Qualcomm's Heyday May Be Drawing to a Close

![]() 10/13 2025

10/13 2025

![]() 526

526

Source: Byte

While the entire internet is absorbed in the sensational news surrounding Zong Fuli and Wahaha, a quieter yet significant development is unfolding: an international chip giant is under investigation.

On October 10, the State Administration for Market Regulation launched an inquiry into Qualcomm for its acquisition of Autotalks. The acquisition was made without legally declaring the concentration of undertakings, a move suspected of breaching the Anti-Monopoly Law of the People's Republic of China.

The following day, Qualcomm issued a response, stating its active cooperation with the Chinese regulatory body's investigation and reiterating its commitment to fostering the growth and development of its customers and partners.

Autotalks, the focal point of this acquisition, is far from an ordinary company. This Israeli firm stands as a global frontrunner in automotive-grade V2X (Vehicle-to-Everything) communication chips. Its products have successfully penetrated the front-end supply chains of automotive giants like BMW and Volkswagen, securing over 30% of the global market share in automotive-grade V2X chips.

Screenshot from the company's official website

Qualcomm's strategic vision is clear: by acquiring Autotalks, it aims to bolster its V2X communication capabilities and integrate them into the "Snapdragon Digital Chassis." This move seeks to achieve full-stack control, spanning from cockpits and intelligent driving to vehicle-road coordination, potentially posing a monopoly risk.

For Qualcomm, failure to make significant strides in the automotive sector—its stronghold—coupled with missing out on the AI computing power dividend in Silicon Valley, could spell doom in the fiercely competitive chip industry.

01 Qualcomm's Lagging Pace

Qualcomm is evidently trailing behind Silicon Valley's narrative.

Historically focused on end-side chip development, Qualcomm has overlooked research and development in server and AI inference chips, potentially missing out on Silicon Valley's current largest industry dividend.

Over the past two months, Silicon Valley has orchestrated a series of dazzling capital operations, bundling together various giants in the AI ecosystem, including OpenAI, NVIDIA, Intel, Oracle, Arm, and AMD, resembling an "AI conglomerate."

The market is highly optimistic about this model. Each time these giants engage in related operations, their stock prices surge. Even Intel, which had previously lagged, is experiencing the exhilaration of soaring stock prices.

Throughout September, Intel's stock price soared by over 50%.

It's worth noting that last year, Qualcomm was the protagonist in a potential acquisition of Intel. According to The Wall Street Journal citing sources, Qualcomm had extended an acquisition offer to the chip giant.

However, the news faded into obscurity without further developments.

If Qualcomm has no intention of focusing on server and AI inference chips and thus misses out on the "AI conglomerate" dividend, there's little to deliberate over.

In reality, Qualcomm is quite optimistic about the prospects of servers and AI inference chips.

At this year's Computex in Taipei, Qualcomm CEO Cristiano Amon stated, "By connecting our custom data center processors to NVIDIA's rack-scale architecture (leveraging NVIDIA's technology to interface with NVIDIA's AI chips), we are advancing towards a shared vision of high-performance, energy-efficient computing for data centers."

During the latest earnings call, Amon further elaborated, "As the scale of inference demand expands, cloud service providers are constructing dedicated inference clusters, focusing not only on performance but also on efficiency, particularly the benefits per dollar/Token and per watt/Token. These factors, combined with the shift from commercial x86 CPUs to custom Arm-compatible CPUs for cloud computing and AI nodes, present an entry point for Qualcomm."

From Amon's remarks, it appears Qualcomm is not only developing data center CPUs but also AI inference chips for data centers.

On May 13, Qualcomm announced a Memorandum of Understanding (MOU) with Saudi Arabian AI company HUMAIN for strategic cooperation in developing next-generation AI data centers, infrastructure, and cloud-to-edge services to meet the rapidly growing global demand for AI.

This raises a pertinent question: Qualcomm's current development progress is clearly lagging behind the expansion speed of the "AI conglomerates" and struggles to meet corresponding demands. Qualcomm's data center plan is still in its infancy, lacking specific product details and technical validation. Whether it can truly deliver high-performance, scalable CPUs and secure long-term orders from leading cloud providers remains to be seen over time.

Qualcomm estimates that its Arm server chips will start generating revenue by 2028. However, judging by the aggressive stance of companies like OpenAI, this timeline may cause Qualcomm to miss a critical window of opportunity.

02 Betting Big on Automotive

Qualcomm has limited room for major breakthroughs in the mobile chip business.

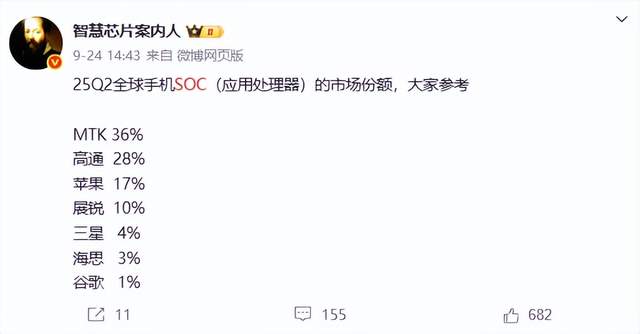

Blogger "Wisdom Chip Insider" revealed on Weibo the market share distribution of global mobile SOC (application processor) in the second quarter of 2025. The data indicates that MediaTek (MTK) maintains the lead with a 36% share, followed by Qualcomm at 28%, and Apple at 17%.

Screenshot from Weibo @Wisdom Chip Insider

This market structure has persisted for years, and with the mobile phone market having reached maturity, Qualcomm's maneuvering space is relatively limited.

From the current vantage point, the "AI conglomerates" show no signs of slowing down and continue to expand aggressively.

"To embark on such a large-scale endeavor, we need the support of the entire industry, or most of it (participants). This encompasses everything from electronics to model distribution and everything in between. It's a monumental task. So, we will collaborate with many," said OpenAI founder Sam Altman, anticipating more deals in the coming months.

Missing out on such dividends makes it challenging to remain composed.

If Qualcomm demonstrates the same courage as AMD, it might have a chance to participate.

In the deal between OpenAI and AMD, AMD's committed Instinct MI400 series chips have not yet fully entered the market and are still considered "futures." Both parties will engage in a deep binding model of "technology + equity."

In essence, AMD leveraged its technically promising future products and corresponding equity to secure its place in the circle.

Such an operation is not beyond Qualcomm's reach; it hinges on whether the company's leadership has the courage to go all-in.

Compared to the uncertain future in the AI sector, Qualcomm can reap tangible benefits in the automotive field.

According to 2024 statistics, in the intelligent cockpit SOC chip sector, Qualcomm, AMD, and Renesas account for 85% of the market share, with Qualcomm dominating at 70%.

According to Qualcomm's fiscal third-quarter earnings report ending June 29 this year, its automotive chip business generated $984 million in revenue, marking a 21% year-over-year increase.

However, in the intelligent driving SOC chip sector, Qualcomm has yet to make a significant impact. In 2024, NVIDIA chips accounted for 39.8% of installations, while Tesla accounted for 25.1%.

For Qualcomm, Autotalks is a crucial piece to complete its V2X technology shortcomings and enhance its intelligent automotive ecosystem, with intelligent cockpits being the core growth driver of its automotive chip business.

Amon stated during the earnings call, "The growth in QCT automotive and IoT revenue further validates our confidence in our diversification strategy and achieving long-term revenue targets."

Therefore, the investigation by the State Administration for Market Regulation is bound to delay Qualcomm's expansion in the automotive chip sector.

According to Qualcomm's latest data, over 350 million vehicles worldwide have adopted Snapdragon Digital Chassis solutions. Since 2023, Snapdragon Digital Chassis solutions have supported the launch of over 210 models by numerous Chinese automotive brands, catering to diverse needs from high-end luxury to mass-market segments.

This provides more room for domestic alternatives to operate. According to ZaoZi Auto Research, the localization rate of intelligent cockpit SOCs reached over 10% in 2024, up from less than 3% previously. Domestic manufacturers such as SemiDrive Technology, HiSilicon, and XingChip Technology are rapidly rising.

As the domestic automotive SOC market accelerates its downward shift, the proportion of mid-to-low-end solutions will significantly increase. Based on cost considerations for vehicle manufacturers, localized solutions with continuously improving low-cost advantages still have a fighting chance.

03 Stung by Regulatory Scrutiny

Qualcomm is no stranger to regulatory investigations. The company has repeatedly faced penalties for implementing monopolies through technical patents and commercial strategies.

In 2019, a U.S. District Judge in San Jose ruled in favor of the Federal Trade Commission's lawsuit against Qualcomm, finding that Qualcomm violated antitrust laws and exploited its technological advantages to demand excessively high patent licensing fees from the market.

However, as a leader in automotive chips, Qualcomm's investigation is having a ripple effect throughout the automotive industry.

At the Qualcomm Tech Summit exhibit in June this year, Bosch, Desay SV, Thundersoft, Chelian Tianxia, and Zoox all showcased solutions based on Qualcomm's Snapdragon 8775 chip.

The most direct impact is on Banma Zhixing.

On September 26 at the Yunqi Conference, Banma Zhixing proudly announced the joint launch of the full-modal on-device large model real-vehicle solution Auto Omni with Alibaba Tongyi and Qualcomm. It positioned this as a "generational breakthrough from instruction-based interaction to proactive services," emphasizing that it was the result of over 15,000 hours (approximately 625 days) of refinement by the three parties.

According to Banma Zhixing, Auto Omni adopts an exclusive deep customization of Tongyi Qwen Omni and achieves exclusive adaptation for platforms like Qualcomm's 8397. Its efficient operation of the on-device large model relies entirely on the computing power support of Qualcomm chips, forming a closed-loop cooperation model of "Tongyi supplies the model, Qualcomm supplies the chips, and Banma implements the solution."

In this cooperation model, if Qualcomm faces supply disruptions at the chip level, Banma Zhixing, responsible for implementation, will struggle to carry out related businesses.

Moreover, Banma Zhixing is under performance pressure. According to its prospectus, from 2022 to 2024, Banma Zhixing's revenue was 805 million yuan, 872 million yuan, and 824 million yuan, respectively. After peaking at 872 million yuan in 2023, revenue declined and failed to break through 900 million yuan.

In the first quarter of 2025, Banma Zhixing's revenue was 136 million yuan, a 19.05% year-over-year decrease from 169 million yuan in the same period of 2024.

Prospectus data shows that implementing intelligent solutions is the absolute mainstay of the business. From 2022 to 2024, Banma Zhixing's revenue from system-level operating system solutions was 699 million yuan, 751 million yuan, and 687 million yuan, respectively, with a decline in 2024.

In other words, Banma Zhixing was counting on Qualcomm to make a significant recovery.

Now, with Qualcomm under investigation, Banma Zhixing must develop corresponding contingency plans.

For Qualcomm, the immediate task is to actively cooperate with the relevant authorities and complete the necessary compliance work. Qualcomm's "failure to declare legally" is not due to technical incompetence but procedural violations; it is not that the market does not welcome it, but that the rules do not permit it.

After all, Qualcomm is not the only company with competitors waiting in the wings to reap the benefits.

Some images are sourced from the internet. Please notify us for removal if there is any infringement.