,999 yuan.

The reason lies in the rapidly disappearing technological barriers of hardware itself, leading to 'plug-and-play' supply chain solutions. Coupled with insufficient product intelligence, these devices face competitive pressure from non-intelligent devices, cloud services, and software apps. Meanwhile, the continuous expansion of smartphone functions can also reduce the demand for other single-function terminals. In the AI era, true differentiation often stems from software capabilities, with hardware designed as a traffic entry point. This forces AI hardware manufacturers to think from the demand side. Therefore, their future core competitiveness will not only lie in the leading capabilities of the model itself but also in whether they can establish a stable, efficient, and low-cost adaptation path. Practically addressing experience pain points and improving the content ecosystem are challenges that must be faced.

References:

10x Volume Growth, One New Product Every 9 Days! Unveiling the Wild Growth Behind AI Glasses - Zhidx

The Next Stop for Artificial Intelligence: New Consumer Hardware - Liu Qiong, Lin Yihan, Ma Siyu, Tencent Research Institute

From Apple OEM Factory to AI Hardware Core Player: Luxshare Precision's Billion-Dollar Transformation - Puzhuo Capital