Byte Believers MiniMax

![]() 10/10 2025

10/10 2025

![]() 434

434

Written by | Hao Xin

Edited by | Wu Xianzhi

Over the past two years, the questions investors feel compelled to ask have shifted from "What will you do if OpenAI does it?" to "What will you do if big tech companies do it?" Some even joke, "When big tech makes a move, small companies tremble in fear."

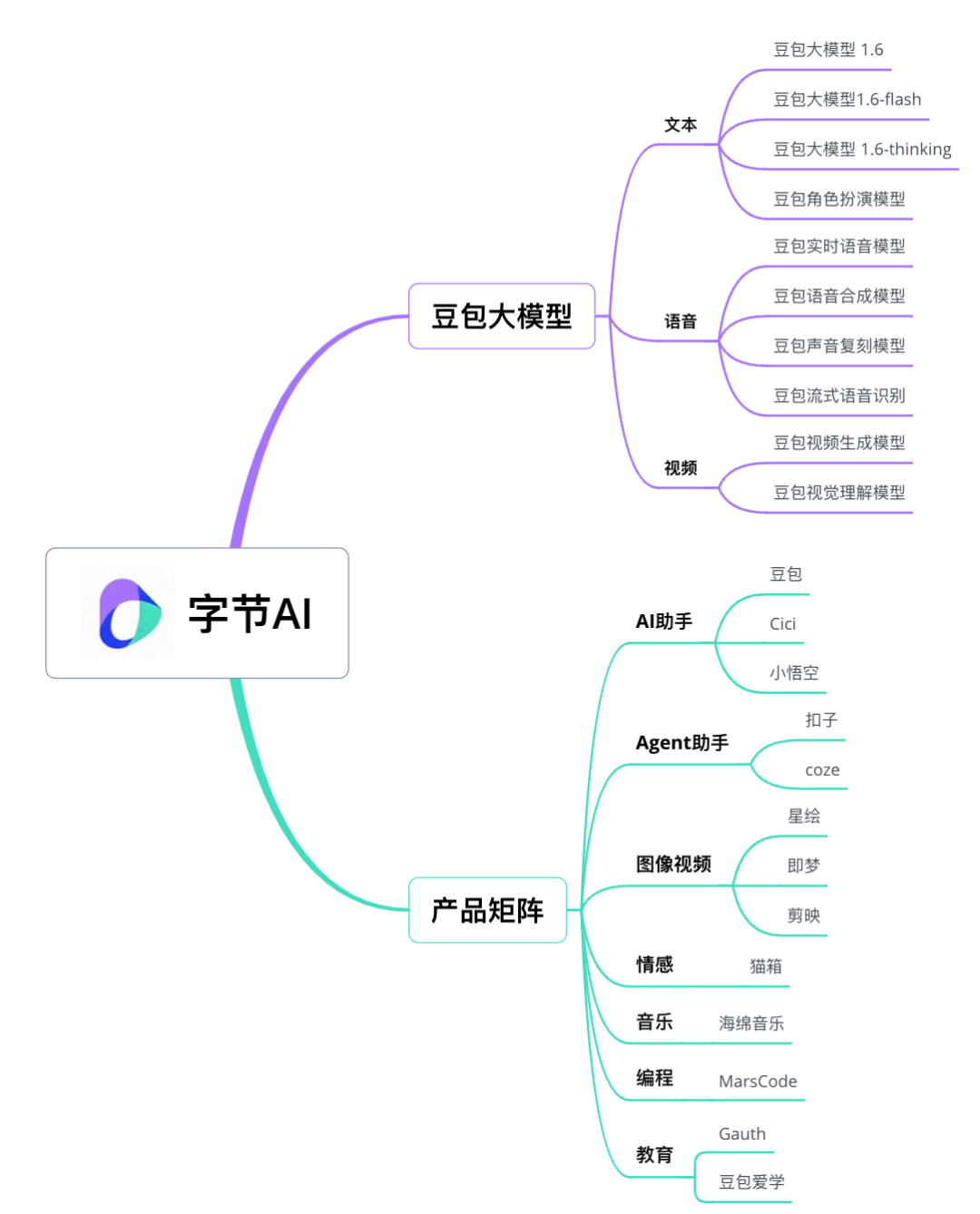

On the international stage, Google is catching up to ChatGPT with a multi-product matrix strategy. Meanwhile, domestically, Doubao has overtaken DeepSeek to become the native AI application with the largest monthly active user base.

Although AI has become a "dimensionality reduction battlefield" for big tech companies in some areas, some companies are still striving to break through.

In June this year, MiniMax made headlines with rumors of an initial public offering (IPO). In July, it secured nearly $300 million in new funding, signaling to the outside world that it is still "in the game."

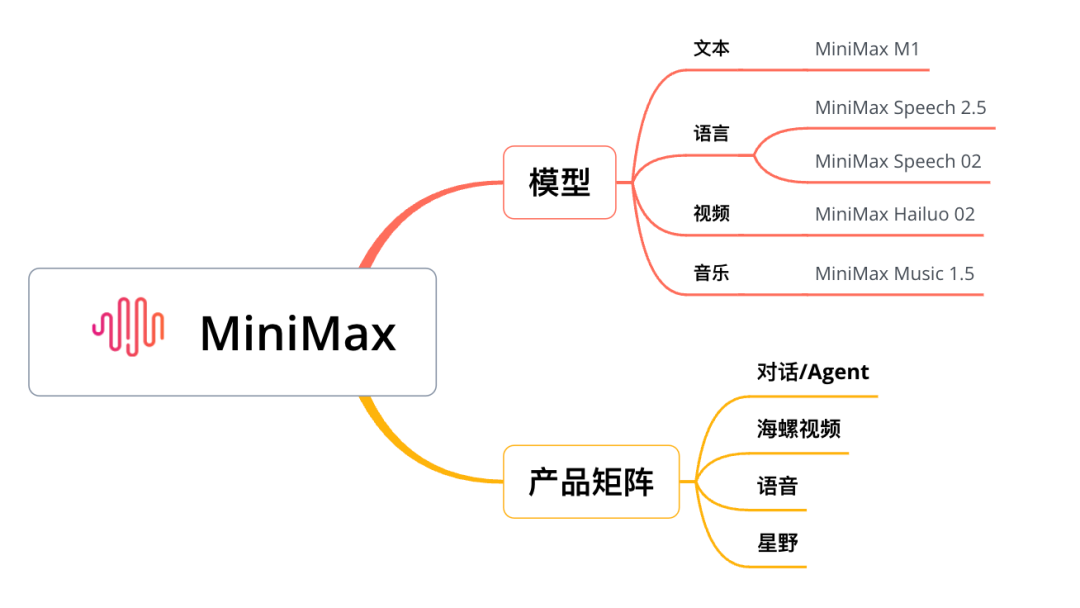

From its early days, MiniMax has placed its bets on a multimodal approach. Its model layer is clearly divided into text, language, video, and music. Under the philosophy of "integrated model and product," it has successively developed products like Hailuo Video, Xingye, and Agents, forming its current product matrix.

Although, starting in 2024, MiniMax has implemented a "model-product separation" strategy, where technology and product development proceed independently. Technology pursues capability limits while products focus on user experience. However, model capabilities remain the foundation of MiniMax's products, with technological exploration breaking free from product constraints.

The above diagram of MiniMax feels familiar; when the model and product layers expand, it resembles the landscape of Byte AI.

Byte AI's model layer is the Doubao large model, encompassing text, voice, and video types. Its product layer is even richer than MiniMax's, covering categories such as AI assistants, Agents, image and video, emotions, music, programming, and education. Hailuo Video is one of Jimeng's biggest competitors, while Xingye and Maoxiang are locked in a fierce battle in the AI companionship track.

On the AI path, MiniMax and Byte AI share a similar vision. If Byte AI is the superfactory of the AI realm, MiniMax resembles a nimble AI-native workshop—small in scale but powered by the same engine.

MiniMax's Route

First, we must clarify the premise of an "AI-native factory": it does not follow the "AI + traditional product" route, enhancing old products with tools, features, or efficiency gains. Instead, it builds entirely new product forms, interaction logics, and user relationships from scratch, centered around AI's core capabilities like multimodal generation, natural language interaction, and autonomous decision-making.

Byte's formidable ability to mass-produce products is well-known. When building its AI product matrix, it had many references, such as ChatGPT for Doubao, Xingye for Maoxiang, and Miaoya for Xinghui.

However, in MiniMax's early days, much of this landscape was uncharted territory. For a startup, deciding "where to go" was more critical than "how to get there."

"Intelligence for Everyone" is MiniMax's entrepreneurial motto. Founder Yan Junjie believes that making AI accessible and affordable for everyone is the future trend.

MiniMax's humanistic spirit, reflected in its core values, stands out amid the current focus on intelligence and artificial general intelligence (AGI), explaining its emphasis on the consumer market.

Targeting products, MiniMax's model architecture is clear, with four teams for text, video, image, and voice models, each corresponding to its product lines.

Talkie is MiniMax's first product, with Xingye as its domestic counterpart. These two AI social products generate most of the company's revenue. The "MiniMax" brand corresponds to the text model foundation, while "Hailuo AI" represents the video and language lines.

According to MiniMax's assessment of technology transitioning to multimodal products, video and voice routes have been prioritized. Photon Planet learned that in the AI video track, Hailuo AI leans more toward consumers, while its competitor Kling AI targets businesses.

In the voice track, MiniMax holds a clearer advantage, with a client base in education and entertainment. Currently, its website lists voice generation as a standalone product. According to New Cortex, a new brand for the audio line may be launched in the future, though the name remains unknown.

Beyond its existing model lines, MiniMax is betting on Agents, launching general-purpose and video Agent products. The general-purpose Agent is integrated into MiniMax's conversational products, while the video Agent is incorporated as a feature into Hailuo AI.

Thus, based on text, language, and video models, MiniMax has formed a product matrix encompassing Agents, conversational assistants, AI video, AI voice, and AI social.

It's worth noting that before Kimi's release, Yang Zhilin also shared similar ideas in an interview. At the time, he believed Kimi could serve as a product to validate model capabilities, and once those capabilities met standards, many AI applications could spin off from Kimi.

In reality, Yuezhi'anmian ultimately chose to go all-in on Kimi, discontinuing other product lines. MiniMax, however, has persisted on this path, consciously building two product brands: "MiniMax AI" and "Hailuo AI."

Standardization vs. Niche Excellence

When thinking of an AI product factory, Byte AI might be the first to come to mind. Since the AIGC wave, Byte has developed nearly twenty AI applications, racing both domestically and internationally with significant traffic.

Even as MiniMax gradually aligns with Byte and falls under the "AI product factory" umbrella, the two fundamentally reflect different paths taken by big tech companies and AI startups. Byte resembles a high-scoring student in standardized education, producing "perfect exam papers" in bulk, while MiniMax is more like a student leveling up through mistakes, forging its own identity with non-standard answers.

Byte AI's technical logic is "centralized model R&D + decentralized product applications," using the Doubao large model as a core foundation to support multiple functional products. Technical resources are concentrated, enabling model capabilities to be reused and reflecting the efficiency of a large platform.

At the product level, Byte AI's matrix covers almost every high-frequency scenario in users' daily lives and creative endeavors, from assistants, education, programming, music, images, emotions, to office tools. Its product diversity reveals a tactic of parallel development across multiple areas.

During product launches, Byte initially leveraged Douyin to drive traffic to its AI products, first via mini-programs and then as standalone apps. Using methods like traffic acquisition, AB testing, and data feedback, Byte quickly validated product feasibility and replicated numerous standardized AI applications.

In summary, Byte AI's strategy is: using a large model foundation to rapidly incubate multi-category, multi-scenario AI functional products, continuously iterating and optimizing through platform capabilities and data-driven approaches to form a vast AI application ecosystem.

In contrast, MiniMax appears less structured. As mentioned earlier, MiniMax faced challenges when confirming its brand identity. Originally, "Hailuo" belonged to a conversational assistant, but its video capabilities later shone, leading to the brand being reassigned to the AI video product.

MiniMax currently offers a limited number of products, but most can be considered "high-quality." Talkie influenced the design of subsequent AI companionship products, including Maoxiang, and contributes significantly to MiniMax's revenue. Hailuo AI ranks among the top tier domestically in terms of user base and model generation capabilities.

Instead of pursuing "comprehensive" functionality, MiniMax focuses on core scenarios of AI-user interaction, selecting a few products and amplifying the interactive experience.

Following Doubao's logic, MiniMax could have aggregated voice, video, and conversation functions into a single app, integrating multimodal AI capabilities through a unified entry point to address users' fragmented task needs. This "all-in-one" strategy has the advantage of quickly gaining traffic but also has significant drawbacks—function overlap dilutes scene focus, fragmenting user behavior data and making it difficult to form precise feedback loops, which not only hinders model training but also impacts product experience optimization.

There is no inherent superiority between the "comprehensive" and "niche" models; essentially, they represent precise adaptations to target user needs, with the core difference lying in the service audience.

A blogger told us that after seeing "Yueban Cat" go viral online, he wanted to create a similar hit. "I tried other tools, but they fell short. Only Hailuo could produce those mischievous and lively expressions."

Another e-commerce entrepreneur prefers Byte's Jimeng, citing its "consistent output—not too flawed, not too poor."

MiniMax's Breakthrough

MiniMax has set its sights on going public and catching up with AGI.

Capital markets are more concerned with: Does it have a sustainably growing business model? Are its revenues healthy and scalable? Is it worth a long-term investment?

Currently, MiniMax's main revenue comes from Talkie and Xingye, products focused on personalized companionship and emotional dialogue. While user engagement may be high, direct user payment motivation is weak, making it difficult to form a "hard" revenue pillar. Productivity-oriented tools like Hailuo Video and Agents have revenue potential, but capital markets still question whether emotional companionship is a viable business and whether this model can sustain a $10 billion valuation.

Currently, MiniMax's income primarily comes from a single consumer product line, with free or lightly paid services. If consumer growth slows, payment willingness declines, or competition intensifies, overall revenue and profitability may face significant pressure.

Instability is also reflected in conversion. Currently, MiniMax has not established a complete, scalable commercial loop from "user acquisition" to "paid conversion" to "long-term retention and repurchase." Whether technological advantages equate to commercial success remains to be seen, as users ultimately pay for experience, not just technology.

After a round of market consolidation, capital and markets have gradually entered a convergence phase. Undeniably, MiniMax still possesses the rarity needed to stay in the game.

Its technical path is differentiated, with early layout in multimodal technology, integrating text, image, voice, and video capabilities to form full-stack AI capabilities. It innovates in large model architecture, replacing traditional Transformer structures with linear attention mechanisms to significantly boost efficiency and reduce costs. Its long-context, Agent, and reasoning capabilities are also being internalized into AI products.

Against a backdrop where most AI startups and big tech companies focus on "tool-based AI," MiniMax breaks the mold, continuously delivering a batch of "small but refined" AI-native applications, serving as a certain "B-side" to ByteDance.

MiniMax's founding vision essentially targets the future consumer market of "AI democratization + personalized experiences." It aims not just to provide single-function tools but also to create emotionally resonant AI, fulfilling users' deep-seated needs for emotional connection, psychological support, and virtual socialization.

MiniMax's next step is to prove it is not just "futuristic" but also "present-focused," balancing technological ideals with commercial realities, and continuing to forge a differentiated path based on models and products.