What Musk Failed to Achieve, Figure AI Accomplished First

![]() 10/13 2025

10/13 2025

![]() 418

418

Author: Mao Xinru

Two American robotics companies, far across the ocean, are experiencing a mix of joy and sorrow.

On one side, Figure AI officially debuted its third-generation robot, F.03, while on the other, Musk's Optimus reportedly scaled back its production plans for the year due to dexterous hand design issues.

As two of the most sought-after robotics companies in the United States, both faced the challenge of updating their third-generation robots this year but delivered vastly different results.

Figure, armed with $1 billion in new financing, the globally leading robot brain Helix, a self-built factory BotQ capable of producing 12,000 robots annually, and the newly upgraded third-generation robot F.03, demonstrated a stronger ambition.

In contrast, Musk's Optimus V3 remains stuck in 'perfectionism' and has been difficult to produce.

This time, Brett Adcock, often referred to as the 'Little Musk,' accomplished what Musk couldn't.

F.03: Four Major Updates

In late September, Brett Adcock hinted on social media that there would be three major announcements over three consecutive days, leading to speculation about the F.03 update. Although the announcements primarily focused on financing and business partnerships, they generated significant anticipation.

The released F.03 represents a comprehensive upgrade from its predecessor, F.02. According to Brett Adcock, the F.01 design was a makeshift solution for the team to begin training robots, while the F.02 design aimed for a better mechanical structure and began training the brain but was not yet suitable for large-scale production.

F.03 now possesses the elements for large-scale production and is considered the most powerful robot globally by Adcock.

Figure conducted a full-stack hardware and software update in this iteration to serve four key modules: the Helix model, family scene applications, scalable production, and continuous cost reduction to drive commercialization.

On the hardware side, Figure updated the actuators internally, doubling their speed and increasing torque density to enhance efficiency in industrial settings. The internal structural design is more compact, with a 9% lighter weight compared to the previous generation, making the robot smaller and more agile.

In terms of external perception, Figure improved the visual and tactile sensing capabilities. The new camera architecture doubled the frame rate, reduced latency to 1/4, increased the field of view by 60% for a single camera, and reduced size. This helps the robot achieve intelligent navigation and precise operations in complex unstructured environments.

For the dexterous hands, Figure embedded wide-angle cameras in each palm to provide redundant close-range visual feedback during grasping. When the head's main camera is obstructed, Helix can still maintain visual perception for real-time adaptive control.

Additionally, F.03's dexterous hands feature self-developed tactile sensors for the first time, with each interdigital sensor capable of perceiving pressures as low as approximately 3g, enabling high-precision identification of objects with different shapes and sizes.

Figure attributes these hardware upgrades to a central goal: enabling Helix to possess true reasoning and closed-loop control capabilities.

It's like making a new dish specifically for Helix's 'vinegar.'

In terms of external positioning, Figure also reflects its intention to push robots into family scenes through promotional videos and design details. Although Brett Adcock himself said that F.03 is not yet capable of 'handling most household chores around the clock' and expects to reach that goal by 2026, the product has already been adapted for family use in terms of appearance and functionality.

To make the robot's appearance softer and reduce the impact of collisions in a family environment, F.03 is covered with a multi-density foam and flexible fabric shell.

At the same time, F.03's feet support wireless inductive charging, allowing for around-the-clock standby when a charging station is placed at home. Its battery can support approximately 5 hours of operation in peak mode.

In fact, F.03's battery was the first to be publicly revealed. Figure stated that it is 78% cheaper than the previous generation, with better flame retardancy and drop resistance, capable of withstanding a 1-meter drop from any angle, reducing battery-related risks if the robot falls at home.

To ensure production capacity, Figure has improved its manufacturing system based on its self-built factory BotQ and set a goal of producing 100,000 units within the next four years. Key points include:

Reducing the number of components and assembly steps

Shifting from CNC machining to processes like die casting, injection molding, and stamping, and creating molds for each module

Self-developing key modules such as drives, batteries, sensors, structures, and electronics

Self-developing a manufacturing execution system to ensure full-process traceability and quality consistency

Figure's 'Landing Logic' for Making a Breakthrough First

The official release of F.03 has also led many to say that 'the pressure is now on Tesla's Optimus.'

The scalability of the third-generation general-purpose robot represents a dual race of engineering and commercialization, with Figure now ahead of Tesla.

Unlike the domestic approach of adapting multiple robots to multiple scenes, both Figure and Tesla share the dream of a general-purpose robot that can serve diverse B2B and B2C scenes with a single robot architecture.

This 'one-size-fits-all' concept represents the ultimate pursuit of the robotics industry.

However, beneath the surface, the core DNA of the two companies differs significantly.

Tesla continues the successful logic of its automotive industry: hardware first, cost is king.

Musk believes that by leveraging Tesla's immense advantages in manufacturing, supply chain, AI chips, and batteries, he can quickly produce a 'body' that is cheap and abundant enough to occupy the market first.

This is essentially a manufacturing war. Musk is betting that as long as the body is cheap enough, the soul can evolve slowly.

In contrast, Figure chose a completely opposite path: AI defines everything, and versatility is fundamental.

They do not pursue the fastest mass production but rather aim to create a sufficiently intelligent soul first. Therefore, Figure unbound from OpenAI this year and self-developed the end-to-end model Helix.

Figure believes that once this brain takes shape, adapting it to different bodies is just a matter of time. Figure is betting that as long as the soul is powerful enough, the body will naturally follow.

This DNA difference is also evident in the design of dexterous hands.

The biggest bottleneck currently faced by Tesla's Optimus is that the engineering team cannot create a mechanical hand as flexible as a human hand, forcing Tesla to halt production and accumulate a large number of bodiless robots.

However, both Musk and Brett Adcock acknowledge that dexterous hands are the most challenging part of robot hardware design. Of course, from the current dexterous hand products on the market, none have achieved the same effect as a human hand.

Faced with existing common challenges, Tesla chose to persist in creating the most perfect dexterous hand, while Figure chose to find the current optimal solution.

Figure's dexterous hands adopt a visual-tactile fusion scheme. They embed wide-angle cameras in each palm, a design more convenient for visual servoing and pose estimation compared to traditional schemes that rely solely on the robot's head main vision or install cameras at the dexterous hand's wrist.

Combined with self-developed tactile sensors, this 'perception compensates for mechanics' approach, although not perfect, is practical and enables Figure 03 to perform precise control on fragile, irregular, or moving objects and complete common household chores like tidying up the table, folding clothes, and using washing machines and dishwashers.

In addition to the bold choice of the end effector dexterous hand, Figure's successful breakthrough also benefits from three key strategic choices.

First, it has built a certain data flywheel and model advantage. Figure's VLA model, Helix, can achieve skill iteration simply by adding new data without developing new algorithms.

More notably, the learning outcomes of F.02 can be seamlessly transferred. For example, the dishwasher organization demonstrated by F.02 was perfectly replicated by F.03. This ability transfer undoubtedly forms a data closed loop (closed loop) where the robot becomes smarter with use.

Second, Figure implemented a vertically integrated supply chain strategy. By self-developing key modules such as drives, batteries, and sensors, and reducing the number of components and assembly steps, Figure not only autonomously controls supply chain security but also gains control over costs and pricing.

More critically, Figure has more firmly chosen a strategy of serving both B2B and B2C markets this time. Unlike F.02, which only worked at BMW's factory, F.03 is not only shown working in family scenes in promotional videos but also in commercial applications like hotel reception.

Combined with its previous cooperation with asset management company Brookfield, which owns a large number of properties, commercial spaces, residences, factories, and other sites, Figure has gained more training grounds and potential orders.

Comprehensive Companies Stand at a Crossroads

Why did the two companies take vastly different productization paths at the third-generation node?

Perhaps it is due to the inherent differences in company attributes. Figure is a typical vertical company, with its business line focused solely on robotics, while Tesla is a typical comprehensive company, with other businesses besides robotics, such as automobiles and energy.

Looking at the entire industry, it is not difficult to find that a large number of vertical companies are running on the track of 'frontier exploration - rapid iteration - vertical commercialization attempts,' while comprehensive companies are intervene (getting involved) in different ways, such as through investment, providing tools, and creating brains.

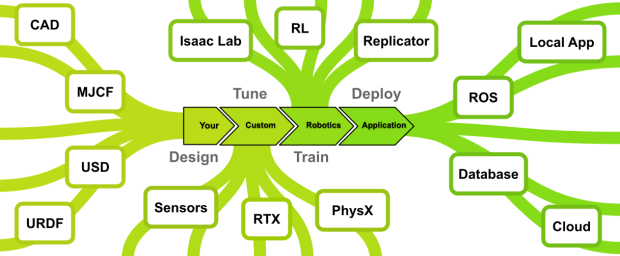

Among overseas tech giants, NVIDIA is a typical 'shovel seller.' As a provider of AI computing, it has invested in companies like Figure and Agility but does not personally manufacture robots. Instead, it influences the entire industry through hardware like the Jetson AGX Thor chip and the Isaac software ecosystem.

This positioning avoids heavy asset risks while allowing it to enjoy the benefits of industry growth.

Microsoft, Amazon, and other giants have chosen the path of strategic investment. They maintain race participation and strategic flexibility through capital involvement rather than personal operation.

The most typical example is the evolution of the relationship between OpenAI and Figure. OpenAI was originally Figure's 'brain supplier' but later parted ways due to Figure's insistence on autonomously controlling algorithms.

This reveals the core status of technological dominance in the robotics industry, where both startups and tech giants are unwilling to be constrained in key technologies.

The layout of domestic leading companies is characterized by 'active investment and cautious self-development.'

On one hand, leading companies like JD, Meituan, and Alibaba are aggressively investing. In the past few months, JD invested in six companies within three months, with a total estimated investment of over 2 billion yuan. Meituan and Alibaba have also poured hundreds of millions of yuan into companies like Unitree and Autovariable along the industrial chain.

On the other hand, companies like Xiaomi, which entered the robotics field relatively early, have launched products like the robot dog Iron Egg and the humanoid robot 'Iron Big.' However, the market feedback for their robot dog has been average, and their humanoid robot has yet to be launched. Xiaomi executive Lu Weibing admitted, 'We are not pushing forward because we do not see a clear commercial return cycle in the short term.'

Why are these comprehensive giants so hesitant in this field predicted by Huang Renxun to be the 'next trillion-dollar industry'?

Because robots, unlike phones or servers, cannot quickly generate stable commercial returns.

Especially in family scenes, where there are high requirements for safety, after-sales service, and compliance, there are not many opportunities to see a clear ROI in the short term. Some executives or venture capital circles have also publicly stated that large-scale promotion of robotics businesses requires significant long-term investment and patience without a clear commercial path.

The operational logic differences between vertical and comprehensive companies have determined their different choices in the embodied intelligence track.

Startup vertical companies like Figure face no obvious performance pressure and can invest all their financing funds into research and development and mass production. Even if their products have flaws initially, they can optimize them through rapid iteration.

In contrast, comprehensive companies need to consider 'return on investment.' If the robotics business incurs long-term losses, it will affect overall financial performance. Therefore, they are more inclined to 'wait and see before making a layout (layout).'

However, this division is not absolute. Once a large company decides to go all-in, they possess more stable cash flow, stronger supply chain control, and global after-sales service and compliance systems, all of which are essential capabilities for bringing robots into thousands of households.

Historically, many technologies, such as smartphones and cloud servers, were conceptualized and prototyped by startups before being popularized by large companies with their scalable execution capabilities.

In other words, startups provide prototypes and innovative pathways, while large companies may, at a certain point in time, propel them onto the true mass production curve with speed + scale.

Of course, regardless of whether they are startups or giants, the ultimate condition for victory in embodied AI is not the performance of a single robot or the success of a single round of financing, but rather the ability to build a continuous data loop, a reliable supply chain, and sustainable commercial service capabilities.

Figure's temporary lead is merely the opening whistle of this trillion-dollar race. On the path to truly general-purpose robots, core challenges such as hardware scale production, software intelligence generalization, and the establishment of safety standards remain to be addressed.

The divergence between Musk and Brett Adcock essentially represents an exploration of two future pathways—whether it will be a comprehensive victory for manufacturing or the ultimate triumph of AI algorithms.

Before the answer is revealed, the entire industry will continue to maintain its unique rhythm of patience coexisting with frenzy.

As the halo of technology gradually fades, we will ultimately have to answer: What kind of robots do humans truly need?

Perhaps, this revolution will truly reach its culmination when robots cease to be a topic of conversation and can serve every household as mundanely as household appliances.