Will OpenAI's Recent Strategic Moves Result in Major Losses for Some?

![]() 10/09 2025

10/09 2025

![]() 579

579

Recently, OpenAI has embarked on new monetization strategies, predictably setting its sights on two highly profitable sectors: short videos and e-commerce advertising.

1. Is AI-Generated Video Content Truly Cut Out for 'Social' Engagement?

Let's first delve into the proposed video social networking platform, which will be entirely powered by the AI model Sora 2 for video generation and dissemination. Users will have the ability to craft video clips up to 10 seconds in length. Notably, the platform will not permit the inclusion of locally uploaded images or videos from devices, but users' portraits can be featured in the videos.

Currently, the product is undergoing beta testing, with employees reporting positive experiences. If, as media reports suggest, this platform is designed to compete with TikTok, its future monetization model will likely hinge on advertising. Indeed, OpenAI has already commenced recruiting efforts to assemble an advertising team.

However, the question remains: can the cost-benefit ratio be effectively balanced? Is a video platform solely reliant on AI-generated content truly conducive to fostering highly engaging social interactions?

Moreover, existing short video platforms like TikTok, Reels, and Shorts already incorporate some AI-generated videos. While these are primarily used to enhance the user content experience, it underscores the fact that 'AI-generated videos' alone cannot serve as an absolute differentiator in the competitive landscape.

Conversely, a social platform that thrives on long-term engagement must be anchored in authentic content. In the AI era, where discerning between real and fake is already a formidable challenge, an influx of AI-generated content on a general social platform will not only raise ethical concerns but also drive users to seek more genuine content experiences.

Therefore, Dolphin Research currently adopts a cautious stance regarding this video social networking platform but will remain vigilant in monitoring new developments.

2. Introducing Transactions: Ecosystem Closure with a Focus on Driving Traffic

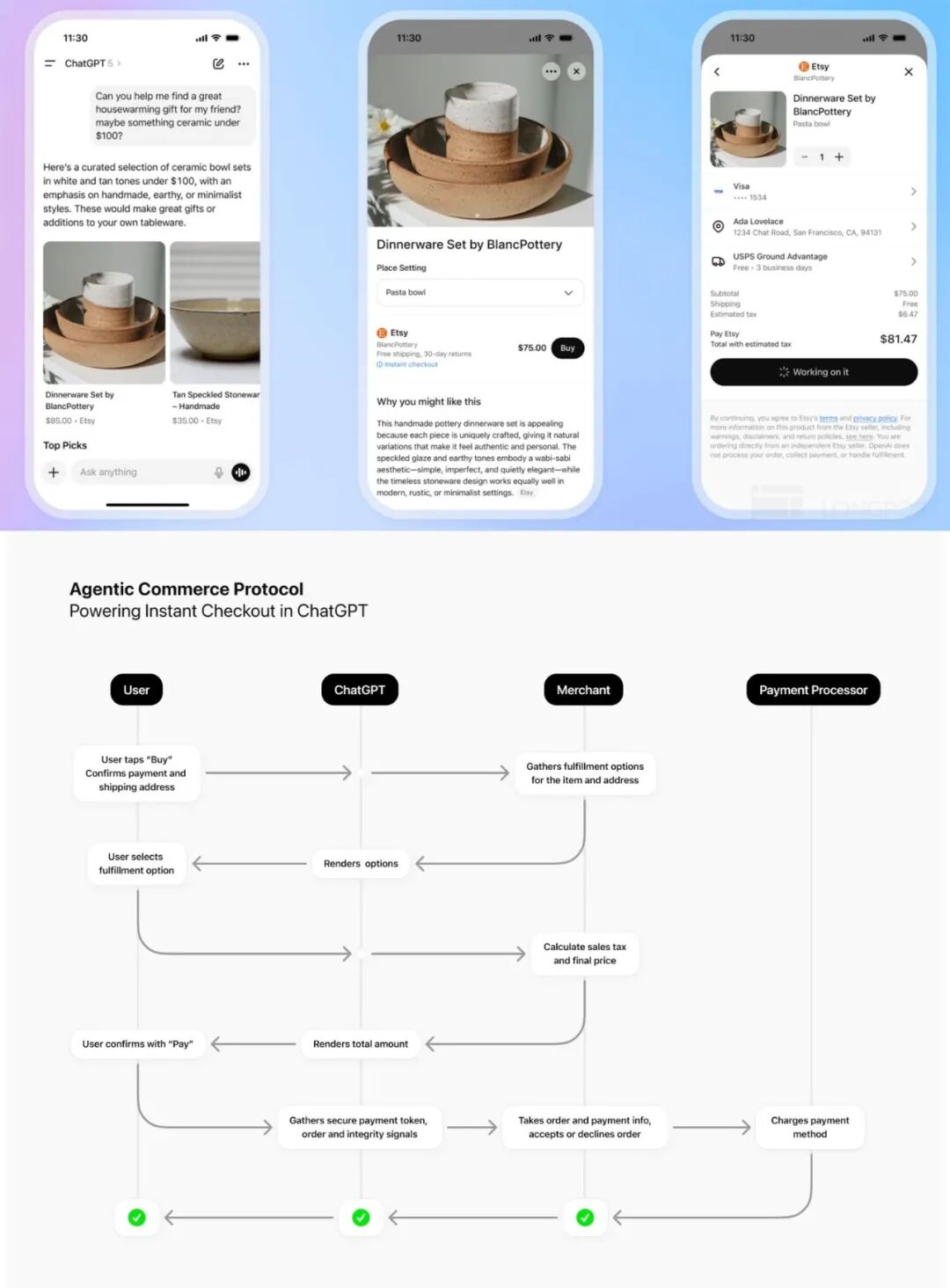

Yesterday, OpenAI unveiled the 'Instant Checkout' feature in the United States, enabling users to complete their entire shopping journey within ChatGPT without being redirected to external links. Etsy and Shopify are the inaugural e-commerce platforms to partner and integrate with this feature.

From a partnership perspective, OpenAI primarily functions as a front-end traffic generator, while back-end services such as product page displays, pre-sales and post-sales customer support, and logistics are managed by the merchants or platforms themselves.

The crux lies in the business model. To preserve the ChatGPT user experience, OpenAI does not intend to monetize product display rankings like traditional search engines. Instead, it adopts a revenue model more akin to e-commerce, generating income through GMV (Gross Merchandise Volume) take rate, aligning with the CPS (Cost per Sale) business model previously mentioned by Sam.

3. Impact on the Shopping Ecosystem: Theoretical Impact is Substantial, but Constraints Exist

OpenAI's strategic move, if it can progressively expand user penetration and attract more merchants, will inevitably reshape the existing competitive landscape:

(1) It will influence the budget allocation for 'traditional CPC (Cost per Click) and CPM (Cost per Mille) advertising' by Google and Meta in the e-commerce sector. Theoretically, OpenAI poses a greater potential threat to Google, as both entities cater to users with strong shopping 'intentions' by offering product promotion services (whereas Meta's recommendations are based on social relationships for 'impulse' consumption).

(2) It will impact leading e-commerce platforms like Amazon. The U.S. e-commerce market is highly concentrated, with Amazon holding a dominant position and significant traffic and scale advantages. However, with OpenAI's support, smaller platforms can effectively supplement their traffic shortcomings, while payment functionality enhances the overall shopping experience, attracting more users to try and stay engaged.

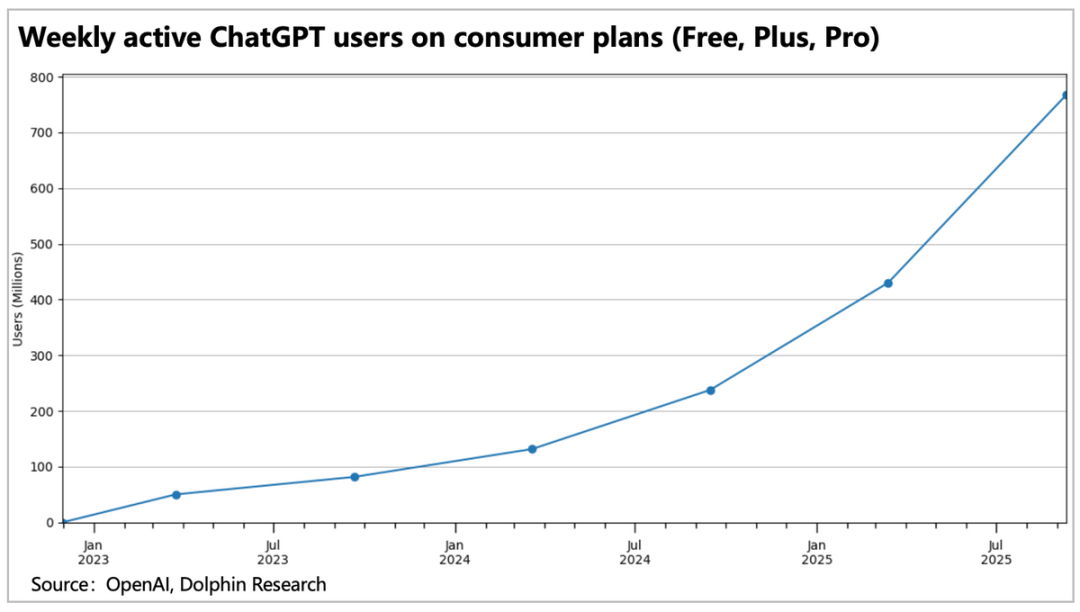

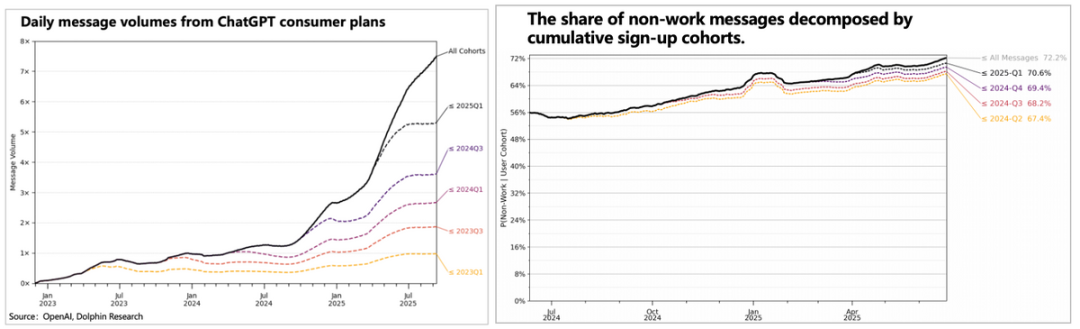

Of course, the linchpin of OpenAI's impact lies in its current massive user base and high engagement levels. With 700 million weekly active users and daily interactions growing exponentially, non-work-related interactions have surged from 56% in July of the previous year to 72%. Users who registered later (1Q25) interact more frequently and are less work-related. This reflects ChatGPT's breakthrough effect, expanding from core users in workflows to the general user base.

However, the core challenge is whether OpenAI can seamlessly expand the merchant ecosystem on its platform:

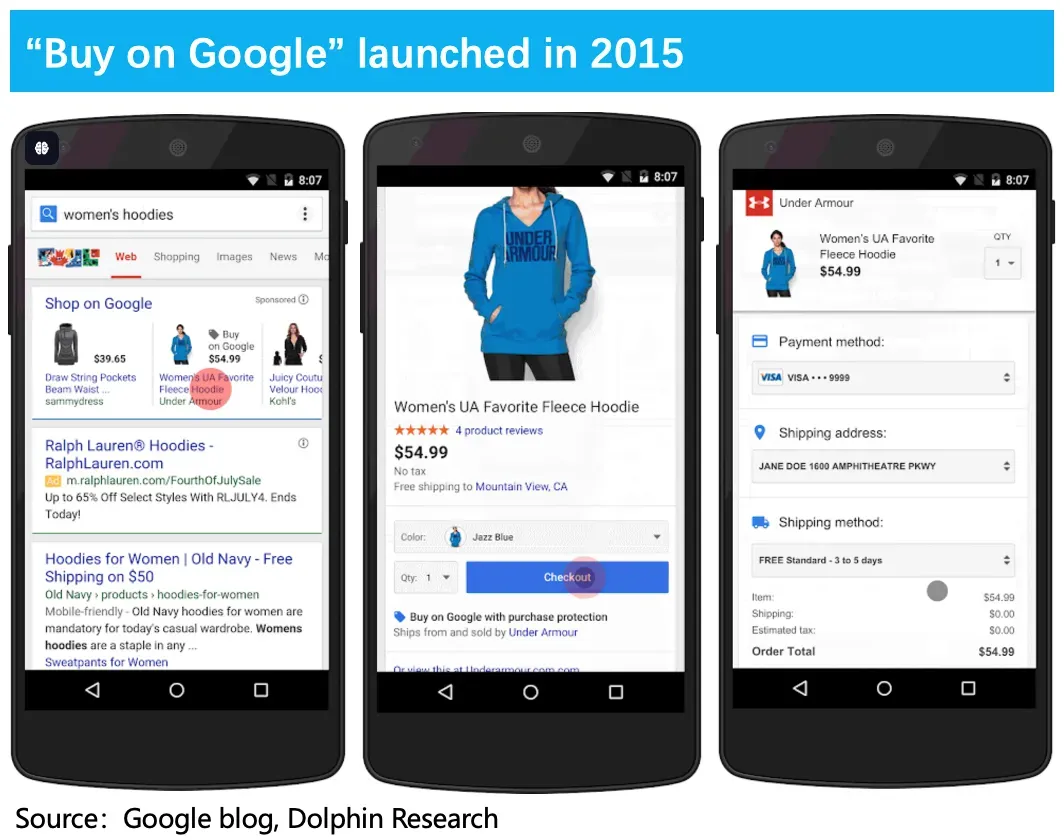

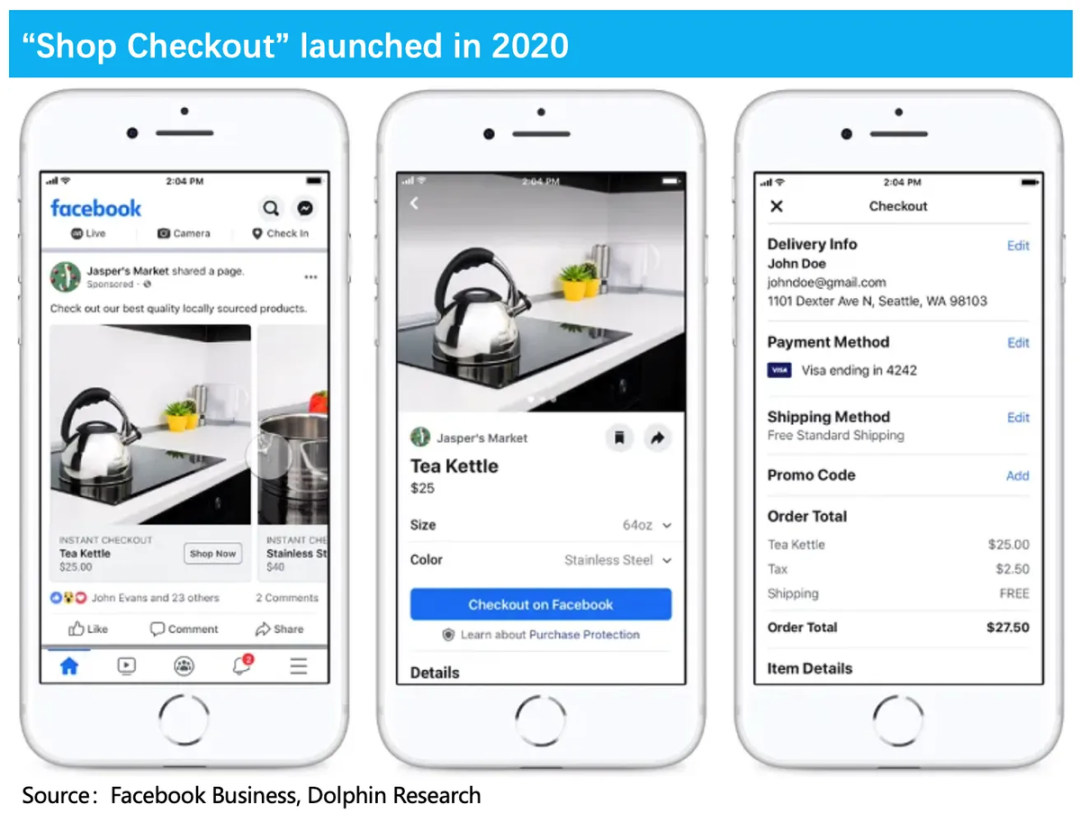

(1) The integration of payment into high-traffic platforms is not a novel concept for OpenAI. Google previously promoted 'Buy on Google,' but it was discontinued in 2023. Similarly, Meta launched a shopping checkout feature alongside its Shops function in 2020 but gradually phased it out two years later (except for a special partnership with Amazon starting in 2023, allowing users to log in to their Prime accounts within Meta to complete purchases).

The primary factor that compelled these two giants to abandon closed ecosystems stems from the 'supply-less-than-demand' pattern in the European and U.S. commodity markets, where brand merchants wield more bargaining power and predominantly favor independent station models.

For merchants, they are adamant about not becoming 'vassals' or 'service providers' of Google and Meta and have a stronger desire to control private traffic. This means they are more inclined to pay for services that drive traffic to their official websites.

A seamless shopping experience within Google or Meta severs merchants' ability to capture data on the entire user conversion process, hindering their subsequent promotional efforts and compelling them to purchase additional Ad Campaign tools from Google and Meta.

Conversely, for e-commerce giants like Amazon, whose traffic has largely plateaued and requires external traffic to penetrate more user scenarios in a defensive stance against emerging market players (implying absolute bargaining power over merchants), they can autonomously choose to form strong alliances with traffic giants like Meta. A seamless in-platform transaction experience maintains satisfaction among existing users and avoids being overtaken by emerging players.

Therefore, for OpenAI, which plays a more significant role in 'guiding user decisions,' the attitude of high-quality merchants in the short term will likely remain cautious. However, long-term observations are needed to see whether they will become more independent and assertive or compromise indirectly due to an inability to resist.

4. AI Agent Payments May Be Inevitable

Although Google discontinued in-platform checkout for search, in early September, it launched the AP2 agent payment protocol, a payment cooperation alliance (encompassing over 60 payment organizations worldwide) prepared for AI Agents. Therefore, it is only a matter of time before Gemini integrates payment functionality. After OpenAI's shopping payment feature is implemented, Google is expected to expedite the introduction of e-commerce platforms and in-platform payments.

The 'follow strategy' will also be emulated by other large models or AI Agents. Therefore, if AI Agent proxy payments become an unavoidable trend, merchant compromises may also arrive sooner in the future.

Meanwhile, if Google and Meta subsequently restore shopping payment functionality in AI Agents and similarly avoid commercializing product display rankings, they could offset the negative impacts of traditional e-commerce advertising and even maintain competitiveness through richer ecosystem synergies.

In essence, it all boils down to game theory (strategic interactions). In the U.S. market, merchant attitude shifts will still require considerable time. During this process, the confrontation between OpenAI and giants like Google, Meta, and Amazon will continue to unfold—beyond cultivating or shifting user mindsets, it also necessitates the perfection of underlying ecosystems. Therefore, a definitive judgment on the actual impact cannot be made yet.

However, what is clear is that under the pressure of massive burn rates, OpenAI's monetization ambitions can no longer be concealed. The monetization potential of 700 million weekly active users engaging in high-frequency interactions is undoubtedly substantial. Currently, the monetization of AI large models has not yet explored an optimal business model, but OpenAI's moves undoubtedly set an industry benchmark for imitation.

Just as ByteDance's dominance in the latter half of China's internet era proved that platforms with massive, highly engaged user bases can succeed regardless of the chosen business model—due to ample room for trial and error—they will inevitably disrupt existing leaders to some extent. The question of who will be affected more or less, who will be disrupted in the future versus now, is a topic worth repeated discussion.

However, the reason giants remain giants is their formidable comprehensive strength, making short-term success or failure indistinguishable. Therefore, at present, rather than panicking over the disruption of giants, it is more worthwhile from an investment perspective to focus on niche (non-leading OTA, local life, e-commerce) players that can survive or ride OpenAI's traffic wave.

- END -

// Reprint Authorization

This article is an original piece by Dolphin Research. Authorization is required for reprinting.

// Disclaimer and General Disclosure

This report is intended solely for general comprehensive data purposes, designed for users of Dolphin Research and its affiliated entities for general reading and data reference. It does not consider the specific investment objectives, investment product preferences, risk tolerance, financial situation, or special needs of any individual receiving this report. Investors must consult with independent professional advisors before making investment decisions based on this report. Any person making investment decisions using or referring to the content or information in this report assumes full risk. Dolphin Research shall not be liable for any direct or indirect responsibilities or losses arising from the use of data contained in this report. The information and data in this report are based on publicly available sources and are intended for reference purposes only. Dolphin Research strives to ensure but does not guarantee the reliability, accuracy, or completeness of the information and data.

The information or viewpoints mentioned in this report shall not be regarded or treated as an offer to sell securities or an invitation to buy or sell securities in any jurisdiction. It does not constitute advice, inquiries, or recommendations regarding relevant securities or related financial instruments. The information, tools, and data in this report are not intended for distribution to or use by individuals in jurisdictions where such distribution, publication, provision, or use contradicts applicable laws or regulations or subjects Dolphin Research and/or its affiliates or associated companies to any registration or licensing requirements in such jurisdictions.

This report reflects only the personal viewpoints, insights, and analytical methods of the relevant authors and does not represent the stance of Dolphin Research and/or its affiliated entities.

This report is produced by Dolphin Research, and all copyrights are reserved by Dolphin Research. Without prior written consent from Dolphin Research, no entity or individual may (i) reproduce, copy, duplicate, reprint, forward, or create any form of copies or replicas in any manner, and/or (ii) directly or indirectly redistribute or transfer them to any unauthorized individuals. Dolphin Research reserves all related rights.