Will the 26-year Intelligent Driving Competition Come to an End? Momenta's Cao Xudong Predicts: Only Three Players May Remain in China

![]() 10/27 2025

10/27 2025

![]() 389

389

Will automakers bet on self-research or seek external support?

The automotive industry has never lacked predictions of a 'survival of the fittest' scenario, but this 'endgame theory' has directly struck the most fiercely competitive assisted driving sector.

Momenta founder and CEO Cao Xudong recently made a bold claim: 'The competition in automotive assisted driving will conclude by 2026, with only three domestic participants emerging victorious.'

Image Source: Momenta Official

Currently, the assisted driving sector is still in a 'hundred schools of thought contend' phase—automakers are either betting on full-stack self-research or partnering with other intelligent driving companies, all frantically building their technological barriers.

Cao Xudong's assertion that 'the competition in assisted driving will end by 2026' is not baseless. He straightforward words (directly stated) that the assisted driving field has undergone a qualitative transformation in the past two years: hardware costs have been halved, while user experience has improved tenfold. This 'cost-effectiveness explosion' has accelerated its penetration from high-end optional features to standard equipment across entire vehicle lineups. The ultimate goal of assisted driving is to evolve toward fully autonomous driving.

This judgment has been collectively 'endorsed' by global automotive leaders. Tesla has set the mass production of its Cybercab self-driving taxi for 2026; Li Xiang of Li Auto straightforward words (directly stated) that 'autonomous driving will be achieved in 3–5 years'; and General Motors CEO Mary Barra has announced the implementation of self-driving technology by 2028.

An iterative storm from assisted driving to autonomous driving seems to be imminent.

Three Major Technical Approaches Coexist, and the Endgame of Intelligent Driving Remains Uncertain

However, from the perspective of Dianchetong, the endgame of competition in the assisted driving field may be even harder to reach than the consolidation of the overall vehicle market, with the core issue lying in the high complexity and diversity of its technological cooperation models.

The current mainstream technical approaches to assisted driving have clearly divided into three camps:

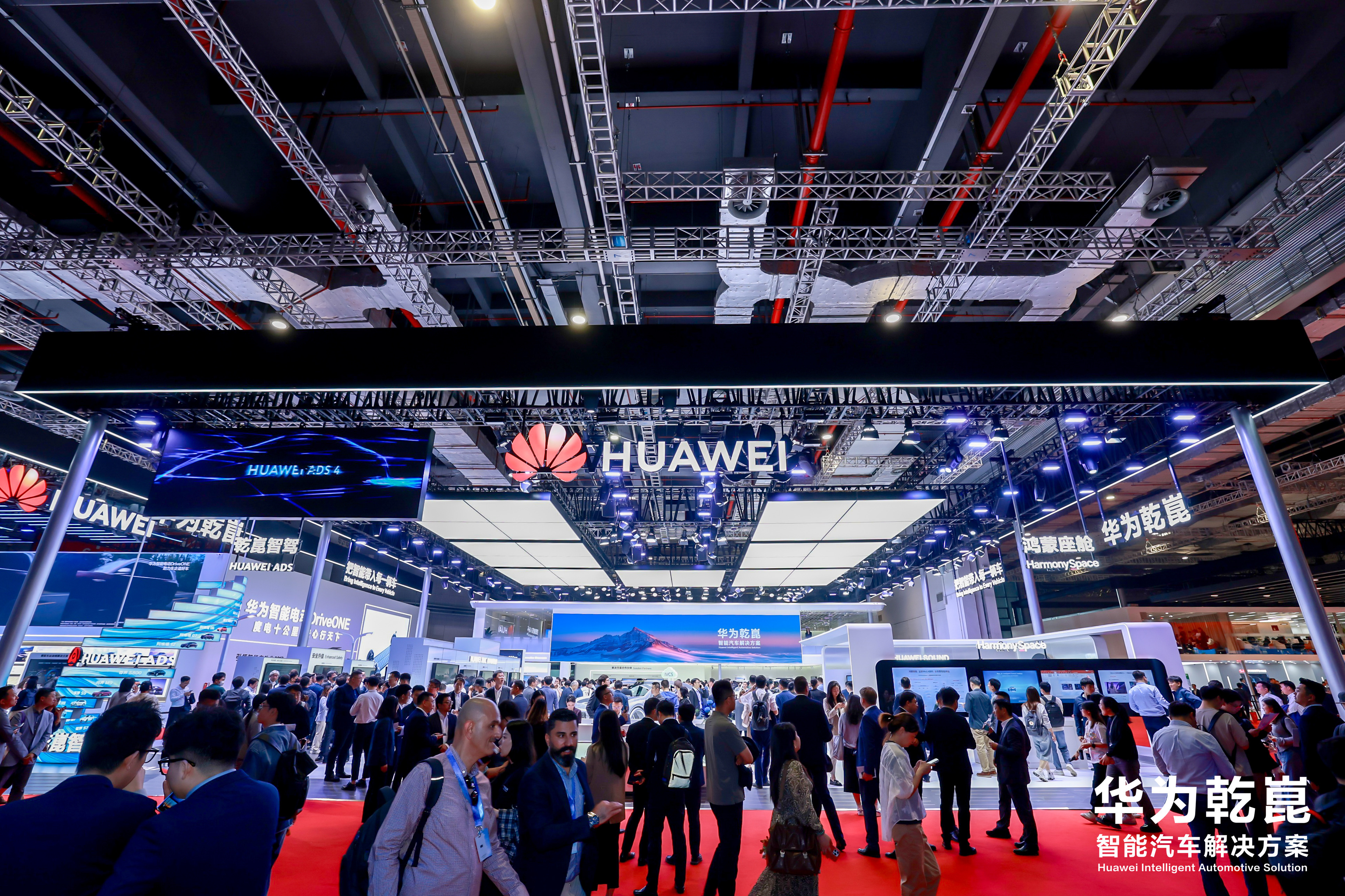

The first is ecosystem closed-loop intelligent driving. Represented primarily by Huawei Qiankun, it builds ecological barriers through a full-stack solution integrating software and hardware, achieving scaling (scaled) implementation by partnering with automakers.

The second is automaker self-research intelligent driving. Leading automakers such as XPENG, BYD, Li Auto, NIO, and Chery are all betting on full-stack self-research to create proprietary technical systems and strengthen product differentiation.

The third is open empowerment intelligent driving. Foreign automakers such as Mercedes-Benz, Toyota, Nissan, Buick, and BMW also widely adopt a joint development model of 'automaker + professional intelligent driving company.'

It is evident that the three technical approaches—ecosystem closed-loop, automaker self-research, and open empowerment—will continue to coexist in parallel in the short term, each corresponding to different automaker groups and market demands. Especially for the 'automaker self-research' camp, leading OEMs have already accumulated a vast user base. Thus, it is clearly premature to conclude that 'the top three will be locked in next year.'

Image Source: Harmony Intelligent Mobility

If one were to select the most representative company for each approach, Dianchetong believes that Huawei Qiankun, XPENG, and Momenta have relatively high leading potential.

Taking Huawei Qiankun as an example, through models such as 'Harmony Intelligent Mobility' and 'HI PLUS,' it deeply binds its ADS high-level intelligent driving to partnered vehicle models. According to Jin Yuzhi, CEO of Huawei's Intelligent Automotive Solution BU, 28 marketed models equipped with Qiankun's intelligent driving have been launched, covering multiple brands such as Harmony Intelligent Mobility's 'Five Realms,' Avita, Shenlan, GAC Trumpchi, and Audi, with cumulative deliveries exceeding 1 million units.

Not only that, but Huawei Qiankun has also planned a clear technical implementation path: the ADS 4.0 system launched this year will be the first to adapt to a high-speed commercial solution with an L3 technical architecture; next year, it aims to achieve scaled commercialization of high-speed L3 and commercial pilots of urban L4; by 2027, it plans to achieve scaled deployment of L3 and enter the commercial phase for urban L4. With its vast market presence and clear technical planning, Huawei Qiankun is highly likely to occupy a key position in the intelligent driving competition.

Image Source: Weibo @Huawei Qiankun Intelligent Automotive Solution

Dianchetong believes that XPENG has leading potential, primarily based on its self-research technical capabilities. He Xiaopeng once announced that the XPENG G7 is the world's first L3-level AI vehicle, equipped with three self-developed Turing AI chips with a total computing power of 2250TOPS, ranking first globally. Clearly, XPENG's willingness to invest in such powerful computing reserves is not only to meet current full-scenario assisted driving needs but also to pave the way for advancing to higher-level autonomous driving.

Image Source: Dianchetong Photography

Currently, many automakers choose to partner with professional intelligent driving companies, and Momenta is one of the most favored partners.

Domestic mainstream new energy vehicle models have generally equipped with assisted driving, while foreign automakers with weaker influence in this field see partnering with leading intelligent driving companies as a key path to rapidly catch up technologically. Most foreign brands, such as Mercedes-Benz, BMW, Toyota, and Nissan, have chosen to collaborate with Momenta.

Momenta's recognition hinges on its massive data and the 'Flywheel Large Model' technical architecture, which supports customized development for different automakers. For example, the high-level intelligent driving system developed for Mercedes-Benz is deeply adapted to the driving logic and interaction habits of its global models; the GAC Toyota bZ3X, leveraging Momenta's intelligent driving capabilities, has become one of the best-selling models in the joint-venture new energy market.

Huawei Qiankun, XPENG, and Momenta have formed differentiated advantages on the three tracks of ecosystem closed-loop, self-research, and open cooperation, respectively, with their technological barriers and market foundations continuously strengthening. Although the approaches coexist and companies accelerate iteration, the trend of industry resources converging toward leading players will become more pronounced.

While it is difficult to determine who will ultimately emerge victorious, in the journey toward autonomous driving, the 'Matthew effect' in the assisted driving field is bound to intensify continuously—raising the question of whether this is a boon or a concern for the industry and consumers.

Intensifying 'Matthew Effect': Should Automakers Bet on Self-Research or Seek External Support?

As the spotlight on the assisted driving track focuses on leading players like Huawei Qiankun, XPENG, and Momenta, we should step out of the single-game perspective of 'who will laugh last'—rather than obsessing over how many players will remain in the endgame, it is more worthwhile to contemplate the survival and development choices faced by companies in different camps when a few technologies dominate the market. This is the core proposition concerning the industry ecosystem.

For companies deploying leading-edge assisted driving technologies, the trend of market concentration toward leading players essentially injects a 'booster' into their technological iteration and commercialization.

These companies have sufficient funds and massive data accumulation to drive rapid technological iteration, while stable iteration capabilities, in turn, enhance product competitiveness, forming a positive cycle that further solidifies their market position. In contrast, companies betting on non-leading technologies often fall into a vicious cycle of 'stalled research and development - declining product competitiveness - market loss' as the 'Matthew effect' becomes more pronounced, with their survival space continuously squeezed.

Image Source: Dianchetong Photography

Take Chery Automobile's intelligent driving layout as an example. Chery once attempted to advance its self-research intelligent driving route through its subsidiary Dazhuo Intelligence, initially planning to cover R&D from L2+ assisted driving to L4-level Robotaxi, which once became the core of Chery's intelligent transformation.

However, limited by insufficient R&D investment and weak breakthroughs in core algorithms, Dazhuo Intelligence failed to form a genuine self-research technological barrier, with its mass production solutions highly dependent on external suppliers' technological integration. It gradually fell behind competitors equipped with leading intelligent driving systems.

Fortunately, Chery quickly adjusted its strategy to reverse its product competitiveness disadvantage, integrating the relevant businesses of Lion Technology, Dazhuo Intelligence, and the R&D Headquarters to establish a unified 'Chery Intelligent Center.' The newly launched 'Falcon Large Model' already possesses relatively comprehensive capabilities, marking a key achievement in reconstructing its self-research system and shedding external dependencies.

For companies, this market structure change is essentially a test of 'strategic fault tolerance.' For those betting on non-leading technologies, once technological iteration fails to keep pace with industry rhythm, it will not only drag down product sales but may also force a reconstruction of their intelligent strategy, incurring high transformation costs.

Image Source: Dianchetong Photography

Therefore, many automakers are more inclined to choose a full-stack self-research route. Li Auto's determination to deep cultivation (deeply cultivate) the intelligent driving field is particularly firm, not only explicitly allocating 10% of its revenue to R&D in core technologies such as intelligent driving but also investing 3 billion yuan in R&D in the first two quarters of this year alone. From a technical route perspective, it has gradually progressed from relying on Mobileye's solutions to promoting algorithm self-research and building the Orin-X chip platform, now taking the lead in implementing the VLA driver large model, with its self-development process continuously accelerating.

Although self-research requires high initial investment and long cycles, it can not only avoid the risks of non-leading routes and enhance strategic fault tolerance but also enable companies to grasp core technological discourse power (discourse power) and avoid being 'choked' by external intelligent driving companies.

Is the L3 Era Coming? A Nightmare for Small and Medium Players?

The assisted driving industry is indeed transitioning from 'hundred schools of thought contend' to 'concentration toward leading players,' potentially leading to a scenario where 'three players emerge victorious.' However, multiple variables remain to be resolved before reaching a true 'endgame.' At least in the next 3–5 years, the industry will continue to exhibit 'diversified models.'

Among the many variables influencing the endgame, the scaled implementation of L3 autonomous driving is undoubtedly the most critical 'breaking point'—it not only marks a technological leap from 'assisted' to 'semi-autonomous' driving but will also reshape industry competition rules and value distribution logic.

So, will the 'Matthew effect' in the assisted driving industry weaken after L3 implementation? Dianchetong believes the answer is likely no; instead, it may further intensify.

The core difference between L3 and L2+ lies in whether the driver or the automaker/intelligent driving solution provider is liable for accidents, imposing exponentially higher requirements on the technological reliability and safety redundancy design of automakers and intelligent driving solution providers.

The prerequisite for L3 implementation is that automakers and intelligent driving solution providers must already possess ultra-redundant hardware configurations, accumulate scene data at the billion-kilometer level, and optimize end-to-end algorithms, requiring at least billions of yuan in R&D investment—far beyond the capacity of small and medium players.

It can be said that L3 implementation is not the endpoint of the 'Matthew effect' but rather an 'accelerator' for leading players to lock in advantages and squeeze the survival space of small and medium players. The trend of industry resources converging toward a few strong players will only become clearer and more irreversible.

(Cover Image Source: Momenta Official)