Exercise Caution in the AI Stock Herding Feast

![]() 10/14 2025

10/14 2025

![]() 573

573

On October 6, AMD, the world's second-largest AI chipmaker, secured a multi-billion-dollar chip order commitment from OpenAI. In return, OpenAI gained the right to subscribe to a 10% stake in AMD. This news sent AMD's stock price soaring by 37% at one point, rivaling Oracle's previous surge.

The U.S. AI sector has reached near-frenzy levels, and A-share AI stocks have followed suit, experiencing a herd-driven rally.

【The Herding Extravaganza】

AI industry leaders are orchestrating a spectacular capital operation through herd behavior.

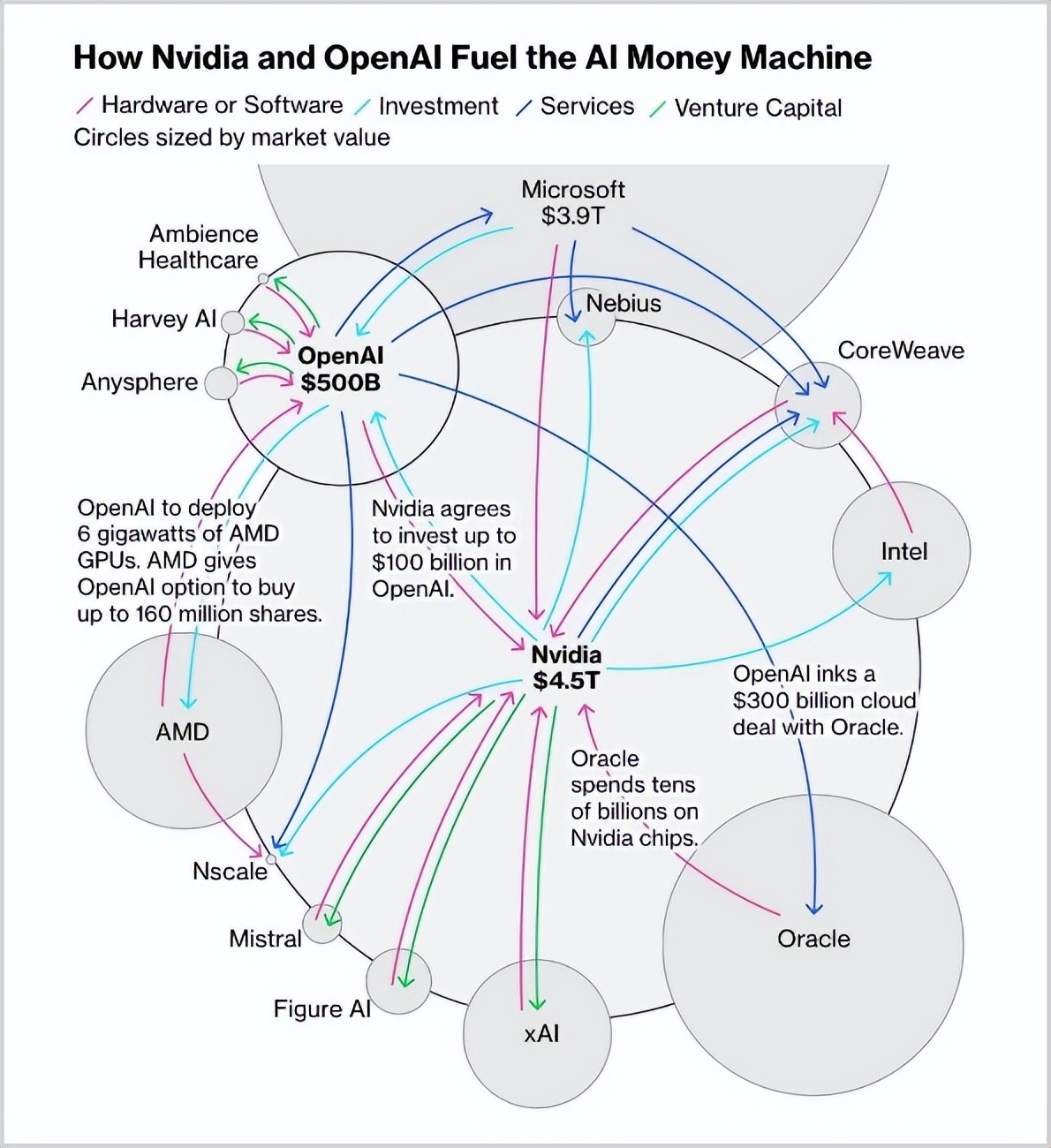

Nvidia invested $100 billion in OpenAI to deploy AI systems. Subsequently, OpenAI invested $100 billion in Oracle for cloud computing services, and Oracle then purchased $100 billion worth of chips from Nvidia.

This capital loop enables the three giants to potentially inflate their performance through 'fictitious transactions,' easily adding hundreds of billions of dollars to their market capitalizations. Now, AMD has joined this game.

▲ How Nvidia and OpenAI are driving AI monetization. Source: Bloomberg

However, the reality cannot be overlooked: OpenAI is projected to generate $13 billion in revenue but incur $13.5 billion in losses in 2025. How can it support $1 trillion in future orders, including those from Oracle and AMD?

The U.S. AI frenzy has also fueled a herd-driven rally in A-shares. From the beginning of 2025 through October 13, the AI index has surged over 90%, outperforming its September 24 level by over 160%. Valuations have skyrocketed from just over 30 times to nearly 70 times.

Leading AI stocks have performed even more spectacularly. YOFC and Shenghong Technology have surged over sixfold at their peaks this year, while CIGC and TFC Communication have jumped over fivefold and threefold, respectively.

These AI blue chips, with market capitalizations in the hundreds of billions or even trillions, have outpaced the 2020 rally in liquor leaders driven by extreme herding.

【The 'Contract Manufacturer' in the Spotlight】

Among A-share AI leaders, Foxconn Industrial Internet stands out as the most notable 'contract manufacturer.'

As of October 13, Foxconn Industrial Internet trades at a price-to-earnings (P/E) ratio of 47 times with a market capitalization exceeding 1.2 trillion yuan, ranking ninth among A-shares alongside banking and oil giants.

Why is a 'contract manufacturer' worth trillions?

ChatGPT's late-2022 debut triggered a global tech investment frenzy in AI, driving explosive growth for 'shovel seller' Nvidia. However, Nvidia-backed Foxconn Industrial Internet failed to match this growth momentum.

From 2023 to 2024, its net profit attributable to shareholders grew by just 4.8% and 10.3% year-over-year (YoY). While growth accelerated to 38.6% in the first half (H1) of 2025, it pales in comparison to YOFC and Shenghong Technology, which saw net profits surge over 350% during the same period.

During Nvidia's fastest growth years, Foxconn Industrial Internet's performance failed to explode. As Nvidia's growth inevitably slows, how can Foxconn Industrial Internet, as a mere contract manufacturer, achieve nonlinear growth?

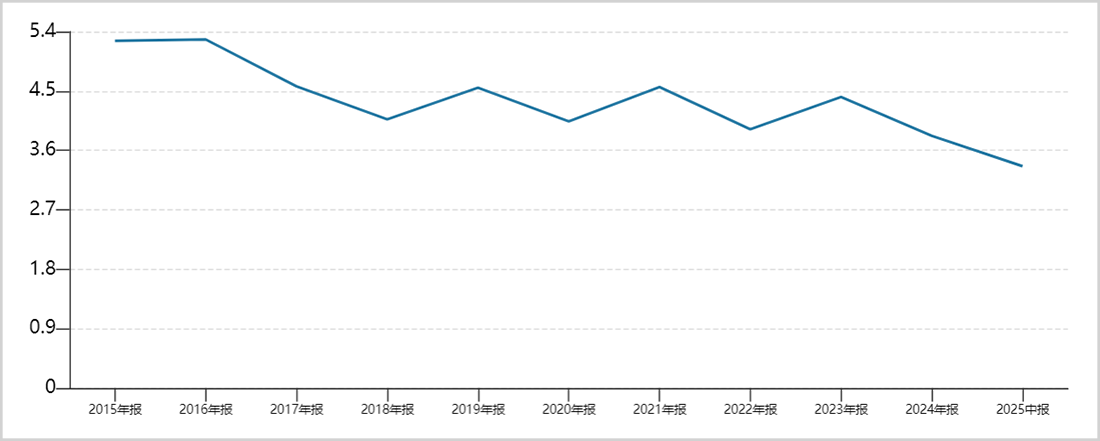

Foxconn Industrial Internet not only lags in growth compared to YOFC, Shenghong Technology, CIGC, and TFC Communication but also trails significantly in profitability. As of H1 2025, its gross margin stood at 6.6%, with a net margin of just 3.4%, both declining for years.

▲ Foxconn Industrial Internet's historical net margin trend. Source: Wind

In contrast, the four aforementioned leaders boast gross margins ranging from 36% to 51% and net margins from 23% to 38%, while Nvidia's net margin hovers around 50%.

Clearly, a vast gap exists between tech giants and contract manufacturers.

Notably, amid record highs in Taiwan's stock market, Foxconn Industrial Internet's parent company, Hon Hai Precision, has a market capitalization of approximately 720 billion yuan. Hon Hai holds over 80% of Foxconn Industrial Internet, corresponding to a value exceeding 1.1 trillion yuan—50% higher than its own market capitalization.

Whether judged by performance or parent company valuation, Foxconn Industrial Internet likely ranks among the A-share AI blue chips with the highest valuation premiums.

Why such a premium?

The answer lies in capital herding.

Foxconn Industrial Internet today evokes comparisons to Haitian Flavoring at its 2021 peak. Back then, Haitian rode the wave of extreme herding in white horse stocks (high-quality blue chips), reaching a valuation of over 110 times with a market capitalization nearing 700 billion yuan.

When market sentiment shifted, its stock plummeted, leaving it with a current market capitalization of just 220 billion yuan. Could Foxconn Industrial Internet follow the same path?

If even a 'contract manufacturer' can command such lofty valuations in A-shares, it suggests the 60-80 times valuations of the other four AI leaders may be overly optimistic.

【The Fragility of High Valuations】

High valuations typically require strong growth to justify them. Once growth falters, the risk of valuation collapse becomes inevitable.

Domestic AI leaders mostly rely on Nvidia as their anchor client. YOFC and CIGC are core optical module suppliers to Nvidia, Shenghong Technology is a key printed circuit board (PCB) supplier, and Foxconn Industrial Internet serves as its primary contract manufacturer.

This interdependence means their fortunes rise and fall together. Thus, a key challenge lies in determining whether Nvidia can sustain its high-growth trajectory in the coming years.

Over the medium to long term, Nvidia may face mounting challenges.

Currently, AI infrastructure buildout remains in its early stages. The duration of heavy capital expenditures hinges on whether downstream tech giants can successfully monetize their AI investments. Otherwise, unsustainable spending could collapse, rendering trillion-dollar spending commitments mere mirages.

AI applications are still in the experimental phase, with no proven large-scale profitable scenarios. While general-purpose tools like ChatGPT have gained traction in office productivity, enterprise AI adoption struggles, with nearly zero penetration in key sectors like consumer retail and manufacturing.

According to a recent MIT AI industry report, 95% of corporate AI investments have failed to generate economic returns, trapping firms in a 'high-input, zero-output' dilemma.

AI may currently resemble the internet revolution of the early 1990s, with true mass adoption and profitability still years or even a decade away.

Beyond industry maturity, Nvidia—which derives nearly 10% of its revenue from China—faces fierce competition from domestic rivals. Huawei's Ascend and Alibaba's T-Head chips now rival Nvidia's H20 in performance, with the technology gap narrowing rapidly.

Moreover, the H20 chip faces backdoor risks and regulatory scrutiny, threatening Nvidia's market share in China, which could be eroded by local giants.

Notably, DeepSeek's success demonstrates that technological leadership doesn't necessarily require brute-force hardware stacking; logical reasoning can achieve similar results, potentially reducing the perceived demand for computing power. This somewhat undermines the supposed barriers erected by giants like OpenAI and Google through their computational reserves and financial firepower.

From a pricing perspective, Nvidia's chips also face challenges. Over the past few years, the AI chip market has shifted from shortage to balance. As supply and demand normalize, excess inventory from previous shortages could pressure prices—a trend consistent with Nvidia's declining gross and net margins since fiscal year (FY) 2025.

Beyond the Nvidia-led overseas supply chain, China's domestic computing power ecosystem is quietly expanding. By 2025, China's total computing capacity will exceed 300 FLOPS, with intelligent computing accounting for over 35%, becoming a core engine of global computing growth.

Huawei leads as the domestic anchor enterprise, supported by CIGC's 1.6T optical modules (key components of Huawei's Ascend super nodes), YOFC's 800G low-power optical (LPO) optical modules (certified by Huawei for low-power Ascend clusters), and TFC Communication's deep integration in passive components and co-packaged optics (CPO) optical engines. Future growth for these AI leaders will partly stem from the rise of Huawei-led domestic computing chains.

Nevertheless, after surging severalfold in just a few months, A-share AI leaders now appear relatively expensive.

Notably, since September, while the A-share market has rallied to decade highs, the AI sector has shown signs of stagnation. Stocks like Shenghong Technology and TFC Communication have corrected over 25% from their peaks. Meanwhile, cyclical sectors like non-ferrous metals and new energy have strengthened, signaling a potential style rotation. If confirmed, this could drain liquidity from elevated AI stocks.

In short, amid the AI frenzy, vigilance is warranted for when the music stops.

Disclaimer

This article contains analyses and judgments based on publicly disclosed information (including but not limited to interim announcements, periodic reports, and official interaction platforms) from listed companies, made by the author in their personal capacity. The information or opinions herein do not constitute investment or other business advice. Market Value Observer assumes no responsibility for any actions taken based on this article.

——END——