Li Shufu Teams Up with Yin Qi to ‘Shake Things Up’, Creating Another ‘Huawei Automotive BU’?

![]() 10/09 2025

10/09 2025

![]() 429

429

By Daoge

From rebirth after bankruptcy to forming an alliance with Mercedes-Benz, Qianli Technology, an ‘AI rising star’, is attempting to carve out new narratives.

Recently, the Chongqing-based intelligent driving enterprise Qianli Technology unveiled its new English brand name, ‘AFARI’, along with the strategic vision that underpins it—the ‘Qianli Plan’.

This move is more than just a brand refresh; it signifies the emergence of a new entity rising from the ashes of the traditional automaker Lifan. This new entity is being steered by AI leaders and is backed by both Geely and Mercedes-Benz.

The name ‘Qianli’ holds multiple meanings. ‘Qianli for Chongqing’ echoes the company’s headquarters. ‘Ambition travels a thousand miles’ reflects its long-term commitment in the AI race. And the new English name ‘AFARI’ cleverly places ‘AI’ at both ends, strongly conveying its AI-centric identity.

‘Zhibaidao’ believes that this renaming is a meticulously planned effort to reshape the narrative. The name ‘Lifan’ carries the heavy historical burden of a traditional motorcycle and automaker that rose, struggled, and eventually underwent bankruptcy reorganization in 2020. For a company aiming to define its future with software and technology, shedding this old name signifies a fresh start.

01 From Traditional Manufacturing to an AI Hub

The story of Qianli Technology must begin with its predecessor, Lifan. Founded in 1992, Lifan was once a leader in China’s motorcycle industry. However, after transitioning to automobile manufacturing, it found itself in a predicament and eventually filed for bankruptcy reorganization in 2020.

Under the leadership of the Chongqing Municipal Government and Geely Holding Group, Lifan completed its judicial restructuring. Geely became its de facto controller, and the company renamed itself Lifan Technology. It then served as a production base for Geely’s Maple and Radar brands, playing a traditional manufacturing role. But this was merely the prologue to its first transformation.

With new management at the helm, early this year, Lifan Technology renamed itself Qianli Technology and embarked on a second, more profound transformation. The company reshaped its core business model into a ‘dual-wheel drive’. The ‘terminal business’, centered on automobile and motorcycle manufacturing, forms a stable foundation. The ‘technology business’, centered on intelligent driving and smart cockpits, is positioned as the future growth engine. The ultimate goal of this strategy is to build an industry-wide ‘AI Intelligent Driving Open Platform’, fully transitioning from an automaker to an AI technology company.

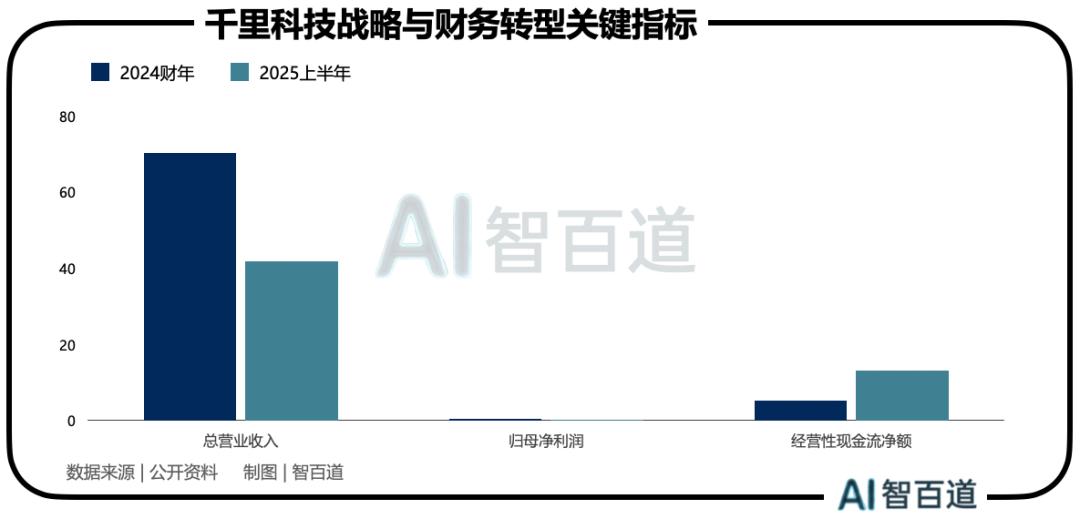

This profound strategic transformation has left clear marks in Qianli Technology’s financial statements.

In 2024, Qianli Technology’s R&D spending reached 935 million yuan, accounting for 13.28% of its total revenue. This is a financial trait uncommon for traditional automakers, whose R&D ratios typically hover between 3 - 5%. This proportion resembles that of a high-growth software or semiconductor company.

‘Zhibaidao’ analyzes that such massive investment, disregarding short-term profits, would be unsustainable without strong capital backing. It clearly indicates that Qianli Technology’s operational logic has broken free from the financial constraints of conventional listed companies. Instead, it resembles more a strategically venture-backed project operating within a listed company shell.

02 The Iron Triangle Alliance

Three key forces shape the ‘Iron Triangle’ alliance behind Qianli Technology, determining its uniqueness and future trajectory.

The first force is Yin Qi, who is at the helm of Qianli Technology. A graduate of Tsinghua University’s ‘Yao Class’, founded by Turing Award winner Professor Yaozhi Yao and known as the ‘cradle of Chinese computer scientists’, Yin is the co-founder and CEO of AI giant Megvii Technology. He has fully experienced China’s AI 1.0 technological wave.

His cross-border entry into the automotive industry was not impulsive but based on profound industry insights. In his view, the intelligent driving industry is far from mature, with blurred industrial chain divisions. This presents a vast window of opportunity for companies capable of mastering both AI technology and hardware manufacturing.

In July 2024, Yin’s company acquired a 19.91% stake in Qianli Technology from Geely for 2.43 billion yuan, becoming its second-largest shareholder. In November, he officially assumed the chairman role. This marked Geely’s proactive transfer of strategic control over this listed company to the AI expert.

The second force behind Qianli Technology is Geely. For Geely, Qianli Technology represents a crucial step in its intelligent strategy. After rescuing Lifan, Geely did not simply use it as a production base but transformed it into an independent, intelligent-focused ‘automotive BU’.

Geely integrated its core intelligent R&D teams, including those from Zeekr and smart brands, into Qianli Technology, forming a research and development cluster of nearly 3,000 people.

‘Zhibaidao’ believes that this structure is a strategic masterstroke for Geely. First, it isolates the high-risk, high-investment intelligent driving R&D into an independent entity. This enables it to more flexibly attract top tech talent and strategic capital. Second, Qianli Technology becomes the ‘central brain’ for the entire Geely Automotive Group. It provides unified, advanced intelligent driving solutions for multiple brands like Geely, Lynk & Co, and Zeekr. Meanwhile, Geely’s vast automotive industrial system offers Qianli Technology crucial platforms for scaled validation, supply chain support, and manufacturing expertise.

On September 25, this alliance welcomed its third heavyweight player. Mercedes-Benz (Shanghai) Digital Technology Co., Ltd. announced the acquisition of a 3% stake in Qianli Technology for approximately 1.339 billion yuan, becoming its fifth-largest shareholder and committing not to reduce its holding for 12 months.

‘Zhibaidao’ analyzes that behind Mercedes-Benz’s move lies market anxiety. Faced with aggressive attacks from Chinese local brands like BYD and Xiaomi in electrification and intelligence, traditional luxury brands’ advantages are rapidly eroding. To maintain competitiveness in China—the world’s largest and most fiercely competitive market—Mercedes-Benz urgently needs to accelerate its localized technology R&D and iteration.

This investment extends beyond finance; it resembles a new cooperation model of ‘technology supply + joint development’. It provides Mercedes-Benz’s Chinese models with underlying technical support better suited to local road conditions. Long-term, both parties may jointly develop next-generation intelligent driving platforms for the global market. Notably, this cooperation builds on the deep relationship between Geely and Mercedes-Benz: Geely Chairman Li Shufu is Mercedes-Benz’s largest single shareholder, and both jointly operate the smart brand.

03 The New Vision of the ‘Qianli Plan’

At the brand launch, Yin Qi fully elaborated on Qianli Technology’s top-level design—the ‘Qianli Plan’.

Yin Qi, Chairman of Qianli Technology

Its core concept is ‘one brain, one operating system, one super intelligent assistant’. It aims to build a unified intelligent agent driven by AI large models, seamlessly integrating user experiences across home, retail, factory, and mobility scenarios. The automobile is merely the first and most complex intelligent terminal in this grand blueprint.

To realize this vision, Qianli Technology has established three core business pillars, forming a complete commercial closed loop from core technology to products and final services.

The first is Qianli Intelligent Driving, the technological core of Qianli Technology. By adopting an ‘end-to-end’ large model architecture, it reduces reliance on traditional programming rules and high-precision maps, enabling system decisions closer to human drivers’ thinking. The second is Qianli Smart Cockpit. For this, Qianli Technology launched the ‘Agent OS’ intelligent cockpit operating system, transforming the cockpit into a ‘super intelligent agent’ based on multimodal large models. The third is Qianli Intelligent Mobility. Qianli Technology announced an ambitious ‘18-month plan’: achieving scaled Robotaxi operations in 10 global cities and deploying over 1,000 Robotaxis in a single city.

‘Zhibaidao’ believes that Qianli Technology’s ‘full-stack’ approach is a double-edged sword. It plays two roles: a Tier 1 technology supplier to automakers like Geely and Mercedes-Benz, and a direct-to-market Robotaxi mobility service operator. The Tier 1 model offers clearer commercial paths, stable cash flow, and valuable mass production data. However, it has limited profit margins and control over end-users. The Robotaxi operator model holds vast market potential but faces astronomical capital requirements, complex regulatory challenges, and a prolonged, uncertain path to profitability.

Qianli Technology’s renaming and brand launch mark the beginning of its arduous journey, the moment when a high-risk, high-reward gamble commences. It is no longer the old Lifan but a new entity fused with cutting-edge AI technology, robust industrial strength, and global ambitions.

The company’s future hinges entirely on its ability to successfully execute its extremely ambitious ‘full-stack’ strategy. This involves commercializing its Tier 1 solutions to continuously fund the eventual operation of a globalized Robotaxi network. This is a monumental challenge, testing the limits of its technology, capital, and execution.

A thousand-mile journey begins with a single step. Whether Qianli Technology can reach its envisioned future depends on its ability to navigate the trials of technological R&D, fierce competition, and commercialization with steady progress.

*Featured image generated by AI