Forging the 'Android' of the Robot Realm: Can Meta's Vision Materialize?

![]() 10/09 2025

10/09 2025

![]() 563

563

Original Source: Shenmou Finance (chutou0325)

Recently, PCMag reported that Andrew Bosworth, Meta's Chief Technology Officer, revealed for the first time at a headquarters briefing that humanoid robots have been elevated to a strategic priority level on par with augmented reality (AR). Over the next few years, Meta plans to pour 'billions of dollars' into crafting a universally licensable software platform, aiming to emerge as the 'Android' of the robotics sector. Bosworth emphasized that Meta has no intentions of mass-producing hardware. Instead, it plans to emulate Google's open approach in the smartphone arena: any robotic body adhering to technical specifications can be outfitted with Meta's operating system, swiftly expanding the ecosystem and gaining sway over industry standard-setting.

Image Source: PCMag

As early as February 2025, Reuters unveiled that Meta had established a dedicated team within its Reality Labs to develop humanoid robots capable of executing physical tasks like household chores.

From clandestine planning to a public declaration, Meta's maneuvers reflect its ambition for the next-generation intelligent terminal ecosystem. Yet, replicating Android's triumph is far more daunting than anticipated.

01

Meta's Vision

From Meta's vantage point, the primary hurdle in robot development lies in the 'brain' rather than the 'body.' While hardware technology has witnessed significant strides in recent years, the 'brain' enabling robots to genuinely comprehend and adapt to the complex physical world and perform delicate tasks like dexterous grasping remains the industry's most formidable obstacle.

Hence, Meta is channeling its resources into constructing this 'brain' by building a 'world model' to surmount software-level challenges and sidestep the 'red ocean' competition in hardware manufacturing.

At the commercial level, the platform model effectively sidesteps the heavy asset and high-risk nature of hardware businesses. Manufacturing physical robots entails substantial supply chain, production costs, and inventory pressures. By offering a platform, Meta can cater to diverse hardware manufacturers at lower costs and with higher scalability, akin to providing the Android system, thereby constructing an ecosystem rather than merely peddling a single product.

Meta's objective isn't to morph into a robot manufacturer but to become the 'rule setter' and core of the underlying ecosystem for the future robotics industry.

By erecting a platform, it has the opportunity to set industry standards, entice numerous hardware partners to join its ecosystem, and thus secure the top spot in the value chain of a potentially vast market. This yields more enduring and far-reaching influence than selling hardware.

More crucially, Meta boasts deep accumulations in artificial intelligence, software engineering, and large-scale platform operations, whereas hardware manufacturing isn't its traditional forte. Opting for the platform path enables it to leverage its software expertise while circumventing the need to tackle hardware engineering challenges from scratch.

Revisiting Meta's strategic transformation trajectory, in 2021, it rebranded from Facebook to Meta, betting heavily on the metaverse as the 'next-generation internet form.' However, after more than two years, the metaverse's progress has fallen far short of expectations. In this context, humanoid robots have emerged as Meta's key choice for discovering new growth avenues. If it can preemptively seize the commanding heights of the robot software platform, it can not only bridge the strategic gap in its metaverse business but also gain the upper hand in the technological competition of the next decade.

Image Source: 36Kr

02

Can the Android Model Be Emulated?

The Android system's success is a tech history classic. By adopting an open-source strategy, it lured hardware manufacturers, relied on a developer ecosystem to enrich application scenarios, and ultimately forged a positive cycle from the system to hardware and then to applications. Now, Meta endeavors to replicate this path to create an Android platform for robots.

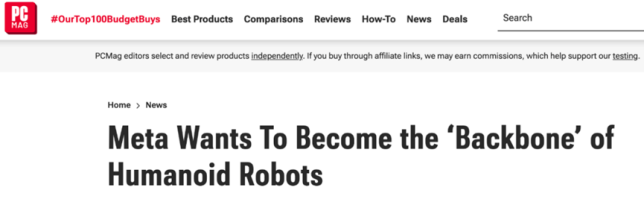

Image Source: Baidu Baike

From a positive standpoint, Meta possesses the genes and resources to construct an open ecosystem. The core advantage of Android lies in its 'hardware neutrality,' and Meta has explicitly stated that it won't be a major hardware manufacturer but will solely provide software blueprint authorization, aligning closely with Google's strategy of avoiding hardware competition and focusing on system empowerment. More significantly, the current robotics industry is ensnared in a dilemma of 'diverse hardware and fragmented software.' Industrial robot manufacturers rely on customized systems, while service robot software lacks compatibility. Developers are compelled to repeatedly develop functions for different hardware. This fragmented state is strikingly similar to the early operating system fragmentation in smartphones, offering an entry point for a universal platform. However, robots and smartphones harbor fundamental disparities. The initial challenge is hardware heterogeneity. The core hardware architecture of smartphones is highly standardized, whereas humanoid robots encompass dozens of differentiated components like joint motors, force control sensors, and dexterous hands. The Android system merely needs to adapt to a limited number of chips and screen sizes, while Meta's software platform must be compatible with diverse hardware ranging from industrial robotic arms to household service robots, with the adaptation difficulty escalating exponentially. Notably, according to Morgan Stanley data, China accounts for 63% of the global core supply chain for humanoid robot hardware. If Meta aims to drive hardware manufacturers to adapt to its platform, it will also need to address regional collaboration challenges in manufacturing.

Image Source: Tesla AI Day

The construction of a developer ecosystem confronts long-term challenges. The Android's success hinges on the synergy of ecological resources like Google Search and the App Store, whereas nurturing developers in the robotics field necessitates more professional toolchain support. Meta needs to invest not only in subsidizing developers but also in building a full-cycle toolchain encompassing simulation testing, safety certification, and data management.

The adaptability of business models is also dubious. Android generates profits through app distribution and advertising, but the monetization path for robot software remains unclear. Industrial scenarios favor customized solutions, while the consumer market still needs to cultivate user payment habits. If Meta persists with the free licensing model of Android, it will struggle to recoup the 'billions of dollars' of R&D investment in the short term, while a paid model may diminish its allure to hardware manufacturers.

More critically, the application scenarios for humanoid robots are ambiguous and highly fragmented. The core functions of smartphones are communication and entertainment, with clear and concentrated application demands. In contrast, humanoid robots must cater to multiple scenarios like industry, home, healthcare, and agriculture, each with vastly different demands, making it arduous for developers to focus and preventing the formation of 'blockbuster applications' like in the mobile internet era. In essence, if Meta cannot bide its time for market expansion, its early investment of billions of dollars may face a protracted return period. The humanoid robot industry may take 5-10 years to enter an explosive growth phase, posing a monumental test for Meta's financial resources and strategic patience. Coupled with the cumulative losses exceeding $68 billion in its Reality Labs department over the past four years, continued investment in the robotics business without short-term returns may erode investor confidence.

03

Competitors Lurking in the Shadows

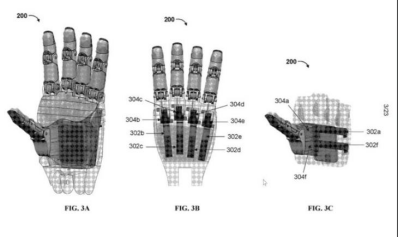

However, while Meta is gearing up for a major push, other tech contenders aren't idle. Google is also pursuing its 'Android system for the robotics world' strategy and has made strides. DeepMind recently unveiled the GeminiRobotics1.5 series models for robots and embodied intelligence. GeminiRobotics1.5 can translate visual information and instructions into robot motion commands to execute tasks, while GeminiRobotics-ER1.5 can reason about the physical world, directly invoke digital tools, and craft detailed multi-step plans to accomplish tasks. Meanwhile, Meta's robot platform is still in its infancy. The open-source camp already enjoys a first-mover advantage. Recently, Open Mind launched the OM1Beta system, the world's inaugural 'AI-native' open-source platform. It not only supports platforms like the UnitreeG1 humanoid robot, Go2, Turtle Bot, and Ubtech robots but also permits integration with third-party large models like Open AI and Gemini, even offering a front-end interface to streamline operations. Such open-source projects swiftly capture developer mindshare with a 'free + collaborative' model. If Meta opts for a closed-source route, it will face disadvantages in ecosystem expansion speed; if it follows the open-source path, it will need to shoulder hefty R&D costs without direct benefits.

Image Source: Open Mind

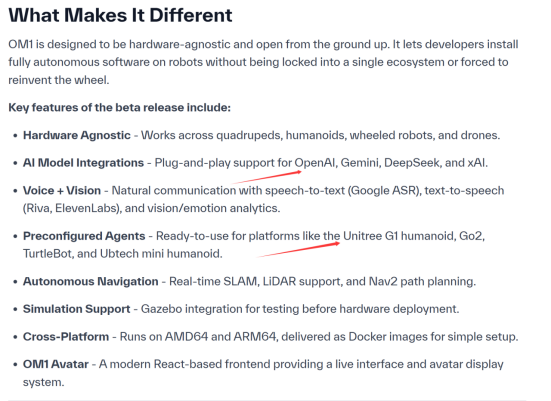

The vertical integration strategies of tech behemoths cannot be underestimated. Tesla adopts a visual data-driven strategy, deeply binding Optimus with its autonomous driving business. The new head, Ashok Elluswamy, oversees both FSD and robotics projects, attempting to reuse the algorithm and data advantages of autonomous driving, bolstered by the computing power of the Colossus supercomputer, forming a closed loop of 'algorithms-data-computing power.' However, in September 2025, Ashish Kumar, a core team member of Optimus AI, departed Tesla to join Meta, which may impact Tesla's technology integration progress.

Image Source: Financial Associated Press

Vertical players in the industrial and consumer sectors are also segmenting the market. Industrial titans like Siemens and Rockwell Automation, with their profound understanding of high-end manufacturing scenarios, have quietly cornered the customized OS market. Their systems, certified by TÜV safety standards and other compliance advantages, have become the preferred choice for industries like automotive and electronics. Android's success hinges on the unified demand of C-end users, whereas the core demand for robots resides in the B-end (industrial manufacturing), where customers are more concerned with safety compliance and customized adaptation rather than universal platforms. If Meta focuses on the B-end, it will need to surmount compliance barriers from companies like Siemens and Rockwell.

04

Conclusion

Meta's elevation of humanoid robots to a strategic priority level on par with augmented reality (AR) is both a precise assessment of the AI and embodied intelligence convergence trend and an inevitable choice to continue the logic of competing for 'ecosystem dominance.' The billions of dollars of investment underscore Zuckerberg's determination to replicate the Android myth, and the fragmented state and software bottlenecks of the robotics industry also furnish theoretical possibilities for success. However, a chasm often exists between theory and reality. Hardware heterogeneity disrupts the standardized foundation of the smartphone era, nurturing a developer ecosystem necessitates surmounting the moats of pioneers, and the ambiguity of business models tests the patience of long-term investment. Meta not only needs to break through technological bottlenecks but also needs to construct an open, secure, and sustainable ecosystem. The race for the 'next computing platform' has just commenced. The dual tests of technological maturity and commercialization paths will permeate Meta's entire strategic execution process, and finding equilibrium among these challenges will be pivotal in determining whether its 'robot Android dream' can materialize. Meta's 'Android dream' may take 5 to 10 years to come to fruition. However, one certainty prevails: Meta's entry will further intensify competition in the humanoid robot arena. Regardless of who ultimately emerges as the 'Google of the robotics world,' it will propel the development of the entire industry and clear obstacles for humanoid robots to permeate thousands of households. *Images are sourced from the internet. Please contact us for removal if there is any infringement.