Will Seres Join Forces with ByteDance to Step into Robotics via AITO?

![]() 10/10 2025

10/10 2025

![]() 468

468

By: ShiyuXingkong

ID: SingingUnderStars

As per Seres' announcement, its subsidiary Phoenix Technology has inked an "Embodied Intelligence Business Cooperation Framework Agreement" with Volcano Engine. The two entities will collaborate on the "Intelligent robot decision - making, control, and human - machine augmentation technology for multi - modal cloud - edge collaboration" project. They aim to establish a closed - loop mechanism of "technology R&D—scenario validation" to jointly lay a technological and collaborative foundation.

Volcano Engine is an AI platform under ByteDance, the parent company of Douyin (the Chinese version of TikTok) and Toutiao. It constructs an AI ecosystem, offers AI computing services, and recently made its intelligent agent workflow tool, coze, open - source.

In recent times, ByteDance has fully embraced AI, with Volcano Engine being its most crucial AI platform.

Interestingly, instead of collaborating on end - to - end large models for automobiles, a car company and an AI enterprise have teamed up on robotics technology.

Elon Musk once remarked that a car is a robot on wheels and then proceeded to create Optimus.

According to Musk, 80% of Tesla's value is tied to Optimus.

Specifically, Tesla's board of directors presented Musk with a $1 trillion compensation package. This package is contingent on him increasing the company's market value from $1 trillion to $8.5 trillion within a decade, delivering 20 million vehicles, achieving 1 million units in the robotaxi business, and delivering 1 million units of Optimus.

If Tesla truly delivers 1 million units of Optimus, which Chinese company would be its equivalent?

Is it Unitree Technology? DeepRobotics? ZhiYuan?

Perhaps Seres will find its place on that long list.

01

Performance Challenges

Seres' recent performance hasn't been without its blemishes.

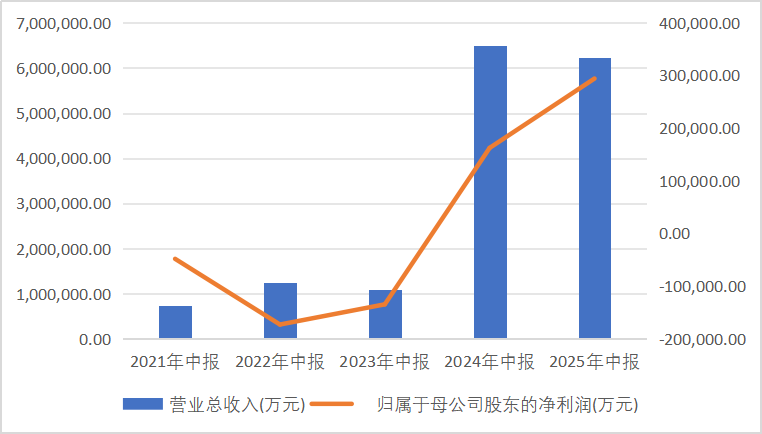

Source: iFind

In the first half of 2025, Seres reported revenue of 62.402 billion yuan, a 4.06% year - on - year decline. However, its net profit attributable to shareholders reached 2.941 billion yuan, an 81.03% year - on - year surge.

The main culprit behind the revenue decline alongside a net profit rise is a significant shift in the company's product mix.

The AITO series M9 and M8, with an average vehicle price exceeding 400,000 yuan, have emerged as the main sales drivers. The increased proportion of relatively high - end models has boosted the gross profit margin.

This represents one of the highest gross profit margins among mass - produced automotive companies (excluding ultra - low - volume luxury car manufacturers), surpassing those of Tesla and BYD.

The September sales report reveals that the company has overcome its growth pains. New energy vehicle sales increased by 19.44% year - on - year, getting back on a growth trajectory, with the AITO series contributing 92.3% of the total. The optimization of the product matrix has achieved initial success.

In the first half of 2025, the company's gross profit margin reached 28.93%, a 4.9 percentage point increase year - on - year. Operating costs for the first half were 44.34 billion yuan, a 10% year - on - year decrease, significantly lower than the revenue decline. This is the primary reason for the improved gross profit margin.

Cost reductions can be attributed to three main factors.

Firstly, the large - scale application of the Magic Cube technology platform. This platform significantly enhances the efficiency of new model development and reduces marginal development costs through the standardization of modules such as chassis, batteries, and three - electric systems. Models like the AITO M9 and M8 are developed based on this platform, enabling rapid iteration of multiple models.

Secondly, the increased automation rate in super factories. Key production processes have achieved 100% automation, with AI online inspection covering weld quality and vehicle static quality, improving production efficiency and reducing unit production costs.

Thirdly, optimized expense control. The sales expense ratio was 14.33%, the management expense ratio was 2.46%, and the R&D expense ratio was 4.69%, all at excellent levels in the industry. Despite a 154.9% year - on - year increase in R&D investment, R&D efficiency has significantly improved through refined management.

02

New Model Impact

As smartphone manufacturers' strategies penetrate the automotive sector, the impact of new product launches on automotive companies' performance has become more pronounced.

In September 2025, Seres' new energy vehicle sales reached 44,678 units, a 19.44% year - on - year increase. Among them, AITO series sales were 41,249 units, a 15.14% increase. From January to September, cumulative new energy vehicle sales exceeded 300,000 units, reaching 304,629 units. The AITO series accounted for 90.7% of the total, with cumulative sales of 276,203 units.

The all - new AITO M7 was launched on September 23, featuring comprehensive upgrades in exterior design, space layout, driving performance, and safety configurations. Within 24 hours of its launch, it received over 40,000 firm orders, creating a market phenomenon of "instant popularity upon launch." On September 26, the first batch of users completed factory acceptance and delivery at Seres' super factory.

The new model has brought substantial profits to Seres but has posed significant challenges for financial analysts like ShiyuXingkong: traditional financial analysis models have become ineffective.

Financial analysis typically assumes relatively stable enterprise operations without significant fluctuations in production and sales. If fluctuations occur, they are usually attributed to seasonal factors, maintaining comparability across different years.

However, Seres has disrupted these analysis models, requiring financial analysts to familiarize themselves with the market, product launches, and firm order data to deduce operational results.

In fact, even the company itself is adjusting its expectations based on market feedback. Seres' 2025 new energy vehicle sales target is 379,500 units, with only 45.35% achieved in the first half, indicating that the original target was relatively conservative. According to institutional forecasts, Seres' actual 2025 deliveries may reach 530,000 - 550,000 units, with new energy vehicles accounting for approximately 450,000 - 490,000 units, far exceeding the original target.

03

Internal and External Competition

Unlike other brands such as BYD and Geely, Seres also faces internal competition from its counterparts under the Harmony Intelligent Mobility Alliance.

Internally, as one of the "Five Realms" in Harmony Intelligent Mobility's strategy, AITO was the earliest product to launch. However, the initial "Huawei" halo has gradually faded. New models like the Luxeed R7, which overlap in price with the AITO M7, along with heavy promotion of other "Realms," may divert user resources from AITO.

Externally, in the high - end intelligent electric vehicle market, models such as the Li Auto L8/L9 and NIO ES8 directly compete with the AITO series. At least 12 mid - to - large SUVs are expected to be launched in the market in 2025, intensifying competition.

Of course, ShiyuXingkong particularly advocates for high - quality automotive companies to expand overseas.

Seres has officially initiated overseas expansion plans for the AITO brand, showcasing the hardcore strength of Chinese new energy vehicles at last year's Paris Motor Show.

The first step is Southeast Asia. The company has established a network of approximately 50 dealers in the ASEAN region and opened an intelligent factory in Indonesia.

The second step is Europe. The European market for luxury new energy vehicles priced between 400,000 - 600,000 yuan has an annual scale of approximately 850,000 units. The company plans to add 50 sales outlets in Europe in 2025 and commence factory construction in Hungary with a planned annual capacity of 150,000 units.

-END-Disclaimer: This article is based on the public company attributes of listed companies and core analysis and research relying on information disclosed by listed companies in accordance with their legal obligations (including but not limited to temporary announcements, periodic reports, and official interaction platforms). ShiyuXingkong strives for fairness in the content and viewpoints presented in the article but does not guarantee their accuracy, completeness, or timeliness. The information or opinions expressed in this article do not constitute any investment advice, and ShiyuXingkong assumes no responsibility for any actions taken based on the use of this article. Copyright Notice: The content of this article is original to ShiyuXingkong and may not be reproduced without authorization.